Assessing Discount Rate for a Project Financed Entirely with Equity

... conclusive and comprehensive to lead to model rejection. The static version of CAPM also has obvious disadvantages: rate of return assessed with CAPM can not be used as discount rate for a project which is not entirely financed with equity capital, because it does not match to forecasted cash flows ...

... conclusive and comprehensive to lead to model rejection. The static version of CAPM also has obvious disadvantages: rate of return assessed with CAPM can not be used as discount rate for a project which is not entirely financed with equity capital, because it does not match to forecasted cash flows ...

tactallocbrochure - Railroad Street Weaith Management LLC

... Asset Allocation is broadly defined as an investment strategy which assigns specific percentages of a portfolio to the different asset types discussed earlier. The portfolio is then periodically rebalanced to the target percentages. The theory behind asset allocation is that by spreading exposure ac ...

... Asset Allocation is broadly defined as an investment strategy which assigns specific percentages of a portfolio to the different asset types discussed earlier. The portfolio is then periodically rebalanced to the target percentages. The theory behind asset allocation is that by spreading exposure ac ...

Chapter 10

... • By doing so, investors could earn an additional premium without taking on additional risk. This opportunity to earn something for nothing would quickly be exploited and eliminated. Because investors can eliminate firm-specific risk “for free” by diversifying their portfolios, they will not require ...

... • By doing so, investors could earn an additional premium without taking on additional risk. This opportunity to earn something for nothing would quickly be exploited and eliminated. Because investors can eliminate firm-specific risk “for free” by diversifying their portfolios, they will not require ...

TIAA-CREF mutual funds CHOOSE THE RIGHT INVESTMENT

... APPROPRIATE INVESTMENT MIX. Many experts agree that while you shouldn’t take unnecessary risks with your savings, you should take a level of risk appropriate for your circumstances to help build the assets to finance the savings goal you have in mind. You can help manage risk by diversifying or spre ...

... APPROPRIATE INVESTMENT MIX. Many experts agree that while you shouldn’t take unnecessary risks with your savings, you should take a level of risk appropriate for your circumstances to help build the assets to finance the savings goal you have in mind. You can help manage risk by diversifying or spre ...

Investment risk, return and volatility

... carry a degree of risk, and risk can never be completely eliminated without giving up some potential return. It’s important to note that the MVP is not expected to address cyclical or random drops in the markets; rather it is a process that kicks in during an extreme market event similar to the Glob ...

... carry a degree of risk, and risk can never be completely eliminated without giving up some potential return. It’s important to note that the MVP is not expected to address cyclical or random drops in the markets; rather it is a process that kicks in during an extreme market event similar to the Glob ...

Handling Market Volatility

... years to invest, keep in mind that stocks have historically outperformed stable-value investments over time, although past performance is no guarantee of future results. If you move most or all of your investment dollars into conservative investments, you've not only locked in any losses you might h ...

... years to invest, keep in mind that stocks have historically outperformed stable-value investments over time, although past performance is no guarantee of future results. If you move most or all of your investment dollars into conservative investments, you've not only locked in any losses you might h ...

Portfolio Management: Course Introduction

... • We can generalize our previous results by considering all risky assets and one risk-free asset. The tangency (optimal risky) portfolio is the market portfolio. All investors will hold a combination of the risk-free asset and this market portfolio. • In this context, the CAL is referred to as the C ...

... • We can generalize our previous results by considering all risky assets and one risk-free asset. The tangency (optimal risky) portfolio is the market portfolio. All investors will hold a combination of the risk-free asset and this market portfolio. • In this context, the CAL is referred to as the C ...

Jeremy Siegel, Rob Arnott and Other Experts Forecast Equity Returns

... offer new ones, and turn the resulting discussion into a book, which has now been published by the CFA Institute’s Research Foundation under the title, Rethinking the Equity Risk Premium. It is available as a free download, or for purchase in hard copy format at a low price, here. The estimates were ...

... offer new ones, and turn the resulting discussion into a book, which has now been published by the CFA Institute’s Research Foundation under the title, Rethinking the Equity Risk Premium. It is available as a free download, or for purchase in hard copy format at a low price, here. The estimates were ...

Which is NOT a basic function of money?

... Bonds- formalized loans that investors offer to businesses and government agencies ...

... Bonds- formalized loans that investors offer to businesses and government agencies ...

smart beta in the limelight

... Investors in securities essentially take two forms of risk: systematic factor risk and idiosyncratic security-specific risk. It is the former that can be isolated and targeted in specific investment strategies. While some individual factors have shown persistence and produced positive returns over t ...

... Investors in securities essentially take two forms of risk: systematic factor risk and idiosyncratic security-specific risk. It is the former that can be isolated and targeted in specific investment strategies. While some individual factors have shown persistence and produced positive returns over t ...

