Impact of FIIs on Trading Quantity and Market Capitalization of

... For developing countries, foreign portfolio equity investment has different characteristics and implications compared to foreign direct investment (FDI). Besides supplementing domestic savings, FDI is expected to facilitate transfer of technology to introduce new management and marketing skills and ...

... For developing countries, foreign portfolio equity investment has different characteristics and implications compared to foreign direct investment (FDI). Besides supplementing domestic savings, FDI is expected to facilitate transfer of technology to introduce new management and marketing skills and ...

Got rejected? Real effects of not getting a loan

... All firms that are subject to the disclosure requirements – independent of their size – need to disclose basic balance sheet items, consisting of two main items on the asset side and two main items on the liability side.5 The two main items on the asset side are current assets (i.e., short-term ass ...

... All firms that are subject to the disclosure requirements – independent of their size – need to disclose basic balance sheet items, consisting of two main items on the asset side and two main items on the liability side.5 The two main items on the asset side are current assets (i.e., short-term ass ...

chapter 2 2

... Clearly, despite an awareness of capital rationing, the surveyed small business owner-managers rely heavily on what they would argue is informed intuition in assessing the viability of investment opportunities. Value maximisation techniques using DCF are generally not adopted. The leading quantitati ...

... Clearly, despite an awareness of capital rationing, the surveyed small business owner-managers rely heavily on what they would argue is informed intuition in assessing the viability of investment opportunities. Value maximisation techniques using DCF are generally not adopted. The leading quantitati ...

Term Sheet Indian Railway Finance Corporation Limited 8.23

... Companies within the meaning of sub-section 20 of Section 2 of the Companies Act, 2013; Statutory bodies/corporations; Co-operative banks; Trusts including Public/ private/ charitable/religious trusts; Limited liability partnership; Regional Rural Banks: Partnership firms; Eligible QFIs not being an ...

... Companies within the meaning of sub-section 20 of Section 2 of the Companies Act, 2013; Statutory bodies/corporations; Co-operative banks; Trusts including Public/ private/ charitable/religious trusts; Limited liability partnership; Regional Rural Banks: Partnership firms; Eligible QFIs not being an ...

key assumptions - Fisher College of Business

... Second, monetary policy is currently expansive and is expected to remain such until the recovery is sure to be sustainable. There are two important points in favor of the value style here. Expansive monetary policy generally leads into a recovery, which we have determined favors value. Also, value t ...

... Second, monetary policy is currently expansive and is expected to remain such until the recovery is sure to be sustainable. There are two important points in favor of the value style here. Expansive monetary policy generally leads into a recovery, which we have determined favors value. Also, value t ...

Franck-Daphis-Presentation-AGM-2016

... Subsidized MFIs also receive soft loans and donor funds; however, opportunity cost of earmarking funds for long repayment periods can be to high. ...

... Subsidized MFIs also receive soft loans and donor funds; however, opportunity cost of earmarking funds for long repayment periods can be to high. ...

Shadow banks and macroeconomic instability CAMA Working Paper

... process by which constraints endogenously tighten on both banks and shadow banks can then lead real disturbances to be amplified.3 The reader should be aware of what we do not do in this paper. First, we do not attempt to model the process of financial innovation and regulatory change which lay behi ...

... process by which constraints endogenously tighten on both banks and shadow banks can then lead real disturbances to be amplified.3 The reader should be aware of what we do not do in this paper. First, we do not attempt to model the process of financial innovation and regulatory change which lay behi ...

Corporate bond issuance in Europe

... could already be observed in 2001 allied with weak growth in bank lending growth from 2002-2004. Moreover, for the first time in decades, dividend yields of some corporations are as high as their bond yields. Accordingly, there are already signs of investors heading back to equity markets. In this r ...

... could already be observed in 2001 allied with weak growth in bank lending growth from 2002-2004. Moreover, for the first time in decades, dividend yields of some corporations are as high as their bond yields. Accordingly, there are already signs of investors heading back to equity markets. In this r ...

Global Financial Stability Report(Chapter 1): Potent Policies for

... currencies of oil producers raises the value of their foreign-denominated debt, further undercutting investment and growth prospects. Other non-oil commodity producers in many countries are also retrenching capital expenditures and output at the same time, in response to falling non-oil commodity pr ...

... currencies of oil producers raises the value of their foreign-denominated debt, further undercutting investment and growth prospects. Other non-oil commodity producers in many countries are also retrenching capital expenditures and output at the same time, in response to falling non-oil commodity pr ...

Title of presentation

... UK vs. US: equalizing gross yields, UK consumer platforms appear to generate better returns • Anecdotally, UK offers better risk reward than US: Comparing Zopa loans of equal gross yield (USD swapped) to Lending Club ‘A grade’ and ‘B grade’ loans shows that equivalent Zopa loans yields an extra 0.4- ...

... UK vs. US: equalizing gross yields, UK consumer platforms appear to generate better returns • Anecdotally, UK offers better risk reward than US: Comparing Zopa loans of equal gross yield (USD swapped) to Lending Club ‘A grade’ and ‘B grade’ loans shows that equivalent Zopa loans yields an extra 0.4- ...

Economic and Financial Statistics in the Context of the Global

... • Financial interconnectedness of household with the other economic sectors (including the rest of the world) – The IAG is promoting the development of from-whom-to-whom breakdowns of the sectoral macroeconomic accounts for financial positions and flows within the context of the sectoral accounts wo ...

... • Financial interconnectedness of household with the other economic sectors (including the rest of the world) – The IAG is promoting the development of from-whom-to-whom breakdowns of the sectoral macroeconomic accounts for financial positions and flows within the context of the sectoral accounts wo ...

