Monetary Policy, Incomplete Information, and the Zero Lower Bound

... the Appropriate Stance of Monetary Policy ● Forecast Targeting: A specific macroeconomic model (usually with judgmental adjustments) is used to determine the policy path that is expected to generate the most appropriate outcomes for real economic activity and inflation over the forecast horizon. ● S ...

... the Appropriate Stance of Monetary Policy ● Forecast Targeting: A specific macroeconomic model (usually with judgmental adjustments) is used to determine the policy path that is expected to generate the most appropriate outcomes for real economic activity and inflation over the forecast horizon. ● S ...

Panel Discussion Lyle E. Gramley*

... monetary policy when the economy was barely six months into a recovery from the deepest recession of the postwar period. That action was taken, not because inflation was accelerating, but because the economy was growing much too rapidly. The second instance was in the latter half of 1984, when growt ...

... monetary policy when the economy was barely six months into a recovery from the deepest recession of the postwar period. That action was taken, not because inflation was accelerating, but because the economy was growing much too rapidly. The second instance was in the latter half of 1984, when growt ...

Monetary Policy and the Interest Rate

... spending and consumer spending, which in turn increases aggregate demand and real GDP in the short run. 2. Contractionary monetary policy raises the interest rate by reducing the money supply. This reduces investment spending and consumer spending, which in turn reduces aggregate demand and real GDP ...

... spending and consumer spending, which in turn increases aggregate demand and real GDP in the short run. 2. Contractionary monetary policy raises the interest rate by reducing the money supply. This reduces investment spending and consumer spending, which in turn reduces aggregate demand and real GDP ...

The Federal Reserve

... then a banks total reserves increase allowing the bank to loan out more money (Expansionary) • If the “FED” sells government securities from banks then a banks total reserves decrease forcing the bank to loan out less money (Contractionary) ...

... then a banks total reserves increase allowing the bank to loan out more money (Expansionary) • If the “FED” sells government securities from banks then a banks total reserves decrease forcing the bank to loan out less money (Contractionary) ...

1994 1. Suppose that the following statements describe the current

... 1. Suppose that the following statements describe the current state of an economy. --The unemployment rate is 5% --Inflation is at an annual rate of 10% --The prime interest rate is 11.5% --The annual growth rate of real GDP is 5% A. Identify the major problem(s) the faces. B. Describe two fiscal po ...

... 1. Suppose that the following statements describe the current state of an economy. --The unemployment rate is 5% --Inflation is at an annual rate of 10% --The prime interest rate is 11.5% --The annual growth rate of real GDP is 5% A. Identify the major problem(s) the faces. B. Describe two fiscal po ...

Name: _________________________________________________ Government Economics Review Guide

... Name: _________________________________________________ Government Economics Review Guide Directions: Work in your groups to complete the review guide. There are two sections, Economic Policies and Economic Measures. Complete both sections and analyze the political cartoon provided at the end of the ...

... Name: _________________________________________________ Government Economics Review Guide Directions: Work in your groups to complete the review guide. There are two sections, Economic Policies and Economic Measures. Complete both sections and analyze the political cartoon provided at the end of the ...

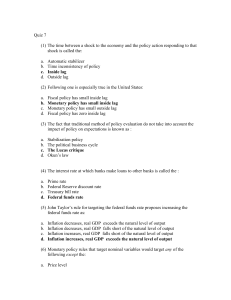

module 31 - Dpatterson

... 2. The central bank of the country of Sewell sells bonds on the open market. (a) Assume that banks in Sewell have no excess reserves. What is the effect of the central bank’s action on the amount of customer loans that banks in Sewell can make? (b) Using a correctly labeled graph of the money ma ...

... 2. The central bank of the country of Sewell sells bonds on the open market. (a) Assume that banks in Sewell have no excess reserves. What is the effect of the central bank’s action on the amount of customer loans that banks in Sewell can make? (b) Using a correctly labeled graph of the money ma ...

U.S. Economy Presentation

... Too little too late? Not clear because we need to know what would have happened without the policy (the condition that we can never know) ...

... Too little too late? Not clear because we need to know what would have happened without the policy (the condition that we can never know) ...

Fiscal Policy:

... • The government will control peaks by increasing taxes and decreasing spending. – Why would they want to control the peak? ...

... • The government will control peaks by increasing taxes and decreasing spending. – Why would they want to control the peak? ...

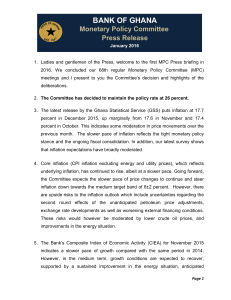

MPC Press Release

... 2. The Committee has decided to maintain the policy rate at 26 percent. 3. The latest release by the Ghana Statistical Service (GSS) puts inflation at 17.7 percent in December 2015, up marginally from 17.6 in November and 17.4 percent in October. This indicates some moderation in price movements ove ...

