Ambac Presentation

... This presentation contains statements that may constitute "forward-looking statements" within the meaning of the safe harbor provisions of the Private Securities Litigation Reform Act of 1995. Any or all of management’s forward-looking statements here or in other publications may turn out to be wron ...

... This presentation contains statements that may constitute "forward-looking statements" within the meaning of the safe harbor provisions of the Private Securities Litigation Reform Act of 1995. Any or all of management’s forward-looking statements here or in other publications may turn out to be wron ...

Mutual funds

... NAV of closed-ended funds is determined by supply and demand. Discounts or premiums discount results from large tax liabilities on capital gains Premiums can result because such funds often have inexpensive access to overseas stocks. McGraw-Hill/Irwin ...

... NAV of closed-ended funds is determined by supply and demand. Discounts or premiums discount results from large tax liabilities on capital gains Premiums can result because such funds often have inexpensive access to overseas stocks. McGraw-Hill/Irwin ...

Survey - eVestment

... diligence is the people. Of course people are only part of the equation. The other P’s of private markets, Performance and Process, also feature highly. Track record and strategy were deemed the second and third most important factors respectively. This year’s survey saw a considerable increase in r ...

... diligence is the people. Of course people are only part of the equation. The other P’s of private markets, Performance and Process, also feature highly. Track record and strategy were deemed the second and third most important factors respectively. This year’s survey saw a considerable increase in r ...

Risk-Adjusted Performance of Private Equity Investments

... institutional investor and an intermediary (the PE fund). A PE fund is usually structured as a limited partnership, and is comprised of a management team (the general partner), which manages the investments of the limited partner. The PE fund's investors hold shares of the limited partner. PE funds ...

... institutional investor and an intermediary (the PE fund). A PE fund is usually structured as a limited partnership, and is comprised of a management team (the general partner), which manages the investments of the limited partner. The PE fund's investors hold shares of the limited partner. PE funds ...

Achieving the Investment Plan for Europe`s €315 billion

... Fix 5 Ensure the Investment Plan crowds in, rather than crowds out, private sector investment It is crucial that the favourable terms that the EFSI might offer do not crowd out potential private investment. The EFSI should have the capacity, including the risk appetite and expertise, to operate eff ...

... Fix 5 Ensure the Investment Plan crowds in, rather than crowds out, private sector investment It is crucial that the favourable terms that the EFSI might offer do not crowd out potential private investment. The EFSI should have the capacity, including the risk appetite and expertise, to operate eff ...

Multi-Seller Commercial Paper - Dorris - Artic

... structure of the multi-seller CP conduit. The organizational documents of the conduit set forth the required facilities. Such facilities are constructed so they will be available to be drawn to cover losses on any transaction in the conduit. Thus, if total collections are insufficient to make paymen ...

... structure of the multi-seller CP conduit. The organizational documents of the conduit set forth the required facilities. Such facilities are constructed so they will be available to be drawn to cover losses on any transaction in the conduit. Thus, if total collections are insufficient to make paymen ...

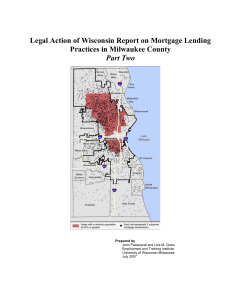

Legal Action of Wisconsin Report on Mortgage Lending

... More than 30 subprime lenders have stopped operations or been sold because of increasing delinquencies from subprime loans (Boston Globe, April 20, 2007). In January 2006 Ameriquest Mortgage Company agreed to pay a $325 million settlement to 49 states and to reform its lending practices. (Wis. Depar ...

... More than 30 subprime lenders have stopped operations or been sold because of increasing delinquencies from subprime loans (Boston Globe, April 20, 2007). In January 2006 Ameriquest Mortgage Company agreed to pay a $325 million settlement to 49 states and to reform its lending practices. (Wis. Depar ...

The Efficient Market Theory and Evidence

... and specify the risk factors relevant to the market. If the benchmark is solely a market-weighted portfolio consisting of all traded securities, then active management (defined as deviations from these market weights) may be useful in accessing factor risk premiums which are not captured by market e ...

