answers to questions - ORU Accounting Information

... Sales journal. Records entries for all sales of merchandise on account. Cash receipts journal. Records entries for all cash received by the business. Purchases journal. Records entries for all purchases of merchandise on account. Cash payments journal. Records entries for all cash paid. Some advanta ...

... Sales journal. Records entries for all sales of merchandise on account. Cash receipts journal. Records entries for all cash received by the business. Purchases journal. Records entries for all purchases of merchandise on account. Cash payments journal. Records entries for all cash paid. Some advanta ...

Going mainstream – how absolute return is moving into the

... and relative return funds. Namely: Absolute return funds display a narrow range of returns in all market conditions; a higher likelihood of delivering positive outperformance when market returns are negative and a tendency to underperform when markets are rising strongly. Conversely, relative return ...

... and relative return funds. Namely: Absolute return funds display a narrow range of returns in all market conditions; a higher likelihood of delivering positive outperformance when market returns are negative and a tendency to underperform when markets are rising strongly. Conversely, relative return ...

Presentation

... • 3. Step 3: Determine the transaction price. • 4. Step 4: Allocate the transaction price to the separate performance obligations • 5. Step 5: Recognize revenue when (or as) performance obligation is satisfied. ...

... • 3. Step 3: Determine the transaction price. • 4. Step 4: Allocate the transaction price to the separate performance obligations • 5. Step 5: Recognize revenue when (or as) performance obligation is satisfied. ...

INVESTMENT PORTFOLIO OPTIMIZATION BY

... clusion in the portfolio increases systematic risk and exposure to market variations (Prigent, 2007, p. 118). Beta coefficient is used for the valuation of the securities to be added to the portfolio, because this coefficient measures the additional risk caused by the inclusion of new security in th ...

... clusion in the portfolio increases systematic risk and exposure to market variations (Prigent, 2007, p. 118). Beta coefficient is used for the valuation of the securities to be added to the portfolio, because this coefficient measures the additional risk caused by the inclusion of new security in th ...

SBA Financing as a Credit Strategy

... As more business owners step up to fund their operations, create jobs and help expand the economy, financing options for working capital will need to be vetted. That process should include a solution that might have been overlooked in the past but cannot be dismissed in the present. Financing from t ...

... As more business owners step up to fund their operations, create jobs and help expand the economy, financing options for working capital will need to be vetted. That process should include a solution that might have been overlooked in the past but cannot be dismissed in the present. Financing from t ...

Download (PDF)

... asked for a measure of central tendency only (Vissing-Jorgensen, 2004). Probabilistic beliefs were first elicited in the 2002 version of the Health and Retirement Survey (HRS) in which respondents were asked for the “chance that mutual fund shares invested in blue chip stocks like those in the Dow Jo ...

... asked for a measure of central tendency only (Vissing-Jorgensen, 2004). Probabilistic beliefs were first elicited in the 2002 version of the Health and Retirement Survey (HRS) in which respondents were asked for the “chance that mutual fund shares invested in blue chip stocks like those in the Dow Jo ...

exercise 6-3 - Fisher College of Business

... method, the earliest costs are assigned to cost of goods sold, and the latest costs remain in ending inventory. The LIFO method will produce the highest cost of goods sold for Dakota Company. Under LIFO the most recent costs are charged to cost of goods sold and the earliest costs are included in th ...

... method, the earliest costs are assigned to cost of goods sold, and the latest costs remain in ending inventory. The LIFO method will produce the highest cost of goods sold for Dakota Company. Under LIFO the most recent costs are charged to cost of goods sold and the earliest costs are included in th ...

introduction to financial statements

... Nowicki, M. (2004). The Financial management of hospitals and healthcare organizations. Health Administration Press: Chicago, Illinois. ...

... Nowicki, M. (2004). The Financial management of hospitals and healthcare organizations. Health Administration Press: Chicago, Illinois. ...

Shorts and Derivatives in Portfolio Statistics

... Futures contracts are popular, because they don’t require as much money upfront as an outright purchase of the underlying asset. Futures contracts are also typically easier to transact than physical securities, because transactions are settled in cash. Futures contracts can also help managers hedge ...

... Futures contracts are popular, because they don’t require as much money upfront as an outright purchase of the underlying asset. Futures contracts are also typically easier to transact than physical securities, because transactions are settled in cash. Futures contracts can also help managers hedge ...

18 Asset Factor White Paper

... indicating an improvement in balance sheet strength, quality of governance, earnings stability, yield or valuation levels are of interest. If a factor cannot be tied back to having an impact on the discounted cash flow calculation then, to us, it shouldn’t be a relevant factor. Our intuitive approac ...

... indicating an improvement in balance sheet strength, quality of governance, earnings stability, yield or valuation levels are of interest. If a factor cannot be tied back to having an impact on the discounted cash flow calculation then, to us, it shouldn’t be a relevant factor. Our intuitive approac ...

Pushing further in search of return: The new private equity model

... These high and rising multiples are transforming the value strategies and equity stories that surround them. There may be a lot of dry powder around and leverage is readily available, but more of these funds are being committed to acquisition. The more private equity funds pay, the more they have to ...

