Consumer Surplus

... You decide to take bids from the four painters and auction off the job to the painter who will do the work for the lowest price. Each painter is willing to take the job if the price she would receive exceeds her cost of doing the work. ...

... You decide to take bids from the four painters and auction off the job to the painter who will do the work for the lowest price. Each painter is willing to take the job if the price she would receive exceeds her cost of doing the work. ...

Financing Real Estate through Capital Markets Real Estate

... It can therefore be correctly argued that REITs provide a practical way in which all investors who have interest in investing in real estate sector within the economy can invest in large scale, income producing, professionally managed companies that owns commercial (and in some cases residential) re ...

... It can therefore be correctly argued that REITs provide a practical way in which all investors who have interest in investing in real estate sector within the economy can invest in large scale, income producing, professionally managed companies that owns commercial (and in some cases residential) re ...

Welfare economics

... • By 2006 169 countries had signed, (not including the US) • Turkey signed in 2009. • BY 2012 emissions will be 5% lower than in 1990 • Various schemes in place including carbon trading ©The McGraw-Hill Companies, 2008 ...

... • By 2006 169 countries had signed, (not including the US) • Turkey signed in 2009. • BY 2012 emissions will be 5% lower than in 1990 • Various schemes in place including carbon trading ©The McGraw-Hill Companies, 2008 ...

IFI_Ch14

... • Since international portfolio managers can choose from a larger bundle of assets than domestic portfolio managers, internationally diversified portfolios often have a higher expected rate of return, and nearly always have a lower level of portfolio risk since national securities markets are imperf ...

... • Since international portfolio managers can choose from a larger bundle of assets than domestic portfolio managers, internationally diversified portfolios often have a higher expected rate of return, and nearly always have a lower level of portfolio risk since national securities markets are imperf ...

Fund Performance - 13D Activist Fund

... Portfolio holdings and allocations are subject to change and should not be considered investment advice. Each of these asset classes has its own set of investment characteristics and risks and investors should consider these risks carefully prior to making any investments. Investments in foreign sec ...

... Portfolio holdings and allocations are subject to change and should not be considered investment advice. Each of these asset classes has its own set of investment characteristics and risks and investors should consider these risks carefully prior to making any investments. Investments in foreign sec ...

Chapter 15 PowerPoint Presentation

... Comprehensive Income: all changes in equity during a period except those from owners’ investments and dividends. Examples of items not included in Net Income but which are ...

... Comprehensive Income: all changes in equity during a period except those from owners’ investments and dividends. Examples of items not included in Net Income but which are ...

Bankruptcy and Firm Value

... However, the mere possibility of bankruptcy would not make debt less attractive. Keep in mind that the firm is an operation that attracts resources from investors, uses them and returns profits to investors according to certain rules. Bankruptcy is simply a recognition that the promised payments to ...

... However, the mere possibility of bankruptcy would not make debt less attractive. Keep in mind that the firm is an operation that attracts resources from investors, uses them and returns profits to investors according to certain rules. Bankruptcy is simply a recognition that the promised payments to ...

- PNC.com

... The Long-Term View Let us start with what we do know. This should help give us a basis for discussing the potential impact of the shifting political regime. From a longer-term perspective, potential economic growth has been reduced in recent years, with certain secular headwinds (that is, aging popu ...

... The Long-Term View Let us start with what we do know. This should help give us a basis for discussing the potential impact of the shifting political regime. From a longer-term perspective, potential economic growth has been reduced in recent years, with certain secular headwinds (that is, aging popu ...

5. Be circumspect about defining debt for cost of capital

... Every valua?on starts with a narra?ve, a story that you see unfolding for your company in the future. ¨ In developing this narra?ve, you will be making assessments of your company (its products, its ...

... Every valua?on starts with a narra?ve, a story that you see unfolding for your company in the future. ¨ In developing this narra?ve, you will be making assessments of your company (its products, its ...

