“Keep It Simple

... sluggish demand/economy (think of Bernanke today) will lower rates. This is a very sensitive game, however. If expansionary monetary policies create too much money supply, there is always a risk if inflation. And then the dual headache of a sluggish economy and higher prices (i.e. stagflation). Som ...

... sluggish demand/economy (think of Bernanke today) will lower rates. This is a very sensitive game, however. If expansionary monetary policies create too much money supply, there is always a risk if inflation. And then the dual headache of a sluggish economy and higher prices (i.e. stagflation). Som ...

Monetary policy, economic growth and prosperity

... a product of its time and did not reflect the perspectives that later established themselves. In the early 1990s the then Minister of Commerce appointed a committee to review the Central Bank Act, chaired by Professor Ágúst Einarsson, the current Dean of the Faculty of Economics and Business Adminis ...

... a product of its time and did not reflect the perspectives that later established themselves. In the early 1990s the then Minister of Commerce appointed a committee to review the Central Bank Act, chaired by Professor Ágúst Einarsson, the current Dean of the Faculty of Economics and Business Adminis ...

The Influence of Monetary and Fiscal Policy on Aggregate Demand

... Fiscal policy influences saving, investment, and growth in the long run. In the short run, fiscal policy primarily affects the aggregate demand. Pengantar Ekonpomi 2 ...

... Fiscal policy influences saving, investment, and growth in the long run. In the short run, fiscal policy primarily affects the aggregate demand. Pengantar Ekonpomi 2 ...

Money

... • 2. Because very few people have enough money to pay for a house in full, they have to finance it with a home mortgage loan (long term property loan) These are normally 30 year loans • 3. To buy a house also requires a down payment, which is usually 20 percent of the purchase price of the property ...

... • 2. Because very few people have enough money to pay for a house in full, they have to finance it with a home mortgage loan (long term property loan) These are normally 30 year loans • 3. To buy a house also requires a down payment, which is usually 20 percent of the purchase price of the property ...

exchange rate forecasts

... struggle to come up with anything nice to say about the Brazilian economy: Inflation is stubbornly stuck at the top of the central bank’s 2.5-6.5 percent target range, real GDP contracted in the first half of 2014, and business sentiment is worse in mid-2014 than at the trough of the global recessio ...

... struggle to come up with anything nice to say about the Brazilian economy: Inflation is stubbornly stuck at the top of the central bank’s 2.5-6.5 percent target range, real GDP contracted in the first half of 2014, and business sentiment is worse in mid-2014 than at the trough of the global recessio ...

Chapter 16—Gaining from International Trade

... a. currency only b. currency, demand deposits, other checkable deposits, and traveler’s checks c. M1 plus large denomination time deposits ...

... a. currency only b. currency, demand deposits, other checkable deposits, and traveler’s checks c. M1 plus large denomination time deposits ...

What`s the one personal finance book that had the biggest impact in

... Dave Ramsey's The Total Money Makeover. It was the very first personal finance book that I read. Knowing what I know now I see that some of his stuff is crazy and radical - mostly the stuff about cash. At its core it's all stuff that completely makes sense - spend less than you earn, debt is dumb, g ...

... Dave Ramsey's The Total Money Makeover. It was the very first personal finance book that I read. Knowing what I know now I see that some of his stuff is crazy and radical - mostly the stuff about cash. At its core it's all stuff that completely makes sense - spend less than you earn, debt is dumb, g ...

The Influence of Monetary and Fiscal Policy

... • A higher interest rate reduces investment spending. • This reduction in demand that results when a fiscal expansion raises the interest rate is called the crowding-out effect. • The crowding-out effect tends to dampen the effects of fiscal policy on aggregate demand. ...

... • A higher interest rate reduces investment spending. • This reduction in demand that results when a fiscal expansion raises the interest rate is called the crowding-out effect. • The crowding-out effect tends to dampen the effects of fiscal policy on aggregate demand. ...

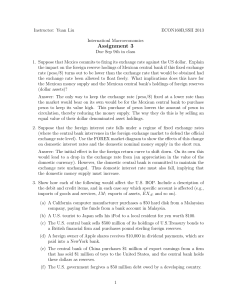

academic honesty

... Class attendance is not mandatory, but the course is designed such that students who choose not to attend the lectures will be at a disadvantage. There will be two mid-term exams, one final exam, and an unspecified number (ranging from 4 to 6) of quizzes. There will be no homework assignments. You a ...

... Class attendance is not mandatory, but the course is designed such that students who choose not to attend the lectures will be at a disadvantage. There will be two mid-term exams, one final exam, and an unspecified number (ranging from 4 to 6) of quizzes. There will be no homework assignments. You a ...

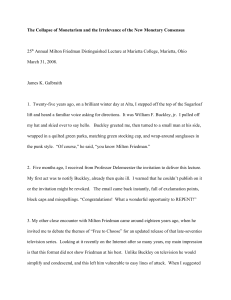

Roots of Capitalist Stability and Instability

... that changes in the economy’s inflation rate as well as, more generally, the econ omy’s swings between overheating and recession, are all due to changes in the growth rate of the economy’s money supply. Central banks, in turn, control the growth rate of the money supply. As such, monetarism postula ...

... that changes in the economy’s inflation rate as well as, more generally, the econ omy’s swings between overheating and recession, are all due to changes in the growth rate of the economy’s money supply. Central banks, in turn, control the growth rate of the money supply. As such, monetarism postula ...

CHAPTER OVERVIEW

... Monetary Policy in Action A. Strengths of monetary policy. 1. It is speedier and more flexible than fiscal policy since the Fed can buy and sell securities daily. 2. It is less political. Fed Board members are isolated from political pressure, since they serve 14-year terms, and policy changes are s ...

... Monetary Policy in Action A. Strengths of monetary policy. 1. It is speedier and more flexible than fiscal policy since the Fed can buy and sell securities daily. 2. It is less political. Fed Board members are isolated from political pressure, since they serve 14-year terms, and policy changes are s ...

Financing Government - Kenston Local Schools

... lower taxes, NOT greater spending, provides the best route to a stronger economy • Based on the assumption that tax cuts increase the supply of money in private hands & thus stimulate the economy Reaganomics Explained 2007: Economic Recession in the United States • Bush followed by Obama enacted a s ...

... lower taxes, NOT greater spending, provides the best route to a stronger economy • Based on the assumption that tax cuts increase the supply of money in private hands & thus stimulate the economy Reaganomics Explained 2007: Economic Recession in the United States • Bush followed by Obama enacted a s ...