Did the Commercial Funding Paper Facility Prevent a Great

... of Basel 1 and 2 is based on the view that the risk management provisions for very large banks effectively lowered the capital requirements from Basel 1 levels. This implies Basel 2 marked an aggregate easing of bank capital standards, particularly because the small number of banks eligible for usin ...

... of Basel 1 and 2 is based on the view that the risk management provisions for very large banks effectively lowered the capital requirements from Basel 1 levels. This implies Basel 2 marked an aggregate easing of bank capital standards, particularly because the small number of banks eligible for usin ...

Banking crises yesterday and today

... Recent research that investigates the determinants of banking fragility across different countries in the current era reaches a similar conclusion: the expansion of government-sponsored deposit insurance and other bank safety net programmes throughout the world in the past three decades accounts ver ...

... Recent research that investigates the determinants of banking fragility across different countries in the current era reaches a similar conclusion: the expansion of government-sponsored deposit insurance and other bank safety net programmes throughout the world in the past three decades accounts ver ...

Barrios Urbanos (7D)

... higher monthly costs (Index 106) but fewer mortgages (Index 89). • Most are older homes, more than 60% built from 1950 to 1989. ...

... higher monthly costs (Index 106) but fewer mortgages (Index 89). • Most are older homes, more than 60% built from 1950 to 1989. ...

Investment Implications of an “Activist” Federal Reserve

... This is for informative purposes only and in no event should be construed as a recommendation by us or as an offer to sell, or solicitation of an offer to buy any securities. The information given herein is taken from sources that we believe to be reliable, but is not guaranteed by us as to accuracy ...

... This is for informative purposes only and in no event should be construed as a recommendation by us or as an offer to sell, or solicitation of an offer to buy any securities. The information given herein is taken from sources that we believe to be reliable, but is not guaranteed by us as to accuracy ...

Download paper (PDF)

... on millions of people, and the poverty to which so many even in the seemingly successful countries seemed condemned. While even apologists for market capitalism have not--at least in recent years--suggested that the market system by itself would generate socially acceptable distributions of income ...

... on millions of people, and the poverty to which so many even in the seemingly successful countries seemed condemned. While even apologists for market capitalism have not--at least in recent years--suggested that the market system by itself would generate socially acceptable distributions of income ...

Our Brave New World

... 2) the most expensive words ever pronounced, 3) the surest way to lose any kind of credibility, And yet, this is exactly what we aim to argue in the following pages. Arguing that ‘things are different this time’, we freely admit that we might end up drawing the wrong conclusions, say silly things an ...

... 2) the most expensive words ever pronounced, 3) the surest way to lose any kind of credibility, And yet, this is exactly what we aim to argue in the following pages. Arguing that ‘things are different this time’, we freely admit that we might end up drawing the wrong conclusions, say silly things an ...

Financial System Overview and the Flow of Funds

... of institutions and markets Major institutions and their regulators Interest rate determination Risk. risk management, and risk premiums Important financial markets in depth Closer scrutiny of the money market and important factors influencing conditions Detailed review of important cred ...

... of institutions and markets Major institutions and their regulators Interest rate determination Risk. risk management, and risk premiums Important financial markets in depth Closer scrutiny of the money market and important factors influencing conditions Detailed review of important cred ...

The £13 billion sale of former Northern Rock assets (Summary)

... valuation. It judged that the alternative would expose it to slower balance sheet reduction, and greater execution and market risk. At the option evaluation stage, Credit Suisse found that large sales scored lowest in terms of taxpayer value, but highest in terms of balance sheet reduction. To sell ...

... valuation. It judged that the alternative would expose it to slower balance sheet reduction, and greater execution and market risk. At the option evaluation stage, Credit Suisse found that large sales scored lowest in terms of taxpayer value, but highest in terms of balance sheet reduction. To sell ...

Economic Insights - CIBC Economics

... • The latest jobs data were one of the last hurdles to cross before a Fed hike in September and it was cleared with room to spare. What’s surprising, then, is how calmly the bond market further out the curve has taken the approach to that lift off. Tame inflation and some equity jitters have kept T ...

... • The latest jobs data were one of the last hurdles to cross before a Fed hike in September and it was cleared with room to spare. What’s surprising, then, is how calmly the bond market further out the curve has taken the approach to that lift off. Tame inflation and some equity jitters have kept T ...

Enhancing Access to Capital for Smaller Unsubsidized Multifamily Rental Properties

... with well-documented income and expense histories to compensate for the costliness of doing full due diligence. 3 There is reason to believe that investment and lending in the small property market can be profitable. A number of creative lending institutions have engaged successfully with this secto ...

