2.6 An Alternative to Moral Principles: Virtue Ethics

... paid a penalty of$100 million for illegally profiting from insider information. According to court records, Boesky paid David Levine, a friend who worked inside a firm that arranged mergers and acquisitions, to provide him with information about companies that were about to be purchased by another p ...

... paid a penalty of$100 million for illegally profiting from insider information. According to court records, Boesky paid David Levine, a friend who worked inside a firm that arranged mergers and acquisitions, to provide him with information about companies that were about to be purchased by another p ...

an analysis of investor`s confidence and risk taking aptitude from the

... Reley and Chow contended (1992) that “relative risk decreases with age- but only up to a point. After the age of 65 (retirement), risk aversion increases with age. Greenwood & Nagel (2006) found that younger investors were more likely than older investors to buy stocks at the peak of the Internet bu ...

... Reley and Chow contended (1992) that “relative risk decreases with age- but only up to a point. After the age of 65 (retirement), risk aversion increases with age. Greenwood & Nagel (2006) found that younger investors were more likely than older investors to buy stocks at the peak of the Internet bu ...

Defensive or offensive?

... so VBS funds can ‘fade’ the move even before it has begun. As such, it is no surprise that volatility-based strategies are very good at protecting against sudden unexpected moves in markets, while managed futures tend to give investors participation in trends – and where that is a bear trend in equi ...

... so VBS funds can ‘fade’ the move even before it has begun. As such, it is no surprise that volatility-based strategies are very good at protecting against sudden unexpected moves in markets, while managed futures tend to give investors participation in trends – and where that is a bear trend in equi ...

Derivatives and Risk Management

... a. A derivative is an indirect claim security that derives its value, in whole or in part, by the market price (or interest rate) of some other security (or market). Derivatives include options, interest rate futures, exchange rate futures, commodity futures, and swaps. b. According to COSO, enterpr ...

... a. A derivative is an indirect claim security that derives its value, in whole or in part, by the market price (or interest rate) of some other security (or market). Derivatives include options, interest rate futures, exchange rate futures, commodity futures, and swaps. b. According to COSO, enterpr ...

adjusting to falling commodity prices

... penny making negotiations difficult because the policy can only provide so much. ...

... penny making negotiations difficult because the policy can only provide so much. ...

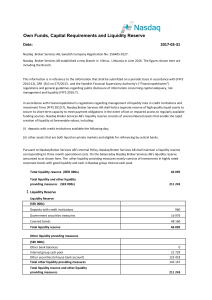

Own Funds, Capital Requirements and Liquidity Reserve

... 2014:12), CRR (EU) no 575/2013, and the Swedish Financial Supervisory Authority’s (“Finansinspektionen”) regulations and general guidelines regarding public disclosure of information concerning capital adequacy, risk management and liquidity (FFFS 2010:7). In accordance with Finansinspektionen's reg ...

... 2014:12), CRR (EU) no 575/2013, and the Swedish Financial Supervisory Authority’s (“Finansinspektionen”) regulations and general guidelines regarding public disclosure of information concerning capital adequacy, risk management and liquidity (FFFS 2010:7). In accordance with Finansinspektionen's reg ...

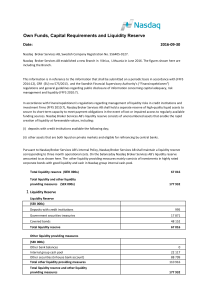

Own Funds, Capital Requirements and Liquidity Reserve

... 2014:12), CRR (EU) no 575/2013, and the Swedish Financial Supervisory Authority’s (“Finansinspektionen”) regulations and general guidelines regarding public disclosure of information concerning capital adequacy, risk management and liquidity (FFFS 2010:7). In accordance with Finansinspektionen's reg ...

... 2014:12), CRR (EU) no 575/2013, and the Swedish Financial Supervisory Authority’s (“Finansinspektionen”) regulations and general guidelines regarding public disclosure of information concerning capital adequacy, risk management and liquidity (FFFS 2010:7). In accordance with Finansinspektionen's reg ...

Systemic risk in European Economies: Deciphering Leading

... systemic risk first, which in its turn raises unemployment and suppresses industrial production growth • For the whole sample the EPU index leads systemic risk, which in its turn increases unemployment rate (pooled BVAR IRF estimates below) ...

... systemic risk first, which in its turn raises unemployment and suppresses industrial production growth • For the whole sample the EPU index leads systemic risk, which in its turn increases unemployment rate (pooled BVAR IRF estimates below) ...

Contractual Obligations

... the direction in which ratings are likely to move over the next 18-24 months, on the U.S. life insurance sector as Stable. The current Stable rating reflects Fitch’s view that the impact of the negative fundamentals indicated in their Sector Outlook remain manageable in the context of industry earni ...

... the direction in which ratings are likely to move over the next 18-24 months, on the U.S. life insurance sector as Stable. The current Stable rating reflects Fitch’s view that the impact of the negative fundamentals indicated in their Sector Outlook remain manageable in the context of industry earni ...

Ch1

... • Thrift’s major asset: a portfolio of long-term mortgage loans • Thrift’s main liability: deposits • “Originate to hold” ...

... • Thrift’s major asset: a portfolio of long-term mortgage loans • Thrift’s main liability: deposits • “Originate to hold” ...

The Investment Environment

... • Thrift’s major asset: a portfolio of long-term mortgage loans • Thrift’s main liability: deposits • “Originate to hold” ...

... • Thrift’s major asset: a portfolio of long-term mortgage loans • Thrift’s main liability: deposits • “Originate to hold” ...

a guide to investing

... all the assets in a fund falling in value at the same time, so there is less chance of investors losing their money. ...

... all the assets in a fund falling in value at the same time, so there is less chance of investors losing their money. ...

