Access to finance, working capital management and company value

... are differences in the average profitability, activity, leverage and liquidity ratios among industry groups. Over the years, a point that has received considerable attention from several authors is what optimal level of company working capital. Deloof (2003) and Howorth and Westhead (2003) confirm tha ...

... are differences in the average profitability, activity, leverage and liquidity ratios among industry groups. Over the years, a point that has received considerable attention from several authors is what optimal level of company working capital. Deloof (2003) and Howorth and Westhead (2003) confirm tha ...

Liquidity, Investor-Level Tax Rates, and Expected Rates of

... residual cash payment (this expression follows from the discussion of capital gains tax in Sikes and Verrecchia 2011); and 1 + (1 ...

... residual cash payment (this expression follows from the discussion of capital gains tax in Sikes and Verrecchia 2011); and 1 + (1 ...

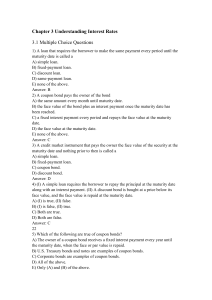

Chapter 3 Understanding Interest Rates

... 52) If you expect the inflation rate to be 5 percent next year and a one-year bond has a yield to maturity of 7 percent, then the real interest rate on this bond is A) -12 percent. B) -2 percent. C) 2 percent. D) 12 percent. Answer: C 53) The nominal interest rate minus the expected rate of inflatio ...

... 52) If you expect the inflation rate to be 5 percent next year and a one-year bond has a yield to maturity of 7 percent, then the real interest rate on this bond is A) -12 percent. B) -2 percent. C) 2 percent. D) 12 percent. Answer: C 53) The nominal interest rate minus the expected rate of inflatio ...

Corporate Bond Portfolios - European Financial Management

... (2002)). With individual corporate bonds, however, this approach is hard to implement as it involves estimating bond expected returns, and their variances and co-variances with a short time-series, large cross-section, and an unbalanced dataset.3 Given the relatively short historical data of corpora ...

... (2002)). With individual corporate bonds, however, this approach is hard to implement as it involves estimating bond expected returns, and their variances and co-variances with a short time-series, large cross-section, and an unbalanced dataset.3 Given the relatively short historical data of corpora ...

The Leverage Rotation Strategy

... One of the mistaken notions about daily re-leveraging is the idea that there is some form of natural decay. This is the belief that over time the cumulative returns from such rebalancing will end up moving towards zero or at the very least being considerably less than a constant buy and hold strateg ...

... One of the mistaken notions about daily re-leveraging is the idea that there is some form of natural decay. This is the belief that over time the cumulative returns from such rebalancing will end up moving towards zero or at the very least being considerably less than a constant buy and hold strateg ...

PSG Global Equity Feeder Fund Class A

... the investment may go down as well as up and past performance is not a guide to future performance. CIS are traded at ruling prices and can engage in borrowing and script lending. The Funds may borrow up to 10% of the market value to bridge insufficient liquidity. Fluctuations or movements in the ex ...

... the investment may go down as well as up and past performance is not a guide to future performance. CIS are traded at ruling prices and can engage in borrowing and script lending. The Funds may borrow up to 10% of the market value to bridge insufficient liquidity. Fluctuations or movements in the ex ...

This PDF is a selection from a published volume from... National Bureau of Economic Research

... Tables 8.1 and 8.2 show annual values and period averages for broad categories of the balance of payments as a percentage of GDP as well as for GDP growth rate. The behavior of the current account has been, in general, dominated by the dynamics of the trade balance, whose deficit cycles are financed ...

... Tables 8.1 and 8.2 show annual values and period averages for broad categories of the balance of payments as a percentage of GDP as well as for GDP growth rate. The behavior of the current account has been, in general, dominated by the dynamics of the trade balance, whose deficit cycles are financed ...