... 2. The Committee has decided to maintain the policy rate at 26 percent. 3. The latest release by the Ghana Statistical Service (GSS) puts inflation at 17.7 percent in December 2015, up marginally from 17.6 in November and 17.4 percent in October. This indicates some moderation in price movements ove ...

Central banking, money and taxation

... A situation in which all available labor resources are being used in the most economically efficient way. It is the highest amount of skilled and unskilled labor that could be employed within an economy at any given time. – full employment An amount produced or manufactured during a certain time – o ...

... A situation in which all available labor resources are being used in the most economically efficient way. It is the highest amount of skilled and unskilled labor that could be employed within an economy at any given time. – full employment An amount produced or manufactured during a certain time – o ...

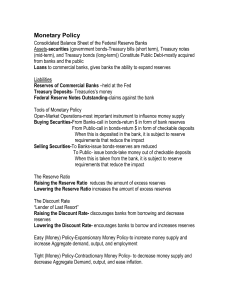

Monetary Policy

... moving the economy out of recession and low employment may be more difficult than “cooling off” the economy. Changes in velocity: An easy money policy will increase velocity (turnovers) since the cost of holding money is lower. A tight money policy will work in the opposite direction. Investment imp ...

... moving the economy out of recession and low employment may be more difficult than “cooling off” the economy. Changes in velocity: An easy money policy will increase velocity (turnovers) since the cost of holding money is lower. A tight money policy will work in the opposite direction. Investment imp ...

MONGOLIA UNDER EMBARGO UNTIL 07.00 GMT, WEDNESDAY, 6 AUGUST 2014

... An extensive amount of off-budget spending occurred using proceeds from the miningsector bond sales, bypassing the 2% of GDP ceiling set by the Fiscal Stability Law. With off-budget spending is likely to continue in 2014, a key challenge will be ensuring improved fiscal transparency and long-term su ...

... An extensive amount of off-budget spending occurred using proceeds from the miningsector bond sales, bypassing the 2% of GDP ceiling set by the Fiscal Stability Law. With off-budget spending is likely to continue in 2014, a key challenge will be ensuring improved fiscal transparency and long-term su ...

Globalization Globalization – Principle and Practice - Rose

... Deflation: a sustained fall in the general price l l over time. level i Productivity: value of output (production) per units it off iinputt ((materials; t i l capital it l equipment; i t labor, etc.). ...

... Deflation: a sustained fall in the general price l l over time. level i Productivity: value of output (production) per units it off iinputt ((materials; t i l capital it l equipment; i t labor, etc.). ...

Open economy macroeconomics

... – Interest rate will also increase, – There will be capital inflow – The central bank increases the money supply to keep the exchange rate constant. – The interest rate will return to the original value. In the meantime the output will increase and a short-term economic boom will be experienced. ...

... – Interest rate will also increase, – There will be capital inflow – The central bank increases the money supply to keep the exchange rate constant. – The interest rate will return to the original value. In the meantime the output will increase and a short-term economic boom will be experienced. ...

Monetary Policy and the Interest Rate

... In a correctly labeled graph, show equilibrium in the money market. In a correctly labeled AD/AS graph, show the current short-run equilibrium in the macroeconomy. In response to this high inflation rate, should the Fed engage in expansionary or contractionary fiscal policy? In your graph from the f ...

... In a correctly labeled graph, show equilibrium in the money market. In a correctly labeled AD/AS graph, show the current short-run equilibrium in the macroeconomy. In response to this high inflation rate, should the Fed engage in expansionary or contractionary fiscal policy? In your graph from the f ...

fiscal and monetary policy

... Rate that banks change each other for very short – as in overnight – loans Loans ...

... Rate that banks change each other for very short – as in overnight – loans Loans ...

fiscal and monetary policy

... The Discount Rate: – Banks borrowing money from Fed to maintain their reserve requirement Interest rate is set by Fed at a discount for Banks – Low interest rate means more money to loan = more money in circulation – High interest rate = less money to loan, less money in circulation – Between 1990 ...

... The Discount Rate: – Banks borrowing money from Fed to maintain their reserve requirement Interest rate is set by Fed at a discount for Banks – Low interest rate means more money to loan = more money in circulation – High interest rate = less money to loan, less money in circulation – Between 1990 ...

Monetary policy

Monetary policy is the process by which the monetary authority of a country controls the supply of money, often targeting an inflation rate or interest rate to ensure price stability and general trust in the currency.Further goals of a monetary policy are usually to contribute to economic growth and stability, to lower unemployment, and to maintain predictable exchange rates with other currencies.Monetary economics provides insight into how to craft optimal monetary policy.Monetary policy is referred to as either being expansionary or contractionary, where an expansionary policy increases the total supply of money in the economy more rapidly than usual, and contractionary policy expands the money supply more slowly than usual or even shrinks it. Expansionary policy is traditionally used to try to combat unemployment in a recession by lowering interest rates in the hope that easy credit will entice businesses into expanding. Contractionary policy is intended to slow inflation in order to avoid the resulting distortions and deterioration of asset values.Monetary policy differs from fiscal policy, which refers to taxation, government spending, and associated borrowing.