Omega:A Sharper Ratio

... may be “unbiased” with respect to market valuations. But those same valuations, in turn, may well be biased (misaligned) with respect to a counterfactual benchmark in which prices reflect the right signals for economic behaviour.” Borio and Tsatsaronis BIS The Finance Development Centre ...

... may be “unbiased” with respect to market valuations. But those same valuations, in turn, may well be biased (misaligned) with respect to a counterfactual benchmark in which prices reflect the right signals for economic behaviour.” Borio and Tsatsaronis BIS The Finance Development Centre ...

TCW Concentrated Core (Large Cap Growth)

... to offer investment advice or be the basis for an investment decision. Nothing in this document constitutes an offer to sell or the solicitation of an offer to buy securities. Investing in any strategy has risks. An account is subject to price volatility. The value of an account’s portfolio will cha ...

... to offer investment advice or be the basis for an investment decision. Nothing in this document constitutes an offer to sell or the solicitation of an offer to buy securities. Investing in any strategy has risks. An account is subject to price volatility. The value of an account’s portfolio will cha ...

Schroder USD Bond Fund

... information contained herein is not misleading, but no representation as to its accuracy or completeness. Prospective unit holder is advised not to rely solely on the information in this document. Losses that might arise will not be covered. From time to time, PT SIMI, its affiliated companies (if a ...

... information contained herein is not misleading, but no representation as to its accuracy or completeness. Prospective unit holder is advised not to rely solely on the information in this document. Losses that might arise will not be covered. From time to time, PT SIMI, its affiliated companies (if a ...

Statement of Capital Adequacy (Form PDR III) Quarter ended

... (a) Tier I Capital funds (after deductions) Rs. (b) Tier II Capital funds eligible ...

... (a) Tier I Capital funds (after deductions) Rs. (b) Tier II Capital funds eligible ...

outlook 2017: executive summary

... catalyst, which we do not see as likely in 2017. How To Invest We continue to favor intermediate-term bonds for 2017, with an emphasis on investment-grade corporates and mortgage-backed securities, given the backdrop of range-bound interest rates. Lower-quality fixed income will likely be supported ...

... catalyst, which we do not see as likely in 2017. How To Invest We continue to favor intermediate-term bonds for 2017, with an emphasis on investment-grade corporates and mortgage-backed securities, given the backdrop of range-bound interest rates. Lower-quality fixed income will likely be supported ...

Chapter 8

... What is the formula for the standard deviation for a portfolio of risky assets, and how does it differ from the standard deviation of an individual risky asset? Given the formula for the standard deviation of a portfolio, why and how does one diversify a portfolio? What happens to the standard devia ...

... What is the formula for the standard deviation for a portfolio of risky assets, and how does it differ from the standard deviation of an individual risky asset? Given the formula for the standard deviation of a portfolio, why and how does one diversify a portfolio? What happens to the standard devia ...

November 2015 Update - Goodwin Securities, Inc.

... Market Update: October was the best month in years with US stocks up about 8%. We talked last month about possibly being at a bottom in stocks with all the pessimism and that looks to be the case. Both the Dow and the S&P are back right beneath their old highs from May to July. Sadly, these declines ...

... Market Update: October was the best month in years with US stocks up about 8%. We talked last month about possibly being at a bottom in stocks with all the pessimism and that looks to be the case. Both the Dow and the S&P are back right beneath their old highs from May to July. Sadly, these declines ...

risk

... People’s willingness to pay the difference for borrowing today and their desire to receive a surplus on their savings give rise to an interest rate referred to as the pure time value of money. ...

... People’s willingness to pay the difference for borrowing today and their desire to receive a surplus on their savings give rise to an interest rate referred to as the pure time value of money. ...

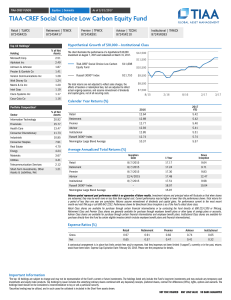

TIAA-CREF Social Choice Low Carbon Equity Fund

... Mutual fund investing involves risk; principal loss is possible. There is no guarantee the Fund’s investment objectives will be achieved. The Fund will include only holdings deemed consistent with the applicable Environmental Social Governance (ESG) guidelines. As a result, the universe of investmen ...

... Mutual fund investing involves risk; principal loss is possible. There is no guarantee the Fund’s investment objectives will be achieved. The Fund will include only holdings deemed consistent with the applicable Environmental Social Governance (ESG) guidelines. As a result, the universe of investmen ...

