* Your assessment is very important for improving the work of artificial intelligence, which forms the content of this project

Download 18_fiscal_and_multip..

Economics of fascism wikipedia , lookup

Non-monetary economy wikipedia , lookup

Modern Monetary Theory wikipedia , lookup

Pensions crisis wikipedia , lookup

Transformation in economics wikipedia , lookup

Rostow's stages of growth wikipedia , lookup

Post–World War II economic expansion wikipedia , lookup

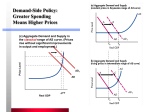

Fiscal Policy and the Multiplier Unemployment Seasonally Adjusted Monthly Unemployment Rate, from January 1984 to December 2004 Unemployment Rate (%) 10 9 8 7 6 5 4 3 2 Ja Ja Ja Ja Ja Ja Ja Ja Ja Ja Ja 0 n- 0 n- 0 n- 9 n- 9 n- 9 n- 9 n- 9 n- 8 n- 8 n- 8 n- 4 2 0 8 6 4 2 0 8 6 4 Month Economic Growth Percentage Change in Real Gross Domestic Product (1984-2004) Percentage Change 8 7 6 5 4 3 2 1 0 04 20 02 20 00 20 98 19 Year 96 19 94 19 92 19 90 19 88 19 86 19 84 19 -1 CPI and PPI Percentage Change in Consumer Price Index (Not Seasonally Adjusted, 1982-84=100) and Implicit Price Deflator (2000=100), 1984-2003 % change in CPI % change in IPD Percentage Change 6.00 5.00 4.00 3.00 2.00 1.00 0.00 02 20 00 20 98 19 96 19 94 19 92 19 90 19 88 19 86 19 84 19 Year Income Determination GDP = C + I + G + (X-M) •CONSUMPTION •INVESTMENT •GOVERNMENT •NET EXPORTS Fiscal Policy • Changes in government spending and taxes to influence the level of economic activity – Increase taxes, contract the economy – Decrease taxes, stimulate the economy – Increase government spending, stimulate the economy – Decrease government spending, contract the economy • President and Congress determine fiscal policy G or T? • Changes in G have greater impact on the economy than changes in taxes. – Government spending is direct – Taxes depend on what consumers do with the tax cut or what they would have done with the money going to pay the tax increase (how much would they consume, how much would they save?) Crowding Out • Government increases spending • Finances it by borrowing in credit market • Interest rates go up • Private investment falls • Increased government spending is offset by decreased private investment The Expenditure Multiplier • There is a change in spending • The change in spending becomes a change in income for others • Those changes in income become spending • The change in spending becomes a change in income for others • Etc. Main Points • Three macro goals – Full employment, economic growth, price stability • Discretionary fiscal policy – the use of changes in government spending and taxes to influence the level of economic activity Main Points • Expenditure multiplier – change in initial spending is multiplied to cause greater change in spending • Changes in G have greater impact than changes in T Main Points • Government deficit – spending greater than taxes per year • Government debt – accumulated deficits • Crowding out – government spending financed by private borrowing raises interest rates and crowds out private investment