Part I – Introduction - LSA

... 3. Does the holder enjoy the typical creditors’ remedies? If all creditors’ remedies are waived, doesn’t look much like debt. 4. Is the payment subordinated to other indebtedness? Subordinated date starts to look like something in the nature of an ownership interest 5. Is the interest rate competiti ...

... 3. Does the holder enjoy the typical creditors’ remedies? If all creditors’ remedies are waived, doesn’t look much like debt. 4. Is the payment subordinated to other indebtedness? Subordinated date starts to look like something in the nature of an ownership interest 5. Is the interest rate competiti ...

share issuance and equity returns in the istanbul stock exchange

... In Turkish markets, capital structure changes occur mostly via rights offerings. A rights offering is a type of issuance of additional shares by a company to raise capital. A rights issue is a special form of shelf offering or shelf registration. With the issued rights, existing shareholders have th ...

... In Turkish markets, capital structure changes occur mostly via rights offerings. A rights offering is a type of issuance of additional shares by a company to raise capital. A rights issue is a special form of shelf offering or shelf registration. With the issued rights, existing shareholders have th ...

Trading Is Hazardous to Your Wealth: The Common Stock

... the South, and 15 percent in the Midwest. The data set includes all accounts opened by each household at this discount brokerage firm. The sample selection was performed at the household level and was stratified based on whether the discount brokerage firm labeled the household as a general ~60,000 ...

... the South, and 15 percent in the Midwest. The data set includes all accounts opened by each household at this discount brokerage firm. The sample selection was performed at the household level and was stratified based on whether the discount brokerage firm labeled the household as a general ~60,000 ...

Annual Equity-Based Insurance Guarantees Conference

... management and risk management committees. He is a frequent speaker at industry meetings on ALM and actuarial topics such as the risk management of variable annuities, the impact of low interest rates on insurers and the transformation of actuarial functions. Andrew joined the company in 1984 in Met ...

... management and risk management committees. He is a frequent speaker at industry meetings on ALM and actuarial topics such as the risk management of variable annuities, the impact of low interest rates on insurers and the transformation of actuarial functions. Andrew joined the company in 1984 in Met ...

Low Correlation Strategy Trust Information Memorandum

... New Zealand investors only Warning The law normally requires people who offer financial products to give information to investors before they invest. This requires those offering financial products to have disclosed information that is important for investors to make an informed decision. The usual ...

... New Zealand investors only Warning The law normally requires people who offer financial products to give information to investors before they invest. This requires those offering financial products to have disclosed information that is important for investors to make an informed decision. The usual ...

Meeting of the Full Council

... Background and Advice The UK Municipal Bonds Agency (MBA) was established by the Local Government Association (LGA) and 56 local authorities, including Lancashire County Council, for the purpose of enabling local authorities to borrow on better rates of interest than would otherwise be available to ...

... Background and Advice The UK Municipal Bonds Agency (MBA) was established by the Local Government Association (LGA) and 56 local authorities, including Lancashire County Council, for the purpose of enabling local authorities to borrow on better rates of interest than would otherwise be available to ...

Should Dark Pools Improve Upon Visible Quotes

... of dark trading within a limit order market, where visible orders may interact with hidden orders at the exchange. In this paper, I study impact of a dark pool that may divert orders away from the visible market. My predictions may also explain some of the seemingly contradictory results in the emp ...

... of dark trading within a limit order market, where visible orders may interact with hidden orders at the exchange. In this paper, I study impact of a dark pool that may divert orders away from the visible market. My predictions may also explain some of the seemingly contradictory results in the emp ...

The Dark Side of Universal Banking: Financial Conglomerates and

... their success in establishing leadership positions in many sectors of the financial markets. During the past two decades, as explained in Parts II.A. and II.B., governmental policies in the U.S., U.K. and Europe encouraged massive consolidation and conglomeration within the financial services indust ...

... their success in establishing leadership positions in many sectors of the financial markets. During the past two decades, as explained in Parts II.A. and II.B., governmental policies in the U.S., U.K. and Europe encouraged massive consolidation and conglomeration within the financial services indust ...

Leverage Cycles and The Anxious Economy.

... Since the 1990’s emerging markets have become increasingly integrated into global financial markets, becoming an asset class. However, contrary to what was widely predicted by policy makers and economic theorists, these changes have not translated into better consumption smoothing opportunities for ...

