Personal Finance CEP

... Higher levels of education equals increase in income, and a lower chance of being unemployed ...

... Higher levels of education equals increase in income, and a lower chance of being unemployed ...

Economic Theories- Vocabulary List

... budget surplus, balanced budget, national debt, spending multiplier, pumppriming, demand- side stimulation, FDR’s New Deal, fiscal policy ...

... budget surplus, balanced budget, national debt, spending multiplier, pumppriming, demand- side stimulation, FDR’s New Deal, fiscal policy ...

Long-Run Aggregate Supply

... predict here. This equation gives us an upper bound. The actual value (somewhere between zero and 2.5) is lower because… i. New income is dissipated in the form of taxes and imports. ii. Inflation from extra spending reduces the real GDP gains. iii. Savings becomes investment, which is also spent bu ...

... predict here. This equation gives us an upper bound. The actual value (somewhere between zero and 2.5) is lower because… i. New income is dissipated in the form of taxes and imports. ii. Inflation from extra spending reduces the real GDP gains. iii. Savings becomes investment, which is also spent bu ...

Fiscal and Monetary Policy

... What to do with a Surplus 1. Pay off public debt Buy back bonds Puts $ back into the system, increases consumption • May offset contractionary policy that created the surplus ...

... What to do with a Surplus 1. Pay off public debt Buy back bonds Puts $ back into the system, increases consumption • May offset contractionary policy that created the surplus ...

Aggregate Expenditures: The multiplier, net exports

... Small change in investment leads to a large change in output and income. The multiplier determines how large the change will be Multiplier = change in GDPr / initial change in spending Ex. A $5 billion change in Ig led to a $20 billion change in GDP. What is the multiplier? ...

... Small change in investment leads to a large change in output and income. The multiplier determines how large the change will be Multiplier = change in GDPr / initial change in spending Ex. A $5 billion change in Ig led to a $20 billion change in GDP. What is the multiplier? ...

Ch 11: Fiscal Policy

... demand at current prices shift initially (before multiplier effects) with a) A $100 billion increase in government purchases? b) A $100 billion tax cut? c) A $100 billion increase in income transfers? What will the cumulative AD shift be for d) the increased G? e) the tax cut? f) the increased trans ...

... demand at current prices shift initially (before multiplier effects) with a) A $100 billion increase in government purchases? b) A $100 billion tax cut? c) A $100 billion increase in income transfers? What will the cumulative AD shift be for d) the increased G? e) the tax cut? f) the increased trans ...

17 November 2012

... In spite of the stimulative effects of Reagan tax cuts and military spending increases, the overnight interest rates were pushed up to close to 20% by the Fed and the economy plunged into two back-to-back recessions. GDP growth in the United States in the early1980s. The short recession at the start ...

... In spite of the stimulative effects of Reagan tax cuts and military spending increases, the overnight interest rates were pushed up to close to 20% by the Fed and the economy plunged into two back-to-back recessions. GDP growth in the United States in the early1980s. The short recession at the start ...

Unit 3 Review

... Unplanned Changes in Inventories – changes in inventories firms did not anticipate Actual Investment – planned investment plus unplanned increase/decrease in inventories ...

... Unplanned Changes in Inventories – changes in inventories firms did not anticipate Actual Investment – planned investment plus unplanned increase/decrease in inventories ...

Economic Ups and Downs

... Only 2 significant times its occurred: At the end of WWI (1900s) During the Great Depression (1920s) ...

... Only 2 significant times its occurred: At the end of WWI (1900s) During the Great Depression (1920s) ...

Chapter 22 Aggregate demand, fiscal policy and trade

... would have been if output had been at the fullemployment level. The inflation-adjusted budget uses real not nominal interest rates to calculate government spending on debt interest. ...

... would have been if output had been at the fullemployment level. The inflation-adjusted budget uses real not nominal interest rates to calculate government spending on debt interest. ...

Ch. 15 / 16 StudyGuide Multiple Choice ____ 1. You are President

... ____ 12. All of the following are features of classical economics EXCEPT A. a free market economy. B. the law of supply and demand. C. the idea of achieving market equilibrium. D. a significant role for government in the running of the economy. ____ 13. Which ONE of the following economists would NO ...

... ____ 12. All of the following are features of classical economics EXCEPT A. a free market economy. B. the law of supply and demand. C. the idea of achieving market equilibrium. D. a significant role for government in the running of the economy. ____ 13. Which ONE of the following economists would NO ...

Fiscal Policy and the Multiplier Effect

... pay raise will increase consumption. B. As a result of a rise in Consumption, stores, restaurants, etc.. may have to hire on more workers to meet the increased demand. Therefore I (Consumption rises). The added employees will also spend some of their earnings. C. Businesses may find that they need t ...

