New Jersey Economic Development Authority 2015 Annual Report

... With the continued collaboration of the Partnership for Action (PFA) and tax incentives through the New Jersey Economic Opportunity Act (EOA) adding to the State’s inherent strengths as a business location, small and large companies in industry sectors targeted for growth are choosing to locate and ...

... With the continued collaboration of the Partnership for Action (PFA) and tax incentives through the New Jersey Economic Opportunity Act (EOA) adding to the State’s inherent strengths as a business location, small and large companies in industry sectors targeted for growth are choosing to locate and ...

Co-operative Capital - Saint Mary`s University

... 4. Almost without exception co-operative businesses were established to respond to unfairness in dominant business arrangements. Often they were started as a direct result of exploitation of people by other types of business. The purpose for which people create co-operatives is to meet member and co ...

... 4. Almost without exception co-operative businesses were established to respond to unfairness in dominant business arrangements. Often they were started as a direct result of exploitation of people by other types of business. The purpose for which people create co-operatives is to meet member and co ...

Options on Fed funds futures and interst rate volatity

... can improve pricing efficiency in the equity markets by eliminating noise. Several researchers find evidence that compared to nonoptioned stocks, post-listing volatility for optioned stocks is lower. Detemple and Jorion (1990) document an increase in the stock price of the underlying firms’ as well ...

... can improve pricing efficiency in the equity markets by eliminating noise. Several researchers find evidence that compared to nonoptioned stocks, post-listing volatility for optioned stocks is lower. Detemple and Jorion (1990) document an increase in the stock price of the underlying firms’ as well ...

2006 Annual Report - Media Corporate IR Net

... largest customer and client base in the industry drive our ability to innovate. More than anything, it was client knowledge and innovation that led to our $0 Online Equity Trades , which we launched in October 2006. This product enables brokerage clients with a deposit balance of $25,000 or more to ...

... largest customer and client base in the industry drive our ability to innovate. More than anything, it was client knowledge and innovation that led to our $0 Online Equity Trades , which we launched in October 2006. This product enables brokerage clients with a deposit balance of $25,000 or more to ...

Liquidity transformation in asset management

... transformation. While investors can withdraw unlimited quantities of deposits without any price impact, bank loans cannot be traded before maturity without creating substantial price impact. For asset managers, however, there is no comparable measure. Their assets are typically tradeable securities, ...

... transformation. While investors can withdraw unlimited quantities of deposits without any price impact, bank loans cannot be traded before maturity without creating substantial price impact. For asset managers, however, there is no comparable measure. Their assets are typically tradeable securities, ...

annex - Financial Ombudsman

... of external gearing may have breathed new life into the split cap sector but investment remains a careful balancing act.” The survey reported – “As one might expect of any geared play on the UK market, split capital investment trusts have had a good run for their money in the past two years.” It goe ...

... of external gearing may have breathed new life into the split cap sector but investment remains a careful balancing act.” The survey reported – “As one might expect of any geared play on the UK market, split capital investment trusts have had a good run for their money in the past two years.” It goe ...

Equity Diversification:

... Investors sometimes feel nervous or uncomfortable about stock volatility and prefer that their portfolio not be more volatile than the overall market. In fact, there are investment managers who are more than willing to capitalize on investor nervousness by constructing portfolios with an eye toward ...

... Investors sometimes feel nervous or uncomfortable about stock volatility and prefer that their portfolio not be more volatile than the overall market. In fact, there are investment managers who are more than willing to capitalize on investor nervousness by constructing portfolios with an eye toward ...

Document

... increase in the number of shares. This generally occurs when shares are issued in exchange for the purchase of a business, and incremental income from the new business must be at least the return on equity (ROE) of the old business. When the purchase price includes goodwill, this becomes a higher hu ...

... increase in the number of shares. This generally occurs when shares are issued in exchange for the purchase of a business, and incremental income from the new business must be at least the return on equity (ROE) of the old business. When the purchase price includes goodwill, this becomes a higher hu ...

Report submitted by Alternative Investment Policy Advisory

... pension funds, insurance companies, banks and endowments and investing them in promising enterprises, add strategic value to portfolio companies, monitor the investments and exit with the aim of realising a reasonable risk-adjusted return. The fund managers of AIF’s are fiduciaries acting in the bes ...

