Infrastructure Investment Policy Blueprint

... countries and asset classes. For the sake of brevity, the Blueprint does not elaborate on factors that are important, but not specific, to infrastructure investment. For example, while stable rule of law, economic policy and robust anti-corruption procedures are important, they are applicable to all ...

... countries and asset classes. For the sake of brevity, the Blueprint does not elaborate on factors that are important, but not specific, to infrastructure investment. For example, while stable rule of law, economic policy and robust anti-corruption procedures are important, they are applicable to all ...

World Bank Document - Open Knowledge Repository

... on Tariffs and Trade in 1986 was widely considered a key promise of the agreement (Kehoe and Kehoe 1994). By strengthening the legal status of the Mexican government’s commitment to open markets, NAFTA was expected to consolidate an investment-friendly policy environment, which would ultimately boos ...

... on Tariffs and Trade in 1986 was widely considered a key promise of the agreement (Kehoe and Kehoe 1994). By strengthening the legal status of the Mexican government’s commitment to open markets, NAFTA was expected to consolidate an investment-friendly policy environment, which would ultimately boos ...

Reliance SIP Insure

... balance amount towards the remaining unpaid SIP installments. An amount equivalent to the aggregate balance of unpaid SIP installments, subject to a maximum of Rs.10 lakhs per investor across all schemes /plans and folios will be invested in the Nominee’s account The said facility is provided in s ...

... balance amount towards the remaining unpaid SIP installments. An amount equivalent to the aggregate balance of unpaid SIP installments, subject to a maximum of Rs.10 lakhs per investor across all schemes /plans and folios will be invested in the Nominee’s account The said facility is provided in s ...

Institutional Determinants of Foreign Direct Investment

... attention by policy makers and scholars due to its economic and policy implications. FDI is an integral part of the economic development strategies of almost all countries, especially of developing and emerging markets countries. FDI is a key element of the international economic relations as it is ...

... attention by policy makers and scholars due to its economic and policy implications. FDI is an integral part of the economic development strategies of almost all countries, especially of developing and emerging markets countries. FDI is a key element of the international economic relations as it is ...

Item 1 – Cover Page - NorthCoast Asset Management

... NorthCoast also manages accounts that are part of “wrap fee” programs (where trade commissions and broker’s management fees are a flat annual rate) sponsored by brokerage firms with whom NorthCoast has selling agreements or dual contracts. NorthCoast may opt to negotiate lower fees in order to parti ...

... NorthCoast also manages accounts that are part of “wrap fee” programs (where trade commissions and broker’s management fees are a flat annual rate) sponsored by brokerage firms with whom NorthCoast has selling agreements or dual contracts. NorthCoast may opt to negotiate lower fees in order to parti ...

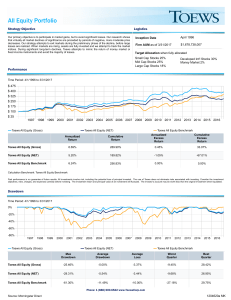

All Equity Portfolio

... additions to the account, size of the account, tax status of the account, investment instruments and custodial platforms chosen. All statistics are calculated on a quarterly basis, and all performance not provided by Morningstar has been calculated on a quarterly basis. Any third-party performance, ...

... additions to the account, size of the account, tax status of the account, investment instruments and custodial platforms chosen. All statistics are calculated on a quarterly basis, and all performance not provided by Morningstar has been calculated on a quarterly basis. Any third-party performance, ...

Shareholder Protection, Ownership Concentration and FDI

... If the foreign subsidiary is fully (100%) owned, according to International Corporate Law, it is subject to the corporate laws of parent’s home country (Bris and Cabolis, 2008). Then, strong shareholder protection at home is likely to “travel” to fully owned subsidiaries. In a sample of cross-boarde ...

... If the foreign subsidiary is fully (100%) owned, according to International Corporate Law, it is subject to the corporate laws of parent’s home country (Bris and Cabolis, 2008). Then, strong shareholder protection at home is likely to “travel” to fully owned subsidiaries. In a sample of cross-boarde ...

Chapter 30

... restriction increases net exports and increases the demand for dollars in the market for foreign-currency exchange. As a result, the dollar appreciates in value, making domestic goods more expensive relative to foreign goods. This appreciation offsets the initial impact of the trade restrictions ...

