the three stages of raising money

... on any salvageable assets. These deal structures put further pressure on management to create a successful company. The initial investment, or first round of financing, is typically for a relatively small amount, often in the range of $2-$3 million, to get the enterprise started. VCs don’t like to ...

... on any salvageable assets. These deal structures put further pressure on management to create a successful company. The initial investment, or first round of financing, is typically for a relatively small amount, often in the range of $2-$3 million, to get the enterprise started. VCs don’t like to ...

finding value in bonds. - The Institute of Financial Planning

... market are over-crowded while other parts are deserted. Buying and selling bonds in any great quantities is difficult, but for reasonably-sized funds with flexible mandates the problem is manageable. To be successful in this environment it helps to have a flexible approach that can benefit from a br ...

... market are over-crowded while other parts are deserted. Buying and selling bonds in any great quantities is difficult, but for reasonably-sized funds with flexible mandates the problem is manageable. To be successful in this environment it helps to have a flexible approach that can benefit from a br ...

Option Pricing Theory and Applications

... Unutilized assets: If you have assets or property that are not being utilized (vacant land, for example), you have not valued it yet. You can assess a market value for these assets and add them on to the value of the firm. Overfunded pension plans: If you have a defined benefit plan and your assets ...

... Unutilized assets: If you have assets or property that are not being utilized (vacant land, for example), you have not valued it yet. You can assess a market value for these assets and add them on to the value of the firm. Overfunded pension plans: If you have a defined benefit plan and your assets ...

Gerry Co - JustAnswer

... MG Lighting had sales of 1,000 units at $100 per unit last year. The marketing manager projects a 10 percent decrease in unit volume this year because a 20 percent price increase is needed to pass rising costs through to customers. Returned merchandise will represent 2 percent of total sales. What i ...

... MG Lighting had sales of 1,000 units at $100 per unit last year. The marketing manager projects a 10 percent decrease in unit volume this year because a 20 percent price increase is needed to pass rising costs through to customers. Returned merchandise will represent 2 percent of total sales. What i ...

Practice Midterm

... in an initial public offering (IPO) or is acquired by another firm. (d) The high returns for venture capital are justified by the high risks; many investments are either complete failures or return negative or no profits. A few big winners are required to justify the risks for investors. (e) Profits ...

... in an initial public offering (IPO) or is acquired by another firm. (d) The high returns for venture capital are justified by the high risks; many investments are either complete failures or return negative or no profits. A few big winners are required to justify the risks for investors. (e) Profits ...

Examples of CIPM Principles Exam Questions

... Expressed as a percentage of total firm assets, the size of the large cap equity composite is closest to: A. 18.5%. B. 24.7%. C. 25.4%. 13. The Brook Corporation writes a letter informing its equity manager, Caribou Asset Management, that the prohibition against using derivative securities has been ...

... Expressed as a percentage of total firm assets, the size of the large cap equity composite is closest to: A. 18.5%. B. 24.7%. C. 25.4%. 13. The Brook Corporation writes a letter informing its equity manager, Caribou Asset Management, that the prohibition against using derivative securities has been ...

Finance 419

... Can also be determined using the current interest rates applicable to bonds of companies with comparable financial structure and bond ratings. ...

... Can also be determined using the current interest rates applicable to bonds of companies with comparable financial structure and bond ratings. ...

Strong Demand for Muni Bonds Yields Pros, Cons

... a complete analysis of the subjects discussed. Any past results provided do not predict or indicate future performance, which may be negative. No part of this material may be reproduced in any form, or referred to in any other publication, without express written permission of AMCO/IMCO and USAA. Di ...

... a complete analysis of the subjects discussed. Any past results provided do not predict or indicate future performance, which may be negative. No part of this material may be reproduced in any form, or referred to in any other publication, without express written permission of AMCO/IMCO and USAA. Di ...

the peloton position - Peloton Wealth Strategists

... assuaged financial markets with its official unveiling of QE2 — short for Quantitative Easing, Round II. Due to the unsatisfying pace of the economic recovery and the persistence of an embarrassingly high unemployment rate, policy intervention had become a foregone conclusion. This round of QE was b ...

... assuaged financial markets with its official unveiling of QE2 — short for Quantitative Easing, Round II. Due to the unsatisfying pace of the economic recovery and the persistence of an embarrassingly high unemployment rate, policy intervention had become a foregone conclusion. This round of QE was b ...

Money, Banking, and Financial Markets (Econ 353): Section 1

... 3. Suppose you buy a bond with Face Value of $2000, annual coupon rate 10% payable annually, with a term to maturity of 2 years. Its yield to maturity is 3.86%. a. What is its selling price? (6 points) b. Exactly one year later, nominal interest rates rise to 16%. If your holding period is 1 year i. ...

