Pricing Insurance Policies: The Internal Rate of Return Model

... company, while the investment rate of return is earned by the insurance company for supplying funds to the stock or bond markets. If these returns are expressed in nominal dollars, both will vary with economic inflation. If they’re expressed in real terms, there is still a connection. The IRR varies ...

... company, while the investment rate of return is earned by the insurance company for supplying funds to the stock or bond markets. If these returns are expressed in nominal dollars, both will vary with economic inflation. If they’re expressed in real terms, there is still a connection. The IRR varies ...

The world at work: Jobs, pay, and skills for 3.5 billion people

... economies around the world, unleashing sweeping changes in markets and sectors. In the process, a global labor market began to take shape, bringing tremendous benefits—as well as dislocations and challenges. The most striking benefit has been the creation of 900 million non-farm jobs in developing c ...

... economies around the world, unleashing sweeping changes in markets and sectors. In the process, a global labor market began to take shape, bringing tremendous benefits—as well as dislocations and challenges. The most striking benefit has been the creation of 900 million non-farm jobs in developing c ...

Government Chapter 7

... makes governments bigger in Europe. It makes sense to focus on social spending, as this turns out to drive much of the difference in overall government spending. It makes sense to start with social transfers; after all, the European welfare state is closely tied to large social transfer programs. So ...

... makes governments bigger in Europe. It makes sense to focus on social spending, as this turns out to drive much of the difference in overall government spending. It makes sense to start with social transfers; after all, the European welfare state is closely tied to large social transfer programs. So ...

Impact of Inflation on Fiscal Aggregates in Austria

... allowances (examples of the latter two are shown in chart 2) led to a substantial increase in implicit wage tax rates11 over this time horizon. This is illustrated by chart 1, which shows separate figures for employees and pensioners. This fiscal drag creates significant room for maneuver for t ...

... allowances (examples of the latter two are shown in chart 2) led to a substantial increase in implicit wage tax rates11 over this time horizon. This is illustrated by chart 1, which shows separate figures for employees and pensioners. This fiscal drag creates significant room for maneuver for t ...

A Tour of The World

... Can Europe reduce its unemployment rate? Should the United States reduce its trade deficit? ...

... Can Europe reduce its unemployment rate? Should the United States reduce its trade deficit? ...

Kocziszky György

... It is justified to raise the questions: to what extent will the next 7 years contribute to the convergence of the region of Northern Hungary; will the negative tendency prevailing for more than 15 years be reversed, and if it is, what extent of convergence can be counted with? Competitiveness versus ...

... It is justified to raise the questions: to what extent will the next 7 years contribute to the convergence of the region of Northern Hungary; will the negative tendency prevailing for more than 15 years be reversed, and if it is, what extent of convergence can be counted with? Competitiveness versus ...

BoZ Monetary Policy Statement July to December

... The World Economic Outlook (WEO) July 2015 edition indicates a downward revision of the global growth forecast in 2015 to 3.3% from the April 2015 forecast of 3.5%. This revision was made largely on account of a slowdown in the US economy following harsh winter weather and a cut in capital expenditu ...

... The World Economic Outlook (WEO) July 2015 edition indicates a downward revision of the global growth forecast in 2015 to 3.3% from the April 2015 forecast of 3.5%. This revision was made largely on account of a slowdown in the US economy following harsh winter weather and a cut in capital expenditu ...

M-P

... Demand for money is downward sloping. The nominal interest rate is pinned down by equilibrium in the money market. If the nominal interest rate is higher than its equilibrium level, then households hold their wealth in savings rather than currency and this pressures the nominal interest rate to fall ...

... Demand for money is downward sloping. The nominal interest rate is pinned down by equilibrium in the money market. If the nominal interest rate is higher than its equilibrium level, then households hold their wealth in savings rather than currency and this pressures the nominal interest rate to fall ...

Retirement schemes and economic growth in sub-

... I would like also to thank JC Pointon who provided me with financial support in 2005. In the same vein I express my gratitude to African Economic Research Consortium (AERC) based in Nairobi (Kenya) by providing a grant to conduct this research and also my warm gratitude to Prof. Caner from the Unive ...