... Since the 1990’s emerging markets have become increasingly integrated into global financial markets, becoming an asset class. However, contrary to what was widely predicted by policy makers and economic theorists, these changes have not translated into better consumption smoothing opportunities for ...

Danish Covered Bond Handbook

... In this document, we describe the Danish mortgage credit market and its pass-through bonds, including a description of the security underlying the bonds. Until 2007, issuance of Danish covered bonds (mortgage bonds) in Denmark was done through specialist mortgage banks where the general feature was ...

... In this document, we describe the Danish mortgage credit market and its pass-through bonds, including a description of the security underlying the bonds. Until 2007, issuance of Danish covered bonds (mortgage bonds) in Denmark was done through specialist mortgage banks where the general feature was ...

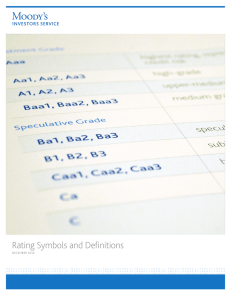

Rating Symbols and Definitions

... Moody’s Global Rating Scales Ratings assigned on Moody’s global long-term and short-term rating scales are forward-looking opinions of the relative credit risks of financial obligations issued by non-financial corporates, financial institutions, structured finance vehicles, project finance vehicles, ...

... Moody’s Global Rating Scales Ratings assigned on Moody’s global long-term and short-term rating scales are forward-looking opinions of the relative credit risks of financial obligations issued by non-financial corporates, financial institutions, structured finance vehicles, project finance vehicles, ...

Norges Bank Working Paper 2012/18

... of funds and their potential borrowers. Banks can screen their borrowers, or can require them to post collateral in order to select creditworthy projects. We find that the potential for longerterm relationships increases banks’ preference for screening. This is because posting collateral only provid ...

... of funds and their potential borrowers. Banks can screen their borrowers, or can require them to post collateral in order to select creditworthy projects. We find that the potential for longerterm relationships increases banks’ preference for screening. This is because posting collateral only provid ...

Thematic Review on mortgage Underwriting and Origination Practices

... Forum recommendations could help to strengthen residential mortgage underwriting practices, and the peer review draws lessons from current practices to illustrate some potential principles (see Annex A) that could guide future standard-setting. However, given that the underlying risks can differ ac ...

... Forum recommendations could help to strengthen residential mortgage underwriting practices, and the peer review draws lessons from current practices to illustrate some potential principles (see Annex A) that could guide future standard-setting. However, given that the underlying risks can differ ac ...

The Equity Premium: Why Is It a Puzzle? Rajnish Mehra

... price than similar assets that pay off in states of high marginal utility. Since rates of return are inversely proportional to asset prices, a high-beta asset will, on average, have a higher rate of return than a lowbeta security. Another perspective on asset pricing emphasizes that economic agents ...

... price than similar assets that pay off in states of high marginal utility. Since rates of return are inversely proportional to asset prices, a high-beta asset will, on average, have a higher rate of return than a lowbeta security. Another perspective on asset pricing emphasizes that economic agents ...

The pari passu clause in sovereign debt instruments

... ("Pari passu clauses are usually not included in domestic U.S. debt instruments because the general parity of unsecured debt obligations, absent statutory priorities or the exercise of a court's equitable powers of subordination, is well established by law. Indeed, it is so established that the pros ...

... ("Pari passu clauses are usually not included in domestic U.S. debt instruments because the general parity of unsecured debt obligations, absent statutory priorities or the exercise of a court's equitable powers of subordination, is well established by law. Indeed, it is so established that the pros ...

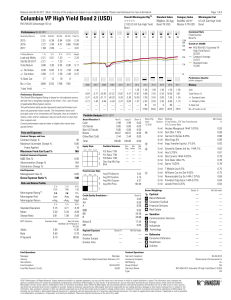

Columbia VP High Yield Bond 2 (USD)

... the fund on the dividend declaration date. Due to foreign tax credits or realized capital losses, after-tax returns may be greater than before-tax returns. After-tax returns for exchange-traded funds are based on net asset value. Money Market Fund Disclosures If money market fund(s) are included in ...

... the fund on the dividend declaration date. Due to foreign tax credits or realized capital losses, after-tax returns may be greater than before-tax returns. After-tax returns for exchange-traded funds are based on net asset value. Money Market Fund Disclosures If money market fund(s) are included in ...

