Fiscal Policy and the Multiplier

... 1. Fiscal policy has a multiplier effect on the economy, the size of which depends upon the fiscal policy. Except in the case of lumpsum taxes, taxes reduce the size of the multiplier. Expansionary fiscal policy leads to an increase in real GDP, while contractionary fiscal policy leads to a reductio ...

... 1. Fiscal policy has a multiplier effect on the economy, the size of which depends upon the fiscal policy. Except in the case of lumpsum taxes, taxes reduce the size of the multiplier. Expansionary fiscal policy leads to an increase in real GDP, while contractionary fiscal policy leads to a reductio ...

Macroeconomics

... been characterized by more expansionary policies regardless of economic conditions State & Local Finance policies may offset ...

... been characterized by more expansionary policies regardless of economic conditions State & Local Finance policies may offset ...

managing the economy

... The multiplier and the aggregate expenditure diagram assume that prices remain constant. Even in the short-run, some adjustment in output prices reduces the size of the multiplier. In the long-run, if prices and wages are flexible, the economy would return to equilibrium anyway. Since wages increas ...

... The multiplier and the aggregate expenditure diagram assume that prices remain constant. Even in the short-run, some adjustment in output prices reduces the size of the multiplier. In the long-run, if prices and wages are flexible, the economy would return to equilibrium anyway. Since wages increas ...

stimulus spending doesn`t work - Let`s Get Down to Business

... view that the expenditure "multipliers" are greater than one—so that gross domestic product expands by more than government spending itself. Stimulus packages typically also feature tax reductions, designed partly to boost consumer demand (by raising disposable income) and partly to stimulate work e ...

... view that the expenditure "multipliers" are greater than one—so that gross domestic product expands by more than government spending itself. Stimulus packages typically also feature tax reductions, designed partly to boost consumer demand (by raising disposable income) and partly to stimulate work e ...

No Slide Title

... 1) The tendency for an expansionary fiscal policy to reduce other components of aggregate demand is called crowding out. 2) Basic mechanism. a) Expansionary fiscal policy will increase debt. b) This drives up interest rates. c) This leads to, i) less investment, ii) higher demand and lower supply fo ...

... 1) The tendency for an expansionary fiscal policy to reduce other components of aggregate demand is called crowding out. 2) Basic mechanism. a) Expansionary fiscal policy will increase debt. b) This drives up interest rates. c) This leads to, i) less investment, ii) higher demand and lower supply fo ...

Group Assignment for Week Four fiscal multipliers without diagram

... elsewhere. But in a recession, when workers and factories lie idle, a fiscal boost can increase overall demand. And if the initial stimulus triggers a cascade of expenditure among consumers and businesses, the multiplier can be well above one. The multiplier is also likely to vary according to the t ...

... elsewhere. But in a recession, when workers and factories lie idle, a fiscal boost can increase overall demand. And if the initial stimulus triggers a cascade of expenditure among consumers and businesses, the multiplier can be well above one. The multiplier is also likely to vary according to the t ...

Chapter 12

... Aggregate Expenditure (AE) – the total planned spending for goods and services by consumers, businesses government, and foreign buyers ...

... Aggregate Expenditure (AE) – the total planned spending for goods and services by consumers, businesses government, and foreign buyers ...

Macro Chapter 12

... will drive up the general level of prices. 3. bad for the economy because the damage from the storm will be subtracted from this year’s GDP. 4. bad for the economy because wealth was destroyed and more spending on repairs will result in less spending on ...

... will drive up the general level of prices. 3. bad for the economy because the damage from the storm will be subtracted from this year’s GDP. 4. bad for the economy because wealth was destroyed and more spending on repairs will result in less spending on ...

ECN 111 PRINCIPLES OF MACROECONOMICS SOLUTIONS TO

... If policy makers think that the economy is overheating because aggregate demand is growing faster than long-run aggregate supply, they have two options. The federal government can either (1) increase taxes [T] or (2) decrease government purchases [G]. This strategy is called a “contractionary fiscal ...

... If policy makers think that the economy is overheating because aggregate demand is growing faster than long-run aggregate supply, they have two options. The federal government can either (1) increase taxes [T] or (2) decrease government purchases [G]. This strategy is called a “contractionary fiscal ...

0910 EOCT Review Guide Economics Macroeconomics standards

... c) Trough: d) Recovery: e) Expansion: ...

... c) Trough: d) Recovery: e) Expansion: ...