Corporate Governance Reform (3) — Private Placement —

... Some have pointed out that tighter regulations are necessary for private placements, given that they can significantly dilute shareholders’ ownership. Companies are entitled to issue new shares or reissue treasury stock to raise capital. These are called share offerings (Corporate Law Articles 199-2 ...

... Some have pointed out that tighter regulations are necessary for private placements, given that they can significantly dilute shareholders’ ownership. Companies are entitled to issue new shares or reissue treasury stock to raise capital. These are called share offerings (Corporate Law Articles 199-2 ...

The European Capital Markets Union

... Attract more investors into the markets For capital markets to play the long-term role that policymakers envisage in supporting the European economy, they will need to grow considerably. A fundamental challenge, therefore, in creating a Capital Markets Union, will be increasing the pool of European ...

... Attract more investors into the markets For capital markets to play the long-term role that policymakers envisage in supporting the European economy, they will need to grow considerably. A fundamental challenge, therefore, in creating a Capital Markets Union, will be increasing the pool of European ...

Chapter 9 - Cost of Capital

... A break point is a level of financing at which ka increases because one of the individual costs increased. In the example that follows only retained earnings break points will be illustrated. In practice, however, changes in the costs of all components (e.g., debt, preferred stock) must be taken ...

... A break point is a level of financing at which ka increases because one of the individual costs increased. In the example that follows only retained earnings break points will be illustrated. In practice, however, changes in the costs of all components (e.g., debt, preferred stock) must be taken ...

Active Vs. Passive - Jentner Wealth Management

... The basis of active management is investing in companies that are predicted to post above-average returns. Much of what active managers do is attempt to gain insight into the future performance of a company. They may look for a company posting significant sales and profits or one that is touting the ...

... The basis of active management is investing in companies that are predicted to post above-average returns. Much of what active managers do is attempt to gain insight into the future performance of a company. They may look for a company posting significant sales and profits or one that is touting the ...

Co-operators Ethical Select Growth Portfolio - The Co

... This section tells you how the fund has performed over the past 4 year(s) for a policyholder who chose the no-load option. Returns are after the MER has been deducted. It is important to note that this does not tell you how the fund will perform in the future. Also, your actual return will depend on ...

... This section tells you how the fund has performed over the past 4 year(s) for a policyholder who chose the no-load option. Returns are after the MER has been deducted. It is important to note that this does not tell you how the fund will perform in the future. Also, your actual return will depend on ...

Products ESQUIRE CAPITAL INVESTMENT ADVISORS LLP

... performances, irrespective of where we are in the market cycle. Focus is to generate substantial alpha over fixed income returns. ...

... performances, irrespective of where we are in the market cycle. Focus is to generate substantial alpha over fixed income returns. ...

Small Firms

... Micro- employs up to nine people Small – employs ten to ninety –nine people Medium- employs one hundred to four hundred and ninety –nine people Other official definitions of small us a turnover of less than £1m or £ 500,000 as well as fewer than 200 or 500 employees. These small firms provide ...

... Micro- employs up to nine people Small – employs ten to ninety –nine people Medium- employs one hundred to four hundred and ninety –nine people Other official definitions of small us a turnover of less than £1m or £ 500,000 as well as fewer than 200 or 500 employees. These small firms provide ...

North Carolina Large Cap Value Fund

... The North Carolina Large Cap Value Fund was offered as an investment option under a group variable annuity contract issued by Prudential Retirement Insurance and Annuity Company, Hartford, CT (“PRIAC”) with the same investment manager(s) and the same investment strategy as the Fund. The PRIAC group ...

... The North Carolina Large Cap Value Fund was offered as an investment option under a group variable annuity contract issued by Prudential Retirement Insurance and Annuity Company, Hartford, CT (“PRIAC”) with the same investment manager(s) and the same investment strategy as the Fund. The PRIAC group ...

Capitol Private Wealth Group LLC Breakthrough or bust: Examining

... than some of the lowest-weighted stocks within the index. If one of the top stocks in the Dow, like Goldman Sachs, sees a large decline, it will drag down the entire index as a result. Because the Dow is heavily influenced by a few major companies, it might not accurately portray how the economy is ...

