fiscal policy - Doral Academy Preparatory

... 1. If the reserve requirement is 25 percent and banks hold no excess reserves, an open market sale of $400,000 of government securities by the Federal Reserve will (A) increase the money supply by up to $1.6 million (B) decrease the money supply by up to $1.6 million (C) increase the money supply b ...

... 1. If the reserve requirement is 25 percent and banks hold no excess reserves, an open market sale of $400,000 of government securities by the Federal Reserve will (A) increase the money supply by up to $1.6 million (B) decrease the money supply by up to $1.6 million (C) increase the money supply b ...

The Monetary System

... • In ancient and even 100 years ago people exchanged something other than coins or paper money. • Doctors as recently as 1900 accepted chickens, pigs and other items in exchange for medical care ...

... • In ancient and even 100 years ago people exchanged something other than coins or paper money. • Doctors as recently as 1900 accepted chickens, pigs and other items in exchange for medical care ...

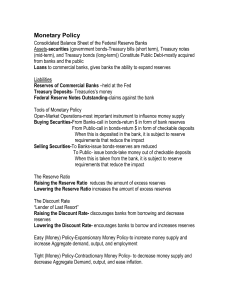

Monetary Policy

... The FOMC has recently used this rate to effect changes in monetary policy. But…the FED does not set the Federal Funds rate or prime rate. Each is established by the interaction of lenders and borrowers. The FED can change the supply of excess reserves in the banking system and so it can obtain the m ...

... The FOMC has recently used this rate to effect changes in monetary policy. But…the FED does not set the Federal Funds rate or prime rate. Each is established by the interaction of lenders and borrowers. The FED can change the supply of excess reserves in the banking system and so it can obtain the m ...

File - Critical Thinking is Required

... ▫ Result = fiat paper standard. Dollar is piece of paper with names stamped on them issued by the State. ...

... ▫ Result = fiat paper standard. Dollar is piece of paper with names stamped on them issued by the State. ...

1 SAMPLE TEST 3 QUESTIONS TRUE

... 1. To decrease the money supply, the Fed buys government securities. TRUE ...

... 1. To decrease the money supply, the Fed buys government securities. TRUE ...

CENTRAL BANKING

... QE is an unconventional monetary policy in which a central bank purchases government securities or other securities from the market in order to lower interest rates and increase the money supply. Quantitative easing increases the money supply by flooding financial institutions with capital in an eff ...

... QE is an unconventional monetary policy in which a central bank purchases government securities or other securities from the market in order to lower interest rates and increase the money supply. Quantitative easing increases the money supply by flooding financial institutions with capital in an eff ...

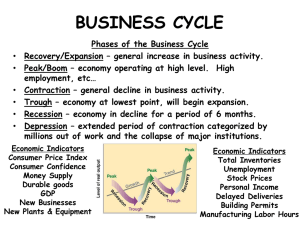

BUSINESS CYCLE, FEDERAL RESERVE, TAXATION

... rising. Inflation is a natural occurrence, but high rates of inflation can cause a decline in business activity. • Inflation is caused by an increase in the money supply. Money in circulation, or being spent. RECESSION • During a period of recession, consumers are not spending money, thus business p ...

... rising. Inflation is a natural occurrence, but high rates of inflation can cause a decline in business activity. • Inflation is caused by an increase in the money supply. Money in circulation, or being spent. RECESSION • During a period of recession, consumers are not spending money, thus business p ...

Multiple Choice: Circle the answer the best completes each question

... a. One commercial bank charges another b. Is charged on credit car balances c. The banks charge their customers d. The Fed charges commercial banks 16. Which of the following is included under M1? a. Cash b. Saving accounts c. Money market accounts d. Large time deposits 17. What term describes the ...

... a. One commercial bank charges another b. Is charged on credit car balances c. The banks charge their customers d. The Fed charges commercial banks 16. Which of the following is included under M1? a. Cash b. Saving accounts c. Money market accounts d. Large time deposits 17. What term describes the ...

Chapter 2 Money and the Payments System

... • Instructions to the bank to take funds from your account and transfer those funds to the person or firm whose name is written in the “Pay to the Order of” line. ...

... • Instructions to the bank to take funds from your account and transfer those funds to the person or firm whose name is written in the “Pay to the Order of” line. ...

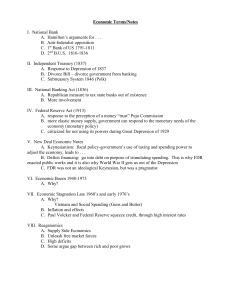

Economic Terms/Notes

... A. Republican measure to tax state banks out of existence B. More involvement IV. Federal Reserve Act (1913) A. response to the perception of a money “trust” Pujo Commission B. more elastic money supply, government can respond to the monetary needs of the economy (monetary policy) C. criticized for ...

... A. Republican measure to tax state banks out of existence B. More involvement IV. Federal Reserve Act (1913) A. response to the perception of a money “trust” Pujo Commission B. more elastic money supply, government can respond to the monetary needs of the economy (monetary policy) C. criticized for ...