Chile_en.pdf

... rose sharply and, towards the end of the year, reached levels comparable to those prior to the crisis. This counteracted efforts to reduce the inflationary pressure, however, and in the second semester, the bank suspended the foreignexchange purchasing programme. In 2009, the projected decline in wo ...

... rose sharply and, towards the end of the year, reached levels comparable to those prior to the crisis. This counteracted efforts to reduce the inflationary pressure, however, and in the second semester, the bank suspended the foreignexchange purchasing programme. In 2009, the projected decline in wo ...

Why is this true? In an open economy, net exports being negative

... In an open economy, net exports being negative causes fiscal stimulus to be weaker for the following reason. Recall that net exports being negative means that the country is importing more than it is exporting. In this situation, the government spending multiplier will be smaller because some of the ...

... In an open economy, net exports being negative causes fiscal stimulus to be weaker for the following reason. Recall that net exports being negative means that the country is importing more than it is exporting. In this situation, the government spending multiplier will be smaller because some of the ...

Monetary and Fiscal Policy

... to the banks. Because it is easier to make gradual changes in the supply of money, open market operations are use more regularly than monetary policy. When member banks want to raise money, they can borrow from Federal Reserve Banks. Just like other loans, there is an interest rate, or a discount ra ...

... to the banks. Because it is easier to make gradual changes in the supply of money, open market operations are use more regularly than monetary policy. When member banks want to raise money, they can borrow from Federal Reserve Banks. Just like other loans, there is an interest rate, or a discount ra ...

Monetary Policy Rules - Central Web Server 2

... An important development—if not the important intellectual development throughout the past 25 years in our understanding of how the macroeconomy works—is the recognition that expectations play a central role in affecting economic behavior. Previously, to the extent that expectations were considered ...

... An important development—if not the important intellectual development throughout the past 25 years in our understanding of how the macroeconomy works—is the recognition that expectations play a central role in affecting economic behavior. Previously, to the extent that expectations were considered ...

The Policy Debate: Keynesians versus Monetarists

... If government policies are necessary, which (monetary or fiscal) is better? Answer depends on the cause of recession: - If AD is low because consumers/businesses cannot find adequate low cost financing, monetary policy maybe better. - If AD is low because of low consumer/business confidence, then in ...

... If government policies are necessary, which (monetary or fiscal) is better? Answer depends on the cause of recession: - If AD is low because consumers/businesses cannot find adequate low cost financing, monetary policy maybe better. - If AD is low because of low consumer/business confidence, then in ...

Main Issues

... • The complementary roles of other macroeconomic policies: It is established that restrictive trade and fixed exchange rate policies mitigate the effectiveness of monetary and fiscal polices, and aggravate the impact of Dutch Disease • The role of institutions especially Central Bank and Monetary Un ...

... • The complementary roles of other macroeconomic policies: It is established that restrictive trade and fixed exchange rate policies mitigate the effectiveness of monetary and fiscal polices, and aggravate the impact of Dutch Disease • The role of institutions especially Central Bank and Monetary Un ...

Macroeconomics: BSc Year One The Monetarist View of Interest

... Note that the second preposition implies that any change in money supply has no effect on any real variable, and that monetary policy is irrelevant in the long run – it only changes inflation. Further studies, however, imply that sharp increases in money growth do not lead to increases in real outpu ...

... Note that the second preposition implies that any change in money supply has no effect on any real variable, and that monetary policy is irrelevant in the long run – it only changes inflation. Further studies, however, imply that sharp increases in money growth do not lead to increases in real outpu ...

Notes on Economics

... Inflation/Deflation – the change of prices for goods and services over a period of time. ...

... Inflation/Deflation – the change of prices for goods and services over a period of time. ...

Reassessing Discretionary Fiscal Policy

... outpace gains in potential output over the near term, an imbalance that contains the seeds of rising inflationary and financial pressures that could undermine the expansion. ... [T]he level of interest rates needed to align demand with potential supply may have increased substantially” ...

... outpace gains in potential output over the near term, an imbalance that contains the seeds of rising inflationary and financial pressures that could undermine the expansion. ... [T]he level of interest rates needed to align demand with potential supply may have increased substantially” ...

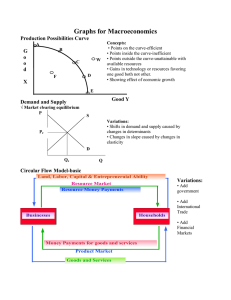

Graphs for Macroeconomics Production Possibilities Curve G o

... • As new demand and supply factors impact this market, changes in interest rate causes changes in investment and interest rate-driven consumption, which affects AD, ASsr, ASlr PL and Real GDP. • When government financing deficit spending, the impact of borrowing increases the demand curve and raises ...

... • As new demand and supply factors impact this market, changes in interest rate causes changes in investment and interest rate-driven consumption, which affects AD, ASsr, ASlr PL and Real GDP. • When government financing deficit spending, the impact of borrowing increases the demand curve and raises ...

College of Business Administration

... Name \ -------------------------------------------------------------Univ. no.\-------------------Serial no. \ -----------------------Q1 To achieve the objectives of the nation the following instruments can be used: A. Expenditure-changing policies B. Expenditure-switching policies, and C. Direct con ...

