World Residential Markets

... bonds although there are global forces at work on them and shaping their future. Success in buying homes or residential property investments abroad therefore depends on understanding which forces are local and which more universal. This new publication contains information on a wide range of popular ...

... bonds although there are global forces at work on them and shaping their future. Success in buying homes or residential property investments abroad therefore depends on understanding which forces are local and which more universal. This new publication contains information on a wide range of popular ...

Cheap Credit, Collateral and the Boom-Bust Cycle

... constraints with housing acting as collateral (as well as providing housing services). These two ingredients together lead to a pattern in which if it is possible to borrow, households borrow and increase their housing and non-housing consumption, and the rise in demand for housing becomes partially ...

... constraints with housing acting as collateral (as well as providing housing services). These two ingredients together lead to a pattern in which if it is possible to borrow, households borrow and increase their housing and non-housing consumption, and the rise in demand for housing becomes partially ...

10ADM-06 Standardized Financial Maintenance Requirements for Medicaid Applicants/Recipients

... The LDSS must compare the total reported expenses on the Financial Maintenance form to the A/R’s income and then determine if the A/R provided a sufficient explanation of how he/she is meeting monthly living expenses. For example, if an explanation is provided for each reported expense not covered b ...

... The LDSS must compare the total reported expenses on the Financial Maintenance form to the A/R’s income and then determine if the A/R provided a sufficient explanation of how he/she is meeting monthly living expenses. For example, if an explanation is provided for each reported expense not covered b ...

Winners and Losers in Housing Markets

... downpayment for buying a house; the household rents and consumes modestly to save for a downpayment. When the household accumulates some net worth, the household buys a house subject to the collateral constraint, which is smaller than a house that would be bought without the collateral constraint. A ...

... downpayment for buying a house; the household rents and consumes modestly to save for a downpayment. When the household accumulates some net worth, the household buys a house subject to the collateral constraint, which is smaller than a house that would be bought without the collateral constraint. A ...

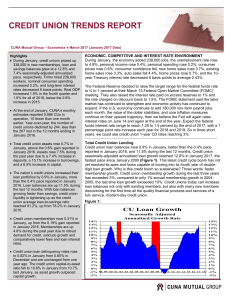

credit union trends report

... credit union borrowings is their quarter-end capital-to-asset ratios. This arbitrage opportunity exists because the government-sponsored enterprises, Fannie Mae and Freddie Mac, cannot deposit their excess liquidity at the Federal Reserve and must therefore sell their excess liquidity in the fed fun ...

... credit union borrowings is their quarter-end capital-to-asset ratios. This arbitrage opportunity exists because the government-sponsored enterprises, Fannie Mae and Freddie Mac, cannot deposit their excess liquidity at the Federal Reserve and must therefore sell their excess liquidity in the fed fun ...

ARM Case Study - Financial Accounting

... view. Now the pendulum seems to have swung the other way. There are many clear reasons why we can no longer expect good returns from common stocks. The risk premium has disappeared. Valuations are so high that it will take years for the market to readjust to reasonable valuation levels. Accounting s ...

... view. Now the pendulum seems to have swung the other way. There are many clear reasons why we can no longer expect good returns from common stocks. The risk premium has disappeared. Valuations are so high that it will take years for the market to readjust to reasonable valuation levels. Accounting s ...

English

... decided to discontinue financing to Company C Group. In January 1999, Credit Cooperative A transferred assets including Loan Nos. 1 through 5 to X (Plaintiff, Intermediate Appellee and Intermediate Appellant), and went into dissolution. In this case, X claimed, as against Y1 and Y2, losses in respec ...

... decided to discontinue financing to Company C Group. In January 1999, Credit Cooperative A transferred assets including Loan Nos. 1 through 5 to X (Plaintiff, Intermediate Appellee and Intermediate Appellant), and went into dissolution. In this case, X claimed, as against Y1 and Y2, losses in respec ...

