Module Income and Expenditure

... in this Module: • The nature of the multiplier, which shows how initial changes in spending lead to further changes • The meaning of the aggregate consumption function, which shows how current disposable income affects consumer spending • How expected future income and aggregate wealth affect consum ...

... in this Module: • The nature of the multiplier, which shows how initial changes in spending lead to further changes • The meaning of the aggregate consumption function, which shows how current disposable income affects consumer spending • How expected future income and aggregate wealth affect consum ...

File - Mr. Haglin Economics

... Driving 20mph is too slow. The car can easily go faster. (High unemployment) 70mph is sustainable. (Full employment) Some cars have the capacity to drive faster then others. (industrial nations vs. 3rd world nations) If the engine (technology) or the gas mileage (productivity) increase then ...

... Driving 20mph is too slow. The car can easily go faster. (High unemployment) 70mph is sustainable. (Full employment) Some cars have the capacity to drive faster then others. (industrial nations vs. 3rd world nations) If the engine (technology) or the gas mileage (productivity) increase then ...

fiscal policy homework

... a) the same effect on AD as a €100 billion increase in G; b) a weaker effect on AD than a €100 billion increase in G; c) a stronger effect on AD than a €100 billion increase in G; d) no effect on AD, since it affects only the "supply side" of the economy. 3. Fiscal policy is more effective: a) the l ...

... a) the same effect on AD as a €100 billion increase in G; b) a weaker effect on AD than a €100 billion increase in G; c) a stronger effect on AD than a €100 billion increase in G; d) no effect on AD, since it affects only the "supply side" of the economy. 3. Fiscal policy is more effective: a) the l ...

18_fiscal_and_multip..

... – Government spending is direct – Taxes depend on what consumers do with the tax cut or what they would have done with the money going to pay the tax increase (how much would they consume, how much would they save?) ...

... – Government spending is direct – Taxes depend on what consumers do with the tax cut or what they would have done with the money going to pay the tax increase (how much would they consume, how much would they save?) ...

C.E.11c The government taxes, borrows, and spends to influence

... the Constitution fo the United States of America authorizes Congress to tax incomes (personal and business). ...

... the Constitution fo the United States of America authorizes Congress to tax incomes (personal and business). ...

Fiscal Policy - McGraw Hill Higher Education - McGraw

... • If AD falls short, there is a gap between what the economy can produce and what people want to buy. – The GDP gap is the difference between fullemployment output and the amount of ...

... • If AD falls short, there is a gap between what the economy can produce and what people want to buy. – The GDP gap is the difference between fullemployment output and the amount of ...

Economics “Ask the Instructor” Clip 66 Transcript

... Fiscal policy refers to intentional changes in federal government expenditures or in tax receipts intended to smooth out the business cycle. Expenditures are increased to fight a recession and are reduced, at least in theory, to combat demand-pull inflation. The other aspect of fiscal policy is taxe ...

... Fiscal policy refers to intentional changes in federal government expenditures or in tax receipts intended to smooth out the business cycle. Expenditures are increased to fight a recession and are reduced, at least in theory, to combat demand-pull inflation. The other aspect of fiscal policy is taxe ...

File

... • Driving 20 mph is too slow. The car can easily go faster. (High unemployment) • 70mph is sustainable. (Full employment) • Some cars have the capacity to drive faster then others. (industrial nations vs. 3rd world nations) • If the engine (technology) or the gas mileage (productivity) increase then ...

... • Driving 20 mph is too slow. The car can easily go faster. (High unemployment) • 70mph is sustainable. (Full employment) • Some cars have the capacity to drive faster then others. (industrial nations vs. 3rd world nations) • If the engine (technology) or the gas mileage (productivity) increase then ...

macro review - WordPress.com

... • The government decides to fill a deflationary gap by increasing its government spending. • Suppose: Government spends $100 million on a school building project. ...

... • The government decides to fill a deflationary gap by increasing its government spending. • Suppose: Government spends $100 million on a school building project. ...

Talking Points Presentation - Federal Reserve Bank of St. Louis

... spending and/or increases in taxes, in theory are thought to decrease overall demand for goods and services. These actions move the budget position toward a surplus. Contractionary policies are rarely used. 4. If the government runs a deficit, it borrows to cover the deficit spending. This borrowing ...

