Capital requirements for MiFID investment firms

... significant counterparty credit risk, as well as market risk on assets held on their own account (whether or not for external clients). ...

... significant counterparty credit risk, as well as market risk on assets held on their own account (whether or not for external clients). ...

Policy Prescription to the Regional Disparities in the Supply

... times higher than their regional counterparts. Commercial funds managed their investee portfolio more intensely. Accordingly, the operating costs of commercial funds were 20% higher than their regional counterparts. However, when expressed as a percentage of funds under management, these costs were ...

... times higher than their regional counterparts. Commercial funds managed their investee portfolio more intensely. Accordingly, the operating costs of commercial funds were 20% higher than their regional counterparts. However, when expressed as a percentage of funds under management, these costs were ...

The Equity Premium: Consistent with GDP Growth and

... portion of the social security trust fund should be invested in the equity market or not. Consequently, it is crucial for finance professionals to be able to accurately gauge the size of the premium and to understand the factors that may change its value. In their seminal paper, Prescott and Mehra ( ...

... portion of the social security trust fund should be invested in the equity market or not. Consequently, it is crucial for finance professionals to be able to accurately gauge the size of the premium and to understand the factors that may change its value. In their seminal paper, Prescott and Mehra ( ...

Fourth Quarter and Full Year 2015

... All returns include dividend and capital gain distributions. All investors should consider the investment objectives, risks, charges and expenses of the Fund carefully before investing. The prospectus contains this and other information about the Fund. Investors can obtain a prospectus from your fi ...

... All returns include dividend and capital gain distributions. All investors should consider the investment objectives, risks, charges and expenses of the Fund carefully before investing. The prospectus contains this and other information about the Fund. Investors can obtain a prospectus from your fi ...

Chapter 15: Intercorporate Investments

... • Fair value option: The option at the time of initial recognition to record an equity method investment at fair value. - Under IFRS, only venture capital firms may opt for fair value. - Under U.S. GAAP, the fair value option is available to all entities. • Equity method investments need periodic re ...

... • Fair value option: The option at the time of initial recognition to record an equity method investment at fair value. - Under IFRS, only venture capital firms may opt for fair value. - Under U.S. GAAP, the fair value option is available to all entities. • Equity method investments need periodic re ...

Using Coke-Cola and Pepsico to demonstrate optimal capital

... theoretical concepts can be applied in practice. The results indicated that Microsoft was not at its optimal capital structure and was therefore not maximizing its value as an all equity firm. The optimal debt ratio based on our analysis should be 37.5%. To expand this work, this paper applies the t ...

... theoretical concepts can be applied in practice. The results indicated that Microsoft was not at its optimal capital structure and was therefore not maximizing its value as an all equity firm. The optimal debt ratio based on our analysis should be 37.5%. To expand this work, this paper applies the t ...

pdf

... political, tax, reporting or illiquidity risk factors that may be different to similar investments in the South African markets. Fluctuations or movements in exchange rates may cause the value of underlying investments to go up or down. The Coronation Money Market fund is not a bank deposit account. ...

... political, tax, reporting or illiquidity risk factors that may be different to similar investments in the South African markets. Fluctuations or movements in exchange rates may cause the value of underlying investments to go up or down. The Coronation Money Market fund is not a bank deposit account. ...

Triangle Capital Corporation to Begin Trading on the New York

... solutions to lower middle market companies located throughout the United States. Triangle's investment objective is to seek attractive returns by generating current income from debt investments and capital appreciation from equity related investments. Triangle's investment philosophy is to partner w ...

... solutions to lower middle market companies located throughout the United States. Triangle's investment objective is to seek attractive returns by generating current income from debt investments and capital appreciation from equity related investments. Triangle's investment philosophy is to partner w ...

2017 Q1 Industry Investment Report - Private Equity Growth Capital

... (B2C) continued to fall for the second consecutive quarter, and Business Products & Services (B2B) experienced a small decline in the number of deals while the amount of capital invested remained the same. These results contrast increases in consumer and business confidence about future economic gro ...