... restriction increases net exports and increases the demand for dollars in the market for foreign-currency exchange. As a result, the dollar appreciates in value, making domestic goods more expensive relative to foreign goods. This appreciation offsets the initial impact of the trade restrictions ...

liberty high yield fund

... This Product Disclosure Statement (PDS) is dated 9 May 2012. The offer to which this PDS relates is only available to persons receiving a copy (electronic or paper copy) in Australia. This offer does not constitute an offer or invitation in any place in which, or to any person to whom, it would not ...

... This Product Disclosure Statement (PDS) is dated 9 May 2012. The offer to which this PDS relates is only available to persons receiving a copy (electronic or paper copy) in Australia. This offer does not constitute an offer or invitation in any place in which, or to any person to whom, it would not ...

Ethical Investment and Portfolio Theory

... a firm’s managers may choose which to prioritize—some firms placing more emphasis than others on profit maximization. If ethical firms are prevented from operating in numerous industries, we might expect ethical investments in general to have a lower return than firms with no ethical restrictions. H ...

... a firm’s managers may choose which to prioritize—some firms placing more emphasis than others on profit maximization. If ethical firms are prevented from operating in numerous industries, we might expect ethical investments in general to have a lower return than firms with no ethical restrictions. H ...

NBER WORKING PAPER SERIES THE LIMITS OF FINANCIAL GLOBALIZATION René M. Stulz

... constituencies of the current rulers of the state and include redistributive taxes. The discretion of rulers to use the state for their own benefit creates an agency problem that I call “the agency problem of state ruler discretion.” When this agency problem is significant, corporations with profes ...

... constituencies of the current rulers of the state and include redistributive taxes. The discretion of rulers to use the state for their own benefit creates an agency problem that I call “the agency problem of state ruler discretion.” When this agency problem is significant, corporations with profes ...

Estimation of the private investment functions for the South African economy

... Public investment is a function of policy priorities of governments while the latter is influenced by different factors (Greene & Villanueva, 1991). As governments around the world are either facing recession-induced fiscal constraints or reaching the limits of fiscal and monetary stimulus packages, ...

... Public investment is a function of policy priorities of governments while the latter is influenced by different factors (Greene & Villanueva, 1991). As governments around the world are either facing recession-induced fiscal constraints or reaching the limits of fiscal and monetary stimulus packages, ...

Alpha Australian Blue Chip Fund

... distribution at 30 June may take longer. Equity Trustees may amend the distribution frequency without notice. An investor’s share of any distributable income is calculated in accordance with the Constitution and is generally based on the number of units held by the investor at the end of the distrib ...

... distribution at 30 June may take longer. Equity Trustees may amend the distribution frequency without notice. An investor’s share of any distributable income is calculated in accordance with the Constitution and is generally based on the number of units held by the investor at the end of the distrib ...

Franklin High Yield Fund

... Source: Franklin Templeton Investments (FTI), as of 31 March 2017 unless otherwise noted, based on latest available data. Total combined Assets Under Management (Total AUM) combines the U.S. and non-U.S. AUM of the investment management subsidiaries of the parent company, Franklin Resources, Inc. (F ...

... Source: Franklin Templeton Investments (FTI), as of 31 March 2017 unless otherwise noted, based on latest available data. Total combined Assets Under Management (Total AUM) combines the U.S. and non-U.S. AUM of the investment management subsidiaries of the parent company, Franklin Resources, Inc. (F ...

Appendix 9 - Managed Investments Act

... The constitution will be a trust deed for trusts and may be contractual documents for non-trust schemes. Under section 601GC, changes may only be made to the constitution of the scheme as approved by a members' special resolution or if the responsible entity is of the view that the amendment will no ...

... The constitution will be a trust deed for trusts and may be contractual documents for non-trust schemes. Under section 601GC, changes may only be made to the constitution of the scheme as approved by a members' special resolution or if the responsible entity is of the view that the amendment will no ...

Shifting the Lens – A De-Risking Toolkit for Impact Investment

... Investments can target a range of returns from below market to market rate.1 ...

... Investments can target a range of returns from below market to market rate.1 ...

FDI Spillovers, Firm Heterogeneity and Degree of Ownership

... human capital. Foreign firms typically invest considerably in the training of their workers. This acquired knowledge may spill over to local firms as employees of foreign firms change jobs or start their own company. Inter-firm mobility accelerates the spread of managing skills and production method ...