Freescale Semiconductor Announces First Quarter 2015 Results

... For the period in which we incurred a net loss but generated adjusted net earnings, dilutive shares have been included in the diluted weighted average shares and the diluted adjusted net earnings per share calculations. ...

... For the period in which we incurred a net loss but generated adjusted net earnings, dilutive shares have been included in the diluted weighted average shares and the diluted adjusted net earnings per share calculations. ...

II. Foreign portfolio investment[7]

... It is equally difficult to draw general conclusions on likely differences in the import-intensity and export-intensity of the operations of enterprises financed through greenfield investment or M&A activity. They will depend primarily on whether the influence of foreign management led to a significa ...

... It is equally difficult to draw general conclusions on likely differences in the import-intensity and export-intensity of the operations of enterprises financed through greenfield investment or M&A activity. They will depend primarily on whether the influence of foreign management led to a significa ...

Valuation: Part I Discounted Cash Flow Valuation

... While risk is usually defined in terms of the variance of actual returns around an expected return, risk and return models in finance assume that the risk that should be rewarded (and thus built into the discount rate) in valuation should be the risk perceived by the marginal investor in the investm ...

... While risk is usually defined in terms of the variance of actual returns around an expected return, risk and return models in finance assume that the risk that should be rewarded (and thus built into the discount rate) in valuation should be the risk perceived by the marginal investor in the investm ...

PSEG

... Prospective Returns In the future, returns are expected to increase for PSEG, but not to the same extent as other companies in this report. As with other companies studied, the returns are expected to increase as electricity contracts expire and the company can take advantage of higher power prices ...

... Prospective Returns In the future, returns are expected to increase for PSEG, but not to the same extent as other companies in this report. As with other companies studied, the returns are expected to increase as electricity contracts expire and the company can take advantage of higher power prices ...

The exercise price is equal to the market price of $24 per share

... shares of stock. Rather they are given an option to buy shares at some time in the future. Options are usually granted 1. for a specified number of shares, 2. at a specified price, 3. during a specified period of time. ...

... shares of stock. Rather they are given an option to buy shares at some time in the future. Options are usually granted 1. for a specified number of shares, 2. at a specified price, 3. during a specified period of time. ...

CHAPTER 10

... any other company faces in making capital-budgeting decisions, not knowing exactly what future competition they will face. We will also learn how Disney or any other company can modify our capital-budgeting criterion to deal with risk. ...

... any other company faces in making capital-budgeting decisions, not knowing exactly what future competition they will face. We will also learn how Disney or any other company can modify our capital-budgeting criterion to deal with risk. ...

पीडीएफ फाइल जो नई विंडों में खुलती है।

... We all know that every business requires some amount of money to start and run the business. Whether it is a small business or large, manufacturing or trading or transportation business, money is an essential requirement for every activity. Money required for any activity is known as finance. So the ...

... We all know that every business requires some amount of money to start and run the business. Whether it is a small business or large, manufacturing or trading or transportation business, money is an essential requirement for every activity. Money required for any activity is known as finance. So the ...

Collateral and Credit Issues in Derivatives Pricing

... spread in 2011. This increased the bank’s net income by about 15% and contributed 2% to its reported return on equity. ...

... spread in 2011. This increased the bank’s net income by about 15% and contributed 2% to its reported return on equity. ...

The Long-Run Performance of German Stock Mutual Funds

... years later – a cash or quasi-cash payment (Körperschaftsteuergutschrift) which results from the fact that the corporate income tax on dividends is taken into account in the calculation of the personal income tax. From 1977 to 1995 this additional payment was in general 56.25% of the cash dividend. ...

... years later – a cash or quasi-cash payment (Körperschaftsteuergutschrift) which results from the fact that the corporate income tax on dividends is taken into account in the calculation of the personal income tax. From 1977 to 1995 this additional payment was in general 56.25% of the cash dividend. ...

BYOG 3 Quick Guide to Key Ratios

... managing fixed assets. Best used with historical ratios to establish trends. This ratio is highly dependent on the company’s kind of business Like others in this class, this measure is highly dependent upon the nature of the business. It is best used to determine ...

