AN INTERTEMPORAL ASSET PRICING MODEL WITH

... investment opportunities. General versions of the ‘mutuaJ fund’ theorem of Merton (1973) and Long (1974) and of their multi-beta CAPM are briefly derived. The single-beta, single-good intertemporal CAPM as described above is derived and discussed in section 3. This derivation also generalizes a simi ...

... investment opportunities. General versions of the ‘mutuaJ fund’ theorem of Merton (1973) and Long (1974) and of their multi-beta CAPM are briefly derived. The single-beta, single-good intertemporal CAPM as described above is derived and discussed in section 3. This derivation also generalizes a simi ...

Treasury Wine Estates Annual 2016 financial result

... 10 Financial information in this report is based on unaudited financial statements. Non-IFRS measures have not been subject to audit or review. The non-IFRS measures are used internally by management to assess the operational performance of the business and make decisions on the allocation of resour ...

... 10 Financial information in this report is based on unaudited financial statements. Non-IFRS measures have not been subject to audit or review. The non-IFRS measures are used internally by management to assess the operational performance of the business and make decisions on the allocation of resour ...

S2AV: A valuation methodology for insurance companies

... valuation methodology focuses on these metrics. However, we note that there may be additional constraints on distribution of surplus, which are discussed later. Our basic goal has been to develop a methodology which measures value as the net present value of future expected distributable profits at ...

... valuation methodology focuses on these metrics. However, we note that there may be additional constraints on distribution of surplus, which are discussed later. Our basic goal has been to develop a methodology which measures value as the net present value of future expected distributable profits at ...

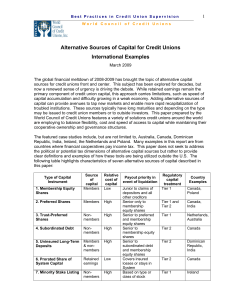

Alternative Sources of Capital for Credit Unions

... instruments based upon the laws of their respective countries, international guidelines and recommendations from the Basel Committee on Banking Supervision and Basel Accords I and II have had substantial influence in determining those capital standards. The Basel Accord on Capital Adequacy defines t ...

... instruments based upon the laws of their respective countries, international guidelines and recommendations from the Basel Committee on Banking Supervision and Basel Accords I and II have had substantial influence in determining those capital standards. The Basel Accord on Capital Adequacy defines t ...

Foundation Investment Policy

... Each investment manager has discretion with regard to security selection and allocation within its respective portfolio. Unless otherwise noted below, under normal market conditions, each investment manager is expected to be invested consistent with its investment style as described in its relevant ...

... Each investment manager has discretion with regard to security selection and allocation within its respective portfolio. Unless otherwise noted below, under normal market conditions, each investment manager is expected to be invested consistent with its investment style as described in its relevant ...

Chapter 18 Shareholders` Equity

... Based upon your knowledge of property dividends, answer the following question. Question Why are property dividends recorded at fair value? Answer Fair value reflects the value of the resource that is given up by the corporation. Liquidating Dividends If a corporation distributes legal dividends and ...

... Based upon your knowledge of property dividends, answer the following question. Question Why are property dividends recorded at fair value? Answer Fair value reflects the value of the resource that is given up by the corporation. Liquidating Dividends If a corporation distributes legal dividends and ...

NBER WORKING PAPER SERIES EXPLAINING DEVIATIONS FROM UNCOVERED INTEREST PARITY Robert E. Cumby

... results of tests of uncovered interest parity in which the U.K. pound and the Deutsche mark are used as the base currency in place of the U.S. dollar. These tests also strongly reject uncovered interest parity. ...

... results of tests of uncovered interest parity in which the U.K. pound and the Deutsche mark are used as the base currency in place of the U.S. dollar. These tests also strongly reject uncovered interest parity. ...

Chapter 17 - McGraw Hill Higher Education

... investment opportunity for the Company, and it underscores our commitment to enhancing long-term shareholder value.’ “The shares will be repurchased with cash on hand, but only if and to the extent the Company holds unrestricted cash in excess of $200 million to ensure that an adequate level of cash ...

... investment opportunity for the Company, and it underscores our commitment to enhancing long-term shareholder value.’ “The shares will be repurchased with cash on hand, but only if and to the extent the Company holds unrestricted cash in excess of $200 million to ensure that an adequate level of cash ...

An Indirect Impact of the Price to Book Value to the Stock Returns

... owner is. Investors buy shares in a company with the hope of gaining future return. Therefore, investments made in stocks of productive enterprise, the business object has a perspective and avoid the falling value of the stock due to the economic cyclical impact as an investment risk that is often t ...

... owner is. Investors buy shares in a company with the hope of gaining future return. Therefore, investments made in stocks of productive enterprise, the business object has a perspective and avoid the falling value of the stock due to the economic cyclical impact as an investment risk that is often t ...

A Transaction Data Study of the Forward Bias Puzzle

... Fama’s beta. Unfortunately, there is no consensus among researchers on the correct explanation for the presence of systematic errors in exchange rate forecasts. Equally important, even after allowing for forecast errors the majority of these studies still find a statistically significant deviation f ...

... Fama’s beta. Unfortunately, there is no consensus among researchers on the correct explanation for the presence of systematic errors in exchange rate forecasts. Equally important, even after allowing for forecast errors the majority of these studies still find a statistically significant deviation f ...

