Do we spend more than we take in?

... What should be the role of government in our economy? • Discuss this with a partner. • Come up with 3 things ...

... What should be the role of government in our economy? • Discuss this with a partner. • Come up with 3 things ...

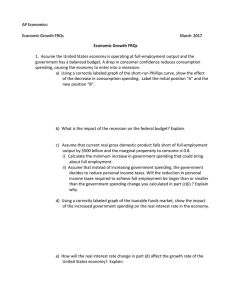

Economic Growth FRQs

... • the federal government budget deficit is equal to $200 billion (5 percent of gross national product) a) Legislation is just been passed which holds government spending constant and raises personal income taxes enough to balance the budget. Explain briefly how and why this policy will affect output ...

... • the federal government budget deficit is equal to $200 billion (5 percent of gross national product) a) Legislation is just been passed which holds government spending constant and raises personal income taxes enough to balance the budget. Explain briefly how and why this policy will affect output ...

Fiscal Policy

... productivity (Ex. Taxes that are too high) Taxes that are too high will discourage work Calls for less government spending and tax cuts ...

... productivity (Ex. Taxes that are too high) Taxes that are too high will discourage work Calls for less government spending and tax cuts ...

hwk3solution

... I = 350 – 1500i, where i=interest rate is equal to 0.07 NX= -25 1) If the interest rate i=0.07, derive the aggregate expenditure equation. Recall the AE= C + I + G + NX. The final form for the AE equation should be in the form AE = Autonomous Expenditures + mpc(1-t)Y. AE = C + I + G + NX AE = 500 + ...

... I = 350 – 1500i, where i=interest rate is equal to 0.07 NX= -25 1) If the interest rate i=0.07, derive the aggregate expenditure equation. Recall the AE= C + I + G + NX. The final form for the AE equation should be in the form AE = Autonomous Expenditures + mpc(1-t)Y. AE = C + I + G + NX AE = 500 + ...

Free-response/problem

... A Formula for the Spending Multiplier • The formula for the multiplier is: Multiplier = 1/(1 - MPC) • An important number in this formula is the marginal propensity to consume (MPC). • It is the fraction of extra income that a household consumes rather than saves. ...

... A Formula for the Spending Multiplier • The formula for the multiplier is: Multiplier = 1/(1 - MPC) • An important number in this formula is the marginal propensity to consume (MPC). • It is the fraction of extra income that a household consumes rather than saves. ...

Chapter 17 File

... budget would have been if output had been at the full-employment level. • The inflation-adjusted budget uses real not nominal interest rates to calculate government spending on debt interest. ©McGraw-Hill Companies, 2010 ...

... budget would have been if output had been at the full-employment level. • The inflation-adjusted budget uses real not nominal interest rates to calculate government spending on debt interest. ©McGraw-Hill Companies, 2010 ...

Pensions are cheap- It’s tax concessions for superanuation

... The relative overall stability of the historical taxto-GDP ratio is largely the result of policy adjustments, particularly periodic adjustments to the personal income tax scale. Under strict no-policy-change assumptions (including no change to personal income tax scales), tax collections would rise ...

... The relative overall stability of the historical taxto-GDP ratio is largely the result of policy adjustments, particularly periodic adjustments to the personal income tax scale. Under strict no-policy-change assumptions (including no change to personal income tax scales), tax collections would rise ...

Q 1

... because prices of resources (wages) are very flexible. 2. AS is vertical so AD can’t increase without causing inflation. ...

... because prices of resources (wages) are very flexible. 2. AS is vertical so AD can’t increase without causing inflation. ...

Fiscal Policy-15

... sustainable output in the long run given the supply of resources, technology and “rules of the game” that nurture production and exchange ...

... sustainable output in the long run given the supply of resources, technology and “rules of the game” that nurture production and exchange ...

Saving

... •Assume the Super Bowl comes to town and there is an increase of $100 in Ashley’s restaurant. •Ashley now has $100 more income. •She saves $50 and spends $50 at Karl’s Salon •Karl now has $50 more income •He saves $25 and spends $25 at Dan’s fruit stand •Dan now has $25 more income. This continues u ...

... •Assume the Super Bowl comes to town and there is an increase of $100 in Ashley’s restaurant. •Ashley now has $100 more income. •She saves $50 and spends $50 at Karl’s Salon •Karl now has $50 more income •He saves $25 and spends $25 at Dan’s fruit stand •Dan now has $25 more income. This continues u ...