Tax-adjusted discount rates with investor taxes and risky

... RA and (18) the correct asset beta. Then we vary the level of T ∗ and examine the errors arising from using approximations to β A and RL . The first approximation error, in row (a), is that resulting from using the standard asset beta formula (19), rather than (18). This gives relatively small error ...

... RA and (18) the correct asset beta. Then we vary the level of T ∗ and examine the errors arising from using approximations to β A and RL . The first approximation error, in row (a), is that resulting from using the standard asset beta formula (19), rather than (18). This gives relatively small error ...

May 2, 2014 Dear Client: Last year was a year of planned, positive

... NEPC, a well-respected institutional investment consultant with over $400 billion in assets under advisement, produced a recent study on the topic of the benefits of active versus passive investing (a full copy of the study is available upon request). Rather than prescribing a dogmatic adherence to ...

... NEPC, a well-respected institutional investment consultant with over $400 billion in assets under advisement, produced a recent study on the topic of the benefits of active versus passive investing (a full copy of the study is available upon request). Rather than prescribing a dogmatic adherence to ...

The Details of our Investment Process

... than investments in either bonds or money market funds. The key to earning above-average returns is discipline and consistency. There are many systems that work, but most break down because investors, for a variety of reasons, override the system. Our strength is in our disciplined approach to stock ...

... than investments in either bonds or money market funds. The key to earning above-average returns is discipline and consistency. There are many systems that work, but most break down because investors, for a variety of reasons, override the system. Our strength is in our disciplined approach to stock ...

Lyxor Green Bond (DR) UCITS ETF

... It is each investor's responsibility to ascertain that it is authorised to subscribe, or invest into this product. Prior to investing in the product, investors should seek independent financial, tax, accounting and legal advice. Lyxor Green Bond (DR) UCITS ETF is an investment company with Variable ...

... It is each investor's responsibility to ascertain that it is authorised to subscribe, or invest into this product. Prior to investing in the product, investors should seek independent financial, tax, accounting and legal advice. Lyxor Green Bond (DR) UCITS ETF is an investment company with Variable ...

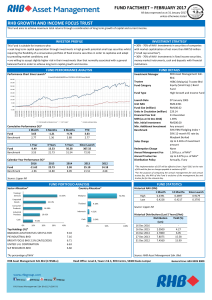

RHB Growth And Income Focus Trust

... call 1-800-88-3175 for a copy of the PHS and the Master Prospectus or collect one from any of our branches or authorised distributors. The Manager wishes to highlight the specific risks for the Fund are liquidity of underlying investments, interest rate risk, credit / default risk, inflation / purch ...

... call 1-800-88-3175 for a copy of the PHS and the Master Prospectus or collect one from any of our branches or authorised distributors. The Manager wishes to highlight the specific risks for the Fund are liquidity of underlying investments, interest rate risk, credit / default risk, inflation / purch ...

Download Document

... Seeing the Big Picture: How Conflict and Corruption Impact Financial Markets ...

... Seeing the Big Picture: How Conflict and Corruption Impact Financial Markets ...

Satrix Top 40 Index Fund

... and service fees. Actual investment performance of the portfolio and the investor will differ depending on the initial fees applicable, the actual investment date, and the date of reinvestment of income as well as dividend withholding tax. Forward pricing is used. The Manager does not provide any gu ...

... and service fees. Actual investment performance of the portfolio and the investor will differ depending on the initial fees applicable, the actual investment date, and the date of reinvestment of income as well as dividend withholding tax. Forward pricing is used. The Manager does not provide any gu ...

Asset allocation in a low-yield and volatile environment

... 50% bond portfolifio are expected to center in the 4.5%–6.5% range in nominal terms and in the 3.5%–4.5% range in real terms over the next decade. This central tendency is below the actual average returns for such a portfolio from 1926 through 2010: 8.2% in nominal terms and 5.1% in real terms. View ...

... 50% bond portfolifio are expected to center in the 4.5%–6.5% range in nominal terms and in the 3.5%–4.5% range in real terms over the next decade. This central tendency is below the actual average returns for such a portfolio from 1926 through 2010: 8.2% in nominal terms and 5.1% in real terms. View ...

Manager`s Comment Performance Total Return

... Kinnevik was our top contributor despite its NAV falling as a result of share price weakness in top holding Zalando and across its listed telecoms businesses. Having remarked last month on Kinnevik’s very wide discount relative to its Swedish holding company peers, we did see it narrow dramatically ...

... Kinnevik was our top contributor despite its NAV falling as a result of share price weakness in top holding Zalando and across its listed telecoms businesses. Having remarked last month on Kinnevik’s very wide discount relative to its Swedish holding company peers, we did see it narrow dramatically ...

