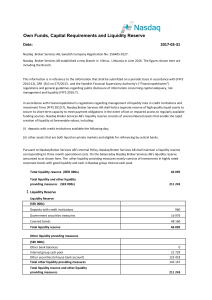

Own Funds, Capital Requirements and Liquidity Reserve

... investment firms (FFFS 2010:7), Nasdaq Broker Services AB shall hold a separate reserve of high-quality liquid assets to secure its short-term capacity to meet payment obligations in the event of lost or impaired access to regularly available funding sources. Nasdaq Broker Services AB’s liquidity re ...

... investment firms (FFFS 2010:7), Nasdaq Broker Services AB shall hold a separate reserve of high-quality liquid assets to secure its short-term capacity to meet payment obligations in the event of lost or impaired access to regularly available funding sources. Nasdaq Broker Services AB’s liquidity re ...

Financial Regulation, Behavioural Finance, and the Global Credit

... Electronic copy available at: http://ssrn.com/abstract=1132665 ...

... Electronic copy available at: http://ssrn.com/abstract=1132665 ...

Access to Refinancing and Mortgage Interest Rates

... evidence of income and/or assets, etc.), and (ii) the borrower being able to provide a sufficient downpayment, typically through borrowing no more than a certain percentage of the appraised home value. Although historically the market for mortgage refinancing functioned smoothly, it encountered stro ...

... evidence of income and/or assets, etc.), and (ii) the borrower being able to provide a sufficient downpayment, typically through borrowing no more than a certain percentage of the appraised home value. Although historically the market for mortgage refinancing functioned smoothly, it encountered stro ...

Heading Upstream

... 3 Outperformance: It’s also feasible that commodity equities will outperform commodities themselves in a rising price environment. For any given percentage increase in price, a producer’s profits will increase by a greater percentage, all else equal. This leverage to commodity prices is greater for ...

... 3 Outperformance: It’s also feasible that commodity equities will outperform commodities themselves in a rising price environment. For any given percentage increase in price, a producer’s profits will increase by a greater percentage, all else equal. This leverage to commodity prices is greater for ...

Japan`s Experience in the Late 1980s and the Lessons

... accelerated from 1985 to 1986. However, the rise was relatively moderate in the early stage and two years (1985–86) coincided with the “endaka recession” (a recession caused by the appreciation of the yen). While few view these years as being part of the bubble period, many consider 1987 as the begi ...

... accelerated from 1985 to 1986. However, the rise was relatively moderate in the early stage and two years (1985–86) coincided with the “endaka recession” (a recession caused by the appreciation of the yen). While few view these years as being part of the bubble period, many consider 1987 as the begi ...

The Broken Bank White Paper_v10

... has contributed to systemic inflation and more severe economic cycles. According to the Consumer Price Index, inflation has increased 2,324.3 percent since the inception of the Federal Reserve in 19135. An item that cost $100 in 19136 now costs $2,324.30. This system gives central banks the ability ...

... has contributed to systemic inflation and more severe economic cycles. According to the Consumer Price Index, inflation has increased 2,324.3 percent since the inception of the Federal Reserve in 19135. An item that cost $100 in 19136 now costs $2,324.30. This system gives central banks the ability ...

drivers of the global real estate financial markets

... How can the real estate (investment) industry develop appropriate risk management strategies where risk is not the exclusively dominant criterion for investment decisions (i.e. avoid the risk of risk management)? • Dimension 4: Scarcity of capital for the riskier market segments How to finance prop ...

... How can the real estate (investment) industry develop appropriate risk management strategies where risk is not the exclusively dominant criterion for investment decisions (i.e. avoid the risk of risk management)? • Dimension 4: Scarcity of capital for the riskier market segments How to finance prop ...

NBER WORKING PAPER SERIES TAX REFORM Patric H. Hendershott David C. Ling

... tax—advantages of owner—occupied housing to higher income households relative to lower income households. In fact, our analysis suggests that all reforms will lower the price of obtaining housing services from owner—occupied housing for these households and raise it for higher—income households. The ...

... tax—advantages of owner—occupied housing to higher income households relative to lower income households. In fact, our analysis suggests that all reforms will lower the price of obtaining housing services from owner—occupied housing for these households and raise it for higher—income households. The ...

Download attachment

... transpired that LTCM were using some 75 counterparties1 (or financial institutions) to source their credit. The list of lenders reads like the Who’s Who of banking. The fund had borrowed 50 times its capital leaving the financial system dangerously exposed when it crashed. Billions of dollars worth of ...

... transpired that LTCM were using some 75 counterparties1 (or financial institutions) to source their credit. The list of lenders reads like the Who’s Who of banking. The fund had borrowed 50 times its capital leaving the financial system dangerously exposed when it crashed. Billions of dollars worth of ...

Financial Frictions, Asset Prices, and the Great Recession

... should not be a primitive, as it is in our model, but an outcome of deeper mechanisms. This paper is related to several strands of the literature. First, it is part of the literature that attributes the recession to household financial distress, which is partly inspired by the empirical work of Mian ...

... should not be a primitive, as it is in our model, but an outcome of deeper mechanisms. This paper is related to several strands of the literature. First, it is part of the literature that attributes the recession to household financial distress, which is partly inspired by the empirical work of Mian ...

United States housing bubble

The United States housing bubble was an economic bubble affecting many parts of the United States housing market in over half of American states. Housing prices peaked in early 2006, started to decline in 2006 and 2007, and reached new lows in 2012. On December 30, 2008, the Case-Shiller home price index reported its largest price drop in its history. The credit crisis resulting from the bursting of the housing bubble is—according to general consensus—the primary cause of the 2007–2009 recession in the United States.Increased foreclosure rates in 2006–2007 among U.S. homeowners led to a crisis in August 2008 for the subprime, Alt-A, collateralized debt obligation (CDO), mortgage, credit, hedge fund, and foreign bank markets. In October 2007, the U.S. Secretary of the Treasury called the bursting housing bubble ""the most significant risk to our economy.""Any collapse of the U.S. housing bubble has a direct impact not only on home valuations, but the nation's mortgage markets, home builders, real estate, home supply retail outlets, Wall Street hedge funds held by large institutional investors, and foreign banks, increasing the risk of a nationwide recession. Concerns about the impact of the collapsing housing and credit markets on the larger U.S. economy caused President George W. Bush and the Chairman of the Federal Reserve Ben Bernanke to announce a limited bailout of the U.S. housing market for homeowners who were unable to pay their mortgage debts.In 2008 alone, the United States government allocated over $900 billion to special loans and rescues related to the U.S. housing bubble, with over half going to Fannie Mae and Freddie Mac (both of which are government-sponsored enterprises) as well as the Federal Housing Administration. On December 24, 2009, the Treasury Department made an unprecedented announcement that it would be providing Fannie Mae and Freddie Mac unlimited financial support for the next three years despite acknowledging losses in excess of $400 billion so far. The Treasury has been criticized for encroaching on spending powers that are enumerated for Congress alone by the United States Constitution, and for violating limits imposed by the Housing and Economic Recovery Act of 2008.