Download pdf | 371 KB |

... Of course this is very unrealistic – it requires common understanding between the central bank and everyone else about the structure of the economy, the current state it is in and also perfect clarity about the precise objectives of the central bank (including how it sees trade-offs between objecti ...

... Of course this is very unrealistic – it requires common understanding between the central bank and everyone else about the structure of the economy, the current state it is in and also perfect clarity about the precise objectives of the central bank (including how it sees trade-offs between objecti ...

interest rate, exchange rate and inflation in romania

... 2.2 Exchange rate - interest rate relation Over time, several theories have emerged regarding the exchange rate and the foreign exchange market. We mention here: the theory of purchasing power parity and interest rate parity theory. In essence, the theory of purchasing power parity says that a count ...

... 2.2 Exchange rate - interest rate relation Over time, several theories have emerged regarding the exchange rate and the foreign exchange market. We mention here: the theory of purchasing power parity and interest rate parity theory. In essence, the theory of purchasing power parity says that a count ...

The Dutch housing market - mortgage interest rates, house prices

... possible defaults. Dutch owner-occupiers may acquire such an NHG insurance against a onetime premium, when they lend money to either buy or renovate their homes. The NHG is issued by the Dutch Homeownership Guarantee Fund (WEW) and thus insures repayment to the mortgage lender of the mortgage amount ...

... possible defaults. Dutch owner-occupiers may acquire such an NHG insurance against a onetime premium, when they lend money to either buy or renovate their homes. The NHG is issued by the Dutch Homeownership Guarantee Fund (WEW) and thus insures repayment to the mortgage lender of the mortgage amount ...

Common Sense Regulation

... that you’ve wanted is a great option, but don’t forget that it’s also a great opportunity to put a little more away in savings. Putting your savings into a money market account (MMA) or a certificate of deposit (CD) provides a safe way of earning interest and growing your balance over time. CDs can ...

... that you’ve wanted is a great option, but don’t forget that it’s also a great opportunity to put a little more away in savings. Putting your savings into a money market account (MMA) or a certificate of deposit (CD) provides a safe way of earning interest and growing your balance over time. CDs can ...

ASX Listing Rules Appendix 5B - Mining exploration entity

... Amount drawn at quarter end $A’000 ...

... Amount drawn at quarter end $A’000 ...

STEUART V. LAW A COMPARISON ON NATIONAL DEBT AND THE CREATION

... particular the ill-devised repairment of it. Steuart shows how the capital holdings and profits of the Company were actually more than able to support the interests due on the notes, even after being merged with the government's finances, and the Mint. In the chapters building up to his critique of ...

... particular the ill-devised repairment of it. Steuart shows how the capital holdings and profits of the Company were actually more than able to support the interests due on the notes, even after being merged with the government's finances, and the Mint. In the chapters building up to his critique of ...

Capital Markets

... • Households borrow to finance housing. The higher are interest rates, the smaller is the house that the householders can buy with a mortgage payment that they can afford. ...

... • Households borrow to finance housing. The higher are interest rates, the smaller is the house that the householders can buy with a mortgage payment that they can afford. ...

Credit Secure Benefit Details

... primary or supplementary Credit Card holders. Credit Limit means the aggregate maximum debit balances permitted by the Bank on the Credit Card for the Primary Credit Card holder or the Supplementary Credit Card holders, if any, and notified to the Primary Credit Card holder from time to time. Credit ...

... primary or supplementary Credit Card holders. Credit Limit means the aggregate maximum debit balances permitted by the Bank on the Credit Card for the Primary Credit Card holder or the Supplementary Credit Card holders, if any, and notified to the Primary Credit Card holder from time to time. Credit ...

Liability

... Example of Southwest Airlines o Southwest Airlines borrows $100,000 from Bank of America on September 1, 2012. o Signing a 6%, six-month note for the amount borrowed plus accrued interest due six months later on March 1, 2013. o On September 1, 2012, Southwest will receive $100,000 in cash and reco ...

... Example of Southwest Airlines o Southwest Airlines borrows $100,000 from Bank of America on September 1, 2012. o Signing a 6%, six-month note for the amount borrowed plus accrued interest due six months later on March 1, 2013. o On September 1, 2012, Southwest will receive $100,000 in cash and reco ...

A behavioural finance model of exchange rate expectations within a

... exchange rate represents the expectations of the market regarding the future value of the spot rate. • We support instead reversed causality: the forward exchange rate is simply the spot rate plus the interest rate differential ...

... exchange rate represents the expectations of the market regarding the future value of the spot rate. • We support instead reversed causality: the forward exchange rate is simply the spot rate plus the interest rate differential ...

file

... – Personal characteristics of borrower – age; first time buyer; gender; credit score and history; occupation; changes in income and employment status – Location specific factors – • liquidity of housing asset;, rising/falling house prices • likelihood of becoming unemployed and finding new employmen ...

... – Personal characteristics of borrower – age; first time buyer; gender; credit score and history; occupation; changes in income and employment status – Location specific factors – • liquidity of housing asset;, rising/falling house prices • likelihood of becoming unemployed and finding new employmen ...

SUNTRUST BANKS INC (Form: 10-Q, Received: 08

... The above mentioned financial statements have been prepared in accordance with the instructions to Form 10-Q and Rule 10-01 of Regulation S-X, and accordingly do not include all of the information and footnotes required by generally accepted accounting principles for complete financial statements. H ...

... The above mentioned financial statements have been prepared in accordance with the instructions to Form 10-Q and Rule 10-01 of Regulation S-X, and accordingly do not include all of the information and footnotes required by generally accepted accounting principles for complete financial statements. H ...

