Slide 1

... AD is like IS-LM equilibrium except is substitutes the Fed response for a fixed money supply AS is Phillips curve with substituting for expected inflation Note that we have moved up one derivative from intro AD-AD because of Phillips curve. ...

... AD is like IS-LM equilibrium except is substitutes the Fed response for a fixed money supply AS is Phillips curve with substituting for expected inflation Note that we have moved up one derivative from intro AD-AD because of Phillips curve. ...

Document

... Discussed by other speakers. • But Budget also drives the macro framework: mix of fiscal, monetary, debt and exchange rate policies which boosts growth by providing a stable investment climate. • Latter is focus of my remarks. ...

... Discussed by other speakers. • But Budget also drives the macro framework: mix of fiscal, monetary, debt and exchange rate policies which boosts growth by providing a stable investment climate. • Latter is focus of my remarks. ...

Monetary Policy

... All banks are required to hold a minimum percentage of deposits as reserve. Changes in required reserve ratios can have an important influence on the money supply. Changes in reserve requirements are made sparingly because they present too large change in monetary policy. ...

... All banks are required to hold a minimum percentage of deposits as reserve. Changes in required reserve ratios can have an important influence on the money supply. Changes in reserve requirements are made sparingly because they present too large change in monetary policy. ...

Indonesia

... Because of the pump priming activities, the government has gone into deficit financing at the rate of 1.5% of GDP in 2009, which is quite manageable given the low inflation in that period. The budget deficit will subsequently narrow as the fiscal stimuli winds down in 2010-11. ...

... Because of the pump priming activities, the government has gone into deficit financing at the rate of 1.5% of GDP in 2009, which is quite manageable given the low inflation in that period. The budget deficit will subsequently narrow as the fiscal stimuli winds down in 2010-11. ...

economics and politics.ppt

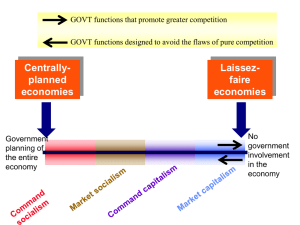

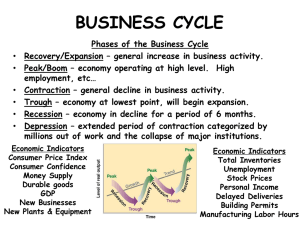

... Business cycle fluctuations result from imbalances between aggregate demand and productive capacity • Aggregate demand is the total amount of money available in the economy to be spent on goods and services • Productive capacity is the total value of goods and services that can be produced by the ec ...

... Business cycle fluctuations result from imbalances between aggregate demand and productive capacity • Aggregate demand is the total amount of money available in the economy to be spent on goods and services • Productive capacity is the total value of goods and services that can be produced by the ec ...

MONETARY POLICY

... Instruments of the Eurosystem Like most central banks, the main policy instrument of the Eurosystem is the short-term interest rate. The reason is that short-term (less than 24h) assets are very close to cash. Since central banks have a monopoly on the supply of cash, they can control the short-ter ...

... Instruments of the Eurosystem Like most central banks, the main policy instrument of the Eurosystem is the short-term interest rate. The reason is that short-term (less than 24h) assets are very close to cash. Since central banks have a monopoly on the supply of cash, they can control the short-ter ...

Yarmouk University Economics 200

... How to measure nominal and real GDP and how to calculate the annual growth rate of anything over any period of time. Understand the Keynesian expenditure model and the IS-LM model. Understand the fiscal dept and deficits, national saving, and the link between international deficits, national s ...

... How to measure nominal and real GDP and how to calculate the annual growth rate of anything over any period of time. Understand the Keynesian expenditure model and the IS-LM model. Understand the fiscal dept and deficits, national saving, and the link between international deficits, national s ...

SRI LANKA UNDER EMBARGO UNTIL 07.00 GMT, WEDNESDAY, 6 AUGUST 2014

... Despite the recent improvement, the current account shortfall remains large. This is reflected in a notable national savings-investment gap. Low domestic savings are partly linked to a lack of public savings, as evident in persistent fiscal deficits. Enhancing private and public savings would help s ...

... Despite the recent improvement, the current account shortfall remains large. This is reflected in a notable national savings-investment gap. Low domestic savings are partly linked to a lack of public savings, as evident in persistent fiscal deficits. Enhancing private and public savings would help s ...

what are the instruments of monetary policy

... Bank’s supply of money in order to achieve the objectives of price stability (or low inflation rate), full employment, and growth in aggregate income. This is necessary because money is a medium of exchange and changes in its demand relative to supply, necessitate spending adjustments. To conduct mo ...

... Bank’s supply of money in order to achieve the objectives of price stability (or low inflation rate), full employment, and growth in aggregate income. This is necessary because money is a medium of exchange and changes in its demand relative to supply, necessitate spending adjustments. To conduct mo ...

PDF

... and further international borrowing appeared unlikely, the government turned to the domestic capital market as potential source of capital. The available potential for further development of the capital market was a condition for the government to try and test the market to secure additional funds w ...

