Risk free yield curves Brian Kipps

... To avoid this, either disallow these assets from the matching premium calculation (not ideal), or strip out the bond/swap basis from the matching premium AND hold capital against the basis risk ...

... To avoid this, either disallow these assets from the matching premium calculation (not ideal), or strip out the bond/swap basis from the matching premium AND hold capital against the basis risk ...

notes - ORB - University of Essex

... • Two states and three assets A, B, C. • Arbitrage portfolio: xA , xB , xC . • AoAO → pC = 3 Example: remarks 1. Arbitrage principle generalizes law of one price to multiple assets and uncertainty 2. Almost all zero initial outlay portfolios are risky i.e. they have postive payoffs in some states an ...

... • Two states and three assets A, B, C. • Arbitrage portfolio: xA , xB , xC . • AoAO → pC = 3 Example: remarks 1. Arbitrage principle generalizes law of one price to multiple assets and uncertainty 2. Almost all zero initial outlay portfolios are risky i.e. they have postive payoffs in some states an ...

Keeping your money in the APSS

... When investing, volatility is a measure of risk that refers to the extent to which investments rise and fall in value over a specific period of time. The more the value of the asset fluctuates (goes up and down) over time, the more volatile it is considered to be. Historically the most volatile asse ...

... When investing, volatility is a measure of risk that refers to the extent to which investments rise and fall in value over a specific period of time. The more the value of the asset fluctuates (goes up and down) over time, the more volatile it is considered to be. Historically the most volatile asse ...

Small Cap Dividends: A Potential Path to

... Past performance is not indicative of future results. Current performance may be lower or higher than the performance data quoted above. For performance information current to the most recent month-end please call toll-free 855-580-0900. Performance shown before June 1, 2013 is for the Fund’s predec ...

... Past performance is not indicative of future results. Current performance may be lower or higher than the performance data quoted above. For performance information current to the most recent month-end please call toll-free 855-580-0900. Performance shown before June 1, 2013 is for the Fund’s predec ...

StochasticCalculus

... • Female achieve higher reproductive success with lower variability. Male achieve higher reproductive success with higher variability. This is why males are more divergent than females. • The regulation is achieved with the genetic structure of XX in females and XY in males. Pairing of XX makes gen ...

... • Female achieve higher reproductive success with lower variability. Male achieve higher reproductive success with higher variability. This is why males are more divergent than females. • The regulation is achieved with the genetic structure of XX in females and XY in males. Pairing of XX makes gen ...

The Effect of Credit Risk on Stock Returns

... returns of assets to a mean-variance optimization model. The key concept of the mean-variance optimization model is to build a portfolio with the same or even higher expected return against a lower volatility by eliminating idiosyncratic risk as far as possible using the diversification strategy. As ...

... returns of assets to a mean-variance optimization model. The key concept of the mean-variance optimization model is to build a portfolio with the same or even higher expected return against a lower volatility by eliminating idiosyncratic risk as far as possible using the diversification strategy. As ...

Real Options

... The time to expiration (t) is the length of time you can delay the investment. The risk-free rate (r) is typically the Treasury bill rate. The standard deviation (σ) is the riskiness of the project's return. ...

... The time to expiration (t) is the length of time you can delay the investment. The risk-free rate (r) is typically the Treasury bill rate. The standard deviation (σ) is the riskiness of the project's return. ...

the enlightenment and the financial crisis of 2008: an

... portfolio theory. It is the intellectual basis behind the proliferation of mutual funds. While investors had always instinctively diversified their asset holdings, Markowitz laid the foundation for a scientific/mathematical approach to building efficient portfolios and determining the efficient allo ...

... portfolio theory. It is the intellectual basis behind the proliferation of mutual funds. While investors had always instinctively diversified their asset holdings, Markowitz laid the foundation for a scientific/mathematical approach to building efficient portfolios and determining the efficient allo ...

Dynamic Asset Pricing With Non

... When the latter are options, which are cash assets, or futures, which are similar to cash assets, traditional results are still expected to hold. However, when the added assets are forward contracts (non cash assets), the optimal portfolio allocation and thus the stock market equilibrium are likely ...

... When the latter are options, which are cash assets, or futures, which are similar to cash assets, traditional results are still expected to hold. However, when the added assets are forward contracts (non cash assets), the optimal portfolio allocation and thus the stock market equilibrium are likely ...

Dynamic allocation strategy

... Investments Inc. and have been licensed for use by CIBC and its affiliates. ...

... Investments Inc. and have been licensed for use by CIBC and its affiliates. ...

Understanding Volatility/Standard Deviation within investment funds.

... Terms and conditions apply. Where relevant life assurance tax applies. This presentation is of a general nature and should not be relied upon without taking appropriate professional advice. The content is for information purposes only and does not constitute an offer or recommendation to invest in t ...

... Terms and conditions apply. Where relevant life assurance tax applies. This presentation is of a general nature and should not be relied upon without taking appropriate professional advice. The content is for information purposes only and does not constitute an offer or recommendation to invest in t ...

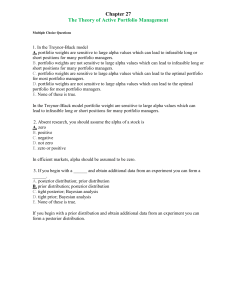

Chapter 27 The Theory of Active Portfolio Management

... 35. According to the Treynor-Black model, the weight of a security in the active portfolio depends on the ratio of __________ to __________. A. the degree of mispricing; the nonsystematic risk of the security B. the degree of mispricing; the systematic risk of the security C. the market sensitivity ...

... 35. According to the Treynor-Black model, the weight of a security in the active portfolio depends on the ratio of __________ to __________. A. the degree of mispricing; the nonsystematic risk of the security B. the degree of mispricing; the systematic risk of the security C. the market sensitivity ...

Dynamic Asset Pricing Model with Exhibition

... equity premium puzzle using a consumption-based model with external habit formation. They use a power utility and the Sharpe ratio inequality to explain the equity premium puzzle. Campbell and Cochrane (1999) use a discrete time model while I am using a continuous time model. In addition, they use t ...

... equity premium puzzle using a consumption-based model with external habit formation. They use a power utility and the Sharpe ratio inequality to explain the equity premium puzzle. Campbell and Cochrane (1999) use a discrete time model while I am using a continuous time model. In addition, they use t ...

Handout 3

... Examples of Risk that are Not Coherent • Standard Deviation – Violates monotonicity – Possible for E[X] + T×Std[X] > Max(X) ...

... Examples of Risk that are Not Coherent • Standard Deviation – Violates monotonicity – Possible for E[X] + T×Std[X] > Max(X) ...

Martingale Theory in Economics and Finance

... returns. Consequently, it is impossible to predict the future return using past returns. Bachelier (1900,1964) develops an elaborate mathematical theory of speculative prices. Roberts (1959) presents a largely heuristic argument for why successive price changes should be independent. Osborne (1959) ...

... returns. Consequently, it is impossible to predict the future return using past returns. Bachelier (1900,1964) develops an elaborate mathematical theory of speculative prices. Roberts (1959) presents a largely heuristic argument for why successive price changes should be independent. Osborne (1959) ...