Commercial Real Estate Non-Performing Loan Liquidating Trust

... 2. Should upfront reserves to guarantee interest also be used to guarantee servicing fees? 3. Should there be a minimum reserve to pay property protection advances, taxes and insurance in order to protect against adverse selection within the pool? If so, is it appropriate for this to build over time ...

... 2. Should upfront reserves to guarantee interest also be used to guarantee servicing fees? 3. Should there be a minimum reserve to pay property protection advances, taxes and insurance in order to protect against adverse selection within the pool? If so, is it appropriate for this to build over time ...

Retail Inventory

... Obtain annual financial statements for fiscal year ending between Feb 1, 2008 and Jan 31, 2009. For example, fiscal year 2008 may end on Jan 31, 2009. In each retail segment, rank firms by chosen metric and divide into 5 or 10 equal portfolios. ...

... Obtain annual financial statements for fiscal year ending between Feb 1, 2008 and Jan 31, 2009. For example, fiscal year 2008 may end on Jan 31, 2009. In each retail segment, rank firms by chosen metric and divide into 5 or 10 equal portfolios. ...

USING DAILY STOCK RETURNS

... range of the 250 day 0 mean performance measures ranges from 5.59 to 5.81, and similar average values apply when the properties of the mean excess returns in the estimation period for each sample are studied. However, while values of the studentized range in panel B are consistent with normality of ...

... range of the 250 day 0 mean performance measures ranges from 5.59 to 5.81, and similar average values apply when the properties of the mean excess returns in the estimation period for each sample are studied. However, while values of the studentized range in panel B are consistent with normality of ...

REIT Stocks: An Underutilized Portfolio Diversifier

... in 1999. Currently, real estate is an industry group within the financials sector. The potential implications of this change are significant for real estate equities. GICS is one of the most widely utilized sector classification structures, and substantial assets are managed in accordance with this ...

... in 1999. Currently, real estate is an industry group within the financials sector. The potential implications of this change are significant for real estate equities. GICS is one of the most widely utilized sector classification structures, and substantial assets are managed in accordance with this ...

managed futures and hedge funds: a match made in

... managed futures. First, investors can buy shares in a public commodity (or futures) fund, in much the same way as they would invest in a stock or bond mutual funds. Second, investors can place funds privately with a commodity pool operator (CPO) who pools investors’ money and employs one or more CTA ...

... managed futures. First, investors can buy shares in a public commodity (or futures) fund, in much the same way as they would invest in a stock or bond mutual funds. Second, investors can place funds privately with a commodity pool operator (CPO) who pools investors’ money and employs one or more CTA ...

04.06.2016Dividend policy

... changes its dividend policy in a significant manner, investors assume that it is in response to an expected change in the firm’s profitability which will last long. An increase in payout ratio signals to shareholders a permanent or long term increase in firm’s expected earnings. It is argued that th ...

... changes its dividend policy in a significant manner, investors assume that it is in response to an expected change in the firm’s profitability which will last long. An increase in payout ratio signals to shareholders a permanent or long term increase in firm’s expected earnings. It is argued that th ...

Kritzman_Portfolio_formation

... Most serious investors use mean-variance optimization to form portfolios, in part, because it requires knowledge only of a portfolio’s expected return and variance. Yet this convenience comes at some expense, because the legitimacy of mean-variance optimization depends on questionable assumptions. E ...

... Most serious investors use mean-variance optimization to form portfolios, in part, because it requires knowledge only of a portfolio’s expected return and variance. Yet this convenience comes at some expense, because the legitimacy of mean-variance optimization depends on questionable assumptions. E ...

Risks in Hedge Fund Strategies: Case of Convertible Arbitrage

... we simulate the positive carry strategy on a daily basis for our bond sample. This simulation produces a monthly return series which embodies the risk-return characteristics of the positive carry strategy. To create the other two ABS factors, credit arbitrage and volatility arbitrage strategies, we ...

... we simulate the positive carry strategy on a daily basis for our bond sample. This simulation produces a monthly return series which embodies the risk-return characteristics of the positive carry strategy. To create the other two ABS factors, credit arbitrage and volatility arbitrage strategies, we ...

The Valuation of Collateralised Debt Obligations - DORAS

... CDO cash flows are dependent on the interaction of a portfolio of debt securities over many time periods They are particularly sensitive to the correlation among the underlying secunties and to the terms of the indenture While much progress has been made in modelling debt portfolios over a single pe ...

... CDO cash flows are dependent on the interaction of a portfolio of debt securities over many time periods They are particularly sensitive to the correlation among the underlying secunties and to the terms of the indenture While much progress has been made in modelling debt portfolios over a single pe ...

How Do Underwriters Value Initial Public Offerings?

... a high dividend can be regarded as entering into an ex ante implicit contract that is verifiable in the period following the IPO. Bhattacharya (1979) shows that only highquality firms can credibly use dividend pay-out to signal their quality to investors. In his theoretical model, dividends are an ...

... a high dividend can be regarded as entering into an ex ante implicit contract that is verifiable in the period following the IPO. Bhattacharya (1979) shows that only highquality firms can credibly use dividend pay-out to signal their quality to investors. In his theoretical model, dividends are an ...

Crouhy et al. - IME-USP

... default and migration risks. KMVÕs methodology diers somewhat from CreditMetrics as it relies upon the ``Expected Default Frequency'', or EDF, for each issuer, rather than upon the average historical transition frequencies produced by the rating agencies, for each credit class. Both approaches rely ...