Fiscal Policy

... If the government spends $5 Million, will AD increase by the same amount? • No, AD will increase even more as spending becomes income for consumers. • Consumers will take that money and spend, thus increasing AD. How much will AD increase? • It depends on how much of the new income consumers save. • ...

... If the government spends $5 Million, will AD increase by the same amount? • No, AD will increase even more as spending becomes income for consumers. • Consumers will take that money and spend, thus increasing AD. How much will AD increase? • It depends on how much of the new income consumers save. • ...

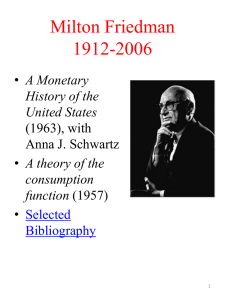

Ch 18 Milton Friedman

... • Transitory changes in income do not affect consumption spending, only permanent changes do • This implies a small marginal propensity to consume and, therefore, a small multiplier. • This makes Keynesian fiscal policy ineffective ...

... • Transitory changes in income do not affect consumption spending, only permanent changes do • This implies a small marginal propensity to consume and, therefore, a small multiplier. • This makes Keynesian fiscal policy ineffective ...

National Income and Price Determination: Aggregate Supply

... Balanced Budget Multiplier • When a change in government spending is offset by a change in lump sum taxes, real GDP changes by the amount of the change in government spending. • Balanced Budget Multiplier: 1/MPS + (MPC/MPS) = 1 ...

... Balanced Budget Multiplier • When a change in government spending is offset by a change in lump sum taxes, real GDP changes by the amount of the change in government spending. • Balanced Budget Multiplier: 1/MPS + (MPC/MPS) = 1 ...

Discretionary Fiscal Policy and Automatic Stabilizers

... One of the goals of economic policy is to stabilize the economy. This means promoting full employment and stable prices. To accomplish this, aggregate demand must be near the full-employment level of output. If aggregate demand is too low, there will be unemployment. If aggregate demand is too high, ...

... One of the goals of economic policy is to stabilize the economy. This means promoting full employment and stable prices. To accomplish this, aggregate demand must be near the full-employment level of output. If aggregate demand is too low, there will be unemployment. If aggregate demand is too high, ...

Last day to sign up for AP Exam

... • If the engine (technology) or the gas mileage (productivity) increase then the car can drive at even higher speeds. (Increase LRAS) The government often speeds up or slows down the economy by using fiscal and/or monetary policy. 2 ...

... • If the engine (technology) or the gas mileage (productivity) increase then the car can drive at even higher speeds. (Increase LRAS) The government often speeds up or slows down the economy by using fiscal and/or monetary policy. 2 ...

Fiscal Policy

... • Government purchases have immediate effect on aggregate demand while tax cuts are less immediate ...

... • Government purchases have immediate effect on aggregate demand while tax cuts are less immediate ...

The Spending Multiplier

... these actions regardless of the appropriateness. As a result political parties would choose other options over this. Public Debt The total amount by the federal government as a result of its past borrowing The amount of may influence the government’s to impose fiscal policies. Due to the fact th ...

... these actions regardless of the appropriateness. As a result political parties would choose other options over this. Public Debt The total amount by the federal government as a result of its past borrowing The amount of may influence the government’s to impose fiscal policies. Due to the fact th ...

Economics Chapter 15 Fiscal Policy

... Fiscal policy decisions, such as how much to spend and how much to tax, are among the most important decisions the federal government makes. ...

... Fiscal policy decisions, such as how much to spend and how much to tax, are among the most important decisions the federal government makes. ...

Fiscal Policy Influences Aggregate Demand

... • With higher interest rate, return on saving increase so consumers more likely to save and less likely to invest in new housing • Therefore, Q of goods & services will fall; basically explaining interest rate effect ...

... • With higher interest rate, return on saving increase so consumers more likely to save and less likely to invest in new housing • Therefore, Q of goods & services will fall; basically explaining interest rate effect ...

Chapter 10 - Humble ISD

... Equal increases in Government spending and taxation increase the equilibrium GDP. Changes in government spending affects aggregate spending more powerfully than a tax change of the same size. Balanced Budget Multiplier is always one ...

... Equal increases in Government spending and taxation increase the equilibrium GDP. Changes in government spending affects aggregate spending more powerfully than a tax change of the same size. Balanced Budget Multiplier is always one ...

Aggregate Expenditure Model

... HHs spent $0.91 cents out of every additional increase in disposable income. ...

... HHs spent $0.91 cents out of every additional increase in disposable income. ...