Technical Handbook

... received after the cut-off time and there is insufficient cover available because the tier two investment has already been effected, these payment orders shall not be effected until sufficient funds are once again available in the account. Retransfer, including interest, is effected on the maturity ...

... received after the cut-off time and there is insufficient cover available because the tier two investment has already been effected, these payment orders shall not be effected until sufficient funds are once again available in the account. Retransfer, including interest, is effected on the maturity ...

FRBSF L CONOMIC

... income. The rapid rise in household net worth encouraged lenders to ease credit even further based on the assumption that house price appreciation would continue indefinitely. U.S. household leverage, as measured by the ratio of debt to disposable income, reached an all-time high of 130% in 2007. Th ...

... income. The rapid rise in household net worth encouraged lenders to ease credit even further based on the assumption that house price appreciation would continue indefinitely. U.S. household leverage, as measured by the ratio of debt to disposable income, reached an all-time high of 130% in 2007. Th ...

The EGP Exchange Rate Questions

... • Accumulating more foreign assets would be reflected in a domestic money supply increase, which in the absence of a sterilization intervention would initiate further inflationary pressures. Raising the nominal interest rates in that case would attract further foreign inflows, leading to a self-fulf ...

... • Accumulating more foreign assets would be reflected in a domestic money supply increase, which in the absence of a sterilization intervention would initiate further inflationary pressures. Raising the nominal interest rates in that case would attract further foreign inflows, leading to a self-fulf ...

Interest Rate

... by its current market price. Discount Yield and Investment Yield: The yield on Tbills (and other discounted securities, such as commercial paper) which are selling at a discount of their maturity values. Yield to Maturity: The interest rate that equates the future payments to be received from a fina ...

... by its current market price. Discount Yield and Investment Yield: The yield on Tbills (and other discounted securities, such as commercial paper) which are selling at a discount of their maturity values. Yield to Maturity: The interest rate that equates the future payments to be received from a fina ...

Aging and Deflation from a Fiscal Perspective

... in some emerging economies such as China as well. This implies that the interconnection between aging and deflation will be an important issue for the emerging countries in the near future. In this study, we analyze the impact of price changes on income distribution across generations and investigate ...

... in some emerging economies such as China as well. This implies that the interconnection between aging and deflation will be an important issue for the emerging countries in the near future. In this study, we analyze the impact of price changes on income distribution across generations and investigate ...

Chapter 8 Working Capital Management

... - Cash before delivery (CBD): Payment before delivery is scheduled. - Cash on delivery (COD): Payment made at the time of delivery. - Bill-to-bill: Prior bill must be paid before next delivery. - Monthly billing: Similar to ordinary, but the net days are the end of the ...

... - Cash before delivery (CBD): Payment before delivery is scheduled. - Cash on delivery (COD): Payment made at the time of delivery. - Bill-to-bill: Prior bill must be paid before next delivery. - Monthly billing: Similar to ordinary, but the net days are the end of the ...

- Südzucker International Finance BV

... bond. Neither does Südzucker currently intend to take any action, such as increase capital for cash or issue a new hybrid bond to fulfil the conditions for termination nor make a public offer to buy back any bonds by way of meeting a capital market compliant procedure, since this could negatively im ...

... bond. Neither does Südzucker currently intend to take any action, such as increase capital for cash or issue a new hybrid bond to fulfil the conditions for termination nor make a public offer to buy back any bonds by way of meeting a capital market compliant procedure, since this could negatively im ...

The challenges for monetary policy

... The baseline scenario used by the FOMC’s members assumes that, if inflation expectations are well anchored, inflation will progressively converge on its target as labour market slack decreases and the effects of the transitory factors wears off – as has been observed to be happening gradually over t ...

... The baseline scenario used by the FOMC’s members assumes that, if inflation expectations are well anchored, inflation will progressively converge on its target as labour market slack decreases and the effects of the transitory factors wears off – as has been observed to be happening gradually over t ...

How Homeowners Choose between Fixed and Adjustable Rate

... Few papers have empirically examined the choice between fixed-rate and adjustable-rate mortgages. Dhillon, Shilling, and Sirmanes (1987) examined micro data on mortgage borrowing and estimated a reduced form of an econometric model of mortgage choice. Their results indicated that pricing variables ...