... default and migration risks. KMVÕs methodology diers somewhat from CreditMetrics as it relies upon the ``Expected Default Frequency'', or EDF, for each issuer, rather than upon the average historical transition frequencies produced by the rating agencies, for each credit class. Both approaches rely ...

Investor Expectations and the Volatility Puzzle in the Japanese

... In Table 6, Panel A indicates p-value, which is the probability holding the null hypotheses that the time-series average of the cross-section regression coefficient (hereafter ‘regression coefficient’) is not statistically significantly different from zero. The regression formulae are listed A0 to A ...

... In Table 6, Panel A indicates p-value, which is the probability holding the null hypotheses that the time-series average of the cross-section regression coefficient (hereafter ‘regression coefficient’) is not statistically significantly different from zero. The regression formulae are listed A0 to A ...

Mutual Fund Ratings: What is the Risk in Risk

... publish relative performance ratings of funds. Perhaps you have seen those full page ads in the New York Times or Wall Street Journal, where a fund management ¯rm trumpets one or more of its funds that have obtained the highest (i.e. ¯ve star) ratings from Morningstar. If you haven't paid attention ...

... publish relative performance ratings of funds. Perhaps you have seen those full page ads in the New York Times or Wall Street Journal, where a fund management ¯rm trumpets one or more of its funds that have obtained the highest (i.e. ¯ve star) ratings from Morningstar. If you haven't paid attention ...

A Switch Criterion for Defined Contribution Pension Schemes

... into bonds (in order to limit the risk), but considers also actual returns from the financial market through a dynamic criterion for the second and definitive switch • numerical results are good in comparison with other investment strategies for DC schemes • it considers both the accumulation and th ...

... into bonds (in order to limit the risk), but considers also actual returns from the financial market through a dynamic criterion for the second and definitive switch • numerical results are good in comparison with other investment strategies for DC schemes • it considers both the accumulation and th ...

Annual Report - San Francisco Employees` Retirement System

... death benefits to beneficiaries. Defined benefit plans are funded through employee and employer contributions and investment earnings. SFERS has a reciprocity agreement with CalPERS, California county retirement systems covered by the 1937 Act Retirement Law, and certain other local, independent ret ...

... death benefits to beneficiaries. Defined benefit plans are funded through employee and employer contributions and investment earnings. SFERS has a reciprocity agreement with CalPERS, California county retirement systems covered by the 1937 Act Retirement Law, and certain other local, independent ret ...

Dreyfus Investment Portfolios, MidCap Stock Portfolio

... products may be similar to other funds managed by Dreyfus. However, the investment results of the fund may be higher or lower than, and may not be comparable to, those of any other Dreyfus fund. Total return includes reinvestment of dividends and any capital gains paid. Past performance is no guaran ...

... products may be similar to other funds managed by Dreyfus. However, the investment results of the fund may be higher or lower than, and may not be comparable to, those of any other Dreyfus fund. Total return includes reinvestment of dividends and any capital gains paid. Past performance is no guaran ...

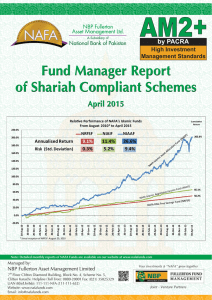

Islamic FMR- April 2015_(Complete)

... the portfolio is invested in bank deposits which enhances the liquidity profile of the Fund. The weighted average time to maturity of the Fund is 21 days. We will rebalance the portfolio based on economic and capital market outlook. ...

... the portfolio is invested in bank deposits which enhances the liquidity profile of the Fund. The weighted average time to maturity of the Fund is 21 days. We will rebalance the portfolio based on economic and capital market outlook. ...

http://dx.doi.org/10.1111/j.1467-629X.2011.00462.x

... budgeting methods as well as the setting of hurdle rates, we address both of the puzzles discussed above. We contrast variables from two main categories of explanations: (i) explanatory variables that explain why certain methods used may be preferable to others, given agency problems within the firm ...

... budgeting methods as well as the setting of hurdle rates, we address both of the puzzles discussed above. We contrast variables from two main categories of explanations: (i) explanatory variables that explain why certain methods used may be preferable to others, given agency problems within the firm ...

CPDO – Managed Trades

... premium earned over the next roll period. – At 15 times leverage, a 10bps spread increase will lead to 1.50% higher return per annum. – Any MTM losses incurred from spread widening in the underlying assets can be made back by increasing the leveraged exposure to this higher spread so that the future ...

... premium earned over the next roll period. – At 15 times leverage, a 10bps spread increase will lead to 1.50% higher return per annum. – Any MTM losses incurred from spread widening in the underlying assets can be made back by increasing the leveraged exposure to this higher spread so that the future ...

Research Insight - Risk and Return of Factor Portfolios

... Factor portfolios have a unit exposure to a risk model’s selected factor and zero to every other factor. They can be used as investment strategies to capture return premia, or as hedges of factor risk. In this Research Insight, we focused on four systematic ways of their construction using differe ...

... Factor portfolios have a unit exposure to a risk model’s selected factor and zero to every other factor. They can be used as investment strategies to capture return premia, or as hedges of factor risk. In this Research Insight, we focused on four systematic ways of their construction using differe ...