... pension funds, insurance companies, banks and endowments and investing them in promising enterprises, add strategic value to portfolio companies, monitor the investments and exit with the aim of realising a reasonable risk-adjusted return. The fund managers of AIF’s are fiduciaries acting in the bes ...

the guide to understanding deflation

... with that buyer’s, then the value of the asset falls, and it falls for everyone who owns it. If a million other people own it, then their net worth goes down even though they did nothing. Two investors made it happen by transacting, and the rest of the investors made it happen by choosing not to dis ...

... with that buyer’s, then the value of the asset falls, and it falls for everyone who owns it. If a million other people own it, then their net worth goes down even though they did nothing. Two investors made it happen by transacting, and the rest of the investors made it happen by choosing not to dis ...

Why Do SMEs Use Informal Credit? A Comparison between Countries

... is far more complicated and not related to the financing aspect only. It can be considered in advertising theory (Nadiri 1969), but also in production quality signalling theory (Lee and Stove, 1993). Another important aspect of trade credit is related to research in the field of operations (Haley an ...

... is far more complicated and not related to the financing aspect only. It can be considered in advertising theory (Nadiri 1969), but also in production quality signalling theory (Lee and Stove, 1993). Another important aspect of trade credit is related to research in the field of operations (Haley an ...

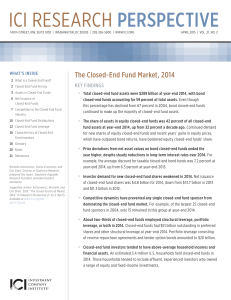

The Closed-End Fund Market, 2014

... common shares to investors during an initial public offering. Subsequent issuance of common shares can occur through secondary or follow-on offerings, at-the-market offerings, rights offerings, or dividend reinvestment. Closed-end funds also are permitted to issue one class of preferred shares in ad ...

... common shares to investors during an initial public offering. Subsequent issuance of common shares can occur through secondary or follow-on offerings, at-the-market offerings, rights offerings, or dividend reinvestment. Closed-end funds also are permitted to issue one class of preferred shares in ad ...

The properties of hedge fund investors* actual returns

... find that even after adjusting for various costs and biases returns on hedge funds exceed those from comparable benchmarks, i.e., hedge funds earn positive alpha for their investors (Stulz 2007). The magnitude of this alpha varies across studies but typical estimates are on the magnitude of 3 to 5 ...

... find that even after adjusting for various costs and biases returns on hedge funds exceed those from comparable benchmarks, i.e., hedge funds earn positive alpha for their investors (Stulz 2007). The magnitude of this alpha varies across studies but typical estimates are on the magnitude of 3 to 5 ...

- Franklin Templeton Investments

... All investments involve risks, including possible loss of principal. Interest rate movements, unscheduled mortgage prepayments and other risk factors will affect the Fund’s share price and yield. Bond prices generally move in the opposite direction of interest rates. As prices of bonds in the Fund a ...

... All investments involve risks, including possible loss of principal. Interest rate movements, unscheduled mortgage prepayments and other risk factors will affect the Fund’s share price and yield. Bond prices generally move in the opposite direction of interest rates. As prices of bonds in the Fund a ...

The Impact of Market Sentiment Index on Stock

... many stock markets, particularly in the European countries. Malaysia is a non exception whereby for the period of the Asian financial crisis from end-June 1997 to end-August 1998 the Kuala Lumpur Composite Index (FBMKLCI) declined by 72% (Zulkafli, Zingales, & Ismail, 2007). According to the informa ...

... many stock markets, particularly in the European countries. Malaysia is a non exception whereby for the period of the Asian financial crisis from end-June 1997 to end-August 1998 the Kuala Lumpur Composite Index (FBMKLCI) declined by 72% (Zulkafli, Zingales, & Ismail, 2007). According to the informa ...

Analysing and Decomposing the Sources of Added

... the intuition suggests that the interaction between performance and hedging motives should also play an important role. We analyse this effect and show that investor welfare can be improved by the design of performance-seeking portfolios with improved liability-hedging properties, or conversely by t ...

