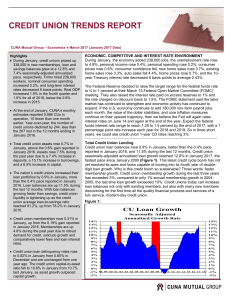

credit union trends report

... expand. If the U.S. economy continues to add 180,000 non-farm payroll jobs each month, the value of the dollar stabilizes, and core inflation measures continue on their upward trajectory, then we believe the Fed will again raise interest rates on June 14 and again at the end of the year. Expect the ...

... expand. If the U.S. economy continues to add 180,000 non-farm payroll jobs each month, the value of the dollar stabilizes, and core inflation measures continue on their upward trajectory, then we believe the Fed will again raise interest rates on June 14 and again at the end of the year. Expect the ...

two-year interest rate

... – The price of the one-year bond varies inversely with the current one year nominal interest rate – A two-year bond—a bond that promises one payment of $100 in two years. Price of the two-year bond: ...

... – The price of the one-year bond varies inversely with the current one year nominal interest rate – A two-year bond—a bond that promises one payment of $100 in two years. Price of the two-year bond: ...

HOW TO EVALUATE THE YIELD CURVE IN A TRANSITION ECONOMY

... well-evaluated yield curve not only perfectly reflects the current condition of some economy but also provides foresight. It is an unavoidable tool for every financial intermediary or any participant in financial market activities. Consequently, for more than a century, theories have been developed ...

... well-evaluated yield curve not only perfectly reflects the current condition of some economy but also provides foresight. It is an unavoidable tool for every financial intermediary or any participant in financial market activities. Consequently, for more than a century, theories have been developed ...

Money Market Operations in China: Monetary Policy or

... Repo rates have eleven categories including overnight, 7-day, 14-day, 21-day, 1-month, 2-month, 3-month, 4-month, 6-month, 9-month and 1-year. ...

... Repo rates have eleven categories including overnight, 7-day, 14-day, 21-day, 1-month, 2-month, 3-month, 4-month, 6-month, 9-month and 1-year. ...

MishkinCh06

... • Bonds of different maturities are not substitutes at all • The interest rate for each bond with a different maturity is determined by the demand for and supply of that bond • Investors have preferences for bonds of one maturity over another • If investors have short desired holding periods and gen ...

... • Bonds of different maturities are not substitutes at all • The interest rate for each bond with a different maturity is determined by the demand for and supply of that bond • Investors have preferences for bonds of one maturity over another • If investors have short desired holding periods and gen ...

chap010

... • Valuation of a financial asset is based on determining the present value of future cash flows – Required rate of return (the discount rate) • Depends on the market’s perceived level of risk associated with the individual security • It is also competitively determined among companies seeking financ ...

... • Valuation of a financial asset is based on determining the present value of future cash flows – Required rate of return (the discount rate) • Depends on the market’s perceived level of risk associated with the individual security • It is also competitively determined among companies seeking financ ...

Finance 534 week 10 quiz 9 Question 1 Which of the following

... Answer Under normal conditions, a firm's expected ROE would probably be higher if it financed with short-term rather than with long-term debt, but using short-term debt would probably increase the firm's risk. Conservative firms generally use no short-term debt and thus have zero current liabilities ...

... Answer Under normal conditions, a firm's expected ROE would probably be higher if it financed with short-term rather than with long-term debt, but using short-term debt would probably increase the firm's risk. Conservative firms generally use no short-term debt and thus have zero current liabilities ...

DATA ANALYSIS

... in the economy because businesses take time to reduce the size of their workforce. However the increase may be proof of a possible recession – even the minimum level is not falling ...

... in the economy because businesses take time to reduce the size of their workforce. However the increase may be proof of a possible recession – even the minimum level is not falling ...

Assignment 3 Solutions

... So 17 quarters are needed or 4.25 years for the desired growth to occur. 3-2-50 Essentially, we just plug into the various formulas with P = 1, r = 0.02, t = 2010. With simple interest, we have: A ...

... So 17 quarters are needed or 4.25 years for the desired growth to occur. 3-2-50 Essentially, we just plug into the various formulas with P = 1, r = 0.02, t = 2010. With simple interest, we have: A ...

Money, Interest and Income

... The greater the responsiveness of the demand for money to income, as measured by k • The lower the responsiveness of the demand for money to the interest rate, h These points can be confirmed by experimenting with Figure 109 or examining equation (7a), ...

... The greater the responsiveness of the demand for money to income, as measured by k • The lower the responsiveness of the demand for money to the interest rate, h These points can be confirmed by experimenting with Figure 109 or examining equation (7a), ...

Chapter 15

... 11 introduced the time value of money and showed how it is used to make financial decisions. Chapter 12 used the time value of money concept to determine if business investment activities should be undertaken. Chapters 13 and 14 explored the issues surrounding business financing decisions. Chapter 1 ...

... 11 introduced the time value of money and showed how it is used to make financial decisions. Chapter 12 used the time value of money concept to determine if business investment activities should be undertaken. Chapters 13 and 14 explored the issues surrounding business financing decisions. Chapter 1 ...

14ed Bonds

... Issuer can refund if rates decline. That helps the issuer but hurts the investor. Therefore, borrowers are willing to pay more, and lenders require more, on callable bonds. Most bonds have a deferred call and a declining call premium Yield to call: yearly rate of return earned on a bond until it’s c ...

... Issuer can refund if rates decline. That helps the issuer but hurts the investor. Therefore, borrowers are willing to pay more, and lenders require more, on callable bonds. Most bonds have a deferred call and a declining call premium Yield to call: yearly rate of return earned on a bond until it’s c ...

