the Money Supply?

... • Unit of account • Goods are valued in dollars • Store of value • A place to store wealth. ...

... • Unit of account • Goods are valued in dollars • Store of value • A place to store wealth. ...

Comparative Static Analysis of the Keynesian Model

... Simple IS-LM, Continued Applying Cramer’s rule for solution: ...

... Simple IS-LM, Continued Applying Cramer’s rule for solution: ...

SUGGESTED ANSWE RS NOV 2012 PAP ER INTRODUCTION TO

... sort of cost on trade that raises the price of the traded products (c) Expansionary fiscal policy: refers to an increase in govt purchases of goods and services; a decrease in net taxes or some combination of the two for purposes of increasing aggregate demand and expanding real output. Expansionary ...

... sort of cost on trade that raises the price of the traded products (c) Expansionary fiscal policy: refers to an increase in govt purchases of goods and services; a decrease in net taxes or some combination of the two for purposes of increasing aggregate demand and expanding real output. Expansionary ...

Term Explanation

... A period in which individuals/businesses are financially successful and thriving ...

... A period in which individuals/businesses are financially successful and thriving ...

Advanced Placement Annual Conference, 2011 San Francisco, CA

... (b) Suppose that the Federal Reserve purchases $5,000 worth of bonds from Sewell Bank. What will be the change in the dollar value of each of the following immediately after the purchase? (i) Excess reserves. $5,000 (ii) Demand deposit (c) Calculate the maximum amount that the money supply can chang ...

... (b) Suppose that the Federal Reserve purchases $5,000 worth of bonds from Sewell Bank. What will be the change in the dollar value of each of the following immediately after the purchase? (i) Excess reserves. $5,000 (ii) Demand deposit (c) Calculate the maximum amount that the money supply can chang ...

Economics - Spring Branch ISD

... 80. President Andrew Jackson was one of the most ardent supporters of the Bank of the United States. 81. In the late 1970s and 1980s, Congress passed laws to deregulate several industries, one of which was the banking industry. 82. Simple interest is interest paid on a loan principal and accumulated ...

... 80. President Andrew Jackson was one of the most ardent supporters of the Bank of the United States. 81. In the late 1970s and 1980s, Congress passed laws to deregulate several industries, one of which was the banking industry. 82. Simple interest is interest paid on a loan principal and accumulated ...

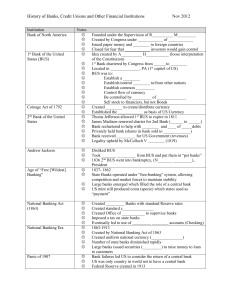

Institution

... Privately held bank (shares in bank sold to _____________) Bank received _________ for US Government (revenues) Legality upheld by McCulloch V ________ (1819) Disliked BUS Took _______ _________ from BUS and put them in “pet banks” 1836 2nd BUS went into bankruptcy, (N_______ _________), President ...

... Privately held bank (shares in bank sold to _____________) Bank received _________ for US Government (revenues) Legality upheld by McCulloch V ________ (1819) Disliked BUS Took _______ _________ from BUS and put them in “pet banks” 1836 2nd BUS went into bankruptcy, (N_______ _________), President ...

LC Economics Syllabus

... What is economics about? Introducing Supply and Demand. Introducing factors of production. How to assess an economy. A brief history of economics in the last 100 years. ...

... What is economics about? Introducing Supply and Demand. Introducing factors of production. How to assess an economy. A brief history of economics in the last 100 years. ...

Determinants of Interest Rates

... Interest Rate and the Money Supply • Liquidity effect: Ms up lowers interest rates But Ms up also increases output and prices • Income effect: Ms up increased output increased demand for money interest rate up • Price-Level effect: Ms up increased price level increased demand for money ...

... Interest Rate and the Money Supply • Liquidity effect: Ms up lowers interest rates But Ms up also increases output and prices • Income effect: Ms up increased output increased demand for money interest rate up • Price-Level effect: Ms up increased price level increased demand for money ...

Money, What it was & what it has become

... all the currency and credit needed to satisfy the spending power of the government and the buying power of the consumers. The privilege of creating and issuing money is not only the supreme prerogative of government, but it is the government's greatest creative opportunity. By the adoption of these ...

... all the currency and credit needed to satisfy the spending power of the government and the buying power of the consumers. The privilege of creating and issuing money is not only the supreme prerogative of government, but it is the government's greatest creative opportunity. By the adoption of these ...

Section 2

... banks to hold more money in reserves – This would cause the money supply to contract, or shrink – Although changing reserve requirements can be an effective means of changing the money supply, the Fed does not use this tool often because it is disruptive to the banking system ...

... banks to hold more money in reserves – This would cause the money supply to contract, or shrink – Although changing reserve requirements can be an effective means of changing the money supply, the Fed does not use this tool often because it is disruptive to the banking system ...

- Unique Writers Bay

... Differences between the federal reserve and the Bank of Canada. Bank of Canada is accountable to the minister of finance( governmental policy control) while the federal reserve system is accountable to no one (no governmental policy control) • The federal reserve operates on its own (on private bas ...

... Differences between the federal reserve and the Bank of Canada. Bank of Canada is accountable to the minister of finance( governmental policy control) while the federal reserve system is accountable to no one (no governmental policy control) • The federal reserve operates on its own (on private bas ...

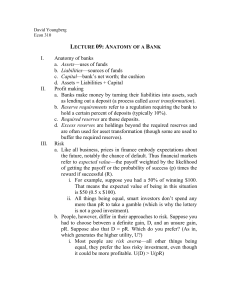

AP Macroeconomics Review sheet 1. The transactions demand for

... 9. Assume that the required reserve ratio for the commercial banks is 10 percent. If the Federal Reserve Banks buy $10 billion in government securities from commercial banks we can say that, as a result of this transaction, the lending ability of the commercial banking system will increase by $100 b ...

... 9. Assume that the required reserve ratio for the commercial banks is 10 percent. If the Federal Reserve Banks buy $10 billion in government securities from commercial banks we can say that, as a result of this transaction, the lending ability of the commercial banking system will increase by $100 b ...

money_increases

... lowers real wages. The lag in expectations of price increases in the labor market expands the system beyond full employment and GDP is above potential GDP. ...

... lowers real wages. The lag in expectations of price increases in the labor market expands the system beyond full employment and GDP is above potential GDP. ...

Course contents - East West University

... o Economy in the long run: economic performance and economic growth, production function and national income distribution among factors, implication of factor’s share. o Business Cycle: relationship between GDP growth, inflation and unemployment, sources of the economic growth, convergence in the ec ...

... o Economy in the long run: economic performance and economic growth, production function and national income distribution among factors, implication of factor’s share. o Business Cycle: relationship between GDP growth, inflation and unemployment, sources of the economic growth, convergence in the ec ...