here

... Another sector that suffered during the reversal was financials. This sector had finished 2016 in spectacular fashion, but trailed the market in the first quarter. We can’t deny that in late 2016, valuation discounts for financials had shrunk significantly, because share prices had risen faster than ...

... Another sector that suffered during the reversal was financials. This sector had finished 2016 in spectacular fashion, but trailed the market in the first quarter. We can’t deny that in late 2016, valuation discounts for financials had shrunk significantly, because share prices had risen faster than ...

Weekly Commentary 11-24-14 PAA

... * The Standard & Poor's 500 (S&P 500) is an unmanaged group of securities considered to be representative of the stock market in general. You cannot invest directly in this index. * The Standard & Poor’s 500 (S&P 500) is an unmanaged index. Unmanaged index returns do not reflect fees, expenses, or s ...

... * The Standard & Poor's 500 (S&P 500) is an unmanaged group of securities considered to be representative of the stock market in general. You cannot invest directly in this index. * The Standard & Poor’s 500 (S&P 500) is an unmanaged index. Unmanaged index returns do not reflect fees, expenses, or s ...

No Slide Title

... • When firms issue stock to the public, investors typically rush to buy and these investors usually realize immediate capital gains. • However, these early gains often turn into losses for the investor. •Bubbles: • There are sometimes cases where market prices as a whole become difficult or impossib ...

... • When firms issue stock to the public, investors typically rush to buy and these investors usually realize immediate capital gains. • However, these early gains often turn into losses for the investor. •Bubbles: • There are sometimes cases where market prices as a whole become difficult or impossib ...

Global Market Maturity Leads to Addition of New Fund: Janus

... Financials Financials Staples Technology Financials Services ...

... Financials Financials Staples Technology Financials Services ...

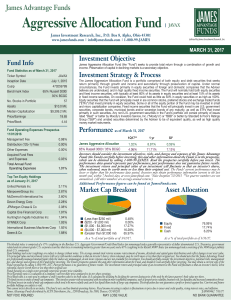

Aggressive Allocation Fund | JAVAX

... Fund holdings and sector weightings are subject to change without notice. The average annual total returns assume reinvestment of income, dividends and capital gains distributions and reflect changes in net asset value. The principal value and investment return will vary with market conditions so th ...

... Fund holdings and sector weightings are subject to change without notice. The average annual total returns assume reinvestment of income, dividends and capital gains distributions and reflect changes in net asset value. The principal value and investment return will vary with market conditions so th ...

Fund Facts

... The services described are provided by CCLA Fund Managers Limited (CCLA), a firm authorised and regulated by the Financial Conduct Authority. This document is issued for information purposes only and is not a solicitation to buy or sell any investment. Nothing in the document should be deemed to con ...

... The services described are provided by CCLA Fund Managers Limited (CCLA), a firm authorised and regulated by the Financial Conduct Authority. This document is issued for information purposes only and is not a solicitation to buy or sell any investment. Nothing in the document should be deemed to con ...

Alternative Investments Global Macro Strategy

... causing modern portfolio management to experience a significant regime change and evolve. Portfolio Management1 theories were developed in the mid to late 1960’s and taught at universities. They were based on the simple assumption that markets were efficient and investors were rational, non-emotiona ...

... causing modern portfolio management to experience a significant regime change and evolve. Portfolio Management1 theories were developed in the mid to late 1960’s and taught at universities. They were based on the simple assumption that markets were efficient and investors were rational, non-emotiona ...

High Dividend Value Select UMA Schafer Cullen

... more concerned about risk. Consequently there is increasing demand for lower-risk investment strategies. However, while many such strategies lessen downside risk, they may reduce upside potential even more. Many investors seem to believe that they must take above average risks to achieve above avera ...

... more concerned about risk. Consequently there is increasing demand for lower-risk investment strategies. However, while many such strategies lessen downside risk, they may reduce upside potential even more. Many investors seem to believe that they must take above average risks to achieve above avera ...

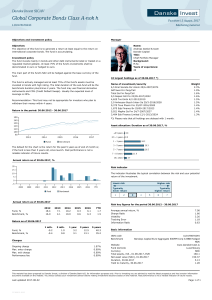

Global Corporate Bonds Class A-nok h

... The main part of the fund's NAV will be hedged against the base currency of the fund. The fund is actively managed and at least 75% of the fund's assets must be invested in bonds with high rating. The total duration of the sub-fund will be the benchmark duration plus/minus 2 years. The fund may use ...

... The main part of the fund's NAV will be hedged against the base currency of the fund. The fund is actively managed and at least 75% of the fund's assets must be invested in bonds with high rating. The total duration of the sub-fund will be the benchmark duration plus/minus 2 years. The fund may use ...