GSE`s: The Denouement

... The above commentary has been created by the Rates Strategy Group of Banc of America Securities LLC (BAS) for informational purposes only and is not a product of the BAS or Merrill Lynch, Pierce, Fenner & Smith (ML) Research Department. Any opinions expressed in this commentary are those of the auth ...

... The above commentary has been created by the Rates Strategy Group of Banc of America Securities LLC (BAS) for informational purposes only and is not a product of the BAS or Merrill Lynch, Pierce, Fenner & Smith (ML) Research Department. Any opinions expressed in this commentary are those of the auth ...

here - Reverse Market Insight

... More closely matches the cost of funds for global investors Very popular for secondary mortgage market investors – makes LIBORindexed mortgage backed securities more liquid (easier to sell) Greater liquidity means lenders can offer lower margins to borrowers ...

... More closely matches the cost of funds for global investors Very popular for secondary mortgage market investors – makes LIBORindexed mortgage backed securities more liquid (easier to sell) Greater liquidity means lenders can offer lower margins to borrowers ...

Protection against major catastrophes: an economic

... This paper intends to further understanding of catastrophic events by reviewing the economic literature on their effects as well as potential means of dealing with the corresponding risks and uncertainties. Since 2000, the world has seen a number of catastrophes including terrorist attacks in the Un ...

... This paper intends to further understanding of catastrophic events by reviewing the economic literature on their effects as well as potential means of dealing with the corresponding risks and uncertainties. Since 2000, the world has seen a number of catastrophes including terrorist attacks in the Un ...

Chapter 7

... Allows marginal buyer to acquire real estate Buyer gets immediate possession Buyer receives full legal title after loan paid off Seller must follow statutory notice requirements if buyer defaults All parties should consult their attorney Vendee may receive poor title. Vendor may have problems during ...

... Allows marginal buyer to acquire real estate Buyer gets immediate possession Buyer receives full legal title after loan paid off Seller must follow statutory notice requirements if buyer defaults All parties should consult their attorney Vendee may receive poor title. Vendor may have problems during ...

THE CFO`S 10-STEP GUIDE TO SLEEPING

... promise and over deliver. Failure to adequately prepare can result in misses from two sources. The first is finance and management not being on the same page regarding an investor relations communication philosophy. Entrepreneurs are born with aggressive DNA and this is one area where this trait can ...

... promise and over deliver. Failure to adequately prepare can result in misses from two sources. The first is finance and management not being on the same page regarding an investor relations communication philosophy. Entrepreneurs are born with aggressive DNA and this is one area where this trait can ...

The Ethics of Rebating and Replacement

... customers or clients in lieu of competent, certified, legal advice. The parties involved in the development of this course shall not be liable for any inappropriate use of this information beyond the purpose stated above. As a student, you should understand that it is your responsibility to adhere t ...

... customers or clients in lieu of competent, certified, legal advice. The parties involved in the development of this course shall not be liable for any inappropriate use of this information beyond the purpose stated above. As a student, you should understand that it is your responsibility to adhere t ...

Changing Times for Financial Institutions Chapter 1

... Basel I Issues Basel I does take into account ...

... Basel I Issues Basel I does take into account ...

Systemic Risk and the Financial Crisis: A Primer

... Systemic Risk and the Financial Crisis: A Primer James Bullard, Christopher J. Neely, and David C. Wheelock How did problems in a relatively small portion of the home mortgage market trigger the most severe financial crisis in the United States since the Great Depression? Several developments played ...

... Systemic Risk and the Financial Crisis: A Primer James Bullard, Christopher J. Neely, and David C. Wheelock How did problems in a relatively small portion of the home mortgage market trigger the most severe financial crisis in the United States since the Great Depression? Several developments played ...

questions in real estate finance

... Any mortgage prepayments are passed to bondholders thus there is no sinking fund This means that the CMO issuer faces no interest rate or reinvestment risk Yield is higher on longer tranches ...

... Any mortgage prepayments are passed to bondholders thus there is no sinking fund This means that the CMO issuer faces no interest rate or reinvestment risk Yield is higher on longer tranches ...

Hazardous Substances - Master Electricians

... 2 = Unlikely = The risk could occur at some time but there is confidence that it will not. ...

... 2 = Unlikely = The risk could occur at some time but there is confidence that it will not. ...

Residential Mortgage Lending - PowerPoint

... Savings of individuals make up an insignificant part of the funds required by the financial market. Mortgage lending is part of the capital market. As a general rule, financial intermediaries can earn higher yields on investments than individuals can. Money market certificates (MMCs) have increased ...

... Savings of individuals make up an insignificant part of the funds required by the financial market. Mortgage lending is part of the capital market. As a general rule, financial intermediaries can earn higher yields on investments than individuals can. Money market certificates (MMCs) have increased ...

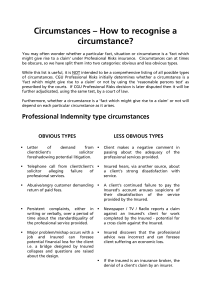

Circumstances – How to recognise a circumstance

... Telephone call from a shareholder / shareholder's solicitor alleging breach of duty or some other failure by Insured. ...

... Telephone call from a shareholder / shareholder's solicitor alleging breach of duty or some other failure by Insured. ...

Stock Insurance Companies Versus Mutual Insurance

... fit many individuals’ needs with the use of dividends and the availability of optional riders.3 Whole life may be appropriate for a person interested in building wealth, leaving a guaranteed inheritance for the next generation or both. ...

... fit many individuals’ needs with the use of dividends and the availability of optional riders.3 Whole life may be appropriate for a person interested in building wealth, leaving a guaranteed inheritance for the next generation or both. ...