Solutions to Chapter 11

... long-term bonds, were almost certainly unanticipated by investors who bought those bonds in prior years. The results for this period demonstrate the perils of attempting to measure “normal” maturity (or risk) premiums from historical data. While experience over long periods may be a reasonable guide ...

... long-term bonds, were almost certainly unanticipated by investors who bought those bonds in prior years. The results for this period demonstrate the perils of attempting to measure “normal” maturity (or risk) premiums from historical data. While experience over long periods may be a reasonable guide ...

Risk Management Investment case

... Investors and their Advisors want to believe that they won’t get caught as they did in 2008 again, that they can time the market or move to cash before the next 2008. This is the eternal optimism that makes us all human, but also exactly why bear markets have happened multiple times over history and ...

... Investors and their Advisors want to believe that they won’t get caught as they did in 2008 again, that they can time the market or move to cash before the next 2008. This is the eternal optimism that makes us all human, but also exactly why bear markets have happened multiple times over history and ...

A quantitative take on recent market volatility

... The commentaries contained herein are provided as a general source of information based on information available as of November 2, 2015 and should not be considered as personal investment advice or an offer or solicitation to buy and/or sell securities. Every effort has been made to ensure accuracy ...

... The commentaries contained herein are provided as a general source of information based on information available as of November 2, 2015 and should not be considered as personal investment advice or an offer or solicitation to buy and/or sell securities. Every effort has been made to ensure accuracy ...

objective of the firm

... business and for the efficient allocation of resources in society, we use it as our assumed objective in considering how financial decisions should be made. The purpose of capital markets is to efficiently allocate savings in an economy from ultimate savers to ultimate users of funds who invest in r ...

... business and for the efficient allocation of resources in society, we use it as our assumed objective in considering how financial decisions should be made. The purpose of capital markets is to efficiently allocate savings in an economy from ultimate savers to ultimate users of funds who invest in r ...

1. “Dissecting the Market Pricing of Return Volatility." Torben

... In recent years, markets for direct trading of realized return volatility have emerged. A critical theoretical backdrop for these developments is the model-free implied volatility which can be computed from the full cross-section of options written on the underlying asset price. This notion underlie ...

... In recent years, markets for direct trading of realized return volatility have emerged. A critical theoretical backdrop for these developments is the model-free implied volatility which can be computed from the full cross-section of options written on the underlying asset price. This notion underlie ...

Leveraged ETF credit risks

... Most exchange-traded products are index investments, backed by the actual portfolio of equities or bonds. Although an investor may be taking on the underlying risks of those portfolio holdings, they are not exposed to any risk from the issuer's financial state. For example, if State Street (NYSE:STT ...

... Most exchange-traded products are index investments, backed by the actual portfolio of equities or bonds. Although an investor may be taking on the underlying risks of those portfolio holdings, they are not exposed to any risk from the issuer's financial state. For example, if State Street (NYSE:STT ...

security analysis and portfolio management

... a) Longer maturity period higher risk b) Creditworthiness of borrower more– risks are lower (Govt. securities) c) Ownership securities as returns are based on net profit—rates are variable. 2. Returns— A major factor influencing pattern of investment is its return—i.e. yield plus capital appreciatio ...

... a) Longer maturity period higher risk b) Creditworthiness of borrower more– risks are lower (Govt. securities) c) Ownership securities as returns are based on net profit—rates are variable. 2. Returns— A major factor influencing pattern of investment is its return—i.e. yield plus capital appreciatio ...

Testing CAPM

... Book-to-market has even stronger (positive) relation Market and book leverage have significant, but opposite effect on returns (+/-) ...

... Book-to-market has even stronger (positive) relation Market and book leverage have significant, but opposite effect on returns (+/-) ...

Don`t let market sentiment derail your portfolio from achieving your

... which in turn, further reduce investor confidence and reinforce selling pressure. All investors want to achieve their desired objectives for their investment portfolios, which can be expressed as a required rate of return to pursue their end goals. Unfortunately, investors want more certainty than t ...

... which in turn, further reduce investor confidence and reinforce selling pressure. All investors want to achieve their desired objectives for their investment portfolios, which can be expressed as a required rate of return to pursue their end goals. Unfortunately, investors want more certainty than t ...

EMH Lecture

... • Cheap (expensive) stocks tend to have surprisingly high (low) realized returns • Cheap (expensive) stocks tend to have low (high) volatility, because little (much) is expected of them • Investors may expect higher returns from expensive stocks but they may be repeatedly surprised by disappointing ...