Seeing the Big Picture: Financial Markets, Conflict and Corruption

... relationship between returns to financial markets and our metric of geopolitical conflict. We are able to confirm the hypotheses that while conflict is bad for financial market outcomes, it is much worse for bond markets where there little upside for investors. We are also able to show that previous ...

... relationship between returns to financial markets and our metric of geopolitical conflict. We are able to confirm the hypotheses that while conflict is bad for financial market outcomes, it is much worse for bond markets where there little upside for investors. We are also able to show that previous ...

Everything You Wanted to Know about Asset Management for

... returns on a future investment (i.e. cash flow) and then arithmetically discount the expected future cash flows to present value. • There are two parts to the exercise. The first is to formulate expectations of future cash flows. For some assets like Treasury bonds, the expected cash flows are essen ...

... returns on a future investment (i.e. cash flow) and then arithmetically discount the expected future cash flows to present value. • There are two parts to the exercise. The first is to formulate expectations of future cash flows. For some assets like Treasury bonds, the expected cash flows are essen ...

Handout 3

... • If assets are fixed, we have sufficient assets if: r(X) = A • If assets can vary, we have sufficient assets if: r(X – A) = 0 • If assets are fixed, the new criteria reduce to the old because of translation invariance. ...

... • If assets are fixed, we have sufficient assets if: r(X) = A • If assets can vary, we have sufficient assets if: r(X – A) = 0 • If assets are fixed, the new criteria reduce to the old because of translation invariance. ...

Tracking Error Regret Is the Enemy of Investors

... S&P 500 Index provided a total return of 83 percent. That was less than half the 171 percent total return provided by the MSCI EAFE Index and not much more than 20 percent of the 391 percent return of the MSCI Emerging Markets Index. Yes, the S&P 500 Index underperformed the MSCI Emerging Markets In ...

... S&P 500 Index provided a total return of 83 percent. That was less than half the 171 percent total return provided by the MSCI EAFE Index and not much more than 20 percent of the 391 percent return of the MSCI Emerging Markets Index. Yes, the S&P 500 Index underperformed the MSCI Emerging Markets In ...

Capital components: debt, preferred stock, and common stock

... the company stock beta is 1.2 rf = 10%, market risk premium = 5% the company is a constant growth firm that just paid a dividend of $2, sells for $27 per share, and a growth rate of 8% marginal tax rate is 40%. What factors influence a company’s composite WACC? Market conditions. (the leve ...

... the company stock beta is 1.2 rf = 10%, market risk premium = 5% the company is a constant growth firm that just paid a dividend of $2, sells for $27 per share, and a growth rate of 8% marginal tax rate is 40%. What factors influence a company’s composite WACC? Market conditions. (the leve ...

Investment Terminology and Concepts

... • Voting Rights • Owning shares in Home Depot does not mean you can go help yourself to free home improvement or other building materials! ...

... • Voting Rights • Owning shares in Home Depot does not mean you can go help yourself to free home improvement or other building materials! ...

Beta (finance)

In finance, the beta (β) of an investment is a measure of the risk arising from exposure to general market movements as opposed to idiosyncratic factors. The market portfolio of all investable assets has a beta of exactly 1. A beta below 1 can indicate either an investment with lower volatility than the market, or a volatile investment whose price movements are not highly correlated with the market. An example of the first is a treasury bill: the price does not go up or down a lot, so it has a low beta. An example of the second is gold. The price of gold does go up and down a lot, but not in the same direction or at the same time as the market.A beta greater than one generally means that the asset both is volatile and tends to move up and down with the market. An example is a stock in a big technology company. Negative betas are possible for investments that tend to go down when the market goes up, and vice versa. There are few fundamental investments with consistent and significant negative betas, but some derivatives like equity put options can have large negative betas.Beta is important because it measures the risk of an investment that cannot be reduced by diversification. It does not measure the risk of an investment held on a stand-alone basis, but the amount of risk the investment adds to an already-diversified portfolio. In the capital asset pricing model, beta risk is the only kind of risk for which investors should receive an expected return higher than the risk-free rate of interest.The definition above covers only theoretical beta. The term is used in many related ways in finance. For example, the betas commonly quoted in mutual fund analyses generally measure the risk of the fund arising from exposure to a benchmark for the fund, rather than from exposure to the entire market portfolio. Thus they measure the amount of risk the fund adds to a diversified portfolio of funds of the same type, rather than to a portfolio diversified among all fund types.Beta decay refers to the tendency for a company with a high beta coefficient (β > 1) to have its beta coefficient decline to the market beta. It is an example of regression toward the mean.