Risk Management of Personal Lending Business

... The Hong Kong Monetary Authority (HKMA) noticed a persistent trend of rising household indebtedness since the global financial crisis. The level of household indebtedness as a percentage of GDP has reached a level that may prove unsustainable should global monetary conditions normalise and interest ...

... The Hong Kong Monetary Authority (HKMA) noticed a persistent trend of rising household indebtedness since the global financial crisis. The level of household indebtedness as a percentage of GDP has reached a level that may prove unsustainable should global monetary conditions normalise and interest ...

State of the Union: The Financial Crisis and the ECB`s

... assets, the Eurosystem has continued to provide liquidity in foreign currencies, most notably in US dollars. In addition, the ECB agreed with the central banks of several European countries outside the euro area to improve the provision of euro liquidity to their banking sectors. This measure has be ...

... assets, the Eurosystem has continued to provide liquidity in foreign currencies, most notably in US dollars. In addition, the ECB agreed with the central banks of several European countries outside the euro area to improve the provision of euro liquidity to their banking sectors. This measure has be ...

The CosT of The Wall sTreeT-Caused finanCial Collapse and

... 11 million homeowners—almost 1 in 4—are saddled with mortgages higher than the value of their homes. Home values have fallen to 2002 levels, destroying $7 trillion in homeowner equity. 3.7 to 5 million foreclosures have already forced millions of American families to move out of their homes ...

... 11 million homeowners—almost 1 in 4—are saddled with mortgages higher than the value of their homes. Home values have fallen to 2002 levels, destroying $7 trillion in homeowner equity. 3.7 to 5 million foreclosures have already forced millions of American families to move out of their homes ...

Developing NDIS housing for people with complex support needs

... program was around $300,000 per person.7 Based on these estimates, creating a housing option for all 6,200 young people in RAC, which the NDIS budget enables, has a capital requirement of $1.8 billion across the next ten years. While not all young people in RAC will choose to leave, the NDIS funding ...

... program was around $300,000 per person.7 Based on these estimates, creating a housing option for all 6,200 young people in RAC, which the NDIS budget enables, has a capital requirement of $1.8 billion across the next ten years. While not all young people in RAC will choose to leave, the NDIS funding ...

United States housing bubble

The United States housing bubble was an economic bubble affecting many parts of the United States housing market in over half of American states. Housing prices peaked in early 2006, started to decline in 2006 and 2007, and reached new lows in 2012. On December 30, 2008, the Case-Shiller home price index reported its largest price drop in its history. The credit crisis resulting from the bursting of the housing bubble is—according to general consensus—the primary cause of the 2007–2009 recession in the United States.Increased foreclosure rates in 2006–2007 among U.S. homeowners led to a crisis in August 2008 for the subprime, Alt-A, collateralized debt obligation (CDO), mortgage, credit, hedge fund, and foreign bank markets. In October 2007, the U.S. Secretary of the Treasury called the bursting housing bubble ""the most significant risk to our economy.""Any collapse of the U.S. housing bubble has a direct impact not only on home valuations, but the nation's mortgage markets, home builders, real estate, home supply retail outlets, Wall Street hedge funds held by large institutional investors, and foreign banks, increasing the risk of a nationwide recession. Concerns about the impact of the collapsing housing and credit markets on the larger U.S. economy caused President George W. Bush and the Chairman of the Federal Reserve Ben Bernanke to announce a limited bailout of the U.S. housing market for homeowners who were unable to pay their mortgage debts.In 2008 alone, the United States government allocated over $900 billion to special loans and rescues related to the U.S. housing bubble, with over half going to Fannie Mae and Freddie Mac (both of which are government-sponsored enterprises) as well as the Federal Housing Administration. On December 24, 2009, the Treasury Department made an unprecedented announcement that it would be providing Fannie Mae and Freddie Mac unlimited financial support for the next three years despite acknowledging losses in excess of $400 billion so far. The Treasury has been criticized for encroaching on spending powers that are enumerated for Congress alone by the United States Constitution, and for violating limits imposed by the Housing and Economic Recovery Act of 2008.