Learning Curve Spillovers and Transactions Cost in

... allows rural banks to financially include them. Why? There has been a significant increase in the number of active borrowers in the Philippines since 1994. Microfinance activities have been existing previous to the 1997 establishment the regulatory body called National Credit Council. Through microf ...

... allows rural banks to financially include them. Why? There has been a significant increase in the number of active borrowers in the Philippines since 1994. Microfinance activities have been existing previous to the 1997 establishment the regulatory body called National Credit Council. Through microf ...

From big to great: The world`s leading institutional investors forge

... the Australian Future Fund in particular raising cash levels to over 20 percent of the portfolio at the end of 2015. However, most institutions have limitations that prevent them from doing this and are exploring other approaches such as factor-based investing, a rapidly accelerating investment styl ...

... the Australian Future Fund in particular raising cash levels to over 20 percent of the portfolio at the end of 2015. However, most institutions have limitations that prevent them from doing this and are exploring other approaches such as factor-based investing, a rapidly accelerating investment styl ...

Austrian financial intermediaries

... widening gap (chart 14), especially since market participants are expecting banks to hold significantly more capital than minimum requirements stipulated by the Basel III rules. While the capital ratios of Austrian banks remained broadly unchanged, the leverage ratio increased to 5.7% in the course ...

... widening gap (chart 14), especially since market participants are expecting banks to hold significantly more capital than minimum requirements stipulated by the Basel III rules. While the capital ratios of Austrian banks remained broadly unchanged, the leverage ratio increased to 5.7% in the course ...

Money Flow in the Emerging Countries after the

... European currency crisis which took place in 1992-1993. The volatility in the foreign exchange market, bond and stock markets rapidly rose and oil prices plummeted. The central banks in advanced economies cut their policy rates almost simultaneously. Massive fiscal expenditures were introduced in ma ...

... European currency crisis which took place in 1992-1993. The volatility in the foreign exchange market, bond and stock markets rapidly rose and oil prices plummeted. The central banks in advanced economies cut their policy rates almost simultaneously. Massive fiscal expenditures were introduced in ma ...

Global Market Outlook 2016: Trends in real estate private equity

... has fallen to single digits. As the economic recovery is factored into pricing, so is the increased visibility on assets — while buyers are more willing to pay lower discounts as portfolios have reduced risk over time, they are also benefitting from the J-curve effect on their investment returns. Ri ...

... has fallen to single digits. As the economic recovery is factored into pricing, so is the increased visibility on assets — while buyers are more willing to pay lower discounts as portfolios have reduced risk over time, they are also benefitting from the J-curve effect on their investment returns. Ri ...

A Theory of Salient Economic Fluctuations

... more salient. It is easy to show that the case −wl + X ≤ 0 does not affect the result. This is thus the opposite of Result 2. This is in line with the break-even effect described in Thaler and Johnson (1990). Following losses, investors are willing to take more risk if they can break-even. In this s ...

... more salient. It is easy to show that the case −wl + X ≤ 0 does not affect the result. This is thus the opposite of Result 2. This is in line with the break-even effect described in Thaler and Johnson (1990). Following losses, investors are willing to take more risk if they can break-even. In this s ...

DOC - Europa EU

... the creditor has access to specified assets of equivalent value, also known as a “right in rem”). Collateral is used throughout the EU to support financial transactions. Market participants use it to manage and reduce their credit risks arising from all kinds of financial transactions, from derivati ...

... the creditor has access to specified assets of equivalent value, also known as a “right in rem”). Collateral is used throughout the EU to support financial transactions. Market participants use it to manage and reduce their credit risks arising from all kinds of financial transactions, from derivati ...

Strategic Considerations for First-Time Sovereign Bond

... corporates to access international markets in the future; and (iii) substantial broadening of the country’s investor base (Agenor, 2001; Dittmar and Yuan, 2007). However, international bond issuance also entails several risks. The key challenge for all sovereign bond issuers, including first-time is ...

... corporates to access international markets in the future; and (iii) substantial broadening of the country’s investor base (Agenor, 2001; Dittmar and Yuan, 2007). However, international bond issuance also entails several risks. The key challenge for all sovereign bond issuers, including first-time is ...

Presentation

... These findings are all consistent with the presence of payoff complementarities among corporate bond-fund investors driven by the illiquidity of their assets. ...

... These findings are all consistent with the presence of payoff complementarities among corporate bond-fund investors driven by the illiquidity of their assets. ...

Regional Networked Market Concept For Implementation of a Single

... The RNM concept is intended to accommodate initially all identified best practices that can be addressed without substantially delaying the implementation process. Other best practices could be incorporated after initial market start-up. As generally discussed in the accompanying paper, RNM is inten ...

... The RNM concept is intended to accommodate initially all identified best practices that can be addressed without substantially delaying the implementation process. Other best practices could be incorporated after initial market start-up. As generally discussed in the accompanying paper, RNM is inten ...

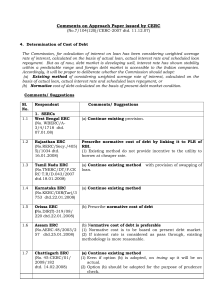

Comments on approach paper 04 - Central Electricity Regulatory

... (1) Issue is whether debt should become an instrument for ...

... (1) Issue is whether debt should become an instrument for ...

Fund Manager Sector Minimum Investment Fund Size

... investment may go down as well as up and past performance is not a guide to future performance. Fluctua�ons or movements in the exchange rates may cause the value of underlying interna�onal investments to go up or down. CIS are traded at ruling prices and can engage in borrowing and script lending. ...

... investment may go down as well as up and past performance is not a guide to future performance. Fluctua�ons or movements in the exchange rates may cause the value of underlying interna�onal investments to go up or down. CIS are traded at ruling prices and can engage in borrowing and script lending. ...