cap and trade systems limiting carbon emissions

... the Earth, then radiated back into the atmosphere. These gases then absorb the energy and either reflect it back to the earth or to other greenhouse gases. Although this process is natural, global climate change has accelerated because of human intervention. In its Fourth Assessment Report, the Inte ...

... the Earth, then radiated back into the atmosphere. These gases then absorb the energy and either reflect it back to the earth or to other greenhouse gases. Although this process is natural, global climate change has accelerated because of human intervention. In its Fourth Assessment Report, the Inte ...

first carbon neutral zone created in the united states

... ATLANTA (NOVEMBER 14, 2008)— Global climate change is one of the most daunting challenges of the 21st century, but the recent growth and popularity of American ecoconsciousness has created a new sense of urgency to address this problem. Today the green movement took a significant step forward as the ...

... ATLANTA (NOVEMBER 14, 2008)— Global climate change is one of the most daunting challenges of the 21st century, but the recent growth and popularity of American ecoconsciousness has created a new sense of urgency to address this problem. Today the green movement took a significant step forward as the ...

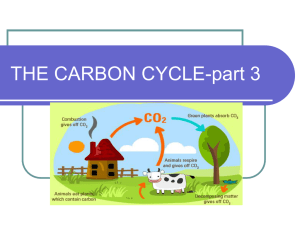

THE CARBON CYCLE - Issaquah Connect

... Burning anything releases more carbon into the atmosphere — especially fossil fuels. Burning Fossil Fuels releases carbon stores ...

... Burning anything releases more carbon into the atmosphere — especially fossil fuels. Burning Fossil Fuels releases carbon stores ...

offsets

... emissions reductions. It is as robust as it gets, and you can't go wrong buying reductions from these projects. – A handful of experienced non-governmental organizations have developed standards for carbon reductions. Offsets meeting these standards are sometimes worthy of your investment. Demand ac ...

... emissions reductions. It is as robust as it gets, and you can't go wrong buying reductions from these projects. – A handful of experienced non-governmental organizations have developed standards for carbon reductions. Offsets meeting these standards are sometimes worthy of your investment. Demand ac ...

Meeting the UK’s carbon budgets

... •Decarbonising our energy supply: a seven-fold increase in renewable energy by 2020, alongside new nuclear energy and clean fossil fuels through Carbon Capture and Storage •Greener homes and communities, with huge increases in energy efficiency, and community level measures such as district heating ...

... •Decarbonising our energy supply: a seven-fold increase in renewable energy by 2020, alongside new nuclear energy and clean fossil fuels through Carbon Capture and Storage •Greener homes and communities, with huge increases in energy efficiency, and community level measures such as district heating ...

Carbon account…… - Centre for Responsible Tourism

... This is usually expressed as an emissions/conversion factor Units of activity x EF = total CO2 generated ...

... This is usually expressed as an emissions/conversion factor Units of activity x EF = total CO2 generated ...

PDF

... commodities, in the sho rt run producers will likely McCarl, B.A., M. Gowen, and T. Yeats. "An Im pact gain and consumers lose. In the longer run con- Assessment of Climate Change Mitigati on Policies and sum er losses may be offse t by the benefits from Carbon Permit Prices on the U.S . Agricultura ...

... commodities, in the sho rt run producers will likely McCarl, B.A., M. Gowen, and T. Yeats. "An Im pact gain and consumers lose. In the longer run con- Assessment of Climate Change Mitigati on Policies and sum er losses may be offse t by the benefits from Carbon Permit Prices on the U.S . Agricultura ...

MHC-200-Powerpoint

... Federal Carbon Tax • If the US itself imposes the tax, it could affect other nations that trade resources that consume fossil fuels, and push other nations to adopt their own taxes. • It would be easier to regulate at the national level the tax, rather than each state having their own tax and making ...

... Federal Carbon Tax • If the US itself imposes the tax, it could affect other nations that trade resources that consume fossil fuels, and push other nations to adopt their own taxes. • It would be easier to regulate at the national level the tax, rather than each state having their own tax and making ...

King`s College London

... • Reduction of other distorting taxes reduces net cost of abatement (revenue neutrality) • If innovation, awareness, industrial cost reduction, reduced distortions are greater than abatement costs, then environmental improvement can be achieved at net gain to the economy – green economic growth (dou ...

... • Reduction of other distorting taxes reduces net cost of abatement (revenue neutrality) • If innovation, awareness, industrial cost reduction, reduced distortions are greater than abatement costs, then environmental improvement can be achieved at net gain to the economy – green economic growth (dou ...

accounting of carbon credit

... periodically checks whether emission reduction has actually taken place or not. Only after verification by DOE, CER’s are delivered. These certificates can be traded at designated markets called as Climate Exchange. ...

... periodically checks whether emission reduction has actually taken place or not. Only after verification by DOE, CER’s are delivered. These certificates can be traded at designated markets called as Climate Exchange. ...

Strategies for suppliers in a carbon constrained world

... • evidence of global warming due to anthropogenic GHG emissions is mounting • increasingly clear that a carbon constrained world will become a reality • multiple initiatives are under way to realise this: – UNFCCC (1992) and the Kyoto Protocol (1997) were first steps – EU Emissions Trading Scheme (E ...

... • evidence of global warming due to anthropogenic GHG emissions is mounting • increasingly clear that a carbon constrained world will become a reality • multiple initiatives are under way to realise this: – UNFCCC (1992) and the Kyoto Protocol (1997) were first steps – EU Emissions Trading Scheme (E ...