... managing fixed assets. Best used with historical ratios to establish trends. This ratio is highly dependent on the company’s kind of business Like others in this class, this measure is highly dependent upon the nature of the business. It is best used to determine ...

Word Document - Berkeley-Haas

... “deposits” in a mutual thrift are actually shares. A mutual thrift depositor’s ownership claims, however, are very different from those typically implied by share ownership. A depositor cannot transfer ownership rights to third parties. Nor can a depositor receive payouts of retained earnings or rea ...

... “deposits” in a mutual thrift are actually shares. A mutual thrift depositor’s ownership claims, however, are very different from those typically implied by share ownership. A depositor cannot transfer ownership rights to third parties. Nor can a depositor receive payouts of retained earnings or rea ...

here - University of Minnesota Extension

... Worth as of a certain date. It can be thought of as a “snapshot” of your financial condition at that time. For producers whose fiscal year coincides with the calendar year, January 1 is an excellent date for the annual Balance Sheet. It marks the beginning and ending of their business year, and enab ...

... Worth as of a certain date. It can be thought of as a “snapshot” of your financial condition at that time. For producers whose fiscal year coincides with the calendar year, January 1 is an excellent date for the annual Balance Sheet. It marks the beginning and ending of their business year, and enab ...

CORRELATION STRUCTURE OF INTERNATIONAL EQUITY MARKETS DURING EXTREMELY VOLATILE PERIODS

... different from ±1, then the return exceedances of all variables tend to independence as the threshold used to define the tails tends to the upper endpoint of the distribution of returns (+∞ for the normal distribution). In particular, the asymptotic correlation of extreme returns is equal to zero. F ...

... different from ±1, then the return exceedances of all variables tend to independence as the threshold used to define the tails tends to the upper endpoint of the distribution of returns (+∞ for the normal distribution). In particular, the asymptotic correlation of extreme returns is equal to zero. F ...

Vanguard Materials ETF Summary Prospectus

... Actual after-tax returns depend on your tax situation and may differ from those shown in the preceding table. When after-tax returns are calculated, it is assumed that the shareholder was in the highest individual federal marginal income tax bracket at the time of each distribution of income or capi ...

... Actual after-tax returns depend on your tax situation and may differ from those shown in the preceding table. When after-tax returns are calculated, it is assumed that the shareholder was in the highest individual federal marginal income tax bracket at the time of each distribution of income or capi ...

Value-at-Risk and Extreme Returns

... cases there are a number of days between the extreme observations. One does not observe market crashes many days in a row. There are indications of some clustering of the tail events over time. However, the measurement of a spike on a given day, is not indicative of a high probability of a spike the ...

... cases there are a number of days between the extreme observations. One does not observe market crashes many days in a row. There are indications of some clustering of the tail events over time. However, the measurement of a spike on a given day, is not indicative of a high probability of a spike the ...

Present Value of an Ordinary Annuity

... CALCULATOR: ((1 + .02) yX 12 – 1) ÷ .02 x 3,000 = 40,236.27 STO 1 1 + .02 x RCL 1 = 41,040.99 FINANCIAL CALCULATOR: Input 12 and then press N. Input 2 and then press I/Y. Input 0, and then press PV. Input 3,000 +/-, and then press PMT. Press CPT FV = 40,236.27 ...

... CALCULATOR: ((1 + .02) yX 12 – 1) ÷ .02 x 3,000 = 40,236.27 STO 1 1 + .02 x RCL 1 = 41,040.99 FINANCIAL CALCULATOR: Input 12 and then press N. Input 2 and then press I/Y. Input 0, and then press PV. Input 3,000 +/-, and then press PMT. Press CPT FV = 40,236.27 ...

![II. Foreign portfolio investment[7]](http://s1.studyres.com/store/data/009465518_1-aaeccb882c08a66cd754bf0cd0f9039d-300x300.png)