MARKET REVIEW AND ECONOMIC OUTLOOK 2014 Q2 MARKET

... of Europe to stay afloat. We have written in recent newsletters about our concerns in the so-called high-yield or junk sectors of the bond market, and this new deal from Greece does nothing to quell those concerns. Investors who are scrambling to find yield in the bond market are accepting a risk le ...

... of Europe to stay afloat. We have written in recent newsletters about our concerns in the so-called high-yield or junk sectors of the bond market, and this new deal from Greece does nothing to quell those concerns. Investors who are scrambling to find yield in the bond market are accepting a risk le ...

CI Signature Canadian Balanced Fund

... Benchmark 40% FTSE TMX Canada Universe Bond, 30% S&P/TSX, 30% MSCI All Country World Net ...

... Benchmark 40% FTSE TMX Canada Universe Bond, 30% S&P/TSX, 30% MSCI All Country World Net ...

Closed-End Fund GGM Guggenheim Credit Allocation Fund

... Risks and Other Considerations There can be no assurance that the Fund will achieve its investment objective. The value of the Fund will fluctuate with the value of the underlying securities. Historically, closed-end funds often trade at a discount to their net asset value. The Fund is subject to in ...

... Risks and Other Considerations There can be no assurance that the Fund will achieve its investment objective. The value of the Fund will fluctuate with the value of the underlying securities. Historically, closed-end funds often trade at a discount to their net asset value. The Fund is subject to in ...

Risk And Return - Thunderbird Trust

... Interest rates affect the price of most fixed income securities, especially bonds Interest rates (yields) go up and down, depending on what is happening in the economy; generally the better the economy, the higher the interest rate ...

... Interest rates affect the price of most fixed income securities, especially bonds Interest rates (yields) go up and down, depending on what is happening in the economy; generally the better the economy, the higher the interest rate ...

IASB Update Note No. 6 – Peter Wright and Nick Dexter This is the

... of the changes from the proposals in the ED (see below) there may be a need for formal re-exposure or at least making a draft of the standard available for what the IASB calls “additional outreach”. Clearly either re-exposure or additional outreach would make the target unachievable. The FASB is som ...

... of the changes from the proposals in the ED (see below) there may be a need for formal re-exposure or at least making a draft of the standard available for what the IASB calls “additional outreach”. Clearly either re-exposure or additional outreach would make the target unachievable. The FASB is som ...

Dynamic Asset Pricing Model with Exhibition

... high equity premium (when the average stock returns so much higher than the average bond returns). It is based on the fact that in order to reconcile the much higher return on stock compared to government bonds in the United States, individuals must have very high risk aversion according to standard ...

... high equity premium (when the average stock returns so much higher than the average bond returns). It is based on the fact that in order to reconcile the much higher return on stock compared to government bonds in the United States, individuals must have very high risk aversion according to standard ...

Figure 3

... Business risk financial asset that the market price (value) of an asset will decline, resulting in a capital loss when sold. Sometimes Financial risk referred to as interest rate risk. The risk to investors whose investment horizon exceeds Investor-spesific the maturity of a financial risk ass ...

... Business risk financial asset that the market price (value) of an asset will decline, resulting in a capital loss when sold. Sometimes Financial risk referred to as interest rate risk. The risk to investors whose investment horizon exceeds Investor-spesific the maturity of a financial risk ass ...

the case for real return investing

... as a result of any reliance on this information. The PDS for the Perpetual Diversified Real Return Fund, issued by PIML, should be considered before deciding whether to acquire or hold units in the fund. The PDS can be obtained by calling 1800 011 022 or visiting our website www.perpetual.com.au. No ...

... as a result of any reliance on this information. The PDS for the Perpetual Diversified Real Return Fund, issued by PIML, should be considered before deciding whether to acquire or hold units in the fund. The PDS can be obtained by calling 1800 011 022 or visiting our website www.perpetual.com.au. No ...

Small Cap Dividends: A Potential Path to

... finding stocks whose market capitalizations are under $1 Billion, businesses whose capital structures support long term dividend payment and growth potential, management teams whose interest align with shareholders, and business models that generate high returns on equity. These characteristics comb ...

... finding stocks whose market capitalizations are under $1 Billion, businesses whose capital structures support long term dividend payment and growth potential, management teams whose interest align with shareholders, and business models that generate high returns on equity. These characteristics comb ...

Country Risk Updates – Q4 2015 Oct

... Low degree of uncertainty associated with expected returns. However, country-wide factors may result in higher volatility of returns at a future date. Enough uncertainty over expected returns to warrant close monitoring of country risk. Customers should actively manage their risk exposures. Signific ...

... Low degree of uncertainty associated with expected returns. However, country-wide factors may result in higher volatility of returns at a future date. Enough uncertainty over expected returns to warrant close monitoring of country risk. Customers should actively manage their risk exposures. Signific ...