... Few papers have empirically examined the choice between fixed-rate and adjustable-rate mortgages. Dhillon, Shilling, and Sirmanes (1987) examined micro data on mortgage borrowing and estimated a reduced form of an econometric model of mortgage choice. Their results indicated that pricing variables ...

Analysis of the Discount Factors in Swap Valuation

... underlying swap contract. It is necessary for such kind of contracts to exist in the financial markets for the debt issuers, in order to keep their flexibility. Some debt issuers need the right to withdraw a certain swap in future, while others require the chance to enter into a prespecified swap la ...

... underlying swap contract. It is necessary for such kind of contracts to exist in the financial markets for the debt issuers, in order to keep their flexibility. Some debt issuers need the right to withdraw a certain swap in future, while others require the chance to enter into a prespecified swap la ...

PDF

... G10 countries. Even though the Basel Committee cannot enforce any of the accords, most member countries still follow their recommendations. The goal of the Basel Committee is to help banks measure and control their risks more accurately and efficiently, which can help increase the profitability, pri ...

... G10 countries. Even though the Basel Committee cannot enforce any of the accords, most member countries still follow their recommendations. The goal of the Basel Committee is to help banks measure and control their risks more accurately and efficiently, which can help increase the profitability, pri ...

Maturity and interest

... One reason to immunize is active bond management. The bonds you find attractively priced cannot be made to cash flow match your obligation. Consider a company that has issued a GIC. Based on analysis of various securities in the fixed income market, it chooses to fund the obligation with 3year zeros ...

... One reason to immunize is active bond management. The bonds you find attractively priced cannot be made to cash flow match your obligation. Consider a company that has issued a GIC. Based on analysis of various securities in the fixed income market, it chooses to fund the obligation with 3year zeros ...

Some international trends in the regulation of mortgage markets

... high dispersion in the models, reflecting the fact that mortgages markets are local in nature, depending on legal and institutional factors. At the same time, however, the reliance on wholesale markets for the funding of mortgages implies that these securities have a global dimension. The contrast b ...

... high dispersion in the models, reflecting the fact that mortgages markets are local in nature, depending on legal and institutional factors. At the same time, however, the reliance on wholesale markets for the funding of mortgages implies that these securities have a global dimension. The contrast b ...

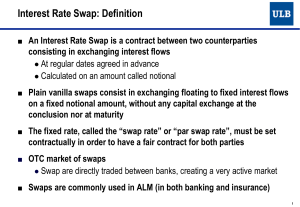

Interest Rate Swap

... ● Suppose that in the market, the 20 years swap rate against Euribor 6 months is 3.5% ● If the bank enters a 20 years spot swap (with a decreasing notional in order to reflect the amortizing schemes of the loans), then a margin of 1% is guaranteed during 20 years ...

... ● Suppose that in the market, the 20 years swap rate against Euribor 6 months is 3.5% ● If the bank enters a 20 years spot swap (with a decreasing notional in order to reflect the amortizing schemes of the loans), then a margin of 1% is guaranteed during 20 years ...

International Fixed Interest Fund

... The International Fixed Interest Fund invests mainly in international fixed interest assets. Investments may include: • fixed interest assets issued by government or international companies, and • cash and cash equivalents. The fund aims to achieve a positive yearly return (after the fund charge and ...

... The International Fixed Interest Fund invests mainly in international fixed interest assets. Investments may include: • fixed interest assets issued by government or international companies, and • cash and cash equivalents. The fund aims to achieve a positive yearly return (after the fund charge and ...

Impact of Interest Rate Changes on Banking Sector

... Low interest rates prove beneficial to lenders for a short short span of time,given the higher lending activity. However the deposit rates are decreased at a much slower rate, as the banks try to attract more depositors, to take advantage of the high lending activity, consequently resulting in lower ...

... Low interest rates prove beneficial to lenders for a short short span of time,given the higher lending activity. However the deposit rates are decreased at a much slower rate, as the banks try to attract more depositors, to take advantage of the high lending activity, consequently resulting in lower ...