... 3. Suppose you buy a bond with Face Value of $2000, annual coupon rate 10% payable annually, with a term to maturity of 2 years. Its yield to maturity is 3.86%. a. What is its selling price? (6 points) b. Exactly one year later, nominal interest rates rise to 16%. If your holding period is 1 year i. ...

Review Questions and Answers for Chapter 1

... (a) a way of summarizing information about the manufacturing costs of a company. (b) a way of summarizing information about the sensitivity of bond prices to changes in credit rating. (c) a way of summarizing information about the sensitivity of bond prices to changes in the bond's yield to maturity ...

... (a) a way of summarizing information about the manufacturing costs of a company. (b) a way of summarizing information about the sensitivity of bond prices to changes in credit rating. (c) a way of summarizing information about the sensitivity of bond prices to changes in the bond's yield to maturity ...

CHAPTER 1 : THE INVESTMENT ENVIRONMENT

... far more difficult time raising capital pay for new projects. The inability to use public financial assets would make financing more difficult (costly), thereby increasing the cost of capital to a business. A higher cost of capital results in less investment and slower real growth. 5. Firms raise ca ...

... far more difficult time raising capital pay for new projects. The inability to use public financial assets would make financing more difficult (costly), thereby increasing the cost of capital to a business. A higher cost of capital results in less investment and slower real growth. 5. Firms raise ca ...

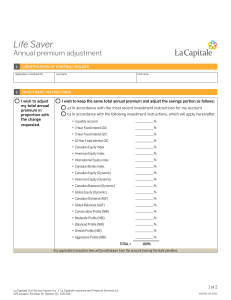

IND001E Life Saver - Annual Premium Adjustment

... generated by these accounts are tied to the performance of a market index or underlying fund, less any applicable management fees. The value of the market index or underlying fund fluctuates depending on the market value of the securities that make up the index or fund. The value of these accounts m ...

... generated by these accounts are tied to the performance of a market index or underlying fund, less any applicable management fees. The value of the market index or underlying fund fluctuates depending on the market value of the securities that make up the index or fund. The value of these accounts m ...

THE EXTRAORDINARY DIVIDEND

... downloads page or from our registered office. If you have a financial adviser, you should seek their advice before investing. Woodford Investment Management Ltd is not authorised to provide investment advice. ...

... downloads page or from our registered office. If you have a financial adviser, you should seek their advice before investing. Woodford Investment Management Ltd is not authorised to provide investment advice. ...

Schroder USD Bond Fund

... information contained herein is not misleading, but no representation as to its accuracy or completeness. Prospective unit holder is advised not to rely solely on the information in this document. Losses that might arise will not be covered. From time to time, PT SIMI, its affiliated companies (if a ...

... information contained herein is not misleading, but no representation as to its accuracy or completeness. Prospective unit holder is advised not to rely solely on the information in this document. Losses that might arise will not be covered. From time to time, PT SIMI, its affiliated companies (if a ...

Brokerage Firms - JCR-VIS

... In January 2016, the KSE, Islamabad Stock Exchange and Lahore Stock Exchange were integrated into PSX. By enhancing the efficiency of capital markets, the integration is expected to support overall development of the brokerage sector. Given that all participants would trade through one exchange, liq ...

... In January 2016, the KSE, Islamabad Stock Exchange and Lahore Stock Exchange were integrated into PSX. By enhancing the efficiency of capital markets, the integration is expected to support overall development of the brokerage sector. Given that all participants would trade through one exchange, liq ...

5 - Blackwell Publishing

... Liquidation value is the projected price that a firm would receive by selling its assets if it were going out of business. Book value is the value of an asset as carried on a balance sheet. Market value is the price at which buyers and sellers trade similar items in an open market place. Int ...

... Liquidation value is the projected price that a firm would receive by selling its assets if it were going out of business. Book value is the value of an asset as carried on a balance sheet. Market value is the price at which buyers and sellers trade similar items in an open market place. Int ...

Outlook on Global Equity Income

... historical norms. Valuation focused strategies have struggled during this period of artificially low rates but the market rotation during the second half of 2016 showed how violently markets can shift on any sign that the current sluggish, low rate environment could end. Valuation focused strategies ...

... historical norms. Valuation focused strategies have struggled during this period of artificially low rates but the market rotation during the second half of 2016 showed how violently markets can shift on any sign that the current sluggish, low rate environment could end. Valuation focused strategies ...