... and further international borrowing appeared unlikely, the government turned to the domestic capital market as potential source of capital. The available potential for further development of the capital market was a condition for the government to try and test the market to secure additional funds w ...

And the second half begins

... • Nothing has changed • Goal was to understand • Changed during DEPRESSION • John Maynard Keynes • First time gov’t got involved QuickTime™ and a decompressor are needed to see this picture. ...

... • Nothing has changed • Goal was to understand • Changed during DEPRESSION • John Maynard Keynes • First time gov’t got involved QuickTime™ and a decompressor are needed to see this picture. ...

solution

... speculators sell the home currency and drain the central bank of its foreign assets. The central bank could always defend if it so chooses (they can raise interest rates to improbably high levels), but if it is unwilling to cripple the economy with tight monetary policy, it must relent. An “inflow” ...

... speculators sell the home currency and drain the central bank of its foreign assets. The central bank could always defend if it so chooses (they can raise interest rates to improbably high levels), but if it is unwilling to cripple the economy with tight monetary policy, it must relent. An “inflow” ...

PDF Download

... not accomplished much yet. Financial conditions have not eased. The decline in interest rates has been fully offset by a weaker stock market and a strengthening dollar. Our Goldman Sachs Financial Conditions index is tighter now than it was at the beginning of the year before the Fed starting cuttin ...

... not accomplished much yet. Financial conditions have not eased. The decline in interest rates has been fully offset by a weaker stock market and a strengthening dollar. Our Goldman Sachs Financial Conditions index is tighter now than it was at the beginning of the year before the Fed starting cuttin ...

Federal Reserve System

... of how we measure the economy’s growth. ▫ it sets a basic interest rate that governs how much banks pay to borrow from the Fed. increasing federal spending and/or reducing taxes can promote more employment and output, but these policies eventually put upward pressure on the price level and interes ...

... of how we measure the economy’s growth. ▫ it sets a basic interest rate that governs how much banks pay to borrow from the Fed. increasing federal spending and/or reducing taxes can promote more employment and output, but these policies eventually put upward pressure on the price level and interes ...

Abenomics”: Can Japan’s “Honest Abe” Emancipate Japan from the

... We reaffirm that our fiscal and monetary policies have been and will remain oriented towards meeting our respective domestic objectives using domestic instruments, and that we will not target exchange rates. …" ...

... We reaffirm that our fiscal and monetary policies have been and will remain oriented towards meeting our respective domestic objectives using domestic instruments, and that we will not target exchange rates. …" ...

Israeli GDP per capita

... • Policy steps should be moderate in order to prevent panic in markets. Harsh decisions should be taken only in crisis times. • Keeping policy transparent. • Signaling agents in the markets regarding policy fundamentals. ...

... • Policy steps should be moderate in order to prevent panic in markets. Harsh decisions should be taken only in crisis times. • Keeping policy transparent. • Signaling agents in the markets regarding policy fundamentals. ...

ECON-262 Principles of Macroeconomics

... • Identify the fiscal and monetary policy tools • Introduce the balance of payment and exchange rates Learning Outcomes: After completion of the course students are expected to be able to: • Measure economic variables (GNP and its components, inflation, unemployment, money supply, balance of payment ...

... • Identify the fiscal and monetary policy tools • Introduce the balance of payment and exchange rates Learning Outcomes: After completion of the course students are expected to be able to: • Measure economic variables (GNP and its components, inflation, unemployment, money supply, balance of payment ...

US Government AG 23.03 Notes Unit 7

... monetary policy is the best method of ensuring economic growth and stability. ...

... monetary policy is the best method of ensuring economic growth and stability. ...

Aim: How does the Federal Reserve regulate the money supply?

... in this photo? What qualifications do you think this employee needs to do her job? ...

... in this photo? What qualifications do you think this employee needs to do her job? ...

BUSINESS CYCLE, FEDERAL RESERVE, TAXATION

... inflation can cause a decline in business activity. • Inflation is caused by an increase in the money supply. Money in circulation, or being spent. RECESSION • During a period of recession, consumers are not spending money, thus business profits and productivity slow down. Periods of recession lead ...

... inflation can cause a decline in business activity. • Inflation is caused by an increase in the money supply. Money in circulation, or being spent. RECESSION • During a period of recession, consumers are not spending money, thus business profits and productivity slow down. Periods of recession lead ...

Monetary policy

Monetary policy is the process by which the monetary authority of a country controls the supply of money, often targeting an inflation rate or interest rate to ensure price stability and general trust in the currency.Further goals of a monetary policy are usually to contribute to economic growth and stability, to lower unemployment, and to maintain predictable exchange rates with other currencies.Monetary economics provides insight into how to craft optimal monetary policy.Monetary policy is referred to as either being expansionary or contractionary, where an expansionary policy increases the total supply of money in the economy more rapidly than usual, and contractionary policy expands the money supply more slowly than usual or even shrinks it. Expansionary policy is traditionally used to try to combat unemployment in a recession by lowering interest rates in the hope that easy credit will entice businesses into expanding. Contractionary policy is intended to slow inflation in order to avoid the resulting distortions and deterioration of asset values.Monetary policy differs from fiscal policy, which refers to taxation, government spending, and associated borrowing.