... than some of the lowest-weighted stocks within the index. If one of the top stocks in the Dow, like Goldman Sachs, sees a large decline, it will drag down the entire index as a result. Because the Dow is heavily influenced by a few major companies, it might not accurately portray how the economy is ...

ACCA F9 S16 Notes

... In the previous sections we have seen how to calculate the cost of both equity and debt. However, most company are financed using a mixture of both equity and debt. It is useful for our later work to be able to calculate the average cost of capital to the company. We do this by calculating the cost ...

... In the previous sections we have seen how to calculate the cost of both equity and debt. However, most company are financed using a mixture of both equity and debt. It is useful for our later work to be able to calculate the average cost of capital to the company. We do this by calculating the cost ...

1/ Global stockmarkets initially fell this week as investors - E-SGH

... 1/ Global stockmarkets initially fell this week as investors digested the failure of Donald Trump’s health-care reform bill and appeared to lose faith in his administration’s ability to fulfil campaign promises. The dollar also hit a four-month low against a basket of currencies. Both regained some ...

... 1/ Global stockmarkets initially fell this week as investors digested the failure of Donald Trump’s health-care reform bill and appeared to lose faith in his administration’s ability to fulfil campaign promises. The dollar also hit a four-month low against a basket of currencies. Both regained some ...

05 HF LCG MAY 2009

... in the stock market can be attributed to massive increases in the money supply created by Central Banks around the world. This cash must go somewhere, and because the “real economy” can not absorb the cash, much of it is finding its way into the stock market, driving prices higher. Some investors fe ...

... in the stock market can be attributed to massive increases in the money supply created by Central Banks around the world. This cash must go somewhere, and because the “real economy” can not absorb the cash, much of it is finding its way into the stock market, driving prices higher. Some investors fe ...

Investors` Interest In Dermatology Is More Than Skin-Deep

... practice definition. Failing to meet even one of the required elements can create risk in the transaction for both the dermatology practice and the private equity investor. Note that since July 15, 2013, when the U.S. Government Accountability Office published a report stating that dermatology prac ...

... practice definition. Failing to meet even one of the required elements can create risk in the transaction for both the dermatology practice and the private equity investor. Note that since July 15, 2013, when the U.S. Government Accountability Office published a report stating that dermatology prac ...

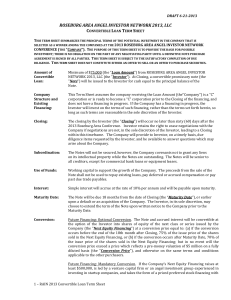

RAIN-2013-Term

... occurs before the end of the 18th month after Closing, 75% of the issue price of the shares sold in the Next Equity Financing, or (b) if the conversion occurs after Maturity Date, 70% of the issue price of the shares sold in the Next Equity Financing; but in no event will the conversion price exceed ...

... occurs before the end of the 18th month after Closing, 75% of the issue price of the shares sold in the Next Equity Financing, or (b) if the conversion occurs after Maturity Date, 70% of the issue price of the shares sold in the Next Equity Financing; but in no event will the conversion price exceed ...

Private equity in the 2000s

Private equity in the 2000s relates to one of the major periods in the history of private equity and venture capital. Within the broader private equity industry, two distinct sub-industries, leveraged buyouts and venture capital experienced growth along parallel although interrelated tracks.The development of the private equity and venture capital asset classes has occurred through a series of boom and bust cycles since the middle of the 20th century. As the 20th century ended, so, too, did the dot-com bubble and the tremendous growth in venture capital that had marked the previous five years. In the wake of the collapse of the dot-com bubble, a new ""Golden Age"" of private equity ensued, as leveraged buyouts reach unparalleled size and the private equity firms achieved new levels of scale and institutionalization, exemplified by the initial public offering of the Blackstone Group in 2007.