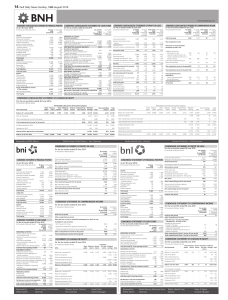

14 Gulf Daily News Sunday, 14th August 2016

... Items that are or may be reclassified subsequently to profit or loss: Available-for-sale securities: - Net change in fair value - Impairment transferred to profit or loss - Transfer to statement of profit or loss on disposal of securities Share of other comprehensive income of equity accounted inves ...

... Items that are or may be reclassified subsequently to profit or loss: Available-for-sale securities: - Net change in fair value - Impairment transferred to profit or loss - Transfer to statement of profit or loss on disposal of securities Share of other comprehensive income of equity accounted inves ...

Chapter 19

... • Forecast of cash inflows and outflows over the next short-term planning period • Primary tool in short-term financial planning • Helps determine when the firm should experience cash surpluses and when it will need to borrow to cover working-capital costs • Allows a company to plan ahead and begin ...

... • Forecast of cash inflows and outflows over the next short-term planning period • Primary tool in short-term financial planning • Helps determine when the firm should experience cash surpluses and when it will need to borrow to cover working-capital costs • Allows a company to plan ahead and begin ...

report - Financial Policy Forum

... This more diversified flow of foreign capital (diversified in the sense that various vehicles were used to channel the capital flows) generated a different distribution of risks. Compared to the bank loans of the 1970s and early 1980s, this more diversified flow of capital tended to distribute risk ...

... This more diversified flow of foreign capital (diversified in the sense that various vehicles were used to channel the capital flows) generated a different distribution of risks. Compared to the bank loans of the 1970s and early 1980s, this more diversified flow of capital tended to distribute risk ...

11 - JustAnswer

... c. What happens to the indifference point if the interest rate on debt increases and the common stock sales price remains constant? Indifference point moves to right, i.e., higher EBIT d. What happens to the indifference point if the interest rate on debt remains constant and the common stock sales ...

... c. What happens to the indifference point if the interest rate on debt increases and the common stock sales price remains constant? Indifference point moves to right, i.e., higher EBIT d. What happens to the indifference point if the interest rate on debt remains constant and the common stock sales ...

part 3

... – If we choose 16 as our bias value, we can consider every number less than 16 a negative number, every number greater than 16 a positive number, and 16 itself can represent 0 – This is called excess-16 representation, since we have to subtract 16 from the stored value to get the actual value – Note ...

... – If we choose 16 as our bias value, we can consider every number less than 16 a negative number, every number greater than 16 a positive number, and 16 itself can represent 0 – This is called excess-16 representation, since we have to subtract 16 from the stored value to get the actual value – Note ...

Chapter 2

... • CCA is depreciation for tax purposes • CCA is deducted before taxes and acts as a tax shield • Every capital assets is assigned to a specific asset class by the government • Every asset class is given a depreciation method and rate • Half-year Rule – In the first year, only half of the asset’s cos ...

... • CCA is depreciation for tax purposes • CCA is deducted before taxes and acts as a tax shield • Every capital assets is assigned to a specific asset class by the government • Every asset class is given a depreciation method and rate • Half-year Rule – In the first year, only half of the asset’s cos ...

CHAPTER 9

... which period its residual value will be negligible. The present furnace has a book value of Rs 15,000 and can be used for another 10 years with only minor repairs. If scrapped now, it can fetch Rs 10,000 but it cannot fetch any amount if scrapped after ten more years of use. The basic advantage of t ...

... which period its residual value will be negligible. The present furnace has a book value of Rs 15,000 and can be used for another 10 years with only minor repairs. If scrapped now, it can fetch Rs 10,000 but it cannot fetch any amount if scrapped after ten more years of use. The basic advantage of t ...

Form 10-Q - Town Sports International Holdings, Inc.

... Facility was issued at an original issue discount (“OID”) of 1.0% or $3,000. The $3,000 OID was recorded as a contra-liability to long-term debt on the accompanying condensed consolidated balance sheet and is being amortized as interest expense using the effective interest method. On May 11, 2011, d ...

... Facility was issued at an original issue discount (“OID”) of 1.0% or $3,000. The $3,000 OID was recorded as a contra-liability to long-term debt on the accompanying condensed consolidated balance sheet and is being amortized as interest expense using the effective interest method. On May 11, 2011, d ...

key assumptions - Fisher College of Business

... will remain that way until actual GDP growth closes the gap with potential GDP and applies upward pressure on prices and ultimately interest rates. It is expected that the high growth economic recovery will last about two years, at which time restrictive monetary policy may again be necessary. Below ...

... will remain that way until actual GDP growth closes the gap with potential GDP and applies upward pressure on prices and ultimately interest rates. It is expected that the high growth economic recovery will last about two years, at which time restrictive monetary policy may again be necessary. Below ...

Private Cash Flow Statements

... and note principal payments, capitalized lease payment, capital debt interest payments, capital acquisitions and capital item sale proceeds ...

... and note principal payments, capitalized lease payment, capital debt interest payments, capital acquisitions and capital item sale proceeds ...