... the intuition suggests that the interaction between performance and hedging motives should also play an important role. We analyse this effect and show that investor welfare can be improved by the design of performance-seeking portfolios with improved liability-hedging properties, or conversely by t ...

four reasons to consider an allocation to international small cap

... We believe that a proven quantitative methodology is the most appropriate way to manage an international small cap portfolio. LMCG utilizes a factor-based quantitative investment methodology to cull through thousands of securities – attempting to identify those companies with the highest likelihood ...

... We believe that a proven quantitative methodology is the most appropriate way to manage an international small cap portfolio. LMCG utilizes a factor-based quantitative investment methodology to cull through thousands of securities – attempting to identify those companies with the highest likelihood ...

Government Intervention in Venture Capital in Canada: Toward

... debt might not be the optimum form of capital. This particularly applies to fast-growing firms that need to recycle cash to fuel future growth, rather than to service debt. Lenders themselves have acknowledged these difficulties, and some have attempted to deal with them. For example, RBC has a Know ...

... debt might not be the optimum form of capital. This particularly applies to fast-growing firms that need to recycle cash to fuel future growth, rather than to service debt. Lenders themselves have acknowledged these difficulties, and some have attempted to deal with them. For example, RBC has a Know ...

The performance of hedge funds and mutual funds in

... capital markets.1 These limitations raise questions about the value added provided by these funds, for example, compared to traditional long-only mutual funds. Emerging market hedge funds have been analyzed as one among many strategies in hedge fund performance measurement literature such as Fung an ...

... capital markets.1 These limitations raise questions about the value added provided by these funds, for example, compared to traditional long-only mutual funds. Emerging market hedge funds have been analyzed as one among many strategies in hedge fund performance measurement literature such as Fung an ...

Rural Finance in Nigeria

... although it came at great cost and would not be efficient to reproduce, Nigeria’s rural finance policies and practices have left behind a respectable (but diminishing) rural branch network. Nigeria also has a history of public private partnerships with commercial banks and other private sector actor ...

... although it came at great cost and would not be efficient to reproduce, Nigeria’s rural finance policies and practices have left behind a respectable (but diminishing) rural branch network. Nigeria also has a history of public private partnerships with commercial banks and other private sector actor ...

Corporate Governance and Enterprise Reform in

... Banks and outside investors lack the capacity, the regulatory support, and the incentives to actively monitor and influence companies’ behavior. Bankruptcy of state-owned enterprises is largely an administrative process, and the effective rights of creditor banks in cases of debtor default are weak. ...

... Banks and outside investors lack the capacity, the regulatory support, and the incentives to actively monitor and influence companies’ behavior. Bankruptcy of state-owned enterprises is largely an administrative process, and the effective rights of creditor banks in cases of debtor default are weak. ...

#32842_30_Mutual Fund Regulation_P1 1..72

... generation of income and preservation of capital through investment in short-term, high-quality debt securities.5 Unlike other registered investment companies, money market funds seek to maintain a stable price per share of $16 through the use of either the amortized cost valuation method or the pen ...

... generation of income and preservation of capital through investment in short-term, high-quality debt securities.5 Unlike other registered investment companies, money market funds seek to maintain a stable price per share of $16 through the use of either the amortized cost valuation method or the pen ...

2014 annual report at the very heart of healthcare. medical

... buy – but you can build it by example, after example, ...

... buy – but you can build it by example, after example, ...

citigroup`s 2008 annual report on form 10-k

... quarter of 2011, compared to a positive CVA of $255 million in the prior-year period. Excluding CVA, Citicorp revenues were flat year-over-year, as growth in international Regional Consumer Banking and Transaction Services was offset by lower revenues in North America Regional Consumer Banking and S ...

... quarter of 2011, compared to a positive CVA of $255 million in the prior-year period. Excluding CVA, Citicorp revenues were flat year-over-year, as growth in international Regional Consumer Banking and Transaction Services was offset by lower revenues in North America Regional Consumer Banking and S ...

Reforming Major Interest Rate Benchmarks

... The major interest reference rates (such as LIBOR, EURIBOR, and TIBOR) are widely used in the global financial system as benchmarks for a large volume and broad range of financial products and contracts. The cases of attempted market manipulation and false reporting of global reference rates, togeth ...

... The major interest reference rates (such as LIBOR, EURIBOR, and TIBOR) are widely used in the global financial system as benchmarks for a large volume and broad range of financial products and contracts. The cases of attempted market manipulation and false reporting of global reference rates, togeth ...