A Market-led Revolution

... lengthy, participatory process facilitated by Stepwise Management (a consulting firm based in Germany). Months of staff time was spent developing mission, values and vision, assessing Equity’s strengths, weaknesses, opportunities and threats, preparing a “structure tree” outlining critical success f ...

... lengthy, participatory process facilitated by Stepwise Management (a consulting firm based in Germany). Months of staff time was spent developing mission, values and vision, assessing Equity’s strengths, weaknesses, opportunities and threats, preparing a “structure tree” outlining critical success f ...

Form 10-Q - Wells Fargo

... • The Independent Directors of the Board have retained the law firm of Shearman & Sterling LLP to assist in its investigation into the Company's retail banking sales practices and related matters. • An extensive review was performed by an independent consulting firm going back to 2011, which was ...

... • The Independent Directors of the Board have retained the law firm of Shearman & Sterling LLP to assist in its investigation into the Company's retail banking sales practices and related matters. • An extensive review was performed by an independent consulting firm going back to 2011, which was ...

Federal Republic of Nigeria: Assessment of Community Banks

... NACRDB is not yet in a position to fully serve farmers in Nigeria. The comparative advantage that community banks have is their spatial proximity to their clients; their intimate knowledge of local cultures, habits, opportunities and constraints; and a concentration on simple banking functions. Desp ...

... NACRDB is not yet in a position to fully serve farmers in Nigeria. The comparative advantage that community banks have is their spatial proximity to their clients; their intimate knowledge of local cultures, habits, opportunities and constraints; and a concentration on simple banking functions. Desp ...

One Size Fits All? Costs and Benefits of Uniform Accounting Standards

... complexity of actually implementing a uniform standard, but also to latent concerns, if not skepticism, on whether a single, international standard is even desirable. The literature on international accounting standards is large and growing. These papers examine the effects of international accounti ...

... complexity of actually implementing a uniform standard, but also to latent concerns, if not skepticism, on whether a single, international standard is even desirable. The literature on international accounting standards is large and growing. These papers examine the effects of international accounti ...

1 - University of Mauritius

... Hong et al. (2000) investigate the relation between momentum and size in more detail. Hong et al. examine the momentum effect by dividing the sample into three momentum portfolios instead of ten. Most papers find that momentum is more pronounced for extreme stock returns, which might reduce the stre ...

... Hong et al. (2000) investigate the relation between momentum and size in more detail. Hong et al. examine the momentum effect by dividing the sample into three momentum portfolios instead of ten. Most papers find that momentum is more pronounced for extreme stock returns, which might reduce the stre ...

Alpha Australian Blue Chip Fund

... Series. The Alpha Fund Series provides investors with access to sector-specific multimanager funds in the following asset classes: large market capitalisation Australian shares, small to mid market capitalisation Australian shares, global shares, fixed interest securities and property securities. ...

... Series. The Alpha Fund Series provides investors with access to sector-specific multimanager funds in the following asset classes: large market capitalisation Australian shares, small to mid market capitalisation Australian shares, global shares, fixed interest securities and property securities. ...

Institutional Competition in the Post-Soviet Space

... political factors. On the contrary, Russian Big Three telecom companies’ involvement in the CIS seems to be mostly driven by purely economic considerations, while Russian investors currently control the dominant share of the mobile service providers market in the CIS. It is worth noticing, that Russ ...

... political factors. On the contrary, Russian Big Three telecom companies’ involvement in the CIS seems to be mostly driven by purely economic considerations, while Russian investors currently control the dominant share of the mobile service providers market in the CIS. It is worth noticing, that Russ ...

Macro-prudential policy for residential mortgage lending (CP87

... in ensuring mortgage insurers undertake their obligations diligently. Mortgage insurers also work very closely with lenders when borrowers go into arrears to help keep those borrowers from losing their home where an affordable and sustainable solution can be found. Mortgage insurers are experienced ...

... in ensuring mortgage insurers undertake their obligations diligently. Mortgage insurers also work very closely with lenders when borrowers go into arrears to help keep those borrowers from losing their home where an affordable and sustainable solution can be found. Mortgage insurers are experienced ...

Agarwal Daniel Naik

... investors may have different high-water marks than original investors.” We specifically address this issue and determine the managerial incentives by measuring the delta of the manager’s incentive-fee option. For this purpose, we compute a fund’s yearly money-flows since the start of a fund’s return ...

