Supply and Demand - HKUST HomePage Search

... What should be the current Fed Funds rate? Will they be increasing it soon? • Step 1. Find Inflation Rate • Step 2. Find Output Gap • Step 3. Calculate Taylor Rule implied rate and compare with current rate. ...

... What should be the current Fed Funds rate? Will they be increasing it soon? • Step 1. Find Inflation Rate • Step 2. Find Output Gap • Step 3. Calculate Taylor Rule implied rate and compare with current rate. ...

Sosa, McGwire, and Greenspan

... • “Why has pricing power [of firms] of late been so delimited?” • “Monetary policy certainly has played a role in constraining the rise in the general level of prices…” • “But our current discretionary monetary policy has difficulty anchoring the price level over time in the same way that the gold s ...

... • “Why has pricing power [of firms] of late been so delimited?” • “Monetary policy certainly has played a role in constraining the rise in the general level of prices…” • “But our current discretionary monetary policy has difficulty anchoring the price level over time in the same way that the gold s ...

MULTIPLE CHOICE: Please select the best answer for the following

... The national debt is increased by double each budget deficit. The national debt is increased by each budget deficit. The national debt is reduced by each budget deficit. The national debt is not affected. ...

... The national debt is increased by double each budget deficit. The national debt is increased by each budget deficit. The national debt is reduced by each budget deficit. The national debt is not affected. ...

MONETARY POLICY IN UKRAINE

... (high inflation inertia) and inflation will stay in doubledigit territory for some time. This will also keep inflation expectations high. According to the enterprise survey conducted by the NBU, inflation expectations (CPI growth in the next 12 months) in the third quarter increased to 17.5% as comp ...

... (high inflation inertia) and inflation will stay in doubledigit territory for some time. This will also keep inflation expectations high. According to the enterprise survey conducted by the NBU, inflation expectations (CPI growth in the next 12 months) in the third quarter increased to 17.5% as comp ...

Document

... Target real variables to permanently reduce the rate of unemployment or increase economic growth Determine real interest rates Fine-tune the economy ...

... Target real variables to permanently reduce the rate of unemployment or increase economic growth Determine real interest rates Fine-tune the economy ...

Chapter 1

... expectations. Nonetheless, labor markets may not clear for many years, leading to extended periods of high unemployment even though the rest of the economy appears to be in equilibrium. ...

... expectations. Nonetheless, labor markets may not clear for many years, leading to extended periods of high unemployment even though the rest of the economy appears to be in equilibrium. ...

Agenda

... In The US, MP is accomplished by three primary tools: -Open market operations (ie: government bonds) -Changing reserve requirements -Changing the discount rate (ie: the rate banks can borrow at) ...

... In The US, MP is accomplished by three primary tools: -Open market operations (ie: government bonds) -Changing reserve requirements -Changing the discount rate (ie: the rate banks can borrow at) ...

Document

... the actual decisions about monetary policy The Fed is a central bank; it conducts monetary policy for the U.S. and regulates financial institutions The Fed changes the money supply through open market operations The Federal funds rate is the rate at which one bank lends reserves to another ban ...

... the actual decisions about monetary policy The Fed is a central bank; it conducts monetary policy for the U.S. and regulates financial institutions The Fed changes the money supply through open market operations The Federal funds rate is the rate at which one bank lends reserves to another ban ...

Econ 100Practice Exam 2

... What are open market operations? The short run Phillips curve slopes _____________. If aggregate supply shifts left, what happens to GDP and the price level? What are the advantages and disadvantages of monetary and fiscal policy? What are automatic stabilizers—give an example. What is the multiplie ...

... What are open market operations? The short run Phillips curve slopes _____________. If aggregate supply shifts left, what happens to GDP and the price level? What are the advantages and disadvantages of monetary and fiscal policy? What are automatic stabilizers—give an example. What is the multiplie ...

New Keynesian Economics

... Interpretation of the model • The interest rate term might seem counter-intuitive; but, recall that the real rate is assumed to be constant so a rise in i means an increase in expected inflation, which, in turn, reduces the desirability of holding home’s currency • Also, for a country that is not i ...

... Interpretation of the model • The interest rate term might seem counter-intuitive; but, recall that the real rate is assumed to be constant so a rise in i means an increase in expected inflation, which, in turn, reduces the desirability of holding home’s currency • Also, for a country that is not i ...

Multiple Choice: Circle the answer the best completes each question

... True or False: Identify the following statements as true or False and if it is false, re-write it to make it into a true statement. 23. One way the Fed can try to combat inflation would be to sell bonds. 24. The most powerful monetary tool is the reserve requirement. 25. One necessary characteristic ...

