The impact of fiscal policy on the business cycle

... effects will be outweighed by the impact on aggregate demand. For example, a cut in company tax would probably spur investment. This investment would lead to greater productive capital in the long term, but, in the short term, the investment will boost aggregate demand as capital is purchased and pu ...

... effects will be outweighed by the impact on aggregate demand. For example, a cut in company tax would probably spur investment. This investment would lead to greater productive capital in the long term, but, in the short term, the investment will boost aggregate demand as capital is purchased and pu ...

Mr. Mayer AP Macroeconomics

... The Long-Run Aggregate Supply or LRAS marks the level of full employment in the economy (analogous to PPC) Because input prices are completely flexible in the long-run, changes in price-level do not change firms’ real profits and therefore do not change firms’ level of output. This means that the LR ...

... The Long-Run Aggregate Supply or LRAS marks the level of full employment in the economy (analogous to PPC) Because input prices are completely flexible in the long-run, changes in price-level do not change firms’ real profits and therefore do not change firms’ level of output. This means that the LR ...

xii premio do tesouro nacional

... Public-private partnerships (PPPs) are contracts that private sector offers infrastructure assets and services that is traditionally been provided by government. PPPs can be attractive for both government and private sector. For the government, private financing can provide expansion of the infrastr ...

... Public-private partnerships (PPPs) are contracts that private sector offers infrastructure assets and services that is traditionally been provided by government. PPPs can be attractive for both government and private sector. For the government, private financing can provide expansion of the infrastr ...

(c.) (a.)

... 14. (56%) A major advantage of automatic stabilizers in fiscal policy is that they a. reduce the public debt b. increase the possibility of a balanced budget c. stabilize the unemployment rate d. go into effect without passage of new legislation e. automatically reduce the inflation rate ...

... 14. (56%) A major advantage of automatic stabilizers in fiscal policy is that they a. reduce the public debt b. increase the possibility of a balanced budget c. stabilize the unemployment rate d. go into effect without passage of new legislation e. automatically reduce the inflation rate ...

The Term Structure of Interest Rates, Real Activity and Inflation

... immediately (to I,) due to the liquidity effect. Rational investors realise that in the medium/long run output will rise, increasing the demand for money. The short term interest rate must thus be expected to rise over time. As a consequence the long interest rate does not fall by as much as the sh ...

... immediately (to I,) due to the liquidity effect. Rational investors realise that in the medium/long run output will rise, increasing the demand for money. The short term interest rate must thus be expected to rise over time. As a consequence the long interest rate does not fall by as much as the sh ...

ICG: The Rise of Private Debt as an Institutional Asset Class

... “The changing strategies of traditional institutional lenders in the wake of the recession continues to act as a drag on business expansion plans. This has spurred a rapid growth and increased interest in alternative forms of lending, with demand from Europe’s SMEs matched by a strong appetite from ...

... “The changing strategies of traditional institutional lenders in the wake of the recession continues to act as a drag on business expansion plans. This has spurred a rapid growth and increased interest in alternative forms of lending, with demand from Europe’s SMEs matched by a strong appetite from ...

Moulton

... New treatment of employee stock options. Accrual-based estimates of liabilities for definedbenefit pension plans. Measures of capital services and integration of ...

... New treatment of employee stock options. Accrual-based estimates of liabilities for definedbenefit pension plans. Measures of capital services and integration of ...

Minimum Wage Fact Sheet

... 1.2 The actual minimum wage rate and the minimum wage rate in 2016 dollars 1 As shown in the graph below, the minimum wage rate in 2016 dollars peaked in 1976 at $11.72 per hour, followed by a sharp decrease to a low point of $7.32 per hour in 1988. During this period, although the actual minimum wa ...

... 1.2 The actual minimum wage rate and the minimum wage rate in 2016 dollars 1 As shown in the graph below, the minimum wage rate in 2016 dollars peaked in 1976 at $11.72 per hour, followed by a sharp decrease to a low point of $7.32 per hour in 1988. During this period, although the actual minimum wa ...

IFC Jobs Study : Assessing Private Sector Contributions To Job

... and Chief Executive Officer 600 million. The number is so large, it’s almost incomprehensible. Yet that’s how many new jobs the world needs by 2020 just to keep up with the globe’s surging population. Getting there won’t be easy. It will be impossible without the private sector. Joblessness, especia ...

... and Chief Executive Officer 600 million. The number is so large, it’s almost incomprehensible. Yet that’s how many new jobs the world needs by 2020 just to keep up with the globe’s surging population. Getting there won’t be easy. It will be impossible without the private sector. Joblessness, especia ...

Sectoral Analysis

... the IS-LM model in the open macro-economics. The degree of mobility of international capital flows and the choice of foreign exchange policy modify the operation of IS-LM. No country other than the might U.S. can claim that the IS-LM model works as itself. All other countries should take into consid ...

... the IS-LM model in the open macro-economics. The degree of mobility of international capital flows and the choice of foreign exchange policy modify the operation of IS-LM. No country other than the might U.S. can claim that the IS-LM model works as itself. All other countries should take into consid ...

Adverse Selection and Risk Aversion in Capital Markets

... entrepreneur’s inability to diversify risks, which leads to inadequate investment in high-risk projects. The risk-sharing possibilities in our model are exogenously restricted by the types of financial contracts allowed in the economy, namely debt and equity. This restricted contract space is someti ...

... entrepreneur’s inability to diversify risks, which leads to inadequate investment in high-risk projects. The risk-sharing possibilities in our model are exogenously restricted by the types of financial contracts allowed in the economy, namely debt and equity. This restricted contract space is someti ...

