Bonds, Interest Rates, and the Impact of Inflation

... There are two fundamental ways that you can profit from owning bonds: from the interest that bonds pay, or from any increase in the bond's price. Many people who invest in bonds because they want a steady stream of income are surprised to learn that bond prices can fluctuate, just as they do with an ...

... There are two fundamental ways that you can profit from owning bonds: from the interest that bonds pay, or from any increase in the bond's price. Many people who invest in bonds because they want a steady stream of income are surprised to learn that bond prices can fluctuate, just as they do with an ...

Stronger Sentiment, Higher Interest Rates

... however, are being formed. Stimulatory fiscal policy initiatives such as tax reform and increased infrastructure spending will support near-term growth and heighten the outlook for wages, corporate profits and overall optimism. These policies, placed in the context of a 4.7% prevailing unemployment ...

... however, are being formed. Stimulatory fiscal policy initiatives such as tax reform and increased infrastructure spending will support near-term growth and heighten the outlook for wages, corporate profits and overall optimism. These policies, placed in the context of a 4.7% prevailing unemployment ...

TAYLOR RULE IN EAST ASIAN COUNTRIES

... part due to inclusion of the lagged interest rate. All have fairly high adjustment coefficients indicating that the changes in interest rate are implemented very quickly. Since the periodicity of the data is monthly the central banks of these nations adjust to their desired rate of interest within a ...

... part due to inclusion of the lagged interest rate. All have fairly high adjustment coefficients indicating that the changes in interest rate are implemented very quickly. Since the periodicity of the data is monthly the central banks of these nations adjust to their desired rate of interest within a ...

Money and Banking

... pay higher rate of interest than other accounts Loans- banks make profit lending deposits to borrowers and charging interest Fractional reserve banking (keeps a fraction of funds on hand and lends rest out) banks today operate under this principle ...

... pay higher rate of interest than other accounts Loans- banks make profit lending deposits to borrowers and charging interest Fractional reserve banking (keeps a fraction of funds on hand and lends rest out) banks today operate under this principle ...

Policy for dealing with Conflicts of Interest

... as through information barriers to block or hinder the flow of information from one department/ unit to another, etc.; 6. We will place appropriate restrictions on transactions in securities while handling a mandate of issuer or client in respect of such security so as to avoid any conflict; 7. We w ...

... as through information barriers to block or hinder the flow of information from one department/ unit to another, etc.; 6. We will place appropriate restrictions on transactions in securities while handling a mandate of issuer or client in respect of such security so as to avoid any conflict; 7. We w ...

Bonds, Interest Rates, and the Impact of Inflation

... There are two fundamental ways that you can profit from owning bonds: from the interest that bonds pay, or from any increase in the bond's price. Many people who invest in bonds because they want a steady stream of income are surprised to learn that bond prices can fluctuate, just as they do with an ...

... There are two fundamental ways that you can profit from owning bonds: from the interest that bonds pay, or from any increase in the bond's price. Many people who invest in bonds because they want a steady stream of income are surprised to learn that bond prices can fluctuate, just as they do with an ...

Economics 3334 – Intermediate Macroeconomics

... Economics 3334 – Intermediate Macroeconomics Prof. Vollrath Fall 2005 ...

... Economics 3334 – Intermediate Macroeconomics Prof. Vollrath Fall 2005 ...

GEBA MAX - at www.GEBA.com.

... A 0.30% higher first-year interest rate may be credited to new and additional premium of $100,000 or greater, subject to certain limitations and restrictions. Additional premium that increases the accumulated value of a fixed annuity to $100,000 or greater may also be eligible for the 0.30% higher f ...

... A 0.30% higher first-year interest rate may be credited to new and additional premium of $100,000 or greater, subject to certain limitations and restrictions. Additional premium that increases the accumulated value of a fixed annuity to $100,000 or greater may also be eligible for the 0.30% higher f ...

bank loans and private placements

... Generally no CUSIP number Not subject to some of the laws/requirements designed to protect investors U.S. Supreme Court Case Reves vs. Ernst & Young, Inc., 494 U.S. 56 (1990) ...

... Generally no CUSIP number Not subject to some of the laws/requirements designed to protect investors U.S. Supreme Court Case Reves vs. Ernst & Young, Inc., 494 U.S. 56 (1990) ...

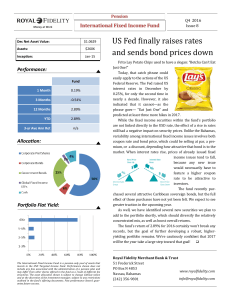

US Fed finally raises rates and sends bond prices down

... still had a negative impact on security prices. Unlike the Bahamas, variability among international fixed income issues involves both coupon rate and bond price, which could be selling at par, a premium, or a discount, depending how attractive that bond is to the market. When interest rates rise, pr ...

... still had a negative impact on security prices. Unlike the Bahamas, variability among international fixed income issues involves both coupon rate and bond price, which could be selling at par, a premium, or a discount, depending how attractive that bond is to the market. When interest rates rise, pr ...

Glossary

... A measure of the change in a security’s duration with respect to changes in interest rates. The more convex a security is, the more its duration will change with interest rate changes. Core Earnings and Core Earnings Per Average Common Share (Unrevised – excluding PAA) Non-GAAP measure that is defin ...