CDS Spread Determinants

... We find that, in general, the results for the sub-sample periods are very similar to each other and to the whole sample period results. In general, our results in Table 4 suggest that the theoretical explanatory variables remain robust to explain the CDS spread for different time periods in Japan. ...

... We find that, in general, the results for the sub-sample periods are very similar to each other and to the whole sample period results. In general, our results in Table 4 suggest that the theoretical explanatory variables remain robust to explain the CDS spread for different time periods in Japan. ...

Holt Algebra 1 2-9

... 2. Find the simple interest paid for 9 months on a a $500 loan at 8% per year. $30 3. After 2 years the simple interest earned on an investment of 4000 was $216. Find the interest rate. 2.7% Holt Algebra 1 ...

... 2. Find the simple interest paid for 9 months on a a $500 loan at 8% per year. $30 3. After 2 years the simple interest earned on an investment of 4000 was $216. Find the interest rate. 2.7% Holt Algebra 1 ...

Ingo(104).pdf

... There is a lively literature that discusses bank credit in the context of informational asymmetries, financial distress and agency costs. Based on the lending relationship between banks and SMEs, it is considered that the inherent information asymmetries drive borrowed firms to harsh credit constrai ...

... There is a lively literature that discusses bank credit in the context of informational asymmetries, financial distress and agency costs. Based on the lending relationship between banks and SMEs, it is considered that the inherent information asymmetries drive borrowed firms to harsh credit constrai ...

198 - uwcentre

... 198. You have been offered the opportunity to invest in a project which will pay $1,000 per year at the end of years one through 10 and $2,000 per year at the end of years 21 through 30. If the appropriate discount rate is 8%, what is the present value of this cash flow pattern? 199. You are saving ...

... 198. You have been offered the opportunity to invest in a project which will pay $1,000 per year at the end of years one through 10 and $2,000 per year at the end of years 21 through 30. If the appropriate discount rate is 8%, what is the present value of this cash flow pattern? 199. You are saving ...

3_Ansel_Caine

... At the time of the TBA trade, the characteristics of the MBSs are limited, the rest are “To Be Announced” two days prior to trade settlement Forward delivery and the ability to satisfy TBA trades with any MBSs of the type agreed upon allow an HFA to lock in a price at the time of reservation S ...

... At the time of the TBA trade, the characteristics of the MBSs are limited, the rest are “To Be Announced” two days prior to trade settlement Forward delivery and the ability to satisfy TBA trades with any MBSs of the type agreed upon allow an HFA to lock in a price at the time of reservation S ...

The Yield Curve

... Observed Phenomena -Yield Curve The downward sloping (inverted) yield curve is unusual but not rare. Interest rates of bonds of all maturities move together (are positively correlated) The downward sloping (inverted) yield curve tends to occur when interest rates in general are high. ...

... Observed Phenomena -Yield Curve The downward sloping (inverted) yield curve is unusual but not rare. Interest rates of bonds of all maturities move together (are positively correlated) The downward sloping (inverted) yield curve tends to occur when interest rates in general are high. ...

PDF - Allen Tate Mortgage

... ARM will change over time. No one can be sure when an index rate will go up or down. Some index rates tend to be higher than others, and some more volatile. (But if a lender bases interest rate adjustments on the average value of an index over time, your interest rate would not be as volatile.) You ...

... ARM will change over time. No one can be sure when an index rate will go up or down. Some index rates tend to be higher than others, and some more volatile. (But if a lender bases interest rate adjustments on the average value of an index over time, your interest rate would not be as volatile.) You ...

Carbaugh, International Economics 9e, Chapter 14

... Deficit nations Would be losing gold, therefore shrinking their money supply and causing prices to fall Lower prices would make their exports more competitive and lessen demand for imports, restoring equilibrium ...

... Deficit nations Would be losing gold, therefore shrinking their money supply and causing prices to fall Lower prices would make their exports more competitive and lessen demand for imports, restoring equilibrium ...

Manulife Investments GIC

... §§Interest can compound to maturity — or, for a non-registered GIC account, be credited monthly, quarterly, semi-annually or annually to the Daily Interest Account ...

... §§Interest can compound to maturity — or, for a non-registered GIC account, be credited monthly, quarterly, semi-annually or annually to the Daily Interest Account ...

Principles of Economics

... The Demand for Money (The Liquid Preference) Portfolio of holding financial wealth: stocks, bonds or money. Holding wealth in currency or checking deposits means loss of potential income from interest on bonds and dividends on ...

... The Demand for Money (The Liquid Preference) Portfolio of holding financial wealth: stocks, bonds or money. Holding wealth in currency or checking deposits means loss of potential income from interest on bonds and dividends on ...

PDF Download

... sheet. Banks receive “fresh money” from the central bank, which aims to enable them to ...

... sheet. Banks receive “fresh money” from the central bank, which aims to enable them to ...

dividend stock investments in a rising interest rate environment

... Information and recommendations contained in Capstone Asset Management Company’s market commentaries and writings are of a general nature and are provided solely for the use of Capstone Asset Management Company, its clients and prospective clients. This content is not to be reproduced, copied or mad ...

... Information and recommendations contained in Capstone Asset Management Company’s market commentaries and writings are of a general nature and are provided solely for the use of Capstone Asset Management Company, its clients and prospective clients. This content is not to be reproduced, copied or mad ...

Using Derivatives to Manage Interest Rate Risk Derivatives A

... The best futures contract will generally be the December 2013, 3-month Eurodollar futures contract, which is the first to expire after November 2013. The contract that expires immediately after the known cash transactions date is generally best because its futures price will show the highest corre ...

... The best futures contract will generally be the December 2013, 3-month Eurodollar futures contract, which is the first to expire after November 2013. The contract that expires immediately after the known cash transactions date is generally best because its futures price will show the highest corre ...