... (B2C) continued to fall for the second consecutive quarter, and Business Products & Services (B2B) experienced a small decline in the number of deals while the amount of capital invested remained the same. These results contrast increases in consumer and business confidence about future economic gro ...

CONSEQUENCES OF MM - City University London

... No easy practical solutions to the capital structure question once we take into account the complexities of the real world. Many influences on the perceived optimal debt-equity mix -the cost of financial distress/monitoring -agency and incentive problems - MBO’s and LBO’s (an unsatisfied ‘clientele’ ...

... No easy practical solutions to the capital structure question once we take into account the complexities of the real world. Many influences on the perceived optimal debt-equity mix -the cost of financial distress/monitoring -agency and incentive problems - MBO’s and LBO’s (an unsatisfied ‘clientele’ ...

Enhanced practice management

... certain information is written in the context of the U.S. market and contain data and analysis specific to the U.S. This document was originally published by Vanguard Investment Strategy Group (“ISG”)—a business unit of The Vanguard Group, Inc. in November 2013. ISG publishes proprietary research on ...

... certain information is written in the context of the U.S. market and contain data and analysis specific to the U.S. This document was originally published by Vanguard Investment Strategy Group (“ISG”)—a business unit of The Vanguard Group, Inc. in November 2013. ISG publishes proprietary research on ...

IAS INDUSTRY ACCOUNTING STANDARDS

... uranium, and other industrial minerals ▫ Accounting for and Disclosure of Mineral Reserves How should the costs of acquiring mineral rights or properties be accounted for given these acquisitions may take the form of taking title to properties, obtaining mineral and mining rights, leases, patents, ...

... uranium, and other industrial minerals ▫ Accounting for and Disclosure of Mineral Reserves How should the costs of acquiring mineral rights or properties be accounted for given these acquisitions may take the form of taking title to properties, obtaining mineral and mining rights, leases, patents, ...

TIB Powerpoint - CP11/11

... - culturally : more of an equity than a bond culture - a powerful mutual funds industry : imagine what use of the structured investments industry would be if it had come first > The potential to fully embrace structured investments in the UK is clear : there is an exponential growth opportunity - wh ...

... - culturally : more of an equity than a bond culture - a powerful mutual funds industry : imagine what use of the structured investments industry would be if it had come first > The potential to fully embrace structured investments in the UK is clear : there is an exponential growth opportunity - wh ...

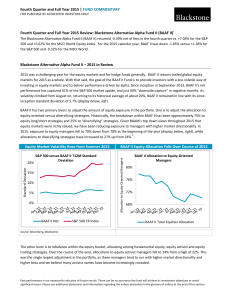

Blackstone Alternative Multi

... guarantee future results. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost and current performance may be lower or higher than the performance data quoted. Additional information ...

... guarantee future results. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost and current performance may be lower or higher than the performance data quoted. Additional information ...

socially responsible investing - Sustainable World Financial Advisors

... housing, and finance small business development in disadvantaged communities. These three complimentary strategies allow investors to choose their level of involvement. Screening provides an opportunity for investors to align their values with their financial goals while earning competitive returns. ...

... housing, and finance small business development in disadvantaged communities. These three complimentary strategies allow investors to choose their level of involvement. Screening provides an opportunity for investors to align their values with their financial goals while earning competitive returns. ...

PBE Paper II Management Accounting and Finance

... XYZ Limited. The total number of shares outstanding is 20,000 and your client holds 75% (i.e. 15,000 shares). The other 25% shareholder is a close family relative. The company was in a loss position but this year the business has started to turn around. The latest audited earnings after tax are $40M ...

... XYZ Limited. The total number of shares outstanding is 20,000 and your client holds 75% (i.e. 15,000 shares). The other 25% shareholder is a close family relative. The company was in a loss position but this year the business has started to turn around. The latest audited earnings after tax are $40M ...

기업의 국내외 상장 ipo

... oil future speculation. It was once held up by SESDEQ as a model of corporate governance. ...