... human capital. Foreign firms typically invest considerably in the training of their workers. This acquired knowledge may spill over to local firms as employees of foreign firms change jobs or start their own company. Inter-firm mobility accelerates the spread of managing skills and production method ...

834KB - Future of Financial Advice

... Act 1982 (Cth) for a submission marked 'confidential' to be made available will be determined in accordance with that Act. While submissions may be lodged electronically or by post, electronic lodgement is preferred. For accessibility reasons, please email responses in a Word or RTF format. An addit ...

... Act 1982 (Cth) for a submission marked 'confidential' to be made available will be determined in accordance with that Act. While submissions may be lodged electronically or by post, electronic lodgement is preferred. For accessibility reasons, please email responses in a Word or RTF format. An addit ...

Mission-Related Investing at the F.B. Heron Foundation

... Heron’s total fund performance was in the second quartile of the Mellon All-Foundation Universe on both a trailing one-year and three-year basis, with 18 percent of assets in market-rate mission-related investments, 6 percent in belowmarket program-related investments (PRIs) and 3 percent in grants. ...

... Heron’s total fund performance was in the second quartile of the Mellon All-Foundation Universe on both a trailing one-year and three-year basis, with 18 percent of assets in market-rate mission-related investments, 6 percent in belowmarket program-related investments (PRIs) and 3 percent in grants. ...

Singapore`s Balance of Payments, 1965 to 2003: An Analysis

... The sharp and sustained rise in Singapore’s saving resulted in a doubling of the national saving rate from around 20% in the early 1970s to around 40% in the mid-1980s. It rose further to over 50% by 1995, and peaked at a high of 53% in 1998, before moderating somewhat in recent years. This sharp in ...

... The sharp and sustained rise in Singapore’s saving resulted in a doubling of the national saving rate from around 20% in the early 1970s to around 40% in the mid-1980s. It rose further to over 50% by 1995, and peaked at a high of 53% in 1998, before moderating somewhat in recent years. This sharp in ...

Brochure - The Brookdale Group

... Alignment of Interests To ensure that a sharp investment focus is maintained and that conflicts of interest between Brookdale and its institutional co-investors in each fund are eliminated or minimized, Brookdale has elected not to provide to its investment funds fee-based services such as property ...

... Alignment of Interests To ensure that a sharp investment focus is maintained and that conflicts of interest between Brookdale and its institutional co-investors in each fund are eliminated or minimized, Brookdale has elected not to provide to its investment funds fee-based services such as property ...

Part 3 FDIs

... products, then licensing arrangements or joint ventures may be more appropriate. Before investing in a foreign country, the potential benefits must be weighed against the costs and risks. As conditions change over time, some countries may become more attractive targets for DFI, while other countries ...

... products, then licensing arrangements or joint ventures may be more appropriate. Before investing in a foreign country, the potential benefits must be weighed against the costs and risks. As conditions change over time, some countries may become more attractive targets for DFI, while other countries ...

Does the difference in valuation between domestic and foreign

... Our hypothesis is that the allocation of domestic stocks between domestic and foreign investors is determined by their valuation difference. More precisely, a stock is held by whoever has a higher valuation for that stock. Since the estimated scaled alpha represents such a valuation averaged over ou ...

... Our hypothesis is that the allocation of domestic stocks between domestic and foreign investors is determined by their valuation difference. More precisely, a stock is held by whoever has a higher valuation for that stock. Since the estimated scaled alpha represents such a valuation averaged over ou ...

How Has NAFTA Affected the Mexican Economy?

... I. INTRODUCTION A decade ago, Canada, Mexico, and the United States launched the world’s largest free trade area under the North American Free Trade Agreement (NAFTA). The agreement represented a watershed in global trade policy, not just because of the size of the free trade area it created, but al ...

... I. INTRODUCTION A decade ago, Canada, Mexico, and the United States launched the world’s largest free trade area under the North American Free Trade Agreement (NAFTA). The agreement represented a watershed in global trade policy, not just because of the size of the free trade area it created, but al ...

City Deposits and Investments

... police department, and an account for the general fund, these accounts would be totaled together if kept at the same financial institution. If the total amount exceeded $250,000, this excess would not be covered by the FDIC. In short, putting money in separate accounts within the same bank is not a ...

... police department, and an account for the general fund, these accounts would be totaled together if kept at the same financial institution. If the total amount exceeded $250,000, this excess would not be covered by the FDIC. In short, putting money in separate accounts within the same bank is not a ...