Efficient Carbon Policy: Taxes vs. Cap & Trade

... Given the appropriate information, it is possible to choose the ceiling to equal the “efficient” amount of carbon Trading of rights mitigates private information problems, and ensures that carbon reduction achieved in the most cost-effective way ...

... Given the appropriate information, it is possible to choose the ceiling to equal the “efficient” amount of carbon Trading of rights mitigates private information problems, and ensures that carbon reduction achieved in the most cost-effective way ...

Carbon Neutral Event

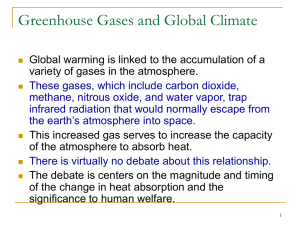

... Greenhouse Gases Greenhouse gases (GHG) are six groups of gases most of which are emitted in the atmosphere mainly from burning fossil fuels such as coal, oil and natural gas for electricity, heating and transportation. Such gases are Carbon dioxide, Methane, Nitrous Oxide, Hydrofluorocarbons, Perfl ...

... Greenhouse Gases Greenhouse gases (GHG) are six groups of gases most of which are emitted in the atmosphere mainly from burning fossil fuels such as coal, oil and natural gas for electricity, heating and transportation. Such gases are Carbon dioxide, Methane, Nitrous Oxide, Hydrofluorocarbons, Perfl ...

The Relative Analysis on the Implementation of Carbon Tax in...

... Although there is a variety of government polices available to achieve the above goals, their respective effects, efficiency and applicalibity in practice must be taken into consideration during the foundation and implementation process. Before the carbon tax is finally enacted, we have to elaborate ...

... Although there is a variety of government polices available to achieve the above goals, their respective effects, efficiency and applicalibity in practice must be taken into consideration during the foundation and implementation process. Before the carbon tax is finally enacted, we have to elaborate ...

Carbon Reduction Appendix 1 [Word Document 39KB]

... payment is set at £12 per tonne for 2011-12, although it is possible that in future years it will track the recently-announced Carbon Floor Price. This will start at £16 per tonne in 2013-14 and have a linear progression to £30 per tonne by 2020. The Energy Bill The Energy Bill is currently making i ...

... payment is set at £12 per tonne for 2011-12, although it is possible that in future years it will track the recently-announced Carbon Floor Price. This will start at £16 per tonne in 2013-14 and have a linear progression to £30 per tonne by 2020. The Energy Bill The Energy Bill is currently making i ...

New report: reliance on carbon trading is a false solution to climate

... climate change Barcelona, 5 November (Josie Lee)-- Amidst the backdrop of discussions closed to observers at the Barcelona climate talks, Friends of the Earth today released the research report: ‘A Dangerous Obsession - Evidence against carbon trading and for real solutions to avoid a climate crunch ...

... climate change Barcelona, 5 November (Josie Lee)-- Amidst the backdrop of discussions closed to observers at the Barcelona climate talks, Friends of the Earth today released the research report: ‘A Dangerous Obsession - Evidence against carbon trading and for real solutions to avoid a climate crunch ...

Methane emissions

... Livestock are considered one of the larger anthropogenic contributors of methane. Methane is considered a major greenhouse gas, being 21 times more potent than carbon dioxide on a molecular basis.1 However, methane has a net lifetime in the atmosphere of only 8.3 ± 1.7 years, after which it converts ...

... Livestock are considered one of the larger anthropogenic contributors of methane. Methane is considered a major greenhouse gas, being 21 times more potent than carbon dioxide on a molecular basis.1 However, methane has a net lifetime in the atmosphere of only 8.3 ± 1.7 years, after which it converts ...

Greenhouse Gases and Farming Livestock

... Calculations provided by Overseer® (www.agresearch/overseerweb/) for Friesian-Jersey cross cows and 600kg/ha milk solids agreed with the Carbon Farming Group calculator when fuel, electricity and capital development were omitted from outputs. ...

... Calculations provided by Overseer® (www.agresearch/overseerweb/) for Friesian-Jersey cross cows and 600kg/ha milk solids agreed with the Carbon Farming Group calculator when fuel, electricity and capital development were omitted from outputs. ...

