Midterm #2

... equation says (after some calculus has been applied to it) that inflation will be equal to zero if: a. the rate of money growth is equal to the real interest rate. b. the rate of money growth is equal to the elasticity of money demand with respect to real income. c. the rate of money growth is equal ...

... equation says (after some calculus has been applied to it) that inflation will be equal to zero if: a. the rate of money growth is equal to the real interest rate. b. the rate of money growth is equal to the elasticity of money demand with respect to real income. c. the rate of money growth is equal ...

Chapter 17 ppoint

... called for a monetary policy rule as opposed to discretionary monetary policy, and which argued—based on a belief that the velocity of money was stable—that GDP would grow steadily if the money supply grew steadily, was influential for a time but was eventually rejected by many macroeconomists. 4. T ...

... called for a monetary policy rule as opposed to discretionary monetary policy, and which argued—based on a belief that the velocity of money was stable—that GDP would grow steadily if the money supply grew steadily, was influential for a time but was eventually rejected by many macroeconomists. 4. T ...

The Political Business Cycle

... called for a monetary policy rule as opposed to discretionary monetary policy, and which argued—based on a belief that the velocity of money was stable—that GDP would grow steadily if the money supply grew steadily, was influential for a time but was eventually rejected by many macroeconomists. 4. T ...

... called for a monetary policy rule as opposed to discretionary monetary policy, and which argued—based on a belief that the velocity of money was stable—that GDP would grow steadily if the money supply grew steadily, was influential for a time but was eventually rejected by many macroeconomists. 4. T ...

The Economic Outlook and Monetary Policy

... Francisco. No audio recording, video recording, or photography is permitted without the permission of the presenter. presenter This presentation may not be reproduced in any form without the express, written permission of the presenter. ...

... Francisco. No audio recording, video recording, or photography is permitted without the permission of the presenter. presenter This presentation may not be reproduced in any form without the express, written permission of the presenter. ...

NBER WORKING PAPER SERIES MONETARY AND FISCAL POLICIES IN AN OPEN ECONOMY

... reducing imports relative to exports [see Mussa (1974)]. ...

... reducing imports relative to exports [see Mussa (1974)]. ...

Bullard (2011) - Federal Reserve Bank of St. Louis

... Balance sheet policy is ordinary monetary policy How should stabilization policy be conducted once shortterm nominal interest rates are effectively zero? The answer is that the central bank should pursue a balance sheet policy which substitutes for movements in short-term interest rates. The purcha ...

... Balance sheet policy is ordinary monetary policy How should stabilization policy be conducted once shortterm nominal interest rates are effectively zero? The answer is that the central bank should pursue a balance sheet policy which substitutes for movements in short-term interest rates. The purcha ...

Final Exam

... b. Compare the effects of these events on the sales of two firms in Hong Kong. Firm A is a real estate developer which builds residential housing. Firm B is a company that makes watches for sale at the best department stores across the world. Which type of firm is likely to experience the strongest ...

... b. Compare the effects of these events on the sales of two firms in Hong Kong. Firm A is a real estate developer which builds residential housing. Firm B is a company that makes watches for sale at the best department stores across the world. Which type of firm is likely to experience the strongest ...

Simple Notes Explaining Intuition Behind the Paper

... Liquidity management is recognized as one of the fundamental problems in banking in practice. These lecture notes explain how monetary policy is implemented by central banks through the liquidity management of banks. To clarify the ideas, consider the balance sheet of a bank depicted in the left pan ...

... Liquidity management is recognized as one of the fundamental problems in banking in practice. These lecture notes explain how monetary policy is implemented by central banks through the liquidity management of banks. To clarify the ideas, consider the balance sheet of a bank depicted in the left pan ...

Marketing Mobile Money: Top 3 Challenges

... they want mobile money to be a product for everyone Mobile money platforms / services are ultimately accessible by “anyone” But demonstrating one specific use case of mobile money for one specific target market has proven to be the most compelling marketing ...

... they want mobile money to be a product for everyone Mobile money platforms / services are ultimately accessible by “anyone” But demonstrating one specific use case of mobile money for one specific target market has proven to be the most compelling marketing ...

