Investment Grade Debt Offerings

... Documentation: Documentation for an investment grade note offering consists primarily of a registration statement (if the issuer does not yet have one on file), an offering document (either a prospectus supplement or a 144A offering memorandum), an underwriting agreement, an indenture, an accoun ...

... Documentation: Documentation for an investment grade note offering consists primarily of a registration statement (if the issuer does not yet have one on file), an offering document (either a prospectus supplement or a 144A offering memorandum), an underwriting agreement, an indenture, an accoun ...

Investments in high-growth gold and silver mining companies

... mining sector. The fund targets a balanced diversification in terms of the size, stage of development and geo-political exposure of our holdings. It therefore maintains about 50 constituents on an on-going basis. The most heavily-weighted position (approximately 50%) comprises producing mines. About ...

... mining sector. The fund targets a balanced diversification in terms of the size, stage of development and geo-political exposure of our holdings. It therefore maintains about 50 constituents on an on-going basis. The most heavily-weighted position (approximately 50%) comprises producing mines. About ...

Download attachment

... Al-Tawfeek Company for Investment Funds Ltd. is a recognized leader in the creation and development of Islamic investment funds designed to meet the needs of the rapidly growing Islamic banking and investment consumer base. Al-Tawfeek has played a crucial role in establishing recognized standards fo ...

... Al-Tawfeek Company for Investment Funds Ltd. is a recognized leader in the creation and development of Islamic investment funds designed to meet the needs of the rapidly growing Islamic banking and investment consumer base. Al-Tawfeek has played a crucial role in establishing recognized standards fo ...

Nordea`s strategic direction

... correct. Accordingly, results could differ materially from those set out in the forward-looking statements as a result of various factors. Important factors that may cause such a difference for Nordea include, but are not limited to: (i) the macroeconomic development, (ii) change in the competitive ...

... correct. Accordingly, results could differ materially from those set out in the forward-looking statements as a result of various factors. Important factors that may cause such a difference for Nordea include, but are not limited to: (i) the macroeconomic development, (ii) change in the competitive ...

it`s spring - time to sell • Sales Show The Market Is

... Interest repayments Investors need to be switched on when it comes to the interest rate environment and how higher rates might affect their expected net return and the market for their property, if they decided to sell. If you get a variable loan, you need to factor in the possibility of higher repa ...

... Interest repayments Investors need to be switched on when it comes to the interest rate environment and how higher rates might affect their expected net return and the market for their property, if they decided to sell. If you get a variable loan, you need to factor in the possibility of higher repa ...

FUSION Income | US Dollar - Capital International Group

... The information contained herein is believed to be correct, but its accuracy cannot be guaranteed. Performance is calculated based on the average actual performance of Fusion portfolios. Model performance has been used prior to 2007. Individual Fusion portfolios may vary significantly from the avera ...

... The information contained herein is believed to be correct, but its accuracy cannot be guaranteed. Performance is calculated based on the average actual performance of Fusion portfolios. Model performance has been used prior to 2007. Individual Fusion portfolios may vary significantly from the avera ...

- T. Rowe Price

... It is important to remember, however, that when interest rates do eventually begin the normalization process, this will not necessarily be bad for stock prices. Higher rates often coincide with improved economic conditions, which, in turn, are supportive of corporate profit growth and, subsequently, ...

... It is important to remember, however, that when interest rates do eventually begin the normalization process, this will not necessarily be bad for stock prices. Higher rates often coincide with improved economic conditions, which, in turn, are supportive of corporate profit growth and, subsequently, ...

Banking - comuf.com

... • Savings banks also earn income from the services they offer such as checking and safe deposit boxes • Savings banks offer higher accounts interest rates savings accounts than comm.. banks • Savings banks are usually referred to as mutual savings banks. ...

... • Savings banks also earn income from the services they offer such as checking and safe deposit boxes • Savings banks offer higher accounts interest rates savings accounts than comm.. banks • Savings banks are usually referred to as mutual savings banks. ...

Fundamental Analysis for Investment Decisions on Five Major Banks

... sector in India so as to facilitate a buy or sell option through the intrinsic value of the shares and the prevalent market price using fundamental analysis. It is basically to know the investment opportunities for the investors in buying the shares of banking companies. This analysis utilizes vario ...

... sector in India so as to facilitate a buy or sell option through the intrinsic value of the shares and the prevalent market price using fundamental analysis. It is basically to know the investment opportunities for the investors in buying the shares of banking companies. This analysis utilizes vario ...

Submission to Australia’s Future Tax System 2009 Name Withheld

... Taxpayers with higher incomes can extract a larger tax break because they have a higher 'other income'. Also, it does not matter how large the loss is on the passive investment, the whole loss can be used against other income, for example salary. Extrapolate this kind of behaviour onto every taxpaye ...

... Taxpayers with higher incomes can extract a larger tax break because they have a higher 'other income'. Also, it does not matter how large the loss is on the passive investment, the whole loss can be used against other income, for example salary. Extrapolate this kind of behaviour onto every taxpaye ...

Pitfalls of relying on banking depth as the main measure of financial

... The discovery that finance affects growth (and not just the other way around) ...

... The discovery that finance affects growth (and not just the other way around) ...

The characteristics of the capital market

... • Tight supervision, and stability-related limitations • International standards––risk management, control, corporate governance, capital (Basel 2) ...

... • Tight supervision, and stability-related limitations • International standards––risk management, control, corporate governance, capital (Basel 2) ...

