CHAPTER 1

... a. The payments mechanism is the means by which transactions are completed; how money is transferred among transactors. b. When you write a check at the grocers, dollars are then credited (added) to the deposit account of the grocer, and debited (removed) from your account. c. The balances in checka ...

... a. The payments mechanism is the means by which transactions are completed; how money is transferred among transactors. b. When you write a check at the grocers, dollars are then credited (added) to the deposit account of the grocer, and debited (removed) from your account. c. The balances in checka ...

A Social Discount Rate for the US

... laborer, the (B / W0 ) ratio becomes B / (0.7W0 ) , i.e. 0.2/0.7, which is around 0.3. In addition, if the marginal investor is temporarily out of work she will receive 33% of her income from the unemployment insurance fund (Hyman, 2008: 346). This means that the ratio B /W0 for the unemployed is ar ...

... laborer, the (B / W0 ) ratio becomes B / (0.7W0 ) , i.e. 0.2/0.7, which is around 0.3. In addition, if the marginal investor is temporarily out of work she will receive 33% of her income from the unemployment insurance fund (Hyman, 2008: 346). This means that the ratio B /W0 for the unemployed is ar ...

Session 18: Post Class tests 1. The objective in corporate finance is

... 1. b. The operating income of the firm will not change as the debt ratio changes. For a lower cost of capital to result in higher firm value, the operating cash flow of the firm will have ...

... 1. b. The operating income of the firm will not change as the debt ratio changes. For a lower cost of capital to result in higher firm value, the operating cash flow of the firm will have ...

Defaultable Debt, Interest Rates and the Current Account

... (because of the shock’s persistence) and on the difference between the two value functions. The latter effect arises because a positive shock to trend implies that income is higher today, but even higher tomorrow, placing a premium on the ability to access capital markets to bring forward anticipated ...

... (because of the shock’s persistence) and on the difference between the two value functions. The latter effect arises because a positive shock to trend implies that income is higher today, but even higher tomorrow, placing a premium on the ability to access capital markets to bring forward anticipated ...

Accounting for Receivables

... Uncollectible accounts receivable are _____________. This estimate is treated as an expense and is matched against ________ in the same accounting period in which the sales occurred. Estimated uncollectibles are ___________to Bad Debts Expense and ___________ to Allowance for Doubtful Accounts throu ...

... Uncollectible accounts receivable are _____________. This estimate is treated as an expense and is matched against ________ in the same accounting period in which the sales occurred. Estimated uncollectibles are ___________to Bad Debts Expense and ___________ to Allowance for Doubtful Accounts throu ...

Online Chapter 15 LEASE FINANCING AND BUSINESS VALUATION

... asset as a fixed asset and the present value of the future lease payments as a liability. This process is called capitalizing the lease; hence, such a lease is called a capital lease. The net effect of capitalizing the lease is to cause Firms B and L to have similar balance sheets, both of which wil ...

... asset as a fixed asset and the present value of the future lease payments as a liability. This process is called capitalizing the lease; hence, such a lease is called a capital lease. The net effect of capitalizing the lease is to cause Firms B and L to have similar balance sheets, both of which wil ...

Real estate appraisal From Wikipedia, the free encyclopedia Jump

... appraisal which relies on the foundation of quantitative-data,[7] risk, and geographical based approaches.[8][9] Pagourtzi et al. have provided a review on the methods used in the industry by comparison between conventional approaches and advanced ones.[10] As mentioned before, an appraiser can gene ...

... appraisal which relies on the foundation of quantitative-data,[7] risk, and geographical based approaches.[8][9] Pagourtzi et al. have provided a review on the methods used in the industry by comparison between conventional approaches and advanced ones.[10] As mentioned before, an appraiser can gene ...

Bonds Payable

... Bond Sinking Fund To provide greater security for bondholders, the bond agreement may specify that the issuing corporation make annual deposits of cash into a special fund—called a sinking fund—to be used to pay off the bond issue when it comes due. The sinking fund may be controlled by either ...

... Bond Sinking Fund To provide greater security for bondholders, the bond agreement may specify that the issuing corporation make annual deposits of cash into a special fund—called a sinking fund—to be used to pay off the bond issue when it comes due. The sinking fund may be controlled by either ...

Ch 6

... The NPV method implicitly assumes that the opportunity exists to reinvest the cash flows generated by a project at the required rate of return, whereas use of the IRR method implies the opportunity to reinvest at the IRR. All independent projects with an NPV > $0 should be invested in by the firm. A ...

... The NPV method implicitly assumes that the opportunity exists to reinvest the cash flows generated by a project at the required rate of return, whereas use of the IRR method implies the opportunity to reinvest at the IRR. All independent projects with an NPV > $0 should be invested in by the firm. A ...

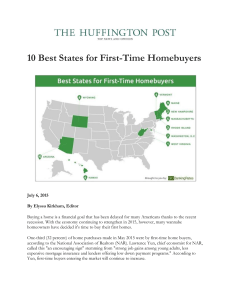

10 Best States for First-Time Homebuyers

... 2. New Hampshire New Hampshire saw an even greater increase in the number of first-time home buyers than West Virginia. The portion of home buyers in the state looking to purchase a house for the first time increased by 89.3 percent from 2003 to 2013. The state's foreclosure rate is not quite as low ...

... 2. New Hampshire New Hampshire saw an even greater increase in the number of first-time home buyers than West Virginia. The portion of home buyers in the state looking to purchase a house for the first time increased by 89.3 percent from 2003 to 2013. The state's foreclosure rate is not quite as low ...

Chapter 1

... paid to holders of the perpetuity, where the weight for each cash flow is equal to the present value of that cash flow divided by the total present value of all cash flows. For cash flows in the distant future, present value approaches zero (i.e., the weight becomes very small) so that these distant ...

... paid to holders of the perpetuity, where the weight for each cash flow is equal to the present value of that cash flow divided by the total present value of all cash flows. For cash flows in the distant future, present value approaches zero (i.e., the weight becomes very small) so that these distant ...