... These high and rising multiples are transforming the value strategies and equity stories that surround them. There may be a lot of dry powder around and leverage is readily available, but more of these funds are being committed to acquisition. The more private equity funds pay, the more they have to ...

introduction to personal investing

... represented by the S&P 500; bonds are represented by US long-term government bonds from 1926 to January 1962, US five-year Treasuries from February 1962 to 1975, and Barclays Capital US Aggregate Index 1976 and thereafter; T-bills are represented by three-month Treasury bills; and inflation by the C ...

... represented by the S&P 500; bonds are represented by US long-term government bonds from 1926 to January 1962, US five-year Treasuries from February 1962 to 1975, and Barclays Capital US Aggregate Index 1976 and thereafter; T-bills are represented by three-month Treasury bills; and inflation by the C ...

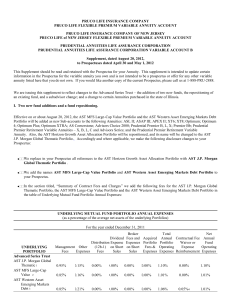

PRUCO LIFE INSURANCE COMPANY PRUCO LIFE FLEXIBLE

... This supplement sets forth changes to the Prospectus, dated April 30, 2012 (the Prospectus), of Advanced Series Trust (the Trust). The Portfolio of the Trust discussed in this supplement may not be available under your variable contract. For more information about the Portfolios available under your ...

... This supplement sets forth changes to the Prospectus, dated April 30, 2012 (the Prospectus), of Advanced Series Trust (the Trust). The Portfolio of the Trust discussed in this supplement may not be available under your variable contract. For more information about the Portfolios available under your ...

Weekly FX Insight - Citibank Hong Kong

... Since weak EUR may be one of the major ECB's objectives and the ECB may implement additional easing, Citi analysts expect the EUR may consolidate at 1.15 for the coming 0-3 months and may drop to 1.10 in the medium and long term and parity may be approached in the coming two years. GBP could be supp ...

... Since weak EUR may be one of the major ECB's objectives and the ECB may implement additional easing, Citi analysts expect the EUR may consolidate at 1.15 for the coming 0-3 months and may drop to 1.10 in the medium and long term and parity may be approached in the coming two years. GBP could be supp ...

3354:1-20-07 Investment policy

... (7) To maintain an appropriate asset allocation based on a total return policy that is compatible with a flexible spending policy, while having the potential to produce positive real returns. (8) To provide an equity/fixed income portfolio of readily marketable assets with an asset allocation weight ...

... (7) To maintain an appropriate asset allocation based on a total return policy that is compatible with a flexible spending policy, while having the potential to produce positive real returns. (8) To provide an equity/fixed income portfolio of readily marketable assets with an asset allocation weight ...

Asset Pricing When Traders Sell Extreme Winners and Losers

... schedule (selling – buying), which corresponds to investors’ demand. Second, I estimate the relative magnitude of demand perturbation on the gain side versus that on the loss side, so that later we can see if the price effects from the two sides are consistent with this relation. I conduct analysis ...

... schedule (selling – buying), which corresponds to investors’ demand. Second, I estimate the relative magnitude of demand perturbation on the gain side versus that on the loss side, so that later we can see if the price effects from the two sides are consistent with this relation. I conduct analysis ...

CHAPTER_3,5_solutions

... 8. The book-to-bill ratio is intended to measure whether demand is growing or falling. It is closely followed because it is a barometer for the entire high-tech industry where levels of revenues and earnings have been relatively volatile. 9. If a company is growing by opening new stores, then presum ...

... 8. The book-to-bill ratio is intended to measure whether demand is growing or falling. It is closely followed because it is a barometer for the entire high-tech industry where levels of revenues and earnings have been relatively volatile. 9. If a company is growing by opening new stores, then presum ...

On the Relation between Capital Flows and the Current

... inducing a change in the current account. Consequently, this view suggests that the relation between the current and the financial account is rather determined by capital flows, and hence indicating the reverse causality direction than the savings/investment view. Based on the theoretical views, the ...

... inducing a change in the current account. Consequently, this view suggests that the relation between the current and the financial account is rather determined by capital flows, and hence indicating the reverse causality direction than the savings/investment view. Based on the theoretical views, the ...

Liquidity article - Zebra Capital Management

... Moore (2005) introduced a “fundamental index” strategy in which a fundamental variable (such as earnings, sales/revenue, book value, and dividends) is used as the basis to determine how much capital is to be invested in a given stock. For example, an “earnings weighted strategy” is defined by an inv ...

... Moore (2005) introduced a “fundamental index” strategy in which a fundamental variable (such as earnings, sales/revenue, book value, and dividends) is used as the basis to determine how much capital is to be invested in a given stock. For example, an “earnings weighted strategy” is defined by an inv ...

Probability Distribution Function of the Internal Rate of Return in One

... This thesis finds the closed form probability distribution expressions of the internal rate of return for certain one and two period stochastic engineering economy problems. In each type of the problem, the roots of the internal rate of return are derived initially. The probability distribution of t ...

... This thesis finds the closed form probability distribution expressions of the internal rate of return for certain one and two period stochastic engineering economy problems. In each type of the problem, the roots of the internal rate of return are derived initially. The probability distribution of t ...