... investors may have different high-water marks than original investors.” We specifically address this issue and determine the managerial incentives by measuring the delta of the manager’s incentive-fee option. For this purpose, we compute a fund’s yearly money-flows since the start of a fund’s return ...

Japan Bond Market Guide

... Extract from Financial Services Agency on the Development of Markets for Specified (Professional) Investors).........................................................................................................24 Japan Securities Dealers Association Regulations for Bond Transactions.............. ...

... Extract from Financial Services Agency on the Development of Markets for Specified (Professional) Investors).........................................................................................................24 Japan Securities Dealers Association Regulations for Bond Transactions.............. ...

... and region effects, as well as from an analysis of homebuyers whose purchase timing was determined by arguably exogenous changes in family structure. Since Dutch mortgages are full recourse, which rules out strategic default behavior, the findings provide new support for the "housing lock hypothesis ...

The Valuation of Collateralised Debt Obligations - DORAS

... o f the market includes approximately 34,000 publicly quoted firms worldwide compared to the 500 or so for which an active CDS market exists. It is estimated that the debt issuance by these 34,000 firms exceeds that o f the top 500 issuers. It comprises, in the main, privately issued debt, provided ...

... o f the market includes approximately 34,000 publicly quoted firms worldwide compared to the 500 or so for which an active CDS market exists. It is estimated that the debt issuance by these 34,000 firms exceeds that o f the top 500 issuers. It comprises, in the main, privately issued debt, provided ...

INTERNATIONAL Route des Morillons 15 Tel: (41 22) 929 88 88 CO

... - to allow financial instruments that are redeemable at book value to be accounted for as equity when they represent the most subordinate interest of an entity, even if they don’t give an individual right on the remaining net assets in case of liquidation ...

... - to allow financial instruments that are redeemable at book value to be accounted for as equity when they represent the most subordinate interest of an entity, even if they don’t give an individual right on the remaining net assets in case of liquidation ...

Capital Series Product Disclosure Statement (Part 1 of 2)

... This PDS has been prepared by Commonwealth Bank of Australia (“Commonwealth Bank”), the issuer of Capital Series. This PDS does not constitute an offer for sale or issue of any securities by Commonwealth Bank that requires disclosure under Chapter 6D of the Corporations Act 2001 (Cth). Terms of Sale ...

... This PDS has been prepared by Commonwealth Bank of Australia (“Commonwealth Bank”), the issuer of Capital Series. This PDS does not constitute an offer for sale or issue of any securities by Commonwealth Bank that requires disclosure under Chapter 6D of the Corporations Act 2001 (Cth). Terms of Sale ...

The Challenge of Sustainable Outreach: How can Public Banks

... Bangladesh, Bolivia and some other countries demonstrated that banking with the poor is not only viable, but indeed has a strong positive developmental impact on clients (income, employment, health, etc.). This was the beginning of what M. Robinson (2001) recently called the Microfinance Revolution. ...

... Bangladesh, Bolivia and some other countries demonstrated that banking with the poor is not only viable, but indeed has a strong positive developmental impact on clients (income, employment, health, etc.). This was the beginning of what M. Robinson (2001) recently called the Microfinance Revolution. ...

The Causes of Fraud in Financial Crises: Evidence

... Figure 1 illustrates the mortgage securitization industry. Mortgage originators, usually home lenders, sell loans to mortgagors, usually home borrowers. Originators sell mortgage debts to securities issuers who bundle them together into MBSs. Issuers register and sell MBSs and are responsible for th ...

... Figure 1 illustrates the mortgage securitization industry. Mortgage originators, usually home lenders, sell loans to mortgagors, usually home borrowers. Originators sell mortgage debts to securities issuers who bundle them together into MBSs. Issuers register and sell MBSs and are responsible for th ...

The Financial Intermediation Premium in the Cross Section of Stock

... In my benchmark specification, I construct three portfolios with low, medium, and high financial intermediary leverage (FILe) as follows. First, based on information from syndicated loans, I establish links (borrower-lender relationships) between firms and the financial institutions from which these ...