Business Learning Center – Econ 102 (Eudey) – Chapter 10 (Fiscal

... 8. Suppose the marginal propensity to consume is 0.75. a. The government spending multiplier is ___________. b. How does the increase in government spending by $100 affect the AD curve? 9. If the government spending multiplier is 3, holding everything else and price level constant, a $200 million de ...

... 8. Suppose the marginal propensity to consume is 0.75. a. The government spending multiplier is ___________. b. How does the increase in government spending by $100 affect the AD curve? 9. If the government spending multiplier is 3, holding everything else and price level constant, a $200 million de ...

Chapter 17 Economic Policymaking

... economy by creating demand for goods and services • “Pump-Priming” (New Deal/FDR) • Favored by Democrats • Considers deficit spending allowable, even necessary at times. ...

... economy by creating demand for goods and services • “Pump-Priming” (New Deal/FDR) • Favored by Democrats • Considers deficit spending allowable, even necessary at times. ...

Fiscal Policy

... • Chronic budget deficits can result in large debts levels, high interest rates, inflation, and economic collapse… The Greek Example. • If the government does not use expansionary fiscal policy. AS will adjust but it takes longer. ...

... • Chronic budget deficits can result in large debts levels, high interest rates, inflation, and economic collapse… The Greek Example. • If the government does not use expansionary fiscal policy. AS will adjust but it takes longer. ...

Macro_online_chapter_12_14e

... 1. less of each additional dollar they earn, so work effort increases, and aggregate supply shifts right. 2. less of each additional dollar they earn, so work effort decreases, and aggregate supply shifts left. 3. more of each additional dollar they earn, so work effort increases, and aggregate supp ...

... 1. less of each additional dollar they earn, so work effort increases, and aggregate supply shifts right. 2. less of each additional dollar they earn, so work effort decreases, and aggregate supply shifts left. 3. more of each additional dollar they earn, so work effort increases, and aggregate supp ...

File

... The economy is naturally stable. • Markets work well when left to themselves. • Government interference can weaken the economy • Fiscal Policy is often bad policy. • A small role for government is good. ...

... The economy is naturally stable. • Markets work well when left to themselves. • Government interference can weaken the economy • Fiscal Policy is often bad policy. • A small role for government is good. ...

1 - Mr. Thomas

... you buy something, the money you spend doesn't disappear. For example, it goes into a cash register and becomes income for the seller. The seller will then spend some part of that new income. That spending becomes someone else's income, and so on. The initial spending has a multiplier effect. How do ...

... you buy something, the money you spend doesn't disappear. For example, it goes into a cash register and becomes income for the seller. The seller will then spend some part of that new income. That spending becomes someone else's income, and so on. The initial spending has a multiplier effect. How do ...

Fiscal and Monetary Policy

... Competes with private businesses With this added demand for $, interest rates may increase and private Ig may decrease ...

... Competes with private businesses With this added demand for $, interest rates may increase and private Ig may decrease ...

Macro_3.7-_Problems_with_Fiscal_Policy

... • Ex: A senator promises more welfare and public works programs when there is already an inflationary gap. ...

... • Ex: A senator promises more welfare and public works programs when there is already an inflationary gap. ...

Comment on: “From Great Depression to Great

... Could have the great depression been avoided had we used these policies more aggressively at the time? These are the provoking and policy relevant questions raised in this paper. The answers (and key messages) in the paper can be summarized as following. Fiscal policy was not used during the great d ...

... Could have the great depression been avoided had we used these policies more aggressively at the time? These are the provoking and policy relevant questions raised in this paper. The answers (and key messages) in the paper can be summarized as following. Fiscal policy was not used during the great d ...

Economic Policy and the Aggregate Demand

... John Maynard Keyne – Keynesian economics – the idea that if the economy is in trouble, the government should correct it by spending money Stabilization policy – is the use of government policy to reduce the severity of recessions and rein in excessively strong expansions ...

... John Maynard Keyne – Keynesian economics – the idea that if the economy is in trouble, the government should correct it by spending money Stabilization policy – is the use of government policy to reduce the severity of recessions and rein in excessively strong expansions ...

Assignment on Fiscal Policy of Bangladesh

... believes there is going to be a recession, they will increase AD, however if this forecast was wrong and the economy grew too fast, the govt action would cause inflation. 4. Time Lags. If the govt plans to increase spending this can take along time to filter into the economy and it may be too late.S ...

... believes there is going to be a recession, they will increase AD, however if this forecast was wrong and the economy grew too fast, the govt action would cause inflation. 4. Time Lags. If the govt plans to increase spending this can take along time to filter into the economy and it may be too late.S ...