... with well-documented income and expense histories to compensate for the costliness of doing full due diligence. 3 There is reason to believe that investment and lending in the small property market can be profitable. A number of creative lending institutions have engaged successfully with this secto ...

2 THE REAL ECONOMY

... sheets lent to entities that invested in assets generated by securitisation and also to entities that then bought derivatives derived from assets generated by securitisation. The bulk of the risks were diversified in this system (at least theoretically). However, it was necessary to seek final asset ...

... sheets lent to entities that invested in assets generated by securitisation and also to entities that then bought derivatives derived from assets generated by securitisation. The bulk of the risks were diversified in this system (at least theoretically). However, it was necessary to seek final asset ...

Urban Development Institute of Australia - 2017

... are liveable, affordable and connected. Value Capture will make an important contribution to infrastructure funding, and UDIA will be responding separately to the Commonwealth’s discussion paper Using Value Capture To Help Deliver Major Land Transport Infrastructure. However, the current interest ra ...

... are liveable, affordable and connected. Value Capture will make an important contribution to infrastructure funding, and UDIA will be responding separately to the Commonwealth’s discussion paper Using Value Capture To Help Deliver Major Land Transport Infrastructure. However, the current interest ra ...

Nonbanks and Lending Standards in Mortgage Markets. The

... as collateral; 3) Some mortgage lenders are more exposed to MBS than others. For example, nonbanks, which cannot fund their loans with deposits, rely on repo borrowings that are repaid once the loan is securitized and sold as a MBS (Echeverry, Stanton and Wallace 2016). For these lenders, the e¤ecti ...

... as collateral; 3) Some mortgage lenders are more exposed to MBS than others. For example, nonbanks, which cannot fund their loans with deposits, rely on repo borrowings that are repaid once the loan is securitized and sold as a MBS (Echeverry, Stanton and Wallace 2016). For these lenders, the e¤ecti ...

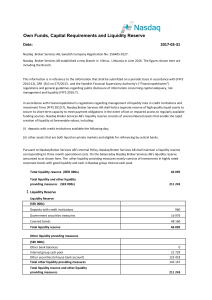

Own Funds, Capital Requirements and Liquidity Reserve

... investment firms (FFFS 2010:7), Nasdaq Broker Services AB shall hold a separate reserve of high-quality liquid assets to secure its short-term capacity to meet payment obligations in the event of lost or impaired access to regularly available funding sources. Nasdaq Broker Services AB’s liquidity re ...

... investment firms (FFFS 2010:7), Nasdaq Broker Services AB shall hold a separate reserve of high-quality liquid assets to secure its short-term capacity to meet payment obligations in the event of lost or impaired access to regularly available funding sources. Nasdaq Broker Services AB’s liquidity re ...

United States housing bubble

The United States housing bubble was an economic bubble affecting many parts of the United States housing market in over half of American states. Housing prices peaked in early 2006, started to decline in 2006 and 2007, and reached new lows in 2012. On December 30, 2008, the Case-Shiller home price index reported its largest price drop in its history. The credit crisis resulting from the bursting of the housing bubble is—according to general consensus—the primary cause of the 2007–2009 recession in the United States.Increased foreclosure rates in 2006–2007 among U.S. homeowners led to a crisis in August 2008 for the subprime, Alt-A, collateralized debt obligation (CDO), mortgage, credit, hedge fund, and foreign bank markets. In October 2007, the U.S. Secretary of the Treasury called the bursting housing bubble ""the most significant risk to our economy.""Any collapse of the U.S. housing bubble has a direct impact not only on home valuations, but the nation's mortgage markets, home builders, real estate, home supply retail outlets, Wall Street hedge funds held by large institutional investors, and foreign banks, increasing the risk of a nationwide recession. Concerns about the impact of the collapsing housing and credit markets on the larger U.S. economy caused President George W. Bush and the Chairman of the Federal Reserve Ben Bernanke to announce a limited bailout of the U.S. housing market for homeowners who were unable to pay their mortgage debts.In 2008 alone, the United States government allocated over $900 billion to special loans and rescues related to the U.S. housing bubble, with over half going to Fannie Mae and Freddie Mac (both of which are government-sponsored enterprises) as well as the Federal Housing Administration. On December 24, 2009, the Treasury Department made an unprecedented announcement that it would be providing Fannie Mae and Freddie Mac unlimited financial support for the next three years despite acknowledging losses in excess of $400 billion so far. The Treasury has been criticized for encroaching on spending powers that are enumerated for Congress alone by the United States Constitution, and for violating limits imposed by the Housing and Economic Recovery Act of 2008.