The Federal Home Loan Bank System: The

... a hostile takeover. Federally guaranteed firms, by contrast, do not benefit from this market discipline, through which outsiders’ concerns about such errors of omission can be expressed. If the federal guaranty is considered sufficiently strong, bond claimants may not bother to examine the firm’s in ...

... a hostile takeover. Federally guaranteed firms, by contrast, do not benefit from this market discipline, through which outsiders’ concerns about such errors of omission can be expressed. If the federal guaranty is considered sufficiently strong, bond claimants may not bother to examine the firm’s in ...

Chapter 2

... same expected return for less risk, or if the security has a higher expected return than another security of comparable risk. Equivalent assets should sell for the same price. This is known as the law of one price. ...

... same expected return for less risk, or if the security has a higher expected return than another security of comparable risk. Equivalent assets should sell for the same price. This is known as the law of one price. ...

The Impact of Financial Markets on Economic Stability and

... financial markets to place their money in various investments that have very little substance — such as subprime-mortgage-backed securities. What makes these investments attractive is sophisticated packaging and the relatively high rate of return (creative financing methods). Once economic condition ...

... financial markets to place their money in various investments that have very little substance — such as subprime-mortgage-backed securities. What makes these investments attractive is sophisticated packaging and the relatively high rate of return (creative financing methods). Once economic condition ...

The Impact of Financial Markets on Economic Stability and Growth

... financial markets to place their money in various investments that have very little substance — such as subprime-mortgage-backed securities. What makes these investments attractive is sophisticated packaging and the relatively high rate of return (creative financing methods). Once economic condition ...

... financial markets to place their money in various investments that have very little substance — such as subprime-mortgage-backed securities. What makes these investments attractive is sophisticated packaging and the relatively high rate of return (creative financing methods). Once economic condition ...

Summary of the EU`s new risk retention rules as they relate to

... CLO collateral managers are not credit institutions, this cash collateralisation requirement will apply to them should they wish to provide the retention synthetically. ...

... CLO collateral managers are not credit institutions, this cash collateralisation requirement will apply to them should they wish to provide the retention synthetically. ...

Extreme Value Theory in Finance

... and is based on a POT-method, where possible dependence is taken into account. In such models, provided they are stationary, the POT-method presented by (1)-(3) in Section 2 has to be modified to account for possible clustering in the extremes. The point process of (2) can, by dependence, become a m ...

... and is based on a POT-method, where possible dependence is taken into account. In such models, provided they are stationary, the POT-method presented by (1)-(3) in Section 2 has to be modified to account for possible clustering in the extremes. The point process of (2) can, by dependence, become a m ...

Mortgage-Related Securities

... What are adjustable rate mortgage (ARM) pass-throughs? ARMs are mortgages with coupons that adjust periodically based on the terms of the mortgage and the applicable value of a specified index. They first originated in the 1970s. The typically lower initial rates (called teaser rates) of ARMs compa ...

... What are adjustable rate mortgage (ARM) pass-throughs? ARMs are mortgages with coupons that adjust periodically based on the terms of the mortgage and the applicable value of a specified index. They first originated in the 1970s. The typically lower initial rates (called teaser rates) of ARMs compa ...

Incorporating Strategy Risk of Active Managers into Portfolio Risk and Optimization

... “tracking error”, which describes the expectation of times-series standard deviation of benchmark relative returns. This is useful for index fund management, where the expectation of the mean for benchmark relative return is fixed at zero. The active management case is problematic, as tracking error ...

... “tracking error”, which describes the expectation of times-series standard deviation of benchmark relative returns. This is useful for index fund management, where the expectation of the mean for benchmark relative return is fixed at zero. The active management case is problematic, as tracking error ...

Financial literacy - Fairfield Public Schools

... Research rights and responsibilities of consumers according to credit legislation (e.g. truth-in-lending, fair credit reporting, equal credit opportunity, and fair debt collection) Content Standard 8 – Protecting against risk by using appropriate risk management strategies ...

