Fiscal and Monetary Policy PowerPoint

... Discount rate – prime rate which banks borrow money from the FED Reserve Requirements – Percentage of deposits that banks must hold Open Market Operations – buying and selling of ...

... Discount rate – prime rate which banks borrow money from the FED Reserve Requirements – Percentage of deposits that banks must hold Open Market Operations – buying and selling of ...

Money, Banking and Monetary Policy

... the money supply. M1 – currency, checkable deposits M2 – Near money (savings, small time deposits, MMMF) Federal Reserve Notes are token money (fiat) Checkable deposits are large component Currency held by the FED, thrift, banks are excluded ...

... the money supply. M1 – currency, checkable deposits M2 – Near money (savings, small time deposits, MMMF) Federal Reserve Notes are token money (fiat) Checkable deposits are large component Currency held by the FED, thrift, banks are excluded ...

monetary reform

... Fair distribution of wealth/assets provided by nature or by society as a whole (e.g. unearned income), within and between generations; Fair return to labor and earned assets ...

... Fair distribution of wealth/assets provided by nature or by society as a whole (e.g. unearned income), within and between generations; Fair return to labor and earned assets ...

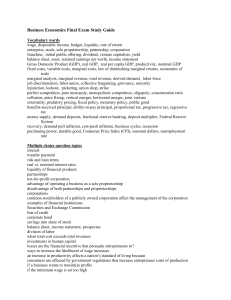

Business Economics Final Exam Study Guide Vocabulary words

... effort made by the United States government to ensure fair competition in the marketplace services regulated and/or operated with help from the government likely result when the U.S. government borrows money to increase its spending progressive, proportional, regressive taxes effects of inflation on ...

... effort made by the United States government to ensure fair competition in the marketplace services regulated and/or operated with help from the government likely result when the U.S. government borrows money to increase its spending progressive, proportional, regressive taxes effects of inflation on ...

MCF Outline 4

... Since FX rates are the prices of one money for another, these “money models” of the economy are applied to different countries to predict and explain future movements in FX rates. ...

... Since FX rates are the prices of one money for another, these “money models” of the economy are applied to different countries to predict and explain future movements in FX rates. ...

POLS 306

... "check." (That's how the money is created.) The sellers deposit those checks into their banks. The banks redeploy those deposits as loans to consumers and business. The money supply expands and, in turn, so does the economy. Otherwise known as … http://www.dallasnews.com/business/columnists/cheryl ...

... "check." (That's how the money is created.) The sellers deposit those checks into their banks. The banks redeploy those deposits as loans to consumers and business. The money supply expands and, in turn, so does the economy. Otherwise known as … http://www.dallasnews.com/business/columnists/cheryl ...

review sheet

... Limitations: people may hold currency and not redeposit it, banks may not lend out all of their excess reserves. -- Monetary Policy – When the Fed alters the money supply (MS) for the purpose of stabilizing aggregate output (GDP) employment and the price level. -- 3 major Monetary Policy Tools 1. Op ...

... Limitations: people may hold currency and not redeposit it, banks may not lend out all of their excess reserves. -- Monetary Policy – When the Fed alters the money supply (MS) for the purpose of stabilizing aggregate output (GDP) employment and the price level. -- 3 major Monetary Policy Tools 1. Op ...

Review Questions Chapter 16

... Practice Questions – Chapters 16,17,18,19 Chapter 16 1. What are the three functions of money? What is the difference between commodity money and fiat money? What are demand deposits? 2. What is the Fed? What are reserves? Define fractional-reserve banking and reserve ratio. Define money multiplier, ...

... Practice Questions – Chapters 16,17,18,19 Chapter 16 1. What are the three functions of money? What is the difference between commodity money and fiat money? What are demand deposits? 2. What is the Fed? What are reserves? Define fractional-reserve banking and reserve ratio. Define money multiplier, ...

Monetary and Fiscal Policy

... but it does serve as an indicator to private bankers of the intentions of the Fed to constrict or enlarge the money supply. The monetary policy is a good way to influence the money Supply, but it does have its weaknesses. One weakness is that tight money policy works better that lose money policy. ...

... but it does serve as an indicator to private bankers of the intentions of the Fed to constrict or enlarge the money supply. The monetary policy is a good way to influence the money Supply, but it does have its weaknesses. One weakness is that tight money policy works better that lose money policy. ...

And the second half begins

... Federal Gov’t • They have lots of jobs • REGULATE THE BUSINESS CYCLE • Been that ways since Depression • 2 different ways to do it ...

... Federal Gov’t • They have lots of jobs • REGULATE THE BUSINESS CYCLE • Been that ways since Depression • 2 different ways to do it ...