Risk premia in general equilibrium

... = ((ρ − ((µ − r)wt + r))u0 (Ct ) + (µ − r)wt u0 (Ct )) dt − u0 (Ct )(µ − r)/σdBt = (ρ − r)u0 (Ct )dt − πu0 (Ct )dBt , ...

... = ((ρ − ((µ − r)wt + r))u0 (Ct ) + (µ − r)wt u0 (Ct )) dt − u0 (Ct )(µ − r)/σdBt = (ρ − r)u0 (Ct )dt − πu0 (Ct )dBt , ...

Six Factors That Explain Executive Pay

... We measure the impact of pay risk on pay level by using percent equity comp to predict pay level. We find that compensation risk is richly rewarded: $8 of equity for each $1 of cash foregone. Company risk is very modestly rewarded: an increase of one standard deviation in stock volatility increases ...

... We measure the impact of pay risk on pay level by using percent equity comp to predict pay level. We find that compensation risk is richly rewarded: $8 of equity for each $1 of cash foregone. Company risk is very modestly rewarded: an increase of one standard deviation in stock volatility increases ...

Does a Structural Macroeconomic Model Help Long

... companies and pension funds) have an increasing social responsibility to allocate their funds in an optimal manner. The allocation must be made on a long-term basis and the institutional investor must account for the expected evolution of financial markets. The theoretical literature provides some g ...

... companies and pension funds) have an increasing social responsibility to allocate their funds in an optimal manner. The allocation must be made on a long-term basis and the institutional investor must account for the expected evolution of financial markets. The theoretical literature provides some g ...

Sequencing riSk a key challenge to creating SuStainaBle

... outcomes are largely driven by investment returns, experiencing this sequence of returns over the final decade of their working life leads to a vastly different outcome. Unlike the younger investor, the 60-year-old does not have the time to recover from these investment losses through gains made on ...

... outcomes are largely driven by investment returns, experiencing this sequence of returns over the final decade of their working life leads to a vastly different outcome. Unlike the younger investor, the 60-year-old does not have the time to recover from these investment losses through gains made on ...

pan american silver and macmillan minerals

... Roscoe Postle Associates Inc. of Toronto (“RPA”) was contracted by MacMillan to review the valuation of the Portfolio prepared by Maverix. RPA has provided its report to the Board of Directors of MacMillan. As a review of valuation of the Portfolio, RPA carried out preliminary valuations of each of ...

... Roscoe Postle Associates Inc. of Toronto (“RPA”) was contracted by MacMillan to review the valuation of the Portfolio prepared by Maverix. RPA has provided its report to the Board of Directors of MacMillan. As a review of valuation of the Portfolio, RPA carried out preliminary valuations of each of ...

ca-ipcc (1st group) financial management (71 imp questions)

... (i) This method of evaluating proposals for capital budgeting is quite simple and easy to understand. It has the advantage of making it clear that there is no profit on any project unless the payback period is over. Further, when funds are limited, they may be made to do more by selecting projects h ...

... (i) This method of evaluating proposals for capital budgeting is quite simple and easy to understand. It has the advantage of making it clear that there is no profit on any project unless the payback period is over. Further, when funds are limited, they may be made to do more by selecting projects h ...

REITs and Real Estate

... Commercial real estate has reported stellar returns following the real estate downturn of 2008–09. Following returns of 13% in 2010 and 14% in 2011, NCREIF Property Index (NPI) returns have since settled into a range of 10–11%. Similarly, FTSE-NAREIT All Equity returns have been healthy, with the in ...

... Commercial real estate has reported stellar returns following the real estate downturn of 2008–09. Following returns of 13% in 2010 and 14% in 2011, NCREIF Property Index (NPI) returns have since settled into a range of 10–11%. Similarly, FTSE-NAREIT All Equity returns have been healthy, with the in ...

Fear of the Unknown: Familiarity and Economic Decisions

... First, some of the important findings of previous studies are driven by the assumption that some assets have greater uncertainty than others—an assumption that is often reasonable. However, our main findings apply even when investors are equally uncertain about the returns of different assets. For e ...

... First, some of the important findings of previous studies are driven by the assumption that some assets have greater uncertainty than others—an assumption that is often reasonable. However, our main findings apply even when investors are equally uncertain about the returns of different assets. For e ...

Inflation and the Price of Real Assets ∗ Monika Piazzesi Martin Schneider

... that reduced the propensity to save in the household sector. First, entry of the young baby boomers into asset markets directly lowered the average savings rate. Second, the erosion of bond portfolios by surprise inflation reduced the ratio of financial wealth to human wealth, which also gives rise ...

... that reduced the propensity to save in the household sector. First, entry of the young baby boomers into asset markets directly lowered the average savings rate. Second, the erosion of bond portfolios by surprise inflation reduced the ratio of financial wealth to human wealth, which also gives rise ...

Labor income risk and asset returns

... predictable over a horizon of one year and more than four …fth of the cross-sectional variation in expected returns of the Fama and French portfolios is explained. What drives the results? In the data, expectations of high future labor income growth are associated with lower stock market excess ret ...

... predictable over a horizon of one year and more than four …fth of the cross-sectional variation in expected returns of the Fama and French portfolios is explained. What drives the results? In the data, expectations of high future labor income growth are associated with lower stock market excess ret ...