... In my benchmark specification, I construct three portfolios with low, medium, and high financial intermediary leverage (FILe) as follows. First, based on information from syndicated loans, I establish links (borrower-lender relationships) between firms and the financial institutions from which these ...

The Impact of Costs and Returns on the Investment

... The Swiss pension fund system is part of the so-called ‘2. Säule‘ of the Swiss retirement plan. The ‘2. Säule‘ covers all pension fund payments related to a person’s professional life. The pension fund scheme helps employees (i) to save money for retirement and (ii) to hedge against invalidity and d ...

... The Swiss pension fund system is part of the so-called ‘2. Säule‘ of the Swiss retirement plan. The ‘2. Säule‘ covers all pension fund payments related to a person’s professional life. The pension fund scheme helps employees (i) to save money for retirement and (ii) to hedge against invalidity and d ...

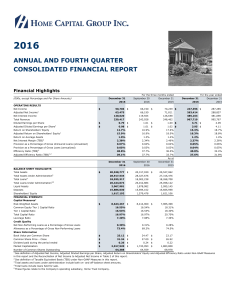

2016 Q4 Report - Home Capital Group

... From time to time Home Capital Group Inc. makes written and verbal forward-looking statements. These are included in the Annual Report, periodic reports to shareholders, regulatory filings, press releases, Company presentations and other Company communications. Forward-looking statements are made in ...

... From time to time Home Capital Group Inc. makes written and verbal forward-looking statements. These are included in the Annual Report, periodic reports to shareholders, regulatory filings, press releases, Company presentations and other Company communications. Forward-looking statements are made in ...

Investor Flows and Fragility in Corporate Bond Funds

... so are more likely to internalize the negative externalities generated by their outflows. Indeed, consistent with this hypothesis, we find that the effect of illiquidity on the sensitivity of outflows to bad performance diminishes when the fund is held mostly by institutional investors. Sixth, the d ...

... so are more likely to internalize the negative externalities generated by their outflows. Indeed, consistent with this hypothesis, we find that the effect of illiquidity on the sensitivity of outflows to bad performance diminishes when the fund is held mostly by institutional investors. Sixth, the d ...

Relational exchanges versus arm`s

... the incentives to trade with outsiders or strangers via arm’s-length transactions are likely to grow. For organizations under high competitive pressures, trading with distant others possessing unique and novel information and resources may be especially crucial to facilitate the absorption, transfer ...

... the incentives to trade with outsiders or strangers via arm’s-length transactions are likely to grow. For organizations under high competitive pressures, trading with distant others possessing unique and novel information and resources may be especially crucial to facilitate the absorption, transfer ...

Privatizing Fannie and Freddie: Be Careful What

... would be more in line with what investors charge SIFIs for contingent capital, through what are called CoCo bonds. These bonds pay investors a yield unless a financial institution approaches insolvency, at which time the bond turns into equity in the institution, providing needed capital. A popular ...

... would be more in line with what investors charge SIFIs for contingent capital, through what are called CoCo bonds. These bonds pay investors a yield unless a financial institution approaches insolvency, at which time the bond turns into equity in the institution, providing needed capital. A popular ...

Non-Performing Loans in CESEE

... banks’ lending) leads to higher NPLs. Although bank-level factors have a significant impact on NPLs, their overall explanatory power was found to be low. The panel VAR analysis broadly confirms the existence of strong macro-financial linkages. In particular, the impulse response functions reveal tha ...

... banks’ lending) leads to higher NPLs. Although bank-level factors have a significant impact on NPLs, their overall explanatory power was found to be low. The panel VAR analysis broadly confirms the existence of strong macro-financial linkages. In particular, the impulse response functions reveal tha ...

Q1 2017 Investor Presentation

... 1 End of period loans and leases for 1Q17 and 4Q16 exclude $9.5B and $9.2B of non-U.S. consumer credit card loans, which are included in assets of business held for sale on the consolidated balance sheet, beginning in 4Q16. 2 See notes A, B and C on slide 25 for definitions of Global Liquidity Sourc ...

... 1 End of period loans and leases for 1Q17 and 4Q16 exclude $9.5B and $9.2B of non-U.S. consumer credit card loans, which are included in assets of business held for sale on the consolidated balance sheet, beginning in 4Q16. 2 See notes A, B and C on slide 25 for definitions of Global Liquidity Sourc ...