... Research rights and responsibilities of consumers according to credit legislation (e.g. truth-in-lending, fair credit reporting, equal credit opportunity, and fair debt collection) Content Standard 8 – Protecting against risk by using appropriate risk management strategies ...

Insurance Liabilities - International Actuarial Association

... typically involves both uncertainty and a long time horizon. The expertise of an actuary includes the assessment of the relatively complicated expected values of these liabilities, incorporating the various risks and embedded options involved. The following discussion represents an actuarial perspec ...

... typically involves both uncertainty and a long time horizon. The expertise of an actuary includes the assessment of the relatively complicated expected values of these liabilities, incorporating the various risks and embedded options involved. The following discussion represents an actuarial perspec ...

ABA Response to FDIC NPR on Risk

... the earlier proposal, where any growth would raise assessments. However, we believe that, even with a ten percent threshold, an asset growth factor would yield false measurements of risk exposure in a number of common scenarios. For examples, relatively rapid short-term asset growth would not raise ...

... the earlier proposal, where any growth would raise assessments. However, we believe that, even with a ten percent threshold, an asset growth factor would yield false measurements of risk exposure in a number of common scenarios. For examples, relatively rapid short-term asset growth would not raise ...

Building an Effective Stress Testing Process

... • Success is determined by an institution’s ability to evaluate and invest in risk • Model risk should be scrutinized ...

... • Success is determined by an institution’s ability to evaluate and invest in risk • Model risk should be scrutinized ...

collque coface 2004 partie I VA

... of public sector especially after EU Directives Increasing pressure from NGOs on ECAs ...

... of public sector especially after EU Directives Increasing pressure from NGOs on ECAs ...

proposal seminar bisnis dan keuangan

... Although financial institutions among Asian countries, especially Indonesia, have been dominated by commercial banks and insurance market share is only 10 percent of the financial market, the insurance industry is an important partner for the banking industry. The industry’s function is guaranteeing ...

... Although financial institutions among Asian countries, especially Indonesia, have been dominated by commercial banks and insurance market share is only 10 percent of the financial market, the insurance industry is an important partner for the banking industry. The industry’s function is guaranteeing ...

How to assess a manager recovery skill - ORBi

... Before the financial crisis, several authors had observed that investors of the mutual fund industry, when choosing among funds, responded to returns ignoring differences in risk (Harless and Peterson [1998]; Berkowitz and Kotowitz [2000]). Yet, the latest financial crisis has left investors wary o ...

... Before the financial crisis, several authors had observed that investors of the mutual fund industry, when choosing among funds, responded to returns ignoring differences in risk (Harless and Peterson [1998]; Berkowitz and Kotowitz [2000]). Yet, the latest financial crisis has left investors wary o ...

Climate change risks

... We asked managers to explain how they manage climate change related risks in their portfolios. In response, managers advised that they utilise a range of techniques, including requiring a higher return to compensate for risk, portfolio risk management strategies and avoidance of most at risk assets. ...

... We asked managers to explain how they manage climate change related risks in their portfolios. In response, managers advised that they utilise a range of techniques, including requiring a higher return to compensate for risk, portfolio risk management strategies and avoidance of most at risk assets. ...

The benefits of growth with lower volatility

... Multi-asset, lower-volatility growth portfolios often include a range of investments that are difficult for other portfolios to access. For instance, among these might be relative value strategies across both equities and interest rates. Positions like these rely on traditional assets but, by taking ...

... Multi-asset, lower-volatility growth portfolios often include a range of investments that are difficult for other portfolios to access. For instance, among these might be relative value strategies across both equities and interest rates. Positions like these rely on traditional assets but, by taking ...

Principles Underlying Asset Liability Management

... Risk is the exposure to an uncertain event or outcome that has a financial impact to which the entity is not indifferent. For insurance and other financial institutions, risk is inherent in doing business. Risk captures the possibility of positive and negative deviations from an expected outcome. Fi ...