Influence of Interest Rates Determinants on the Performance of

... difference in spot and future exchange rates. This parity condition states that the domestic interest rate should equal the foreign interest rate plus the expected change of the exchange rates. The interest rate differential between domestic country and world is equal to the expected change in the d ...

... difference in spot and future exchange rates. This parity condition states that the domestic interest rate should equal the foreign interest rate plus the expected change of the exchange rates. The interest rate differential between domestic country and world is equal to the expected change in the d ...

The Impact of Inflation

... contained in this report does not purport to be a complete description of the securities, markets, or developments referred to in this material. This information is not intended as a solicitation or an offer to buy or sell any security referred to herein. Investments mentioned may not be suitable fo ...

... contained in this report does not purport to be a complete description of the securities, markets, or developments referred to in this material. This information is not intended as a solicitation or an offer to buy or sell any security referred to herein. Investments mentioned may not be suitable fo ...

Credit History and the Performance of Prime and Nonprime Mortgages

... Home owners can be driven to default by trigger events, such as a loss in income or job, that make it impossible for the household to meet its financial obligations. Therefore, indicators such as the area unemployment rate provide a proxy for some of the trigger events. However, some borrowers are m ...

... Home owners can be driven to default by trigger events, such as a loss in income or job, that make it impossible for the household to meet its financial obligations. Therefore, indicators such as the area unemployment rate provide a proxy for some of the trigger events. However, some borrowers are m ...

Solution 1:

... ► Equal to ► Can not be found (It's worth (1+i) times the value of the ordinary annuity with the same terms Annuity due means you get the money at the beginning of the period, rather than the end, hence the times 1+i value is considered. ...

... ► Equal to ► Can not be found (It's worth (1+i) times the value of the ordinary annuity with the same terms Annuity due means you get the money at the beginning of the period, rather than the end, hence the times 1+i value is considered. ...

Pindyck/Rubinfeld Microeconomics

... Capital is measured as a stock. If a firm owns an electric motor factory worth $10 million, we say that it has a capital stock worth $10 million. Suppose the firm sells 8000 motors per month for $52.50 each. Average variable cost is $42.50 per unit. Average profit is $52.50 – $42.50 = $10 per unit a ...

... Capital is measured as a stock. If a firm owns an electric motor factory worth $10 million, we say that it has a capital stock worth $10 million. Suppose the firm sells 8000 motors per month for $52.50 each. Average variable cost is $42.50 per unit. Average profit is $52.50 – $42.50 = $10 per unit a ...

Joint Center for Housing Studies Harvard University Natalie Pickering

... sector often constructing their own homes with insufficient materials and few basic services. Markets are not clearing, in part, because of distortions in the institutional structure of mortgage finance that prevent long-term lending. The SOFOLES, in particular, are constrained by funding; FOVI cann ...

... sector often constructing their own homes with insufficient materials and few basic services. Markets are not clearing, in part, because of distortions in the institutional structure of mortgage finance that prevent long-term lending. The SOFOLES, in particular, are constrained by funding; FOVI cann ...

Integrated Approach to Managing Risk and

... managing trading floor risks, it has many limitations for managing the risks of a structural balance sheet. For example, consider the treasury function. Such monitoring the risk can be used for position management but it is not used for structural balance sheet management, formulating funding strat ...

... managing trading floor risks, it has many limitations for managing the risks of a structural balance sheet. For example, consider the treasury function. Such monitoring the risk can be used for position management but it is not used for structural balance sheet management, formulating funding strat ...

The Bank of Japan's Experience with Non-Traditional Monetary Policy* Kazuo Ueda

... of 2007, central banks around the world have been engaging in the so-called non-traditional approaches to stimulate the economies and address problems in the financial system. Although unprecedented measures seem to have been adopted by major central banks since 2007, many of them have been tried in ...

... of 2007, central banks around the world have been engaging in the so-called non-traditional approaches to stimulate the economies and address problems in the financial system. Although unprecedented measures seem to have been adopted by major central banks since 2007, many of them have been tried in ...