NBER WORKING PAPER SERIES EURO-PRODUCTIVITY AND EURO-JOB SINCE THE

... Portugal, or the Pacific Rim countries besides New Zealand. Clearly, unemployment compensation differed in its timing as well as in long-run national averages. B. The Strictness of Employment Protection Legislation Past studies have been restricted to a few limited snapshots of EPL due to lack of da ...

... Portugal, or the Pacific Rim countries besides New Zealand. Clearly, unemployment compensation differed in its timing as well as in long-run national averages. B. The Strictness of Employment Protection Legislation Past studies have been restricted to a few limited snapshots of EPL due to lack of da ...

Answer Key - Department Of Economics

... 22. According to the aggregate demand and aggregate supply model, in the long run a decrease in the money supply leads to a. decreases in both the price level and real GDP. b. an increase in real GDP and an increase in the price level. c. a decrease in the price level but does not change real GDP. d ...

... 22. According to the aggregate demand and aggregate supply model, in the long run a decrease in the money supply leads to a. decreases in both the price level and real GDP. b. an increase in real GDP and an increase in the price level. c. a decrease in the price level but does not change real GDP. d ...

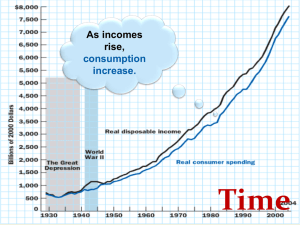

29.3 aggregate demand

... An increase in expected future income increases the amount of consumption goods that people plan to buy today and increases aggregate demand. An increase in expected future inflation increases aggregate demand today because people decide to buy more goods and services before their prices rise. An in ...

... An increase in expected future income increases the amount of consumption goods that people plan to buy today and increases aggregate demand. An increase in expected future inflation increases aggregate demand today because people decide to buy more goods and services before their prices rise. An in ...

Defined contribution workplace pension market study revised

... support that the Government may need to provide to retired people. 1.2 For most people a workplace pension is a very attractive form of saving. This is because it is tax efficient and because employers also make a contribution. 1.3 These considerations lay behind the Government’s introduction of aut ...

... support that the Government may need to provide to retired people. 1.2 For most people a workplace pension is a very attractive form of saving. This is because it is tax efficient and because employers also make a contribution. 1.3 These considerations lay behind the Government’s introduction of aut ...

United Kingdom - G20 Information Centre

... The Bank of England’s August 2016 Inflation Report outlined a pronounced shift in the outlook for UK economic activity. The Bank expects heightened uncertainty to weigh on output and employment as households defer consumption and firms delay investment decisions. There are lower paths for demand, su ...

... The Bank of England’s August 2016 Inflation Report outlined a pronounced shift in the outlook for UK economic activity. The Bank expects heightened uncertainty to weigh on output and employment as households defer consumption and firms delay investment decisions. There are lower paths for demand, su ...

Octagon Investment Partners XIV Ltd./Octagon

... reinvestment period, or when reinvesting proceeds from the sale of a credit risk or defaulted obligation. For this transaction, the non-model version of CDO Monitor may be used as an alternative to the model-based approach. This version of CDO Monitor is built on the foundation of six portfolio benc ...

... reinvestment period, or when reinvesting proceeds from the sale of a credit risk or defaulted obligation. For this transaction, the non-model version of CDO Monitor may be used as an alternative to the model-based approach. This version of CDO Monitor is built on the foundation of six portfolio benc ...

OECD Economic Surveys KOREA JUNE 2014

... green growth plan. Promoting social cohesion and well-being Korea has a dualistic labour market, with non-regular workers accounting for a third of employment, contributing to high wage dispersion and low female labour participation. Public social spending as a share of GDP is less than half of the ...

... green growth plan. Promoting social cohesion and well-being Korea has a dualistic labour market, with non-regular workers accounting for a third of employment, contributing to high wage dispersion and low female labour participation. Public social spending as a share of GDP is less than half of the ...

Presentation at Diamond Privilege Investment

... Nigeria is a low-taxed economy, the second lowest in Africa and the fourth lowest in the world. Excluding oil and gas revenues, tax receipts are estimated at just 3% of GDP. If these could be increased to the Sub-Saharan African economies’ average of 18% of GDP, Nigeria could potentially raise its ...

... Nigeria is a low-taxed economy, the second lowest in Africa and the fourth lowest in the world. Excluding oil and gas revenues, tax receipts are estimated at just 3% of GDP. If these could be increased to the Sub-Saharan African economies’ average of 18% of GDP, Nigeria could potentially raise its ...

Can We Predict the Next Capital Account Crisis?

... sample, and considered Malaysia less vulnerable than the average country in the sample. However, all East-Asian countries would have been misclassified as safe once we had taken into account a second set of conditions based on exchange rate overvaluation or fiscal positions, which are good predictor ...

... sample, and considered Malaysia less vulnerable than the average country in the sample. However, all East-Asian countries would have been misclassified as safe once we had taken into account a second set of conditions based on exchange rate overvaluation or fiscal positions, which are good predictor ...

Keynesian Macroeconomics without the LM Curve

... interest rate rule; that is, it acts to make the real interest rate behave in a certain way as a function of macroeconomic variables such as inflation and output. This assumption is a vastly better description of how central banks behave than the assumption that they follow a money supply rule. Cent ...

... interest rate rule; that is, it acts to make the real interest rate behave in a certain way as a function of macroeconomic variables such as inflation and output. This assumption is a vastly better description of how central banks behave than the assumption that they follow a money supply rule. Cent ...