Wages, employment and prices

... Keynesian model, the labour market has no mechanism to create higher employment by itself. Capital and goods markets can be in equilibrium and at the same time the labour market can be in a stable situation of unemployment (Heine and Herr, 2002). Wage levels and prices in the Keynesian model In the ...

... Keynesian model, the labour market has no mechanism to create higher employment by itself. Capital and goods markets can be in equilibrium and at the same time the labour market can be in a stable situation of unemployment (Heine and Herr, 2002). Wage levels and prices in the Keynesian model In the ...

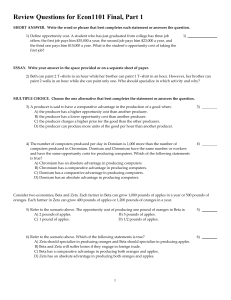

Econ 1101 Practice Questions Final Exam

... A) At the equilibrium wage rate, quantity demanded of labor exceeds the quantity supplied of labor. B) At wages above the equilibrium wage rate, quantity supplied of labor exceeds the quantity demanded of labor. C) At wages below the equilibrium wage rate, quantity supplied of labor exceeds the quan ...

... A) At the equilibrium wage rate, quantity demanded of labor exceeds the quantity supplied of labor. B) At wages above the equilibrium wage rate, quantity supplied of labor exceeds the quantity demanded of labor. C) At wages below the equilibrium wage rate, quantity supplied of labor exceeds the quan ...

mmi04-razin 224754 en

... ex ante and other domestic and foreign firms that set their prices so as to clear the markets ex post. This market-organization feature determines in turn the degree of price stickiness. Understanding why nominal changes have real consequences (why a short run aggregate supply relationship exists) h ...

... ex ante and other domestic and foreign firms that set their prices so as to clear the markets ex post. This market-organization feature determines in turn the degree of price stickiness. Understanding why nominal changes have real consequences (why a short run aggregate supply relationship exists) h ...

Answers to Text Questions and Problems in

... 3. A horizontal short-run aggregate supply curve would occur if firms provide the output demanded by customers at the prices that the firms have posted. 4. False. The law of demand explains why a rise in the price of an individual good leads to a fall in the quantity demanded. This is because other ...

... 3. A horizontal short-run aggregate supply curve would occur if firms provide the output demanded by customers at the prices that the firms have posted. 4. False. The law of demand explains why a rise in the price of an individual good leads to a fall in the quantity demanded. This is because other ...

Slide - MyWeb

... Monetary and Fiscal Policy Effects Long-Run Aggregate Supply and Policy Effects It is important to realize that if the AS curve is vertical in the long run, neither monetary policy nor fiscal policy has any effect on aggregate output in the long run. ...

... Monetary and Fiscal Policy Effects Long-Run Aggregate Supply and Policy Effects It is important to realize that if the AS curve is vertical in the long run, neither monetary policy nor fiscal policy has any effect on aggregate output in the long run. ...

nci 03.04.17 20:59:35

... A) can produce more of all goods than another economy. B) can produce less of all goods than another economy. C) has the highest opportunity cost of producing a particular good. D) has the lowest opportunity cost of producing a particular good. ...

... A) can produce more of all goods than another economy. B) can produce less of all goods than another economy. C) has the highest opportunity cost of producing a particular good. D) has the lowest opportunity cost of producing a particular good. ...

Chapter 24 The Keynesian Framework Chapter 25 The IS-LM World

... Keynesians assume that the quantity of loanable funds does not change when monetary supply is adjusted (reduced/increased) Monetarists and Rational Expectations suggest that when money supply is increased, inflationary expectations rise which cause a higher demand for loanable funds This shifts the ...

... Keynesians assume that the quantity of loanable funds does not change when monetary supply is adjusted (reduced/increased) Monetarists and Rational Expectations suggest that when money supply is increased, inflationary expectations rise which cause a higher demand for loanable funds This shifts the ...

Review for Unit 2 Exam KEYGross Domestic Product What are the

... UR = (Unemployment/Labor Force) x 100 March 2007 March 2008 Northeast 4.3% ...

... UR = (Unemployment/Labor Force) x 100 March 2007 March 2008 Northeast 4.3% ...

INTERNATIONAL FINANCE

... C. the willingness that the central bank changes interest rate D. all of the above ...

... C. the willingness that the central bank changes interest rate D. all of the above ...

short-run macroeconomic equilibrium

... Long-Run Macroeconomic Equilibrium The economy is in long-run macroeconomic equilibrium when the point of short-run macroeconomic equilibrium is on the long-run aggregate supply curve. ...

... Long-Run Macroeconomic Equilibrium The economy is in long-run macroeconomic equilibrium when the point of short-run macroeconomic equilibrium is on the long-run aggregate supply curve. ...

Aggregate supply

... • Keynesian economics point out that there have been times when markets have failed to clear for long periods of time. • Keynesian economics was developed out of the great depression of 1930’s when large scale unemployment lasted for a decade. • If it had not been for WW2 it is believed that large s ...

... • Keynesian economics point out that there have been times when markets have failed to clear for long periods of time. • Keynesian economics was developed out of the great depression of 1930’s when large scale unemployment lasted for a decade. • If it had not been for WW2 it is believed that large s ...