UDC: 330.322/341.1:334.7 INNOVATION AND INVESTMENT

... institutions, and connected with them by geographic and functional features of government, academia , and various infrastructure components , working in a particular area for a specific purpose . The mission is to enhance the functioning of clusters connections between different areas of activity wh ...

... institutions, and connected with them by geographic and functional features of government, academia , and various infrastructure components , working in a particular area for a specific purpose . The mission is to enhance the functioning of clusters connections between different areas of activity wh ...

Introduction to Non-Interest Banking

... arrangement, the contract is between an investor (or financier) and an entrepreneur or investment manager known as the mudarib. Risk and rewards are shared. In the case of a profit, both parties receive their agreed-upon share of the profit. In the case of a loss, the investor bears any loss of capi ...

... arrangement, the contract is between an investor (or financier) and an entrepreneur or investment manager known as the mudarib. Risk and rewards are shared. In the case of a profit, both parties receive their agreed-upon share of the profit. In the case of a loss, the investor bears any loss of capi ...

PowerPoint-Präsentation

... | No secondary market for equity investments (yet) for a number of reasons | Debt capital is widely used ...

... | No secondary market for equity investments (yet) for a number of reasons | Debt capital is widely used ...

FAQs ON INVESTMENT REGULATIONS

... pension liabilities – for DB schemes the Authority would expect a statement of the asset allocation strategy and how the nature of the liabilities of the scheme have been taken into account in setting it. For DC schemes, the Authority would expect this section to include a description of the investm ...

... pension liabilities – for DB schemes the Authority would expect a statement of the asset allocation strategy and how the nature of the liabilities of the scheme have been taken into account in setting it. For DC schemes, the Authority would expect this section to include a description of the investm ...

Ted Bernhard - Stoel Rives

... • Complex and confusing investment structures • Failure to provide incentives that matter to investors • Failure to communicate the opportunity effectively • Qualification: some of this is due to factors outside of any one individual’s control ...

... • Complex and confusing investment structures • Failure to provide incentives that matter to investors • Failure to communicate the opportunity effectively • Qualification: some of this is due to factors outside of any one individual’s control ...

1929 Stock Market Crash ¡@ October 1929 was the beginning of the

... guidelines, corporations began printing up more and more common stock. Many investors in the stock market practiced "buying on margin," that is, buying stock on credit. Confident that a given stock's value would rise, an investor put a down payment on the stock, expecting in a few months to pay the ...

... guidelines, corporations began printing up more and more common stock. Many investors in the stock market practiced "buying on margin," that is, buying stock on credit. Confident that a given stock's value would rise, an investor put a down payment on the stock, expecting in a few months to pay the ...

what the future holds for property - Society of Chartered Surveyors

... had experienced a 100 per cent success were driving up land and building costs Cost burdens rate in cases she oversaw in Britain and and adding to the renting crisis. Two cost bases were identified as They were among a number of speakers stumbling blocks in the current led to increased developer and ...

... had experienced a 100 per cent success were driving up land and building costs Cost burdens rate in cases she oversaw in Britain and and adding to the renting crisis. Two cost bases were identified as They were among a number of speakers stumbling blocks in the current led to increased developer and ...

Investment Terminology and Concepts

... Buying Stocks • Brokers • DRIPs & DSPPs or DIPs – Dividend Reinvestment Plans (DRIPs) and – Direct Stock Purchase Plans (DSPPs) or Direct Investment Plans (DIPs) are plans with which individual companies for a minimal cost, allow shareholders to purchase stock directly from the company. ...

... Buying Stocks • Brokers • DRIPs & DSPPs or DIPs – Dividend Reinvestment Plans (DRIPs) and – Direct Stock Purchase Plans (DSPPs) or Direct Investment Plans (DIPs) are plans with which individual companies for a minimal cost, allow shareholders to purchase stock directly from the company. ...

Comments Before the Local Donor Mee by Drs. Kwik Kian Gie

... domestic debt, foreign borrowing does not crowd out domestic investment, and foreign borrowing supports the balance of payments, thereby helping to strengthenthe rupiah. However, foreign borrowing also entails greaterrisk, particularly if the exchangerate depreciates in the future. As long as the ec ...

... domestic debt, foreign borrowing does not crowd out domestic investment, and foreign borrowing supports the balance of payments, thereby helping to strengthenthe rupiah. However, foreign borrowing also entails greaterrisk, particularly if the exchangerate depreciates in the future. As long as the ec ...

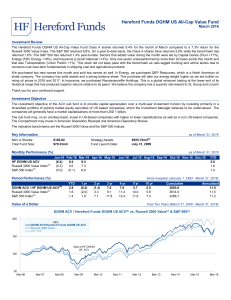

Click to download DGHM ACV March 2016

... 44F, rue de la Vallée, L- 2661 Luxembourg, and any distributor or intermediary appointed by the Fund. No warranty is given, in whole or in part, regarding performance of the Fund. There is no guarantee that its investment objectives will be achieved. Potential investors shall be aware that the value ...

... 44F, rue de la Vallée, L- 2661 Luxembourg, and any distributor or intermediary appointed by the Fund. No warranty is given, in whole or in part, regarding performance of the Fund. There is no guarantee that its investment objectives will be achieved. Potential investors shall be aware that the value ...

Land banking

Land banking is the practice of aggregating parcels of land for future sale or development.While in many countries land banking may refer to various private real-estate investment schemes, in the United States it refers to the establishment of quasi-governmental county or municipal authorities purposed with managing an inventory of surplus land.