The Financial Structure of Startup Firms: The Role of

... where ensuring the alignment of interests between managers and shareholders is more difficult. Our question: does the ranking with regard to internal funds, external debt, and external equity that comes from established-firm theory play out for startups, which have different asset and information ch ...

... where ensuring the alignment of interests between managers and shareholders is more difficult. Our question: does the ranking with regard to internal funds, external debt, and external equity that comes from established-firm theory play out for startups, which have different asset and information ch ...

KIM - Birla Sun Life Fixed Term Plan

... to abide by the terms, conditions, rules and regulations governing the scheme. I/We hereby declare that the amount invested in the scheme is through legitimate sources only and does not involve and is not designed for the purpose of the contravention of any Act, Rules, Regulations, Notifications or ...

... to abide by the terms, conditions, rules and regulations governing the scheme. I/We hereby declare that the amount invested in the scheme is through legitimate sources only and does not involve and is not designed for the purpose of the contravention of any Act, Rules, Regulations, Notifications or ...

Taste, information, and asset prices: Implications for the valuation of

... erogeneous beliefs or preferences hold di¤ering portfolios in equilibrium. While their results on the e¤ects of tastes on diversi…cation are similar to ours, they focus on situations where investors either derive a non-random utility from their share holdings or where fundamental returns in‡uence t ...

... erogeneous beliefs or preferences hold di¤ering portfolios in equilibrium. While their results on the e¤ects of tastes on diversi…cation are similar to ours, they focus on situations where investors either derive a non-random utility from their share holdings or where fundamental returns in‡uence t ...

Understanding Yield Curves - PGIM Investments

... envision. Our investment professionals also manage money for major corporations and pension funds around the world, which means you benefit from the same expertise, innovation, and attention to risk demanded by today’s most sophisticated investors. We are part of Prudential Financial, a company Amer ...

... envision. Our investment professionals also manage money for major corporations and pension funds around the world, which means you benefit from the same expertise, innovation, and attention to risk demanded by today’s most sophisticated investors. We are part of Prudential Financial, a company Amer ...

Understanding Yield Curves

... envision. Our investment professionals also manage money for major corporations and pension funds around the world, which means you benefit from the same expertise, innovation, and attention to risk demanded by today’s most sophisticated investors. We are part of Prudential Financial, a company Amer ...

... envision. Our investment professionals also manage money for major corporations and pension funds around the world, which means you benefit from the same expertise, innovation, and attention to risk demanded by today’s most sophisticated investors. We are part of Prudential Financial, a company Amer ...

FEMIP - The Potential of Mesofinance for Job Creation in

... disproportionate share of the labour force. With an average “Ease of Doing Business ranking”10 of 98.2, the MENA region finds itself in mid-range internationally11. This has not changed much since the Arab spring; to the contrary, due to the upheaval reforms long overdue could not yet be tackled. Th ...

... disproportionate share of the labour force. With an average “Ease of Doing Business ranking”10 of 98.2, the MENA region finds itself in mid-range internationally11. This has not changed much since the Arab spring; to the contrary, due to the upheaval reforms long overdue could not yet be tackled. Th ...

Equity Management

... not convey voting privileges. Because of legal restrictions on cooperative dividends (8 percent in Oklahoma) there is typically little interest among investors in cooperative preferred stock. Some cooperatives have converted the equity of inactive members into preferred stock. In this case, the pref ...

... not convey voting privileges. Because of legal restrictions on cooperative dividends (8 percent in Oklahoma) there is typically little interest among investors in cooperative preferred stock. Some cooperatives have converted the equity of inactive members into preferred stock. In this case, the pref ...

household debt and unemployment

... results are also in line with the findings of Dobbie and Goldsmith-Pinkham (2015), who find that limited recourse for mortgage debt—i.e. household limited liability—leads to a decrease in the employment rate.7 Brown and Matsa (forthcoming) find that an increase in an employer’s distress results in f ...

... results are also in line with the findings of Dobbie and Goldsmith-Pinkham (2015), who find that limited recourse for mortgage debt—i.e. household limited liability—leads to a decrease in the employment rate.7 Brown and Matsa (forthcoming) find that an increase in an employer’s distress results in f ...