Figure 3

... specifies that the seller, who has the short position, will deliver some quantity of a commodity or financial instrument to the buyer, who has the long position, on a specific date, called settlement or delivery date, for a predetermined price. No payments are made initially when the contract is agr ...

... specifies that the seller, who has the short position, will deliver some quantity of a commodity or financial instrument to the buyer, who has the long position, on a specific date, called settlement or delivery date, for a predetermined price. No payments are made initially when the contract is agr ...

Capital Budgeting - University of North Florida

... Cash Flows with Capital Budgeting Decisions Types of cash flows present in all capital budgeting decisions Operating cash flows Occur every year as net inflows (hopefully) Inflation and other budgeting issues may cause differences in amounts each year ...

... Cash Flows with Capital Budgeting Decisions Types of cash flows present in all capital budgeting decisions Operating cash flows Occur every year as net inflows (hopefully) Inflation and other budgeting issues may cause differences in amounts each year ...

Understanding Derivative – Beyond Accounting Presented By Safwat Khalid

... rates, in the shape of the yield curve or in any other interest rate relationship. Such changes usually affect securities inversely and can be reduced by diversifying (investing in fixed-income securities with different durations) or hedging (e.g. through an interest rate swap). • Interest rate risk ...

... rates, in the shape of the yield curve or in any other interest rate relationship. Such changes usually affect securities inversely and can be reduced by diversifying (investing in fixed-income securities with different durations) or hedging (e.g. through an interest rate swap). • Interest rate risk ...

B233note

... 1- All investors will choose to hold the market portfolio 2- The market portfolio will be on the efficient frontier. A passive strategy is efficient. The mutual fund theorem implies that only one mutual fund of risky assets is sufficient to satisfy investor’s demands. 3- The risk premium of the mark ...

... 1- All investors will choose to hold the market portfolio 2- The market portfolio will be on the efficient frontier. A passive strategy is efficient. The mutual fund theorem implies that only one mutual fund of risky assets is sufficient to satisfy investor’s demands. 3- The risk premium of the mark ...

Highlights of Chapters 19, 16, 33, and 25

... Low (or zero) tax bracket investors are attracted to high dividend paying stocks. ...

... Low (or zero) tax bracket investors are attracted to high dividend paying stocks. ...

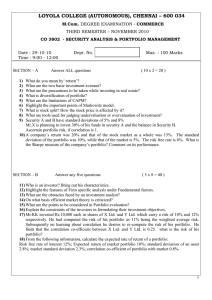

LOYOLA COLLEGE (AUTONOMOUS), CHENNAI – 600 034

... 12) Highlight the features of Firm specific analysis under Fundamental factors. 13) What are the obstacles faced by an investment analyst? 14) On what basis efficient market theory is criticized? 15) What are the points to be considered in Portfolio evaluation? 16) Explain the constraints of the inv ...

... 12) Highlight the features of Firm specific analysis under Fundamental factors. 13) What are the obstacles faced by an investment analyst? 14) On what basis efficient market theory is criticized? 15) What are the points to be considered in Portfolio evaluation? 16) Explain the constraints of the inv ...

November 2015 Update - Goodwin Securities, Inc.

... with our recent 1.5% growth in the third Quarter. The poor Federal Reserve has threatened us with higher rates for several years now and last September was the “for real” date; but, they have backed off, again. This economy is driving them mad: just enough growth to muddle along, but never enough sp ...

... with our recent 1.5% growth in the third Quarter. The poor Federal Reserve has threatened us with higher rates for several years now and last September was the “for real” date; but, they have backed off, again. This economy is driving them mad: just enough growth to muddle along, but never enough sp ...

Markets, Firms, Investors

... – Practice of issuing marketable securities backed by non-marketable loans, such as mortgage and asset backed loans Lecture I: Markets, Firms & Investors ...

... – Practice of issuing marketable securities backed by non-marketable loans, such as mortgage and asset backed loans Lecture I: Markets, Firms & Investors ...

presentation

... One single national brand International presence to take advantage of fiscal benefits for customers ...

... One single national brand International presence to take advantage of fiscal benefits for customers ...