... I would like also to thank JC Pointon who provided me with financial support in 2005. In the same vein I express my gratitude to African Economic Research Consortium (AERC) based in Nairobi (Kenya) by providing a grant to conduct this research and also my warm gratitude to Prof. Caner from the Unive ...

Longer-term trends - Public Sector Finance

... in receipts reflects the weakening of the tax base due to falling spending, incomes and corporate profits which will have reduced revenues from VAT, income tax and corporation tax among others. In contrast, central government expenditure continued to grow: some components of expenditure, such as hea ...

... in receipts reflects the weakening of the tax base due to falling spending, incomes and corporate profits which will have reduced revenues from VAT, income tax and corporation tax among others. In contrast, central government expenditure continued to grow: some components of expenditure, such as hea ...

Economic Growth across Countries

... coefficient implies that convergence occurs at a rate of about 2.3 percent per year.4 According to this coefficient, a one-standard-deviation decline in the log of per capita GDP (0.98 in 1985) would raise the growth rate on impact by 0.023. This effect is large in comparison with the other effects ...

... coefficient implies that convergence occurs at a rate of about 2.3 percent per year.4 According to this coefficient, a one-standard-deviation decline in the log of per capita GDP (0.98 in 1985) would raise the growth rate on impact by 0.023. This effect is large in comparison with the other effects ...

This PDF is a selection from a published volume from... Bureau of Economic Research

... expected economic performance of this period also contributed to the 2.7% decline in revenue as a share of GDP.5 To a large extent, the fiscal deterioration of this period was a replay of the Reagan years—with tax cuts and increased security spending producing higher deficits. Before turning to the ...

... expected economic performance of this period also contributed to the 2.7% decline in revenue as a share of GDP.5 To a large extent, the fiscal deterioration of this period was a replay of the Reagan years—with tax cuts and increased security spending producing higher deficits. Before turning to the ...

A two-period closed economy with sticky prices

... In this note, we review this argument, in the context of a two-period closed economy where the interest rate is exogenously given. Analytically, the approach is similar to that of a small open economy, the difference being that the exogenous interest rate is determined in the (omitted) money market, ...

... In this note, we review this argument, in the context of a two-period closed economy where the interest rate is exogenously given. Analytically, the approach is similar to that of a small open economy, the difference being that the exogenous interest rate is determined in the (omitted) money market, ...

document

... Current opinion swings in US and elsewhere shows that doubts as to the scope of government intervention…especially as people worry about mounting budget deficits Here we will argue that need for liberalized markets does not call for a reduced state, but rather for a "suitable" state. ...

... Current opinion swings in US and elsewhere shows that doubts as to the scope of government intervention…especially as people worry about mounting budget deficits Here we will argue that need for liberalized markets does not call for a reduced state, but rather for a "suitable" state. ...

In a mixed economy, what to produce and how much to produce are

... given year c. The federal government spends more than it collects in taxes in a given year d. High levels of unemployment use up tax collections e. Interest payments on the national debt increase from one year to the next 6. Under which of the following conditions would consumer spending most likely ...

... given year c. The federal government spends more than it collects in taxes in a given year d. High levels of unemployment use up tax collections e. Interest payments on the national debt increase from one year to the next 6. Under which of the following conditions would consumer spending most likely ...

Activity 1: Answer Key Exploring Average Total Costs

... 4. What is the number of workers that will give the lowest average total cost? Explain the implications of average total cost associated with hiring this number of workers. (Sample Answer: (7, 1.48). This means that when 7 workers are hired, the average cost of producing each cookie is $1.48. In thi ...

... 4. What is the number of workers that will give the lowest average total cost? Explain the implications of average total cost associated with hiring this number of workers. (Sample Answer: (7, 1.48). This means that when 7 workers are hired, the average cost of producing each cookie is $1.48. In thi ...

A model for interest rates near the zero lower bound:

... The consistency of movements in the shadow FFR and the events above indicates that, analogous to the actual FFR in conventional monetary policy environments, the shadow FFR provides a gauge of the US monetary policy stance in unconventional monetary policy environments. That said, the shadow FFR has ...

... The consistency of movements in the shadow FFR and the events above indicates that, analogous to the actual FFR in conventional monetary policy environments, the shadow FFR provides a gauge of the US monetary policy stance in unconventional monetary policy environments. That said, the shadow FFR has ...