... oil future speculation. It was once held up by SESDEQ as a model of corporate governance. ...

Figure 7 Grain yields continue to improve despite winter rainfall

... o The impacts of weather and the markets for the different grains. o In recent years, corporate investors have become more common, with investors putting in excess of $A50 million (m) into the industry, creating a diverse portfolio of investment properties. The amount required to be invested can ran ...

... o The impacts of weather and the markets for the different grains. o In recent years, corporate investors have become more common, with investors putting in excess of $A50 million (m) into the industry, creating a diverse portfolio of investment properties. The amount required to be invested can ran ...

Technical Prep

... Acquisition Comparables – “Relative to other transactions” This approach is based on the principle that similar assets should trade or sell at similar prices. These are acquisitions that happened in the past. Such multiples represent an index of recent market prices paid by other acquirers and accep ...

... Acquisition Comparables – “Relative to other transactions” This approach is based on the principle that similar assets should trade or sell at similar prices. These are acquisitions that happened in the past. Such multiples represent an index of recent market prices paid by other acquirers and accep ...

2017 LONG-TERM CAPITAL MARKET EXPECTATIONS

... also see inflation hovering in the moderate zone for the next five to 10 years. ...

... also see inflation hovering in the moderate zone for the next five to 10 years. ...

2017 Long-Term Capital Market Expectations

... also see inflation hovering in the moderate zone for the next five to 10 years. ...

... also see inflation hovering in the moderate zone for the next five to 10 years. ...

LU0028118809

... information on our funds. Further information on our products is available in English using the contact details shown. Subscriptions of shares are only accepted on the basis of the most up to date legal offering documents. The legal offering documents (fund & share class specific Key Investor Inform ...

... information on our funds. Further information on our products is available in English using the contact details shown. Subscriptions of shares are only accepted on the basis of the most up to date legal offering documents. The legal offering documents (fund & share class specific Key Investor Inform ...

the Syllabus - Sites@PSU

... of the just described deliverables, respectively. As stated above, your individual final grade for each deliverable will be based upon your contribution to these collective efforts as deemed warranted by your team members’ evaluations: Each student will submit an evaluation of each team members’ con ...

... of the just described deliverables, respectively. As stated above, your individual final grade for each deliverable will be based upon your contribution to these collective efforts as deemed warranted by your team members’ evaluations: Each student will submit an evaluation of each team members’ con ...

Oct 2013 Micro Cap WP.indd

... number of sustainable advantages when compared to other market cap segments. Consequently, they allow active asset managers focused on these stocks the potential to outperform over long periods of time. This is especially true of micro caps, which are typically valued at less than $1 billion. ...

... number of sustainable advantages when compared to other market cap segments. Consequently, they allow active asset managers focused on these stocks the potential to outperform over long periods of time. This is especially true of micro caps, which are typically valued at less than $1 billion. ...

No Slide Title

... Through the use of a financial metric (free cash flow) rather than an accounting metric (earnings) it is easier to discern those firms most likely to utilize their free cash flow intelligently for shareholder value creation. If the return on incremental capital to be deployed in the business is eq ...

... Through the use of a financial metric (free cash flow) rather than an accounting metric (earnings) it is easier to discern those firms most likely to utilize their free cash flow intelligently for shareholder value creation. If the return on incremental capital to be deployed in the business is eq ...

Private equity in the 2000s

Private equity in the 2000s relates to one of the major periods in the history of private equity and venture capital. Within the broader private equity industry, two distinct sub-industries, leveraged buyouts and venture capital experienced growth along parallel although interrelated tracks.The development of the private equity and venture capital asset classes has occurred through a series of boom and bust cycles since the middle of the 20th century. As the 20th century ended, so, too, did the dot-com bubble and the tremendous growth in venture capital that had marked the previous five years. In the wake of the collapse of the dot-com bubble, a new ""Golden Age"" of private equity ensued, as leveraged buyouts reach unparalleled size and the private equity firms achieved new levels of scale and institutionalization, exemplified by the initial public offering of the Blackstone Group in 2007.