... A measure of the change in a security’s duration with respect to changes in interest rates. The more convex a security is, the more its duration will change with interest rate changes. Core Earnings and Core Earnings Per Average Common Share (Unrevised – excluding PAA) Non-GAAP measure that is defin ...

Week One Quiz

... A) currency B) savings bonds C) money market deposit accounts D) overnight repurchase agreements Answer: B 9) The narrowest money measure is A) currency plus non-interest bearing checking accounts. B) currency plus all checking accounts. C) currency plus all deposits at financial institutions. D) de ...

... A) currency B) savings bonds C) money market deposit accounts D) overnight repurchase agreements Answer: B 9) The narrowest money measure is A) currency plus non-interest bearing checking accounts. B) currency plus all checking accounts. C) currency plus all deposits at financial institutions. D) de ...

rate_note

... beginning of year and at the end of year, respectively. The equation of value can be summarized as following: accumulated amount of initial balance at the end of year + all deposits accumulated to the end of year with simple interest = all withdrawals accumulated to the end of year with simple inter ...

... beginning of year and at the end of year, respectively. The equation of value can be summarized as following: accumulated amount of initial balance at the end of year + all deposits accumulated to the end of year with simple interest = all withdrawals accumulated to the end of year with simple inter ...

A) income. B) profits. C) as

... expected in real terms. B) creditors with an indexed contract gain because they get more than they contracted for in nominal terms. C) debtors with an unindexed contract do not gain because they pay exactly what they contracted for in nominal terms. D) debtors with an indexed contract are hurt becau ...

... expected in real terms. B) creditors with an indexed contract gain because they get more than they contracted for in nominal terms. C) debtors with an unindexed contract do not gain because they pay exactly what they contracted for in nominal terms. D) debtors with an indexed contract are hurt becau ...

Lecture 11

... Key risks associated with QE? • Central bank independence and credibility – CBs banks have taken on new roles such as QE and may now be subject to greater levels of political interference • Inflation expectations – some argue that QE may result in higher inflation in future (but not as yet) • Finan ...

... Key risks associated with QE? • Central bank independence and credibility – CBs banks have taken on new roles such as QE and may now be subject to greater levels of political interference • Inflation expectations – some argue that QE may result in higher inflation in future (but not as yet) • Finan ...

Long run relationship between budget deficit and long

... The government sector is a major borrower of banking sectors funds; a higher demand from the government due to high budget deficit has considerable implications for long-term interest rate. Our results imply that the budget deficit potentially crowd out private sector investment through its increasi ...

... The government sector is a major borrower of banking sectors funds; a higher demand from the government due to high budget deficit has considerable implications for long-term interest rate. Our results imply that the budget deficit potentially crowd out private sector investment through its increasi ...

Financial Definitions and Ratios as they are used

... 1. Asset Turnover: Sales, generated in a particular year, divided by the value of total assets for the same period. 2. Bond Rating: If your firm has no debt at all, your short term interest rates are the prime rate and you are awarded an AAA bond rating. As your debt-to-assets ratio increases, your ...

... 1. Asset Turnover: Sales, generated in a particular year, divided by the value of total assets for the same period. 2. Bond Rating: If your firm has no debt at all, your short term interest rates are the prime rate and you are awarded an AAA bond rating. As your debt-to-assets ratio increases, your ...

lecture 3.slides

... - medium of exchange - store of wealth - unit of account (measure of relative value) - relates the future to the present (wage contracts, repayment of debt) Jump to first page ...

... - medium of exchange - store of wealth - unit of account (measure of relative value) - relates the future to the present (wage contracts, repayment of debt) Jump to first page ...

Slide 1

... Unwinding of imbalances • High real rates will eventually have their effect on domestic demand for credit • Reasonable exchange rate stability since the turmoil of last year – window of opportunity to correct the imbalances before the exchange rate does the job in a more painful way • The adjustmen ...

... Unwinding of imbalances • High real rates will eventually have their effect on domestic demand for credit • Reasonable exchange rate stability since the turmoil of last year – window of opportunity to correct the imbalances before the exchange rate does the job in a more painful way • The adjustmen ...

The Risk and Term Structure of Interest Rates

... Markets for different bonds do not interact at all. The interest rates on each bond are determined by the individual demand and supply only. People have specific preferences for maturities, so that bonds of different maturities are not substitutes at all – returns on one bond do not influence return ...

... Markets for different bonds do not interact at all. The interest rates on each bond are determined by the individual demand and supply only. People have specific preferences for maturities, so that bonds of different maturities are not substitutes at all – returns on one bond do not influence return ...

Interest

Interest is money paid by a borrower to a lender for a credit or a similar liability. Important examples are bond yields, interest paid for bank loans, and returns on savings. Interest differs from profit in that it is paid to a lender, whereas profit is paid to an owner. In economics, the various forms of credit are also referred to as loanable funds.When money is borrowed, interest is typically calculated as a percentage of the principal, the amount owed to the lender. The percentage of the principal that is paid over a certain period of time (typically a year) is called the interest rate. Interest rates are market prices which are determined by supply and demand. They are generally positive because loanable funds are scarce.Interest is often compounded, which means that interest is earned on prior interest in addition to the principal. The total amount of debt grows exponentially, and its mathematical study led to the discovery of the number e. In practice, interest is most often calculated on a daily, monthly, or yearly basis, and its impact is influenced greatly by its compounding rate.