... True or False: Identify the following statements as true or False and if it is false, re-write it to make it into a true statement. 23. One way the Fed can try to combat inflation would be to sell bonds. 24. The most powerful monetary tool is the reserve requirement. 25. One necessary characteristic ...

5/7 Warm Up

... • To explain how economic stabilization tools affect the money supply, interest rates, & aggregate demand • To analyze economic data to determine how fiscal & monetary policy should be used to correct economic problems ...

... • To explain how economic stabilization tools affect the money supply, interest rates, & aggregate demand • To analyze economic data to determine how fiscal & monetary policy should be used to correct economic problems ...

Test Your Knowledge - Federal Reserve Bank of Atlanta

... used tool of monetary policy • The ratio of deposits that banks must hold to cover demands for liquidity • Set by the U.S. Congress ...

... used tool of monetary policy • The ratio of deposits that banks must hold to cover demands for liquidity • Set by the U.S. Congress ...

The Euro: Past and Future

... Called for a common monetary and economic policy among member nations Created the European Central Bank ▪ Located in Frankfurt, Germany ▪ Administers Monetary Policy ...

... Called for a common monetary and economic policy among member nations Created the European Central Bank ▪ Located in Frankfurt, Germany ▪ Administers Monetary Policy ...

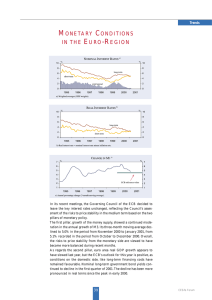

PDF Download

... The first pillar, growth of the money supply, showed a continued moderation in the annual growth of M3. Its three-month moving average declined to 5.0% in the period from November 2000 to January 2001, from 5.1% recorded in the period from October to December 2000. Overall, the risks to price stabil ...

... The first pillar, growth of the money supply, showed a continued moderation in the annual growth of M3. Its three-month moving average declined to 5.0% in the period from November 2000 to January 2001, from 5.1% recorded in the period from October to December 2000. Overall, the risks to price stabil ...

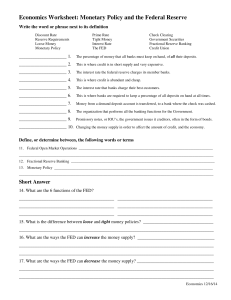

Economics Worksheet: Monetary Policy and the Federal Reserve

... The percentage of money that all banks must keep on hand, of all their deposits. ...

... The percentage of money that all banks must keep on hand, of all their deposits. ...

William A. Niskanen POLITICAL GUIDANCE ON MONETARY POLICY

... pectcd—either favorable or unfavorable—changes in supply condilions. Similarly, a demand rule is superior to a money rule because it accommodates unexpected changes in the demand for money. For these reasons, I suggest that implementation ofa demand rule is the most appropriate next step for U.S. mo ...

... pectcd—either favorable or unfavorable—changes in supply condilions. Similarly, a demand rule is superior to a money rule because it accommodates unexpected changes in the demand for money. For these reasons, I suggest that implementation ofa demand rule is the most appropriate next step for U.S. mo ...

Abstract

... the regulation of the money supply and interest rates by a central bank. Monetary policy also refers to how the central bank uses interest rates and the money supply to guide economic growth by controlling inflation and stabilizing currency. Like any other central bank, Bangladesh Bank is performing ...

... the regulation of the money supply and interest rates by a central bank. Monetary policy also refers to how the central bank uses interest rates and the money supply to guide economic growth by controlling inflation and stabilizing currency. Like any other central bank, Bangladesh Bank is performing ...

Document

... • Recessions are the solution, not the problem! • Keynesian policy - interest to spending. • Leads to misallocation of resources. • Leads to an unsustainable boom. ...

... • Recessions are the solution, not the problem! • Keynesian policy - interest to spending. • Leads to misallocation of resources. • Leads to an unsustainable boom. ...

Monetary policy

Monetary policy is the process by which the monetary authority of a country controls the supply of money, often targeting an inflation rate or interest rate to ensure price stability and general trust in the currency.Further goals of a monetary policy are usually to contribute to economic growth and stability, to lower unemployment, and to maintain predictable exchange rates with other currencies.Monetary economics provides insight into how to craft optimal monetary policy.Monetary policy is referred to as either being expansionary or contractionary, where an expansionary policy increases the total supply of money in the economy more rapidly than usual, and contractionary policy expands the money supply more slowly than usual or even shrinks it. Expansionary policy is traditionally used to try to combat unemployment in a recession by lowering interest rates in the hope that easy credit will entice businesses into expanding. Contractionary policy is intended to slow inflation in order to avoid the resulting distortions and deterioration of asset values.Monetary policy differs from fiscal policy, which refers to taxation, government spending, and associated borrowing.