The Impact of Inflation

... year, consider saving $1,030 this year ($1,000 x the 3% average historical rate of inflation). To continue at that inflation-adjusted rate, you would save $1,061 the following year. ...

... year, consider saving $1,030 this year ($1,000 x the 3% average historical rate of inflation). To continue at that inflation-adjusted rate, you would save $1,061 the following year. ...

Relationship between Interest Rate and Bank Common Stock Return

... never go down. Therefore, many banks and mortgage lending institutions kept giving out mortgage loans without requirement on a credit check or the ability to pay from their borrowers. After issuing mortgage loans, these institutions packed them into portfolios and issued the mortgage-backed securiti ...

... never go down. Therefore, many banks and mortgage lending institutions kept giving out mortgage loans without requirement on a credit check or the ability to pay from their borrowers. After issuing mortgage loans, these institutions packed them into portfolios and issued the mortgage-backed securiti ...

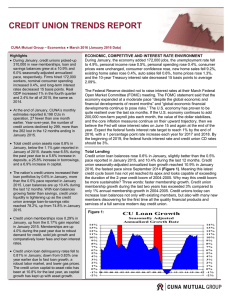

March

... quite resilient over the last six months. If the U.S. economy continues to add 200,000 non-farm payroll jobs each month, the value of the dollar stabilizes, and the core inflation measures continue on their upward trajectory, then we believe the Fed will raise interest rates on June 15 and again at ...

... quite resilient over the last six months. If the U.S. economy continues to add 200,000 non-farm payroll jobs each month, the value of the dollar stabilizes, and the core inflation measures continue on their upward trajectory, then we believe the Fed will raise interest rates on June 15 and again at ...

Examination Paper, Solutions and Examiner`s Report Certificate in

... The commercial activities and associated core competencies of a company will affect the risk appetite of that company. RRR manufactures a specialised home security product and may need to take risk by investing in research and development activities with uncertain outcomes with the aim of keeping at ...

... The commercial activities and associated core competencies of a company will affect the risk appetite of that company. RRR manufactures a specialised home security product and may need to take risk by investing in research and development activities with uncertain outcomes with the aim of keeping at ...

Market Risk Guidance Notes - Reserve Bank of New Zealand

... The disclosure Orders in Council (the “Orders”) require New Zealand-incorporated banks to disclose their capital charge for market risk, broken down into sub-totals for each type of market risk in their full year and half year disclosure statements, and the total amount in their off-quarter disclosu ...

... The disclosure Orders in Council (the “Orders”) require New Zealand-incorporated banks to disclose their capital charge for market risk, broken down into sub-totals for each type of market risk in their full year and half year disclosure statements, and the total amount in their off-quarter disclosu ...

Fin 129

... into their components. Be able to interpret changes in any of the components. Given the relevant information be able to use the component to analyze changes in the banks financial position. Be able to look at a UBPR and interpret the information and apply ration analysis to the information in the re ...

... into their components. Be able to interpret changes in any of the components. Given the relevant information be able to use the component to analyze changes in the banks financial position. Be able to look at a UBPR and interpret the information and apply ration analysis to the information in the re ...

Chapter 4

... Banks hold reserves for three reasons: 1. On any given day, some depositors withdraw cash from their checking accounts, while others deposit cash into their accounts. 2. In the same way, on any given day, people with accounts at the bank write checks to people with accounts at other banks, and peopl ...

... Banks hold reserves for three reasons: 1. On any given day, some depositors withdraw cash from their checking accounts, while others deposit cash into their accounts. 2. In the same way, on any given day, people with accounts at the bank write checks to people with accounts at other banks, and peopl ...

Risk Free Discount Rates under AASB 1038 1

... The TF also discussed whether the rate that is used as a starting point has to be a government bond rate. It was noted that paragraph 8.8.2 was not definitive. Additionally, under financial economic theory a number of assets (or portfolios of assets) with different fair values may have cash flows th ...

... The TF also discussed whether the rate that is used as a starting point has to be a government bond rate. It was noted that paragraph 8.8.2 was not definitive. Additionally, under financial economic theory a number of assets (or portfolios of assets) with different fair values may have cash flows th ...

Engineering Economics - Inside Mines

... A new piece of equipment is being evaluated for purchase which will generate annual benefits in the amount of $10,000 for a 10 year period, with annual costs of $5,000. The initial cost of the machine is $40,000 and the expected salvage is $2,000 at the end of 10 years. What is the net annual worth ...

... A new piece of equipment is being evaluated for purchase which will generate annual benefits in the amount of $10,000 for a 10 year period, with annual costs of $5,000. The initial cost of the machine is $40,000 and the expected salvage is $2,000 at the end of 10 years. What is the net annual worth ...

1 - ASU

... a. The final number of bacteria is 3 times as much of the initial value instead of 2 times as much. b. The initial number of bacteria is 3 instead of 2. c. The number of bacteria triples every day instead of doubling every day. d. The growth rate of the bacteria in the culture is 30% per day instead ...

... a. The final number of bacteria is 3 times as much of the initial value instead of 2 times as much. b. The initial number of bacteria is 3 instead of 2. c. The number of bacteria triples every day instead of doubling every day. d. The growth rate of the bacteria in the culture is 30% per day instead ...

A Call to ARMs: Adjustable Rate Mortgages in the 1980s

... lower initial interest rates than FRMs. The relaxation of restrictions on ARMs nationBecause borrowers typically qualify for mortwide in 1981 was followed by a period of experimengages based on the rafio of their initial mortgage tation with the various allowable ARM features to payment to their cur ...

... lower initial interest rates than FRMs. The relaxation of restrictions on ARMs nationBecause borrowers typically qualify for mortwide in 1981 was followed by a period of experimengages based on the rafio of their initial mortgage tation with the various allowable ARM features to payment to their cur ...