... Risk is the exposure to an uncertain event or outcome that has a financial impact to which the entity is not indifferent. For insurance and other financial institutions, risk is inherent in doing business. Risk captures the possibility of positive and negative deviations from an expected outcome. Fi ...

Bulletin Reserve Bank of New Zealand The insurance sector and

... risks (IAIS, 2013). The New Zealand insurance market has the necessary scale and diversity required in large part due to a significant overseas presence, operating either directly as owners of primary insurers, or indirectly ...

... risks (IAIS, 2013). The New Zealand insurance market has the necessary scale and diversity required in large part due to a significant overseas presence, operating either directly as owners of primary insurers, or indirectly ...

Active Equity Risk - University of California Regents

... E.g., a .01 standard deviation increase* in exposure to the Momentum (style) risk factor will cause portfolio risk to decrease by 0.0012% or .12 bp *Calculation assumes that an increase (decrease) in asset weights resulting in increase (decrease) in factor exposure is offset by a decrease (incre ...

... E.g., a .01 standard deviation increase* in exposure to the Momentum (style) risk factor will cause portfolio risk to decrease by 0.0012% or .12 bp *Calculation assumes that an increase (decrease) in asset weights resulting in increase (decrease) in factor exposure is offset by a decrease (incre ...

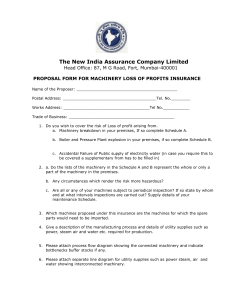

The New India Assurance Company Limited

... 12. a. What are your normal working hours? Are there regular night shifts? b. How many shifts per day? c. Working days per year? d. Can extra shifts be worked to make up production loss? 13. If business is “seasonal” indicate the period of high and low output or turnover and indicate the degree of f ...

... 12. a. What are your normal working hours? Are there regular night shifts? b. How many shifts per day? c. Working days per year? d. Can extra shifts be worked to make up production loss? 13. If business is “seasonal” indicate the period of high and low output or turnover and indicate the degree of f ...

Will crowdfunding contribute to financial development in developing

... Against this background, it has been claimed that crowdfunding might offer the chance to bypass banks and other financial institutions as key providers of funds in developing and emerging countries (World Bank 2013). The claim is largely backed by the argument that in many developing countries finan ...

... Against this background, it has been claimed that crowdfunding might offer the chance to bypass banks and other financial institutions as key providers of funds in developing and emerging countries (World Bank 2013). The claim is largely backed by the argument that in many developing countries finan ...

Indicators and metrics used in enterprise risk management

... metrics, will be possible to form a comprehensive picture of the interdependencies that form between the feedback processes that takes place in the enterprise and can generate different types of risks. Decisions will be monitored by the indicators calculated in the system and will be able to be eval ...

... metrics, will be possible to form a comprehensive picture of the interdependencies that form between the feedback processes that takes place in the enterprise and can generate different types of risks. Decisions will be monitored by the indicators calculated in the system and will be able to be eval ...

magna retirement savings plans stable value fund

... Guarantees for the GFC portion are based upon the claims-paying ability of the issuing insurance company. Insurance products from the Principal Financial Group® are issued by Principal National Life Insurance Company (except in New York) and Principal Life Insurance Company. Plan administrative serv ...

... Guarantees for the GFC portion are based upon the claims-paying ability of the issuing insurance company. Insurance products from the Principal Financial Group® are issued by Principal National Life Insurance Company (except in New York) and Principal Life Insurance Company. Plan administrative serv ...

Risk and Return

... The reward-to-risk ratio is the expected return per "unit" of systematic risk, or, in other words, the ratio of the risk premium and the amount of systematic risk. Since systematic risk is all that matters in determining expected return, the reward-to-risk ratio must be the same for all assets a ...

... The reward-to-risk ratio is the expected return per "unit" of systematic risk, or, in other words, the ratio of the risk premium and the amount of systematic risk. Since systematic risk is all that matters in determining expected return, the reward-to-risk ratio must be the same for all assets a ...