Effects of Monetary and Fiscal Policy Power Point

... – The money supply is controlled by the Fed through: • Open-market operations • Changing the reserve requirements • Changing the discount rate ...

... – The money supply is controlled by the Fed through: • Open-market operations • Changing the reserve requirements • Changing the discount rate ...

2010_Macro_FRQ_ans

... (i) On your graph in part (a), show how the government action affects AD. (ii) How will this government action affect the unemployment rate in the short run? Explain. Answer: 1. (b) (i) As can be seen on the graph, the increase in G would increase AD to AD2, increasing PL and Y. 1. (b) (II) The incr ...

... (i) On your graph in part (a), show how the government action affects AD. (ii) How will this government action affect the unemployment rate in the short run? Explain. Answer: 1. (b) (i) As can be seen on the graph, the increase in G would increase AD to AD2, increasing PL and Y. 1. (b) (II) The incr ...

2010 FRQ

... (i) On your graph in part (a), show how the government action affects AD. (ii) How will this government action affect the unemployment rate in the short run? Explain. Answer: 1. (b) (i) As can be seen on the graph, the increase in G would increase AD to AD2, increasing PL and Y. 1. (b) (II) The incr ...

... (i) On your graph in part (a), show how the government action affects AD. (ii) How will this government action affect the unemployment rate in the short run? Explain. Answer: 1. (b) (i) As can be seen on the graph, the increase in G would increase AD to AD2, increasing PL and Y. 1. (b) (II) The incr ...

14.02 Principles of Macroeconomics Fall 2005 Quiz 2

... and that in each period the real interest rate decreases by the same percentage points by which the real money growth rate increases, and vice versa. The dynamics of the real money growth are as you derived in part 2). Compare the value of the stock Q0 in the old equilibrium and after the change in ...

... and that in each period the real interest rate decreases by the same percentage points by which the real money growth rate increases, and vice versa. The dynamics of the real money growth are as you derived in part 2). Compare the value of the stock Q0 in the old equilibrium and after the change in ...

The importance of inflation expectations

... important, since it allows the sustainable anchoring of economic agents’ expectations. As a direct consequence, their decisions and behaviour will rely to an increasing extent on the information supplied by the central bank, especially if it pursues a transparent communication with the public. Infla ...

... important, since it allows the sustainable anchoring of economic agents’ expectations. As a direct consequence, their decisions and behaviour will rely to an increasing extent on the information supplied by the central bank, especially if it pursues a transparent communication with the public. Infla ...

Macro_online_chapter_09_14e

... An increase in the price level increases profits so firms are willing to make more goods ...

... An increase in the price level increases profits so firms are willing to make more goods ...

Answers to Self Test Questions

... c) Interest rate equals 8% and GDP equals $400. Given the money demand shown in Figure 8.18A, if the money supply is set at $100, then the equilibrium rate must be 8%. If the interest rate is 8%, then Figure 8.18B shows that investment spending will be $80. If the product market is in equilibrium, t ...

... c) Interest rate equals 8% and GDP equals $400. Given the money demand shown in Figure 8.18A, if the money supply is set at $100, then the equilibrium rate must be 8%. If the interest rate is 8%, then Figure 8.18B shows that investment spending will be $80. If the product market is in equilibrium, t ...

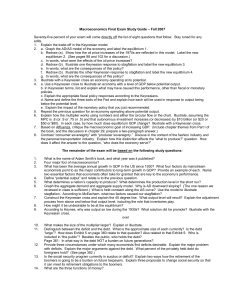

Macroeconomics Final Exam Study Guide – Fall 2007

... What is the name of Adam Smith’s book, and what year was it published? Four major foci of macroeconomics? What has been the average annual growth in GDP in the US since 1930? What four factors do mainstream economists point to as the major contributors to long-term growth in GDP? Provide an example ...

... What is the name of Adam Smith’s book, and what year was it published? Four major foci of macroeconomics? What has been the average annual growth in GDP in the US since 1930? What four factors do mainstream economists point to as the major contributors to long-term growth in GDP? Provide an example ...