... and specify the risk factors relevant to the market. If the benchmark is solely a market-weighted portfolio consisting of all traded securities, then active management (defined as deviations from these market weights) may be useful in accessing factor risk premiums which are not captured by market e ...

The thirty-minute guide to Private Equity

... UNI Global Union continues to advocate respect for labour rights with the alternative financial asset classes in a period of significant change for financial markets. Private equity and hedge fund assets are feeling the pressure of their creatively crafted debt arrangements. The fact remains however ...

... UNI Global Union continues to advocate respect for labour rights with the alternative financial asset classes in a period of significant change for financial markets. Private equity and hedge fund assets are feeling the pressure of their creatively crafted debt arrangements. The fact remains however ...

Why Capital Markets Matter

... It is for this reason that historian Niall Ferguson says, “The evolution of credit and debt was as important as any technological innovation in the rise of civilization…without the foundation of borrowing and lending, the economic history of our world would scarcely have gotten off the ground.”2 Wi ...

... It is for this reason that historian Niall Ferguson says, “The evolution of credit and debt was as important as any technological innovation in the rise of civilization…without the foundation of borrowing and lending, the economic history of our world would scarcely have gotten off the ground.”2 Wi ...

Working Paper 29: Overcoming barriers to institutional investment in

... There is strong demand for fixed interest securities from the annuity funds but institutional liabilities tend to be real in nature – ie they increase over time as prices/wages increase. As a result, institutional investors need to include real assets within their portfolios such as indexlinked secu ...

... There is strong demand for fixed interest securities from the annuity funds but institutional liabilities tend to be real in nature – ie they increase over time as prices/wages increase. As a result, institutional investors need to include real assets within their portfolios such as indexlinked secu ...

Handbook on Climate-Related Investing across Asset Classes

... Signatory banks agree to avoid where possible negative impacts on project-affected ecosystems and communities, and if these impacts are unavoidable, they should be reduced, mitigated and/or compensated for appropriately. ...

... Signatory banks agree to avoid where possible negative impacts on project-affected ecosystems and communities, and if these impacts are unavoidable, they should be reduced, mitigated and/or compensated for appropriately. ...

capital and speculation in emerging market economies

... had broadened, risk was being appropriately priced and future servicing requirements by and large matched repayment capacity. As regards the investor base, the globalisation of markets for emerging market securities has continued to broaden. Latin American securities were increasingly being sold in ...

... had broadened, risk was being appropriately priced and future servicing requirements by and large matched repayment capacity. As regards the investor base, the globalisation of markets for emerging market securities has continued to broaden. Latin American securities were increasingly being sold in ...

The Chicago Plan Revisited Jaromir Benes and Michael Kumhof WP/12/202

... lending, an extraordinary privilege that is not enjoyed by any other type of business. Rather, banks would become what many erroneously believe them to be today, pure intermediaries that depend on obtaining outside funding before being able to lend. Having to obtain outside funding rather than being ...

... lending, an extraordinary privilege that is not enjoyed by any other type of business. Rather, banks would become what many erroneously believe them to be today, pure intermediaries that depend on obtaining outside funding before being able to lend. Having to obtain outside funding rather than being ...

Leverage, Default, and Forgiveness

... important indicators of economic conditions than riskless interest rates. Nevertheless, central bankers have paid scant attention to default in their macroeconomic models.1 In my opinion, central banks should pay attention to, and influence, risky interest rates if they want to preserve financial stab ...

... important indicators of economic conditions than riskless interest rates. Nevertheless, central bankers have paid scant attention to default in their macroeconomic models.1 In my opinion, central banks should pay attention to, and influence, risky interest rates if they want to preserve financial stab ...

Report 2015 - Savings and financing the Belgian economy

... up to € 1.9 billion for the first three quarters of 2015, a total € 2.7 billion of debt securities was issued, less than in the corresponding period of 2014. Non-bank loans declined, with this category including loans provided by other financial institutions, such as insurers, as well as leases and ...

... up to € 1.9 billion for the first three quarters of 2015, a total € 2.7 billion of debt securities was issued, less than in the corresponding period of 2014. Non-bank loans declined, with this category including loans provided by other financial institutions, such as insurers, as well as leases and ...