... Name \ -------------------------------------------------------------Univ. no.\-------------------Serial no. \ -----------------------Q1 To achieve the objectives of the nation the following instruments can be used: A. Expenditure-changing policies B. Expenditure-switching policies, and C. Direct con ...

Document

... exams. There will be no early exams or e-exams. If you miss an exam, you have to make sure that your excuse is documented and approved by the University. If you have a valid reason with required documentation, such as a doctor’s report approved by the University, you will be allowed to take the make ...

... exams. There will be no early exams or e-exams. If you miss an exam, you have to make sure that your excuse is documented and approved by the University. If you have a valid reason with required documentation, such as a doctor’s report approved by the University, you will be allowed to take the make ...

Panel Discussion Bennett T. McCallum*

... with these levels dictated by the monetary policy rule that is under discussion. This study is a rather crude one, but it does attempt to take realistic account quantitatively of shock variances and response magnitudes for the U.S. economy. And it suggests that this type of compromise scheme would b ...

... with these levels dictated by the monetary policy rule that is under discussion. This study is a rather crude one, but it does attempt to take realistic account quantitatively of shock variances and response magnitudes for the U.S. economy. And it suggests that this type of compromise scheme would b ...

The Role of the Interest Rate Channel of

... 2. Should have its strongest influence on shortterm interest rates like the federal funds rate and its weakest effect on the long-term rates. (Ben S. Bernanke and Mark Gertler) ...

... 2. Should have its strongest influence on shortterm interest rates like the federal funds rate and its weakest effect on the long-term rates. (Ben S. Bernanke and Mark Gertler) ...

Day 4 - Mr

... 12.4.1 Labor unions, procedures, benefits for their members, effects of unionizations, the minimum wages, and unemployment insurance. 12.4.4 Explain the effects of international mobility of capital and labor on the U.S. economy. 12.5.2 Significance of unemployment rate, new jobs created monthly, inf ...

... 12.4.1 Labor unions, procedures, benefits for their members, effects of unionizations, the minimum wages, and unemployment insurance. 12.4.4 Explain the effects of international mobility of capital and labor on the U.S. economy. 12.5.2 Significance of unemployment rate, new jobs created monthly, inf ...

Fiscal and Monetary Policy PowerPoint

... Regulating the economy We want slow growth If the economy is not doing good we can fall into a recession (right now) and people can lose their jobs If the economy is growing too fast we can have rapid inflation; where prices rise faster than wages Both are bad – Two ways to make sure our economy is ...

... Regulating the economy We want slow growth If the economy is not doing good we can fall into a recession (right now) and people can lose their jobs If the economy is growing too fast we can have rapid inflation; where prices rise faster than wages Both are bad – Two ways to make sure our economy is ...

Chapter 14

... nearly impossible to vote for higher interest rates, and the result would be that the economy had a bias toward letting inflation get established. • Fixed rules: fixed rules as to when the money supply would be allowed to grow (in accordance with the rate in growth of the economy). But new financial ...

... nearly impossible to vote for higher interest rates, and the result would be that the economy had a bias toward letting inflation get established. • Fixed rules: fixed rules as to when the money supply would be allowed to grow (in accordance with the rate in growth of the economy). But new financial ...

Macroeconomics 6

... the course will cover fiscal and monetary policy in closed and open economies from theoretical, empirical, and historical perspectives. The issues of policy are highly controversial, and most of the material will be based on recent research, which is far from being the last word in the field. Hence, ...

... the course will cover fiscal and monetary policy in closed and open economies from theoretical, empirical, and historical perspectives. The issues of policy are highly controversial, and most of the material will be based on recent research, which is far from being the last word in the field. Hence, ...

Expansionary and Contractionary Monetary Policy

... economy is now at RGDPNR where RGDP equals the potential level of output. ...

... economy is now at RGDPNR where RGDP equals the potential level of output. ...

Course contents - East West University

... money creation, money market equilibrium and monetary policy. o Income determination: Keynesian cross, aggregate demand function, multiplier process, impact of fiscal and monetary policies, recessionary & inflationary gap, effectiveness of fiscal and monetary policies. o Unemployment: Calculation of ...

... money creation, money market equilibrium and monetary policy. o Income determination: Keynesian cross, aggregate demand function, multiplier process, impact of fiscal and monetary policies, recessionary & inflationary gap, effectiveness of fiscal and monetary policies. o Unemployment: Calculation of ...

Monetary policy

Monetary policy is the process by which the monetary authority of a country controls the supply of money, often targeting an inflation rate or interest rate to ensure price stability and general trust in the currency.Further goals of a monetary policy are usually to contribute to economic growth and stability, to lower unemployment, and to maintain predictable exchange rates with other currencies.Monetary economics provides insight into how to craft optimal monetary policy.Monetary policy is referred to as either being expansionary or contractionary, where an expansionary policy increases the total supply of money in the economy more rapidly than usual, and contractionary policy expands the money supply more slowly than usual or even shrinks it. Expansionary policy is traditionally used to try to combat unemployment in a recession by lowering interest rates in the hope that easy credit will entice businesses into expanding. Contractionary policy is intended to slow inflation in order to avoid the resulting distortions and deterioration of asset values.Monetary policy differs from fiscal policy, which refers to taxation, government spending, and associated borrowing.