Study on Financial Market Segmentation in China: Evidence from Stock Market

... H-shares is only one of the many choices for international investors, and the holders of H-shares will face a certain degree of inventory risk and adverse selection risk, its liquidity is weak. So the investors holding H-shares will require an additional compensation earnings for the weak liquidity, ...

... H-shares is only one of the many choices for international investors, and the holders of H-shares will face a certain degree of inventory risk and adverse selection risk, its liquidity is weak. So the investors holding H-shares will require an additional compensation earnings for the weak liquidity, ...

Chapter 8 - McGraw Hill Higher Education

... • Stocks, also known as common stock or equity, are shares in a firm’s ownership. • Stocks first appeared in the 16th century as a way to finance voyages of explorers. • The idea was to spread the risk through joint-stock companies, organizations that issued stock and used the proceeds to finance se ...

... • Stocks, also known as common stock or equity, are shares in a firm’s ownership. • Stocks first appeared in the 16th century as a way to finance voyages of explorers. • The idea was to spread the risk through joint-stock companies, organizations that issued stock and used the proceeds to finance se ...

Chapter 01 - Investments: Background and Issues Chapter 01

... primary offering, and thus improves the terms on which firms can raise money in the equity market. 21. Treasury bills serve a purpose for investors who prefer a low-risk investment. The lower average rate of return compared to stocks is the price investors pay for predictability of investment perfor ...

... primary offering, and thus improves the terms on which firms can raise money in the equity market. 21. Treasury bills serve a purpose for investors who prefer a low-risk investment. The lower average rate of return compared to stocks is the price investors pay for predictability of investment perfor ...

Marketline Nov 13 - Cascade Investment Advisors

... the inevitable crash? On the one hand we like this question because it means that there’s still a lot of pessimism out there – including some of our own! Pessimism means there’s still buying power in the market and stocks can still go up. On the other hand, the question of protection is odd, because ...

... the inevitable crash? On the one hand we like this question because it means that there’s still a lot of pessimism out there – including some of our own! Pessimism means there’s still buying power in the market and stocks can still go up. On the other hand, the question of protection is odd, because ...

Lazard US Equity Value Portfolio

... The performance quoted represents past performance. Past performance does not guarantee future results. The current performance may be lower or higher than the performance data quoted. An investor may obtain performance data current to the most recent month-end online at www.LazardNet.com. The inves ...

... The performance quoted represents past performance. Past performance does not guarantee future results. The current performance may be lower or higher than the performance data quoted. An investor may obtain performance data current to the most recent month-end online at www.LazardNet.com. The inves ...

Shopping Centre Finance

... Synthetic leases are designed under current accounting rules to achieve off-balance sheet treatment. When structured as intended, neither the asset nor the liability appear on the lessee’s balance sheet and lease payments are classified as operating expenses. Return on assets (ROA), return on equity ...

... Synthetic leases are designed under current accounting rules to achieve off-balance sheet treatment. When structured as intended, neither the asset nor the liability appear on the lessee’s balance sheet and lease payments are classified as operating expenses. Return on assets (ROA), return on equity ...

Personal Finance 1200 Fall 2010 Exam #1

... 25. (p. 82) Current liabilities are amounts that must be paid within a short period of time, usually less than a year. TRUE 26. (p. 83) A personal cash flow statement presents income and outflows of cash for a given time period, such as a month. TRUE 27. (p. 84-85) Medical expenses, clothing, and te ...

... 25. (p. 82) Current liabilities are amounts that must be paid within a short period of time, usually less than a year. TRUE 26. (p. 83) A personal cash flow statement presents income and outflows of cash for a given time period, such as a month. TRUE 27. (p. 84-85) Medical expenses, clothing, and te ...

Inv Club 04_09_10 - Sites at Lafayette

... LOW Plumbing/Electrical/Kitchen: 32% of net sales Hardware/Seasonal: 15% of net sales Building Materials/Lumber/Millwork: 20% of net sales Paint/Flooring: 14% of net sales Home Care: 18% of net sales ...

... LOW Plumbing/Electrical/Kitchen: 32% of net sales Hardware/Seasonal: 15% of net sales Building Materials/Lumber/Millwork: 20% of net sales Paint/Flooring: 14% of net sales Home Care: 18% of net sales ...