... • Cheap (expensive) stocks tend to have surprisingly high (low) realized returns • Cheap (expensive) stocks tend to have low (high) volatility, because little (much) is expected of them • Investors may expect higher returns from expensive stocks but they may be repeatedly surprised by disappointing ...

Sample title for chapter 1

... on the overall risk of the firm. – A firm may plan to invest in the building products industry carrying a high degree of risk. • The overall risk exposure of that firm might diminish. • The investing firm could alter cyclical fluctuations inherent in its business and reduce overall risk exposure. • ...

... on the overall risk of the firm. – A firm may plan to invest in the building products industry carrying a high degree of risk. • The overall risk exposure of that firm might diminish. • The investing firm could alter cyclical fluctuations inherent in its business and reduce overall risk exposure. • ...

Document

... • Moderate investors seek a middle course between protecting the assets they already have and achieving long-term growth. • For instance, a portfolio that is invested 35% in large cap domestic stocks, 15% in small-company and international securities, and 50% in bonds, might be considered very moder ...

... • Moderate investors seek a middle course between protecting the assets they already have and achieving long-term growth. • For instance, a portfolio that is invested 35% in large cap domestic stocks, 15% in small-company and international securities, and 50% in bonds, might be considered very moder ...

Document

... of their investment changes over time. For example, a stock may pay a $1 dividend while its value falls from $30 to $25 over the ...

... of their investment changes over time. For example, a stock may pay a $1 dividend while its value falls from $30 to $25 over the ...

sygnia skeleton worldwide flexible fund

... return of the portfolio. Nothing in this minimum disclosure document will be considered to state or imply that the collective investment scheme or portfolio is suitable for a particular type of investor. All figures used are merely for illustrative purposes only. This document is for information pur ...

... return of the portfolio. Nothing in this minimum disclosure document will be considered to state or imply that the collective investment scheme or portfolio is suitable for a particular type of investor. All figures used are merely for illustrative purposes only. This document is for information pur ...

I_Ch05

... – Asset pricing (資產定價): to derive the theoretical price of a financial asset (or equivalently, to derive the required return for a series of future cash flows) – Asset allocation (資產配置): to study portfolio choice among broad investment classes (the goal is to form a portfolio with higher expected re ...

... – Asset pricing (資產定價): to derive the theoretical price of a financial asset (or equivalently, to derive the required return for a series of future cash flows) – Asset allocation (資產配置): to study portfolio choice among broad investment classes (the goal is to form a portfolio with higher expected re ...

Confidence Intervals for Value at Risk

... financial markets. There are many risk management models, but by far the most widely used is called VaR or Value at Risk. It is built around statistical topics and probability concepts that have been around for decades. Value at Risk was established and disseminated in the early 1990s by a handful o ...

... financial markets. There are many risk management models, but by far the most widely used is called VaR or Value at Risk. It is built around statistical topics and probability concepts that have been around for decades. Value at Risk was established and disseminated in the early 1990s by a handful o ...

Beta (finance)

In finance, the beta (β) of an investment is a measure of the risk arising from exposure to general market movements as opposed to idiosyncratic factors. The market portfolio of all investable assets has a beta of exactly 1. A beta below 1 can indicate either an investment with lower volatility than the market, or a volatile investment whose price movements are not highly correlated with the market. An example of the first is a treasury bill: the price does not go up or down a lot, so it has a low beta. An example of the second is gold. The price of gold does go up and down a lot, but not in the same direction or at the same time as the market.A beta greater than one generally means that the asset both is volatile and tends to move up and down with the market. An example is a stock in a big technology company. Negative betas are possible for investments that tend to go down when the market goes up, and vice versa. There are few fundamental investments with consistent and significant negative betas, but some derivatives like equity put options can have large negative betas.Beta is important because it measures the risk of an investment that cannot be reduced by diversification. It does not measure the risk of an investment held on a stand-alone basis, but the amount of risk the investment adds to an already-diversified portfolio. In the capital asset pricing model, beta risk is the only kind of risk for which investors should receive an expected return higher than the risk-free rate of interest.The definition above covers only theoretical beta. The term is used in many related ways in finance. For example, the betas commonly quoted in mutual fund analyses generally measure the risk of the fund arising from exposure to a benchmark for the fund, rather than from exposure to the entire market portfolio. Thus they measure the amount of risk the fund adds to a diversified portfolio of funds of the same type, rather than to a portfolio diversified among all fund types.Beta decay refers to the tendency for a company with a high beta coefficient (β > 1) to have its beta coefficient decline to the market beta. It is an example of regression toward the mean.