Slide 0 - Brookings Institution

... »Did companies mislead shareholders and the public about climate change science? ...

... »Did companies mislead shareholders and the public about climate change science? ...

The changes in climate that drive these declines may be manifested

... Climate-driven changes to federal lands could undercut the gains achieved by the Clean Power Plan The US Geological Survey has published the first-ever comprehensive estimate of carbon storage on federal lands under future climate scenarios. Initially, it looks like good news: federal lands are proj ...

... Climate-driven changes to federal lands could undercut the gains achieved by the Clean Power Plan The US Geological Survey has published the first-ever comprehensive estimate of carbon storage on federal lands under future climate scenarios. Initially, it looks like good news: federal lands are proj ...

climate change and the greenhouse effect

... human industrial activities has led to the burning of more fossil fuels, and in turn more carbon dioxide has been released into the atmosphere. With urbanisation and population growth, more forests are also felled to ...

... human industrial activities has led to the burning of more fossil fuels, and in turn more carbon dioxide has been released into the atmosphere. With urbanisation and population growth, more forests are also felled to ...

Discounting and the Environment

... • “Weitzman is surely correct that prevailing interest rates reveal ethically relevant information. But it is information about how individuals, acting as individuals and largely in their own interests, weight present versus future wellbeing. However, the social discount rate should reflect explicit ...

... • “Weitzman is surely correct that prevailing interest rates reveal ethically relevant information. But it is information about how individuals, acting as individuals and largely in their own interests, weight present versus future wellbeing. However, the social discount rate should reflect explicit ...

Global Air Quality - Northern Arizona University

... • Carbon tax is more specific, targeting only carbon-based fuels gasoline, coal, natural gas – The carbon tax changes relative fuel prices and could elevate the price by the MEC of the environmental damage, internalizing the negative externality ...

... • Carbon tax is more specific, targeting only carbon-based fuels gasoline, coal, natural gas – The carbon tax changes relative fuel prices and could elevate the price by the MEC of the environmental damage, internalizing the negative externality ...

Nitrogen and the Terrestrial Carbon Cycle in UKESM1 Andy

... One key aspect of Earth System Models (ESM) that distinguishes them from their (physical) Global Climate Model (GCM) relations is the inclusion of interactive biogeochemical processes, such as the carbon cycle. The Earth’s natural carbon cycle acts to moderate the amount of anthropogenic emitted CO2 ...

... One key aspect of Earth System Models (ESM) that distinguishes them from their (physical) Global Climate Model (GCM) relations is the inclusion of interactive biogeochemical processes, such as the carbon cycle. The Earth’s natural carbon cycle acts to moderate the amount of anthropogenic emitted CO2 ...

Carbon Removals Peter Read Massey University Centre for Energy

... adapt them to 10 per cent ethanol • Mandate investment by stationary emitters [both energy, and land based] in a rising area of new plantations Do not rely on price signals – today’s price is a weak driver for investment decisions ...

... adapt them to 10 per cent ethanol • Mandate investment by stationary emitters [both energy, and land based] in a rising area of new plantations Do not rely on price signals – today’s price is a weak driver for investment decisions ...

CCL Monthly Conference Call, Saturday, April 4, 2015

... Looking at the effects of climate change happening now – rising seas, intensifying storms, severe droughts – it is clear we have little time to waste in our efforts to reduce greenhouse gas emissions. In lieu of a price on carbon, our only available option to lower carbon emissions is through the EP ...

... Looking at the effects of climate change happening now – rising seas, intensifying storms, severe droughts – it is clear we have little time to waste in our efforts to reduce greenhouse gas emissions. In lieu of a price on carbon, our only available option to lower carbon emissions is through the EP ...

Road Transport - the Carbon Challenge

... Technology offers the potential to significantly reduce greenhouse gas emissions from road transport – but responsible vehicle use and other behaviour changes also have important roles A wide range range of fuel and vehicle technology options Low carbon technologies are more expensive and need ...

... Technology offers the potential to significantly reduce greenhouse gas emissions from road transport – but responsible vehicle use and other behaviour changes also have important roles A wide range range of fuel and vehicle technology options Low carbon technologies are more expensive and need ...

Seven Steps for Managing the Carbon Footprint of your

... However, it will be impossible to reach a level of carbon neutrality (zero GHG emissions) by the sole implementation of internal improvements, for every action of development cause externalities to the environment. For this reason, a voluntary next step of the cycle is the purchase of carbon offset ...

... However, it will be impossible to reach a level of carbon neutrality (zero GHG emissions) by the sole implementation of internal improvements, for every action of development cause externalities to the environment. For this reason, a voluntary next step of the cycle is the purchase of carbon offset ...

blue carbon - Conservation International

... immediately available and cost-effective tool for removing greenhouse gases already in the atmosphere. In addition, these habitats provide many other ecosystem services that are critical for helping communities and biodiversity adapt to the impacts of climate change. ...

... immediately available and cost-effective tool for removing greenhouse gases already in the atmosphere. In addition, these habitats provide many other ecosystem services that are critical for helping communities and biodiversity adapt to the impacts of climate change. ...

Citizens Climate Lobby - 2017-18 Pre-Budget

... the budget appear not to be working and it is increasingly difficult to find much support, let alone consensus for policy measures to keep the economy on track. And Australia has committed to the Paris Agreement and is working with other countries to keep global warming below 2C and preferably close ...

... the budget appear not to be working and it is increasingly difficult to find much support, let alone consensus for policy measures to keep the economy on track. And Australia has committed to the Paris Agreement and is working with other countries to keep global warming below 2C and preferably close ...