Money

... A second criticism of monetary theory is called the rational expectations theory. According to the “rational expectations” theory workers and businesses will adjust their wages and prices up if they believe that expansionary monetary policy will lead to inflation and increased price levels. Therefor ...

... A second criticism of monetary theory is called the rational expectations theory. According to the “rational expectations” theory workers and businesses will adjust their wages and prices up if they believe that expansionary monetary policy will lead to inflation and increased price levels. Therefor ...

Long-Run and Short-Run Concerns: Growth, Productivity

... • Deflation is a decrease in the overall (average) price level. • Sustained inflation is inflation that continues over a significant period of time. ...

... • Deflation is a decrease in the overall (average) price level. • Sustained inflation is inflation that continues over a significant period of time. ...

HKUMacroch01_5e

... long periods? Has the United States entered a New Economy, in which growth will be much higher in the future? Can other countries emulate China and grow at the same rate? Copyright © 2009 Pearson Education, Inc. Publishing as Prentice Hall • Macroeconomics, 5/e • Olivier Blanchard ...

... long periods? Has the United States entered a New Economy, in which growth will be much higher in the future? Can other countries emulate China and grow at the same rate? Copyright © 2009 Pearson Education, Inc. Publishing as Prentice Hall • Macroeconomics, 5/e • Olivier Blanchard ...

Nominal GDP Targeting Bennett McCallum Tepper School of

... that is, the difference between actual output and its “natural” value (which would be forthcoming if it were not for certain frictions, including primarily “price level stickiness,” i.e., slow adjustment of prices to changes in macroeconomic conditions). To focus on nominal GDP growth is only one w ...

... that is, the difference between actual output and its “natural” value (which would be forthcoming if it were not for certain frictions, including primarily “price level stickiness,” i.e., slow adjustment of prices to changes in macroeconomic conditions). To focus on nominal GDP growth is only one w ...

Sections 3 & 4

... 1. Sticky wages; 2. discretionary fiscal policy; 3. long-run aggregate supply curve; 4. automatic stabilizers; _____a graphical representation of the relationship between the aggregate price level and the quantity of aggregate output supplied if all prices, including nominal wages, were fully flexib ...

... 1. Sticky wages; 2. discretionary fiscal policy; 3. long-run aggregate supply curve; 4. automatic stabilizers; _____a graphical representation of the relationship between the aggregate price level and the quantity of aggregate output supplied if all prices, including nominal wages, were fully flexib ...

Due Date: Thursday, September 8th (at the beginning of class)

... that saving equals investment (S=I). In the Keynesian cross model, we assumed that desired investment in fixed. This assumption implies that investment is the same in the new equilibrium as it was in the old. We can conclude that saving is exactly the same in both equilibria. The paradox of thrift i ...

... that saving equals investment (S=I). In the Keynesian cross model, we assumed that desired investment in fixed. This assumption implies that investment is the same in the new equilibrium as it was in the old. We can conclude that saving is exactly the same in both equilibria. The paradox of thrift i ...

Three Items for the Macroeconomic Agenda

... The Smithian factories form a nonlinear input-output system where each firm produces under increasing returns to scale and also uses one or more intermediate inputs produced by other increasing-returns firms. Structures of this kind can be enormously productive at high levels of activity but are, by ...

... The Smithian factories form a nonlinear input-output system where each firm produces under increasing returns to scale and also uses one or more intermediate inputs produced by other increasing-returns firms. Structures of this kind can be enormously productive at high levels of activity but are, by ...

Stagnation Traps

... Weak aggregate demand has a negative impact on firms’ profits and investment in innovation, resulting in low growth ...

... Weak aggregate demand has a negative impact on firms’ profits and investment in innovation, resulting in low growth ...

Stabilisation policy under Romer IS-MP-IA

... movement along the IA curve. But given that φy ≥ 0 and b > 0, this number is always less than 1. Therefore, it must be the case that after the shock, y > y N . Obviously, the number is equal to zero if φy = 0 (i.e. there is no shift in the AD curve). ...

... movement along the IA curve. But given that φy ≥ 0 and b > 0, this number is always less than 1. Therefore, it must be the case that after the shock, y > y N . Obviously, the number is equal to zero if φy = 0 (i.e. there is no shift in the AD curve). ...

Phillips curve

In economics, the Phillips curve is a historical inverse relationship between rates of unemployment and corresponding rates of inflation that result in an economy. Stated simply, decreased unemployment, (i.e., increased levels of employment) in an economy will correlate with higher rates of inflation.While there is a short run tradeoff between unemployment and inflation, it has not been observed in the long run. In 1968, Milton Friedman asserted that the Phillips Curve was only applicable in the short-run and that in the long-run, inflationary policies will not decrease unemployment. Friedman then correctly predicted that, in the upcoming years after 1968, both inflation and unemployment would increase. The long-run Phillips Curve is now seen as a vertical line at the natural rate of unemployment, where the rate of inflation has no effect on unemployment. Accordingly, the Phillips curve is now seen as too simplistic, with the unemployment rate supplanted by more accurate predictors of inflation based on velocity of money supply measures such as the MZM (""money zero maturity"") velocity, which is affected by unemployment in the short but not the long term.