1 Quarterly Statistical Release March 2010, N° 40 This release and

... page, money market funds suffered net redemptions each month in the fourth quarter as investors sought alternative investments to secure higher returns against the backdrop of very low short-term interest rates. This portfolio shift benefited long-term UCITS, i.e. UCITS excluding money market funds, ...

... page, money market funds suffered net redemptions each month in the fourth quarter as investors sought alternative investments to secure higher returns against the backdrop of very low short-term interest rates. This portfolio shift benefited long-term UCITS, i.e. UCITS excluding money market funds, ...

mutual fund strategy

... the fund manager at the close of each business day. Open-end funds Most mutual funds, and all mutual funds in 401(k) retirement accounts in the United States, are open-end funds. Open-end mutual funds must be willing to buy back their shares from their investors at the end of every business day at t ...

... the fund manager at the close of each business day. Open-end funds Most mutual funds, and all mutual funds in 401(k) retirement accounts in the United States, are open-end funds. Open-end mutual funds must be willing to buy back their shares from their investors at the end of every business day at t ...

press release

... In Q4 2012 observable data has confirmed the re-rating of CLO risk, albeit the trend has continued at a slower pace. For example, according to Citibank research, the spread on originally BB-rated U.S. CLO tranches decreased from approximately 11% at the end of Q2 2012 to 8% as of the end of Septembe ...

... In Q4 2012 observable data has confirmed the re-rating of CLO risk, albeit the trend has continued at a slower pace. For example, according to Citibank research, the spread on originally BB-rated U.S. CLO tranches decreased from approximately 11% at the end of Q2 2012 to 8% as of the end of Septembe ...

Personal Finance 2015-2016 CSS Page 1 of 10 Instructional Area

... e. Cite an example of a defined benefit retirement plan. f. Cite an example of a defined contribution retirement plan. g. Discuss protections that are in place to protect employees’ retirement plans. h. Explain the relationship between Social Security benefits and a benefit retirement plan. i. Discu ...

... e. Cite an example of a defined benefit retirement plan. f. Cite an example of a defined contribution retirement plan. g. Discuss protections that are in place to protect employees’ retirement plans. h. Explain the relationship between Social Security benefits and a benefit retirement plan. i. Discu ...

Information, Power, Credit Restrictions and international banking

... Whatsoever, even this is not sufficient to produce an equilibrium that is creditrationed. To do this the New Keynesian decisional apparatus (including asymmetric information) has to be based on the loanable funds theory. Banks need to obtain the funds that they lend first and have to obtain hoarding ...

... Whatsoever, even this is not sufficient to produce an equilibrium that is creditrationed. To do this the New Keynesian decisional apparatus (including asymmetric information) has to be based on the loanable funds theory. Banks need to obtain the funds that they lend first and have to obtain hoarding ...

Summary of the EU`s new risk retention rules as they relate to

... If the retained interest is met on a synthetic basis by a retention holder other than a credit institution, it must be fully collateralised in cash held in a segregated account. Given that most CLO collateral managers are not credit institutions, this cash collateralisation requirement will apply to ...

... If the retained interest is met on a synthetic basis by a retention holder other than a credit institution, it must be fully collateralised in cash held in a segregated account. Given that most CLO collateral managers are not credit institutions, this cash collateralisation requirement will apply to ...

Advanced Derivatives: swaps beyond plain vanilla Structured notes

... sell call to pay for put: choose put so that loss possibility at least 10%. (Investor is “at risk”, not an IRS “constructive sale”). ...

... sell call to pay for put: choose put so that loss possibility at least 10%. (Investor is “at risk”, not an IRS “constructive sale”). ...

Financial Amplification Mechanisms and the Federal Reserve`s

... incentives of arbitrageurs to eliminate mispricings between two securities with identical cash flows. They consider the agency relationship between arbitrageurs with specialized market knowledge (e.g. hedge funds) and the investors who fund them (e.g. wealthy individuals, banks and endowments). If i ...

... incentives of arbitrageurs to eliminate mispricings between two securities with identical cash flows. They consider the agency relationship between arbitrageurs with specialized market knowledge (e.g. hedge funds) and the investors who fund them (e.g. wealthy individuals, banks and endowments). If i ...