A New Paradigm for Macroeconomic Policy Philip Arestis, University

... of lower savings, higher investment, lower imports and higher exports at the level of output corresponding to a zero output gap. The notion of lower imports and higher exports clearly cannot be achieved for all (or even most) countries; consequently, the focus would have to be on lower savings and h ...

... of lower savings, higher investment, lower imports and higher exports at the level of output corresponding to a zero output gap. The notion of lower imports and higher exports clearly cannot be achieved for all (or even most) countries; consequently, the focus would have to be on lower savings and h ...

Chapter 32

... A Social Security and Medicare Time Bomb There are 77 million “baby boomers” in the United States and the first of them started to collect Social Security pensions in 2008 and became eligible for Medicare in 2011. By 2030, all baby boomers will be supported by Social Security and Medicare and benef ...

... A Social Security and Medicare Time Bomb There are 77 million “baby boomers” in the United States and the first of them started to collect Social Security pensions in 2008 and became eligible for Medicare in 2011. By 2030, all baby boomers will be supported by Social Security and Medicare and benef ...

AP Macroeconomics The Loanable Funds Market

... If the Fed buys bonds, there is more $ in the MS and therefore people don’t borrow and loans become cheap (lower r%) Buy Bonds = Big Bucks Sell bonds = small Bucks The Fed “targets” the Fed Funds Rate by buying & selling bonds. “Buying” bonds means “bigger” supply of money and lower Fed Funds Rate. ...

... If the Fed buys bonds, there is more $ in the MS and therefore people don’t borrow and loans become cheap (lower r%) Buy Bonds = Big Bucks Sell bonds = small Bucks The Fed “targets” the Fed Funds Rate by buying & selling bonds. “Buying” bonds means “bigger” supply of money and lower Fed Funds Rate. ...

The Rate of Surplus Value, the Composition of Capital, and

... neglectable, the change in the rate of surplus value attributed mainly to the decline in the share of profit. And in the sequencial period, the rise of surlus value attributed to two factors: firstly, in this period the decling trend of share of profit was inversed and this contributed a great part ...

... neglectable, the change in the rate of surplus value attributed mainly to the decline in the share of profit. And in the sequencial period, the rise of surlus value attributed to two factors: firstly, in this period the decling trend of share of profit was inversed and this contributed a great part ...

Thailand Economic Update

... industries also provide limited access to foreigners such as retail trade and telecoms. Foreign participation is welcomed for export industries such as automobiles. ...

... industries also provide limited access to foreigners such as retail trade and telecoms. Foreign participation is welcomed for export industries such as automobiles. ...

Document

... On-the-run Treasury: The newest Treasury issues. Bootstrapping used to get the different yields. On-the-run Treasury issues and selected off-the-run Treasury issues: helps to avoid a large maturity gap in the on-the-run Treasuries. Note there is a tax effect for Treasuries not selling at par-the ...

... On-the-run Treasury: The newest Treasury issues. Bootstrapping used to get the different yields. On-the-run Treasury issues and selected off-the-run Treasury issues: helps to avoid a large maturity gap in the on-the-run Treasuries. Note there is a tax effect for Treasuries not selling at par-the ...

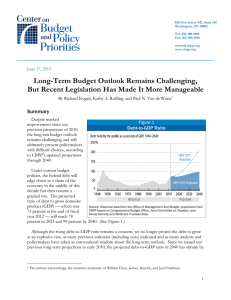

Long-Term Budget Outlook Remains Challenging, But Recent

... well below its potential, as it has been since 2008. But a persistently rising debt-to-GDP ratio in good times and bad alike reflects an unsustainable budget policy that ultimately poses threats to financial stability and long-term growth.8 That’s why the debt ratio should not rise when the economy ...

... well below its potential, as it has been since 2008. But a persistently rising debt-to-GDP ratio in good times and bad alike reflects an unsustainable budget policy that ultimately poses threats to financial stability and long-term growth.8 That’s why the debt ratio should not rise when the economy ...

![Untitled [web.worldbank.org]](http://s1.studyres.com/store/data/008211710_1-95746362f6f88b5b0126be6a28aa5ff4-300x300.png)