... pay raise will increase consumption. B. As a result of a rise in Consumption, stores, restaurants, etc.. may have to hire on more workers to meet the increased demand. Therefore I (Consumption rises). The added employees will also spend some of their earnings. C. Businesses may find that they need t ...

Fiscal Policy Government action to influence the economy

... • Will additional government spending “crowd out” private spending? • Crowding-out: government spending leads to reductions in private spending • Example: An additional $2,000,000 dollars spent on education by government may result in consumers spending $2,000,000 less on private school tuition. ...

... • Will additional government spending “crowd out” private spending? • Crowding-out: government spending leads to reductions in private spending • Example: An additional $2,000,000 dollars spent on education by government may result in consumers spending $2,000,000 less on private school tuition. ...

Key Ideas by Morton

... The marginal propensity to consume (MPC) is the additional consumption spending from an additional dollar of income. The marginal propensity to save (MPS) is the additional savings from an additional dollar of income. The marginal propensity to consumer and the marginal propensity to save are relate ...

... The marginal propensity to consume (MPC) is the additional consumption spending from an additional dollar of income. The marginal propensity to save (MPS) is the additional savings from an additional dollar of income. The marginal propensity to consumer and the marginal propensity to save are relate ...

Fiscal Policy - Granbury ISD

... to inflation or they have to borrow it. Q. How does the government borrow money? A. They sell U.S. treasury bonds, treasury ...

... to inflation or they have to borrow it. Q. How does the government borrow money? A. They sell U.S. treasury bonds, treasury ...

Chapter 5

... 5. Identify the factors that influence the levels of spending by households and businesses. 6. Explain the effect of household borrowing, transfer payments, saving, and taxes on household spending. 7. Identify the major causes of fluctuations in investment spending. 8. Understand the role of financi ...

... 5. Identify the factors that influence the levels of spending by households and businesses. 6. Explain the effect of household borrowing, transfer payments, saving, and taxes on household spending. 7. Identify the major causes of fluctuations in investment spending. 8. Understand the role of financi ...

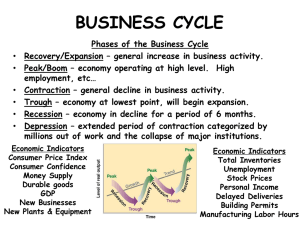

BUSINESS CYCLE, FEDERAL RESERVE, TAXATION

... rising. Inflation is a natural occurrence, but high rates of inflation can cause a decline in business activity. • Inflation is caused by an increase in the money supply. Money in circulation, or being spent. RECESSION • During a period of recession, consumers are not spending money, thus business p ...

... rising. Inflation is a natural occurrence, but high rates of inflation can cause a decline in business activity. • Inflation is caused by an increase in the money supply. Money in circulation, or being spent. RECESSION • During a period of recession, consumers are not spending money, thus business p ...

Fiscal Policy

... IRS determines how much you have paid in taxes and how much you owe, or overpaid. The amount that an individual owes is dependent ...

... IRS determines how much you have paid in taxes and how much you owe, or overpaid. The amount that an individual owes is dependent ...

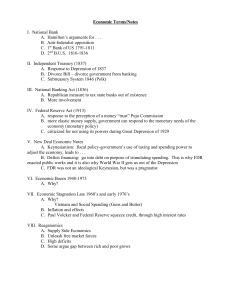

Economic Terms/Notes

... A. Republican measure to tax state banks out of existence B. More involvement IV. Federal Reserve Act (1913) A. response to the perception of a money “trust” Pujo Commission B. more elastic money supply, government can respond to the monetary needs of the economy (monetary policy) C. criticized for ...

... A. Republican measure to tax state banks out of existence B. More involvement IV. Federal Reserve Act (1913) A. response to the perception of a money “trust” Pujo Commission B. more elastic money supply, government can respond to the monetary needs of the economy (monetary policy) C. criticized for ...

Fiscal Policy Government action to influence the economy

... • Will higher tax rates give the government greater tax revenues? • Will lower tax rates give the government smaller tax revenues? ...

... • Will higher tax rates give the government greater tax revenues? • Will lower tax rates give the government smaller tax revenues? ...

Module Income and Expenditure

... Thus the MPC = (Δ C/Δ Yd) = .8 and The MPS = (Δ S/Δ Yd) = .20. So if this household receives $1 of additional Yd, they will consume 80 cents and save 20 cents of it ...

... Thus the MPC = (Δ C/Δ Yd) = .8 and The MPS = (Δ S/Δ Yd) = .20. So if this household receives $1 of additional Yd, they will consume 80 cents and save 20 cents of it ...

Chapter 7: Government Sector

... economic growth when there is economic recession or depression. – Cotractionary Fiscal policy when the output and the employment level is higher that the full employment/stable level. ...

... economic growth when there is economic recession or depression. – Cotractionary Fiscal policy when the output and the employment level is higher that the full employment/stable level. ...