Quiz 1

... market instruments have an original maturity of less than one year. Examples are: T-bills, Commercial paper, Large CDs, etc. Capital market instruments have an original maturity of more than one year. Examples are: Corporate bonds, municipal bonds, stocks. ...

... market instruments have an original maturity of less than one year. Examples are: T-bills, Commercial paper, Large CDs, etc. Capital market instruments have an original maturity of more than one year. Examples are: Corporate bonds, municipal bonds, stocks. ...

increasing interest rates

... time period. Additionally, I will provide you with some clarity on how policies that are intended to impact one indicator can and will impact other indicators as well. A demand side approach is intended to impact aggregate demand and therefore impact price levels, spending, GDP, and employment Examp ...

... time period. Additionally, I will provide you with some clarity on how policies that are intended to impact one indicator can and will impact other indicators as well. A demand side approach is intended to impact aggregate demand and therefore impact price levels, spending, GDP, and employment Examp ...

Financial Maths Questions File

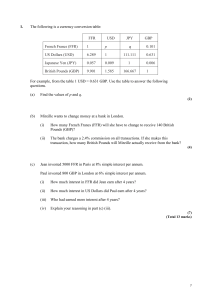

... The total deductions after 20 months is $1540 and after 30 months it is $2140. (d) ...

... The total deductions after 20 months is $1540 and after 30 months it is $2140. (d) ...

the optimal path of monetary expansion

... percentage of its resources for interest-free lending. The central bank can supplement such resources from its CD earnings. Some would make funds available for interest free lending for religious reasons, encouraged by stable prices. Central bank can issue central lending certificates, CLC's, ...

... percentage of its resources for interest-free lending. The central bank can supplement such resources from its CD earnings. Some would make funds available for interest free lending for religious reasons, encouraged by stable prices. Central bank can issue central lending certificates, CLC's, ...

Full class notes

... C. Elasticity and Total Revenue 1) Total Revenue = Price x Quantity(sold) 2) If demand is inelastic and price increases, total revenue will increase 3) If demand is elastic and price increases, total revenue will decrease ...

... C. Elasticity and Total Revenue 1) Total Revenue = Price x Quantity(sold) 2) If demand is inelastic and price increases, total revenue will increase 3) If demand is elastic and price increases, total revenue will decrease ...

Interest Rates & Inflation

... – There are short term & long term interest rates • Low interest rates are critical for a healthy economy (GDP) – As interest rates ↑ => cost of borrowing money ↑ => Investment (I) ↓ ...

... – There are short term & long term interest rates • Low interest rates are critical for a healthy economy (GDP) – As interest rates ↑ => cost of borrowing money ↑ => Investment (I) ↓ ...

Free - 2010 Macro FRQ Click Here

... 1. (d) [2 pts] In order to finance the increase in government spending on national defense from part (b), the government borrows funds from the public. Using a correctly labeled graph of the loanable funds market, show the effect of the government’s borrowing on the real interest rate. (e) [2 pts] G ...

... 1. (d) [2 pts] In order to finance the increase in government spending on national defense from part (b), the government borrows funds from the public. Using a correctly labeled graph of the loanable funds market, show the effect of the government’s borrowing on the real interest rate. (e) [2 pts] G ...

Macroeconomics

... policy analysis. It covers a wide range of macroeconomic topics, including GDP calculations and structures, consumption and savings, investments and net export, government purchases and budget deficit, inflation and unemployment, monetary system and policy, macroeconomic equilibriums, etc. skills ...

... policy analysis. It covers a wide range of macroeconomic topics, including GDP calculations and structures, consumption and savings, investments and net export, government purchases and budget deficit, inflation and unemployment, monetary system and policy, macroeconomic equilibriums, etc. skills ...

Chapter 15

... Fiduciary Monetary System A system in which currency is issued by the government and its value rests on the public’s confidence that it can be exchanged for goods and services The Latin fiducia means “trust” or “confidence.” ...

... Fiduciary Monetary System A system in which currency is issued by the government and its value rests on the public’s confidence that it can be exchanged for goods and services The Latin fiducia means “trust” or “confidence.” ...

... each consistent with bubbles that drove prices above their fundamentals and that then crashed. Researchers studying asset price bubbles often associate them with periods when investors appear willing to accept lower compensation for holding risk, with the crash then occurring once investors become m ...

MACROECONOMIC STUDY REVIEW SHEET Bond prices move in

... 69. Savings, Taxes and Imports are considered _____________ while Investments, Government Purchases, Transfer Payments and Exports are considered ______________. 70. ___________ ____________ are not included in GDP because they do not represent a 2-sided transaction (i.e. – there is not an exchange ...

... 69. Savings, Taxes and Imports are considered _____________ while Investments, Government Purchases, Transfer Payments and Exports are considered ______________. 70. ___________ ____________ are not included in GDP because they do not represent a 2-sided transaction (i.e. – there is not an exchange ...