Protecting Against Alternative Investment Risk

... For distribution in EMEA, Korea and Taiwan for Professional Investors only (or professional clients, as such term may apply in the relevant jurisdictions). BlackRock Investment Management (Taiwan) Limited is an independent legal entity, which is located at 28F, 95 Tun Hwa South Road, Section 2, Taip ...

... For distribution in EMEA, Korea and Taiwan for Professional Investors only (or professional clients, as such term may apply in the relevant jurisdictions). BlackRock Investment Management (Taiwan) Limited is an independent legal entity, which is located at 28F, 95 Tun Hwa South Road, Section 2, Taip ...

May 2014

... We also see clients looking to re-strike their yield triggers in line with the current forward curve. Very low levels of equity market volatility combined with high outright market levels have contributed to increased interest in solutions that reduce the volatility of growth asset returns. ...

... We also see clients looking to re-strike their yield triggers in line with the current forward curve. Very low levels of equity market volatility combined with high outright market levels have contributed to increased interest in solutions that reduce the volatility of growth asset returns. ...

Other binomial approaches –

... Heuristic argument of the risk neutral valuation method: Because no assumptions about risk bearing behavior are required to develop the partial differential equation valuation method the solution obtained by the partial differential equation method must be valid in all preference (risk bearing) envi ...

... Heuristic argument of the risk neutral valuation method: Because no assumptions about risk bearing behavior are required to develop the partial differential equation valuation method the solution obtained by the partial differential equation method must be valid in all preference (risk bearing) envi ...

Five for first-timers - The South African Financial Markets Journal

... you want to avoid putting all your eggs in one basket. Keep in mind though that no matter how much you diversify your portfolio, there is always an element of risk involved whenever you invest. ...

... you want to avoid putting all your eggs in one basket. Keep in mind though that no matter how much you diversify your portfolio, there is always an element of risk involved whenever you invest. ...

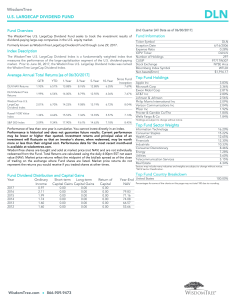

WisdomTree LargeCap Dividend Fund

... Performance of less than one year is cumulative. You cannot invest directly in an index. Performance is historical and does not guarantee future results. Current performance may be lower or higher than quoted. Investment returns and principal value of an investment will fluctuate so that an investor ...

... Performance of less than one year is cumulative. You cannot invest directly in an index. Performance is historical and does not guarantee future results. Current performance may be lower or higher than quoted. Investment returns and principal value of an investment will fluctuate so that an investor ...

Maxis Bhd

... Readers should be fully aware that this report is for information purposes only. The opinions contained in this report are based on information obtained or derived from sources that we believe are reliable. MIDF AMANAH INVESTMENT BANK BERHAD makes no representation or warranty, expressed or implied, ...

... Readers should be fully aware that this report is for information purposes only. The opinions contained in this report are based on information obtained or derived from sources that we believe are reliable. MIDF AMANAH INVESTMENT BANK BERHAD makes no representation or warranty, expressed or implied, ...

Beta (finance)

In finance, the beta (β) of an investment is a measure of the risk arising from exposure to general market movements as opposed to idiosyncratic factors. The market portfolio of all investable assets has a beta of exactly 1. A beta below 1 can indicate either an investment with lower volatility than the market, or a volatile investment whose price movements are not highly correlated with the market. An example of the first is a treasury bill: the price does not go up or down a lot, so it has a low beta. An example of the second is gold. The price of gold does go up and down a lot, but not in the same direction or at the same time as the market.A beta greater than one generally means that the asset both is volatile and tends to move up and down with the market. An example is a stock in a big technology company. Negative betas are possible for investments that tend to go down when the market goes up, and vice versa. There are few fundamental investments with consistent and significant negative betas, but some derivatives like equity put options can have large negative betas.Beta is important because it measures the risk of an investment that cannot be reduced by diversification. It does not measure the risk of an investment held on a stand-alone basis, but the amount of risk the investment adds to an already-diversified portfolio. In the capital asset pricing model, beta risk is the only kind of risk for which investors should receive an expected return higher than the risk-free rate of interest.The definition above covers only theoretical beta. The term is used in many related ways in finance. For example, the betas commonly quoted in mutual fund analyses generally measure the risk of the fund arising from exposure to a benchmark for the fund, rather than from exposure to the entire market portfolio. Thus they measure the amount of risk the fund adds to a diversified portfolio of funds of the same type, rather than to a portfolio diversified among all fund types.Beta decay refers to the tendency for a company with a high beta coefficient (β > 1) to have its beta coefficient decline to the market beta. It is an example of regression toward the mean.