Developing Low Carbon Cities in Asia: A Study of Bhopal, India

... AIM/ExSS model. In consultation with policymakers and city planners, action plan and policy measures are suggested for moving towards the low carbon society Bhopal 2035. The simulations show that the GHG emission and energy consumption increase in the both the ...

... AIM/ExSS model. In consultation with policymakers and city planners, action plan and policy measures are suggested for moving towards the low carbon society Bhopal 2035. The simulations show that the GHG emission and energy consumption increase in the both the ...

The Carbon Cycle and Climate Change

... soil quality; improves agronomic productivity; and advances food security. It is a low-hanging fruit and a bridge to the future, until carbon-neutral fuel sources and low-carbon economy take effect. ...

... soil quality; improves agronomic productivity; and advances food security. It is a low-hanging fruit and a bridge to the future, until carbon-neutral fuel sources and low-carbon economy take effect. ...

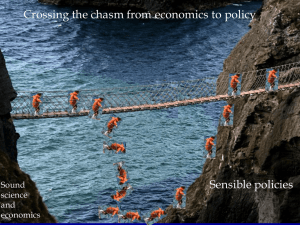

How to Break the Climate Deadlock

... For the past 30 years the ideology of the unfettered marketplace has so dominated our discourse that most of us can scarcely imagine an alternative way of organizing our affairs. Individuals who try are dismissed as unrealistic, romantic, polemical or (in America) communists. When environmentalist a ...

... For the past 30 years the ideology of the unfettered marketplace has so dominated our discourse that most of us can scarcely imagine an alternative way of organizing our affairs. Individuals who try are dismissed as unrealistic, romantic, polemical or (in America) communists. When environmentalist a ...

IIGCC Statement on EU ETS Reform

... The scientific evidence on manmade climate change is clear. Yet despite global efforts to control emissions, global CO2 concentrations are still rising, with an increase of more than 5% in 2010 – unprecedented in the past two decades1. Concentrations of greenhouse gases in the atmosphere are now clo ...

... The scientific evidence on manmade climate change is clear. Yet despite global efforts to control emissions, global CO2 concentrations are still rising, with an increase of more than 5% in 2010 – unprecedented in the past two decades1. Concentrations of greenhouse gases in the atmosphere are now clo ...

Climate facts Labor overlooked

... of per capita emissions said to be necessary to stabilise atmospheric levels of carbon dioxide. In both countries, nuclear power and efficient coal-fired electricity generators are being embraced, but these choices are directed at energy supply efficiency not carbon dioxide emissions. Minister Combe ...

... of per capita emissions said to be necessary to stabilise atmospheric levels of carbon dioxide. In both countries, nuclear power and efficient coal-fired electricity generators are being embraced, but these choices are directed at energy supply efficiency not carbon dioxide emissions. Minister Combe ...

REDUCE EMISSIONS THROUGH NATURE CONSERVATON

... Mitigation measures should also take advantage of opportunities to sequester carbon in urban nature settings. Small pockets of greenery in an urban setting can still hold a significant amount of carbon while also providing additional benefits especially if they are allowed to expand, such as bufferi ...

... Mitigation measures should also take advantage of opportunities to sequester carbon in urban nature settings. Small pockets of greenery in an urban setting can still hold a significant amount of carbon while also providing additional benefits especially if they are allowed to expand, such as bufferi ...

Louise Hicks

... • How to frame climate change related KPIs and other climate change related clauses in contracts. Incentives? • Increased top-down pressure on the supply chain will provide incentives for improved environmental management in a range of industries and service providers, not just the high-profile area ...

... • How to frame climate change related KPIs and other climate change related clauses in contracts. Incentives? • Increased top-down pressure on the supply chain will provide incentives for improved environmental management in a range of industries and service providers, not just the high-profile area ...

Le climat et les ressources naturelles. Quels enjeux pour 2010

... <2ºC pathway requires: BOTH 40% below 1990 by 2020 in Annex I countries; AND a limit to the growth in emissions equal to Annex I reductions in Non-Annex I countries. Any offsetting must be in addition to the these reductions in Non-Annex I countries. ...

... <2ºC pathway requires: BOTH 40% below 1990 by 2020 in Annex I countries; AND a limit to the growth in emissions equal to Annex I reductions in Non-Annex I countries. Any offsetting must be in addition to the these reductions in Non-Annex I countries. ...