... spending and/or increases in taxes, in theory are thought to decrease overall demand for goods and services. These actions move the budget position toward a surplus. Contractionary policies are rarely used. 4. If the government runs a deficit, it borrows to cover the deficit spending. This borrowing ...

The Multiplier

... Assume producers are willing to supply additional output at a fixed price Take the interest rate as given Assume there is no government spending and taxes (no taxes) Assume exports and imports are zero (no trade) ...

... Assume producers are willing to supply additional output at a fixed price Take the interest rate as given Assume there is no government spending and taxes (no taxes) Assume exports and imports are zero (no trade) ...

Eco 200 – Principles of Macroeconomics

... Lump-sum tax multiplier = -(MPC-MPI) / (MPS + MPI) Balanced-budget multiplier = effect of equal changes in G and T = 1 ...

... Lump-sum tax multiplier = -(MPC-MPI) / (MPS + MPI) Balanced-budget multiplier = effect of equal changes in G and T = 1 ...

Macro

... Give an example of an action during a tight money policy. During what phase of the business cycle would this occur? ...

... Give an example of an action during a tight money policy. During what phase of the business cycle would this occur? ...

Macro_Module_21

... Transfers and Taxes Suppose the government decides to lower income taxes by a lump-sum $1000. The MPC = .90. When Americans get $1000 back into their pockets, they will save $100 (10%) and spend ...

... Transfers and Taxes Suppose the government decides to lower income taxes by a lump-sum $1000. The MPC = .90. When Americans get $1000 back into their pockets, they will save $100 (10%) and spend ...

Stabilization Policies

... Programs that automatically trigger benefits if changes in the economy threaten income Unemployment insurance Insurance that workers who lose their jobs through no fault of their own can collect for a limited amount of time ...

... Programs that automatically trigger benefits if changes in the economy threaten income Unemployment insurance Insurance that workers who lose their jobs through no fault of their own can collect for a limited amount of time ...

Module 21

... policy is lessened by the progressive tax system. • Assume the economy is in recession and the government has increased G to boost employment and real GDP. • AS some consumers find jobs and increased income, they start paying more taxes and disposable income falls. • As Yd falls, it slows down the m ...

... policy is lessened by the progressive tax system. • Assume the economy is in recession and the government has increased G to boost employment and real GDP. • AS some consumers find jobs and increased income, they start paying more taxes and disposable income falls. • As Yd falls, it slows down the m ...

Module Fiscal Policy and the Multiplier

... • Changes GDP in smaller increments due to how Households/businesses re-use the money. Usually subject to the MPC and MPS Ratios ...

... • Changes GDP in smaller increments due to how Households/businesses re-use the money. Usually subject to the MPC and MPS Ratios ...

QUESTIONS FOR DISCUSSION

... balanced budget would cripple the use of fiscal policy to counteract business cycles. It would be very difficult to use government spending to stimulate the economy if taxes also had to be increased to balance the budget. Of course, since dollar for dollar government spending is more powerful than t ...

... balanced budget would cripple the use of fiscal policy to counteract business cycles. It would be very difficult to use government spending to stimulate the economy if taxes also had to be increased to balance the budget. Of course, since dollar for dollar government spending is more powerful than t ...

3 Macroeconomics LESSON 1 s ACTIVITY 21

... 2. What is the value of the government spending multiplier if the MPC is 0.67? 3. What is the tax multiplier if the MPS is 0.25? ...

... 2. What is the value of the government spending multiplier if the MPC is 0.67? 3. What is the tax multiplier if the MPS is 0.25? ...

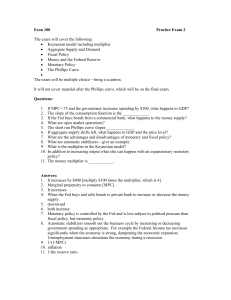

Econ 100Practice Exam 2

... government spending as appropriate. For example the Federal Income tax increases significantly when the economy is strong, dampening the economic expansion. Unemployment insurance stimulates the economy during a recession. 9. 1/(1-MPC) ...

... government spending as appropriate. For example the Federal Income tax increases significantly when the economy is strong, dampening the economic expansion. Unemployment insurance stimulates the economy during a recession. 9. 1/(1-MPC) ...