Chapter 7 – global warming - Iowa State University Department of

... but this is a step in the right direction. Work will commence on methods to demonstrate emissions reductions from retarded deforestation and design policy incentives for reducing emissions from deforestation and land degradation. (Deforestation — from a range of countries, including Brazil and the C ...

... but this is a step in the right direction. Work will commence on methods to demonstrate emissions reductions from retarded deforestation and design policy incentives for reducing emissions from deforestation and land degradation. (Deforestation — from a range of countries, including Brazil and the C ...

19/06/2012 - IFIEC Europe

... • No arbitrary, improvised set aside or price setting, but logical changes that makes ETS attractive even for fast developing countries with a massive carbon output (the ones that really ...

... • No arbitrary, improvised set aside or price setting, but logical changes that makes ETS attractive even for fast developing countries with a massive carbon output (the ones that really ...

Hosting a Carbon Neutral Event in Thunder Bay, Ontario Many

... carbon cost of operating the Outpost space even though many of these costs would have been incurred even if the conference had not taken place. Another consideration is the carbon cost of airplane flights; many conversions result in about the same amount per individual per km as for an ...

... carbon cost of operating the Outpost space even though many of these costs would have been incurred even if the conference had not taken place. Another consideration is the carbon cost of airplane flights; many conversions result in about the same amount per individual per km as for an ...

CCCI FS5b Climate Change Mitigation

... electricity by 2015, then targeting 100% coverage by 20203. To date, the Cook Islands has achieved its 50% target and is on track to achieving the 2020 target. Our forests and oceans contain important carbon sinks. Both the ocean and forests absorb and store carbon dioxide from the atmosphere. There ...

... electricity by 2015, then targeting 100% coverage by 20203. To date, the Cook Islands has achieved its 50% target and is on track to achieving the 2020 target. Our forests and oceans contain important carbon sinks. Both the ocean and forests absorb and store carbon dioxide from the atmosphere. There ...

WSDCCRES - 770 - 160130 - PASS - INT

... WHEREAS I-732 is not revenue neutral, but according to a State Department of Revenue analysis will increase Washington State's structural budget deficit by $ 675 million over the next four years, exacerbating the current problem of funding the McCleary decision, mental health funding, and a range of ...

... WHEREAS I-732 is not revenue neutral, but according to a State Department of Revenue analysis will increase Washington State's structural budget deficit by $ 675 million over the next four years, exacerbating the current problem of funding the McCleary decision, mental health funding, and a range of ...

Supporting policies & laws

... Emissions Trading Scheme Voluntary carbon market: verified emissions reductions under internationally recognised certification standards (Voluntary Carbon Standard, VER+ & the Gold Standard) China domestic carbon market (Panda Standard) Since 1 December 2009 HK companies can wholly own & contro ...

... Emissions Trading Scheme Voluntary carbon market: verified emissions reductions under internationally recognised certification standards (Voluntary Carbon Standard, VER+ & the Gold Standard) China domestic carbon market (Panda Standard) Since 1 December 2009 HK companies can wholly own & contro ...

The Trillion-Ton Cap: Allocating the World`s Carbon Emissions by

... share," he says. In the end, political agreements will mean nothing unless there are practical means of achieving them. So what needs to be done? Some used to think we might run out of oil and other fossil fuels in time to stave off climate disaster. That no longer seems likely. Discoveries of uncon ...

... share," he says. In the end, political agreements will mean nothing unless there are practical means of achieving them. So what needs to be done? Some used to think we might run out of oil and other fossil fuels in time to stave off climate disaster. That no longer seems likely. Discoveries of uncon ...

Brendan Reid of the Carbon Trust

... Regulation – International & National Level Kyoto – UK commitment to 12.5% reduction in CO2 by 2008-2012 (c.f. 1990) – Actual is 2% rise driven by increased energy demand and transport sectors – 2nd stage of Kyoto (CDM for developing countries just about to start) ...

... Regulation – International & National Level Kyoto – UK commitment to 12.5% reduction in CO2 by 2008-2012 (c.f. 1990) – Actual is 2% rise driven by increased energy demand and transport sectors – 2nd stage of Kyoto (CDM for developing countries just about to start) ...

![Carbon Reduction Appendix 1 [Word Document 39KB]](http://s1.studyres.com/store/data/002220608_1-93900bdad703477c16c5096b2c47b94b-300x300.png)